Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock he believes will see some big positive changes in the new year.

Markets are going to be quite subdued, with stock futures mixed. This is technically the first day of the SCR period, which lasts from December 22 until January 3rd.

One news item in the GGM Advisory EMAIL ALERT overnight was the announcement of Q2 earnings by Nike Inc., (NKE:NYSE), the sports apparel company, in which they missed estimates by a wide margin but also announced a US$2 billion cost reduction program. This is not an action consistent with a “soft landing” outcome in 2024. You will recall that earlier this week, Federal Express (FDX:NYSE) gave a less-than-rosy outlook, citing “weakening demand” as a reason for missing their earnings number.

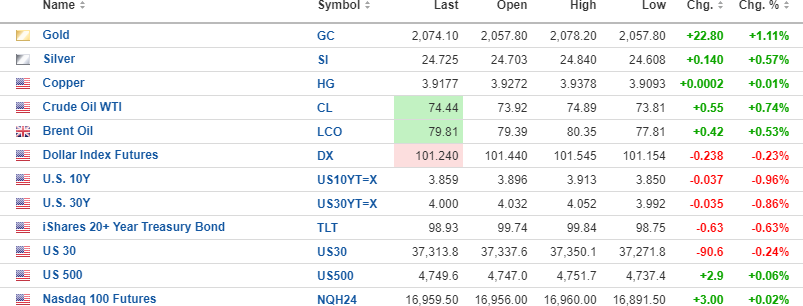

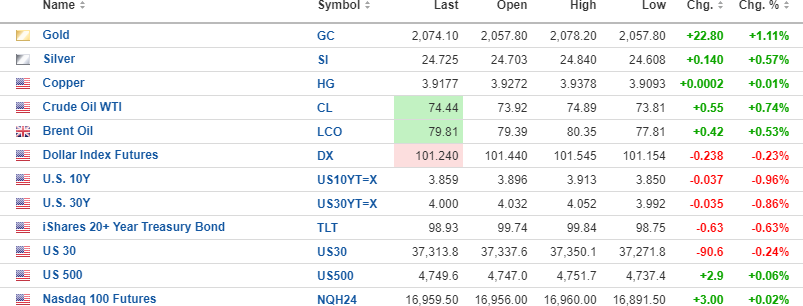

The “performance chase” in U.S. Treasuries continues with money flowing hard into bonds as the bond trade is now the most crowded trade out there after being the most hated trade back in late October when the 10-year yield spike above 5%. Norseman Silver Inc. (NOC:TSX.V; NOCSF:OTCQB)

Today, it is down to 3.85% which marks one of the fastest plunges in recent memory. The bond market, which always rallies during weak economic periods, seems to be sniffing out economic stress on the horizon. Rising stock prices against declining bond yields are usually what one sees at the end of recessions and not at the end of economic expansions such as the one exhibited by the U.S. in 2023. In fact, stocks have had a habit of displaying manic behavior right at the tail end of bull markets and just before recessions arrive.

Also about to close is the Norseman Silver Inc. (NOC:TSX.V; NOCSF:OTCQB) CA$1.09mm unit financing which was also quite a feat despite the very heavy tax-loss selling season for the junior resource space.

Norseman is going to see big changes in 2024, and all are for the better, starting with a new, dedicated focus on copper, at a US$5.38mm market cap.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- [Norseman Silver Inc.] is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of [Norseman Silver Inc.].

- [Michael Ballanger]: I, or members of my immediate household or family, own securities of: [All]. My company has a financial relationship with [Norseman Silver Inc.]. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

( Companies Mentioned: NOC:TSX.V; NOCSF:OTCQB,

)

IRS To Boost Enforcement Workforce By 40% By Year-End 2024

3 Magnificent Stocks to Buy on the Dip: February 2024

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock he believes will see some big positive changes in the new year.

Markets are going to be quite subdued, with stock futures mixed. This is technically the first day of the SCR period, which lasts from December 22 until January 3rd.

One news item in the GGM Advisory EMAIL ALERT overnight was the announcement of Q2 earnings by Nike Inc., (NKE:NYSE), the sports apparel company, in which they missed estimates by a wide margin but also announced a US$2 billion cost reduction program. This is not an action consistent with a “soft landing” outcome in 2024. You will recall that earlier this week, Federal Express (FDX:NYSE) gave a less-than-rosy outlook, citing “weakening demand” as a reason for missing their earnings number.

The “performance chase” in U.S. Treasuries continues with money flowing hard into bonds as the bond trade is now the most crowded trade out there after being the most hated trade back in late October when the 10-year yield spike above 5%. Norseman Silver Inc. (NOC:TSX.V; NOCSF:OTCQB)

Today, it is down to 3.85% which marks one of the fastest plunges in recent memory. The bond market, which always rallies during weak economic periods, seems to be sniffing out economic stress on the horizon. Rising stock prices against declining bond yields are usually what one sees at the end of recessions and not at the end of economic expansions such as the one exhibited by the U.S. in 2023. In fact, stocks have had a habit of displaying manic behavior right at the tail end of bull markets and just before recessions arrive.

Also about to close is the Norseman Silver Inc. (NOC:TSX.V; NOCSF:OTCQB) CA$1.09mm unit financing which was also quite a feat despite the very heavy tax-loss selling season for the junior resource space.

Norseman is going to see big changes in 2024, and all are for the better, starting with a new, dedicated focus on copper, at a US$5.38mm market cap.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- [Norseman Silver Inc.] is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of [Norseman Silver Inc.].

- [Michael Ballanger]: I, or members of my immediate household or family, own securities of: [All]. My company has a financial relationship with [Norseman Silver Inc.]. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

( Companies Mentioned: NOC:TSX.V; NOCSF:OTCQB,

)

IRS To Boost Enforcement Workforce By 40% By Year-End 2024

3 Magnificent Stocks to Buy on the Dip: February 2024

Argentina Is One of the Most Regulated Countries in the World

In the coming days and weeks, we can expect further, far‐reaching reform proposals that will go through the Argentine congress.