Resources Top 5: Aguia brings the Christmas gains with planned Andean takeover in South America

- Aguia Resources leads ressie gains on the last day of trading before Christmas

- Tassie tungsten in the news, courtesy of Group 6 Metals

- KZR, LSR and ENV also among the bigger gainers

Here are some of the biggest resources winners in early trade, Friday December 22.

Aguia Resources (ASX:AGR)

AGR is focused on phosphate and copper sulphate projects in southern Brazil. Today, it’s a +66% ressie-pack leader (at time of key tapping) on takeover deal news.

The company is planning to acquire South American gold hunter Andean Mining and its high-grade operations in an all-share offer.

That’d be a helluva coup – for both parties, potentially.

Andean Mining has a portfolio of 100%-owned, high-grade gold, silver and copper projects in the Republic of Colombia.

The Santa Barbara mine is a high-grade mesothermal gold project with a 30 tonnes per day pilot plant that has treated 500 tonnes of ore, with average recoveries of 20 g/t Au.

Atocha, meanwhile, is a high-grade silver/gold exploration project with reported drill intercepts that include 20.14g/t Au and 723g/t Ag (29.0g/t AuEq) over a true width of 0.8m.

Then there’s the El Dovio high grade copper/gold project with its VMS-style mineralisation and 34 drill hole intercepts including 8.14g/t Au, 6.92% Cu, 39.41g/t Ag and 1.46% Zn over 5.80 metres.

Cu for Christmas: With very high grade copper and gold grades from drilling at its El Dovio project Andean Mining is a standout among copper plays offered to ASX investors in end of year IPOs – at a time of hot demand for the red metal. See more: https://t.co/tNSKQtR4PN pic.twitter.com/OXiqCT5FY5

— Andean Mining Limited (@AndeanLimited) December 1, 2021

Aguia’s non-executive director Ben Jarvis said:

“The acquisition of Andean Mining will be an important development for Aguia as it offers the opportunity for a near-term cash generating asset.

“The very high-grade Santa Barbara Gold Project in Colombia has already demonstrated its merit following a pilot scale operation that established underground mining conditions, metallurgical parameters and excellent recovered grades.”

Andean’s MD William Howe meanwhile added: “The proposed transaction with Aguia provides our shareholders with an opportunity to be part of an ASX-listed public company with multiple assets in South America and the capacity to more rapidly fund the growth and development of our portfolio of gold and copper projects in Colombia.”

AGR share price

Kalamazoo Resources (ASX:KZR)

This gold and lithium exploration company has assets in Tier 1 mining jurisdictions – the Victorian Goldfields, the Pilbara region in WA and the Lachlan Fold Belt in NSW.

But the excitement is coming from the impending IPO of Kali Metals.

That company is looking to take all the lithium ground locked up in the portfolios of Kalamazoo and TSX-Listed Karora Resources and turn it into one of the largest holders of lithium prospective ground in Australia.

The oversubscribed $15 million IPO is due to hit the boards of the ASX early next year having bucked the trend of weak interest in local mining floats to raise its capital in quick time last month.

Today is critical for Kalamazoo shareholders looking to get on board after a series of resolutions were passed comfortably at a general meeting last week.

It’s the record date, meaning if they missed out on the IPO or would like to top up through the in-specie distributions today is the time to do it.

KZR will transfer a quarter of its Kali holding to its shareholders via a 1 for 17.64 distribution.

KZR share price

Lodestar Minerals (ASX:LSR)

(Up on news… from a few days ago)

This small gold and copper WA-focused explorer is going well today on relatively fresh news.

Here’s an in case you missed it tweet that pretty much sums it up – diamond core drilling has now wrapped up at the company’s flagship Earaheedy base and precious metals project:

ICYMI: Diamond Core Drilling Completed at #Earaheedy Project

Three diamond core holes and one RC hole comprising 1,093.4m were completed to follow up the significant RC drilling #gold and #basemetal intersections

More: https://t.co/Es2KjS32Nd $LSR $LSR.ax #exploration #ASX pic.twitter.com/URIGzZrLlx

— Lodestar Minerals Limited (@LodestarASX) December 20, 2023

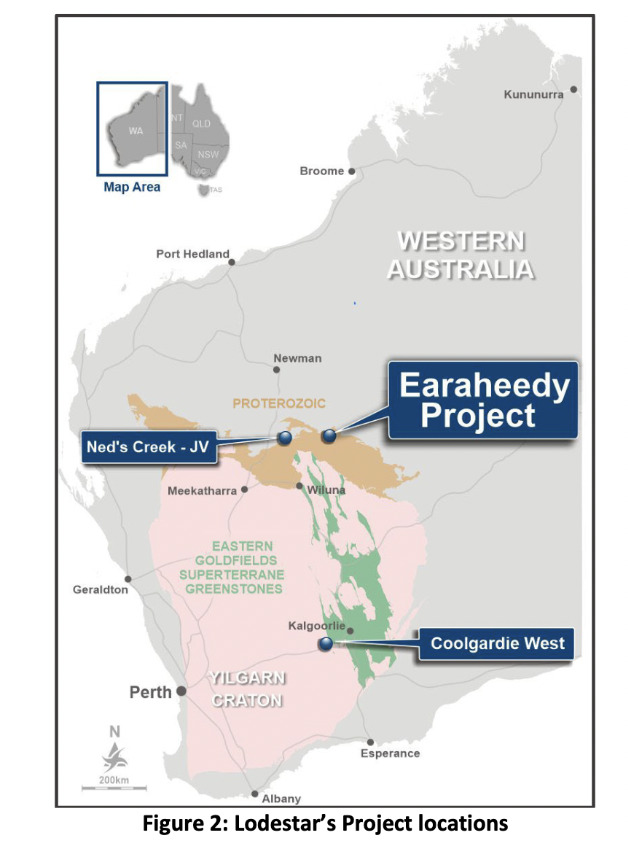

Lodestar’s projects comprise the 100% owned Earaheedy and Coolgardie West projects as well as the Ned’s Creek JV Project – see below.

The company also has exposure to lithium via a large shareholding in Future Battery Minerals (ASX:FBM), which owns the Kangaroo Hills lithium project in WA and the Nevada Lithium project in the US.

LSR share price

Group 6 Metals (ASX:G6M)

Tungsten. Yesss. Fist pump, the OG critical metal is back in the ressie gainers.

Group 6 Metals has provided an update on its operational activities at its wholly-owned Dolphin Tungsten Mine (DTM), which is on the cheese-tastic King Island down in Tassie.

Essentially the mine is receiving a cash injection to help it ramp up its output of this hardest of all metals that’s super useful across various industries including aerospace, defence, mining, construction and automotive, among others.

It also has the highest melting point of all metals (3410°C) – even higher than nickel.

G6M notes that the DTM recently achieved a new daily ore processing record – more than 1,000t of high-grade ore over 24 hours. And this, the company says, marks “a steady climb towards its nameplate production capacity … with an hourly throughput of 44 tph or 73% of the design nameplate capacity”.

Essentially, it’s looking good for the mine to be able to consistently deliver larger volumes of tungsten concentrate in the future.

And this puts the company in a great position because, as our Garimpeiro’ columnist Barry FitzGerald pointed out not long ago:

“The overall tungsten market is not a big market at around 100,000t annually. But assuming just GDP-type growth in consumption, a supply gap is forecast to open up in the back half of the decade.

“More mines are needed, and more non-Chinese mines are needed given China’s demonstrated willingness to mess with supplies of metals in which it dominates to make a political point.”

Ramp-up of production continues at the Group 6 Metals #G6M Dolphin Tungsten mine, with the process plant achieving the significant milestone of greater than 1,000t milled per day in early December.

Read more here: https://t.co/BcgS80XW43 pic.twitter.com/bfqUpPi64l

— Group 6 Metals Limited (@Group6Metals) December 12, 2023

Group 6 Metals MD and CEO Keith McKnight said:

“The team’s dedication to stabilising operations in October led to significant improvement in November. Plant utilisation is approaching the assumed 75%, and the recent daily ore processing record of 44 tph in early December indicates that the process plant is on the right track”.

G6M share price

Enova Mining (ASX:ENV)

Earlier this week, this critical minerals hunter was a sub-$10m market capper. It just broke that ceiling today and is having quite the week with an 88% gain, turning around its YTD fortunes, too, which is now also in the green: +13%.

On Dec 18, the company announced it was all set to acquire highly prospective Caldeira REE and Brazilian Lithium Valley tenements.

There’s been no further official word from the company itself just yet, but it’s looking good.

Great job to Enova Mining $ENV management in getting this done.

Eagerly looking forward to the next stops of this transformatory acquisition. https://t.co/GgnJy7IDOg

— Flynn (@Flynn_ASX) December 21, 2023

The company has entered into a binding option agreement to acquire 100% of the Poços, Juquia, Resplendor, Carai, Santo Antonio and Salinas East prospects – all in Brazil comprising some 675.79km2 of land.

The majority of the tenements are located in Brazil’s renowned Poços deCaldas/Caldeira Rare Earth complex and “Lithium Valley” in the mining state of Minas Gerais.

Importantly for shareholders, the tenements are close to several world class deposits, including Sigma Lithium’s Grota do Cirilo Resource (77Mt at 1.43% Li2O + 8.5Mt at 1.43% Li2O Inferred) and Latin Resources’ (ASX:LRS) Salinas Project (45.2Mt at 1.32% Li2O).

ENV share price

The post Resources Top 5: Aguia brings the Christmas gains with planned Andean takeover in South America appeared first on Stockhead.

tsx

asx

ax

gold

silver

lithium

ree

copper

tungsten

tsxv-sgml

sigma-lithium

sigma lithium