Companies

Independence Gold (TSXV:IGO) Unveils Assay Results from 3Ts Project Winter Drill Program, Intersects 11.50 Metres Grading 7.72 g/t Gold and 172.85 g/t Silver

Independence Gold (TSXV:IGO) has announced the latest findings from its winter drill program, which spanned 4,000 meters at the 3Ts Project. The project,…

Independence Gold (TSXV:IGO) has announced the latest findings from its winter drill program, which spanned 4,000 meters at the 3Ts Project. The project, wholly owned by Independence Gold Corp., is located around 185 kilometres southwest of Prince George, British Columbia. Notably, it sits just 16 kilometres southwest of Artemis Gold Inc.’s Blackwater Project.

The primary objective of the winter drill program was to explore targets beyond the known Tommy vein system and to fill in significant gaps in historical drilling of the Tommy vein system, as highlighted in the 2022 resource model. The Tommy and Ted-Mint vein systems, comprising both in-pit and underground components, contain a combined inferred resource estimate of 4,469,297 tonnes. These veins have a grading of 3.64 grams per tonne (“g/t”) gold and 96.26 g/t silver, with 522,330 ounces of gold and 13,831,415 ounces of silver, subject to a cut-off grade of 0.4 g/t gold equivalent (“AuEq”) in-pit and 2.0 g/t AuEq underground. (For detailed information, please refer to the news release dated August 18th, 2022.)

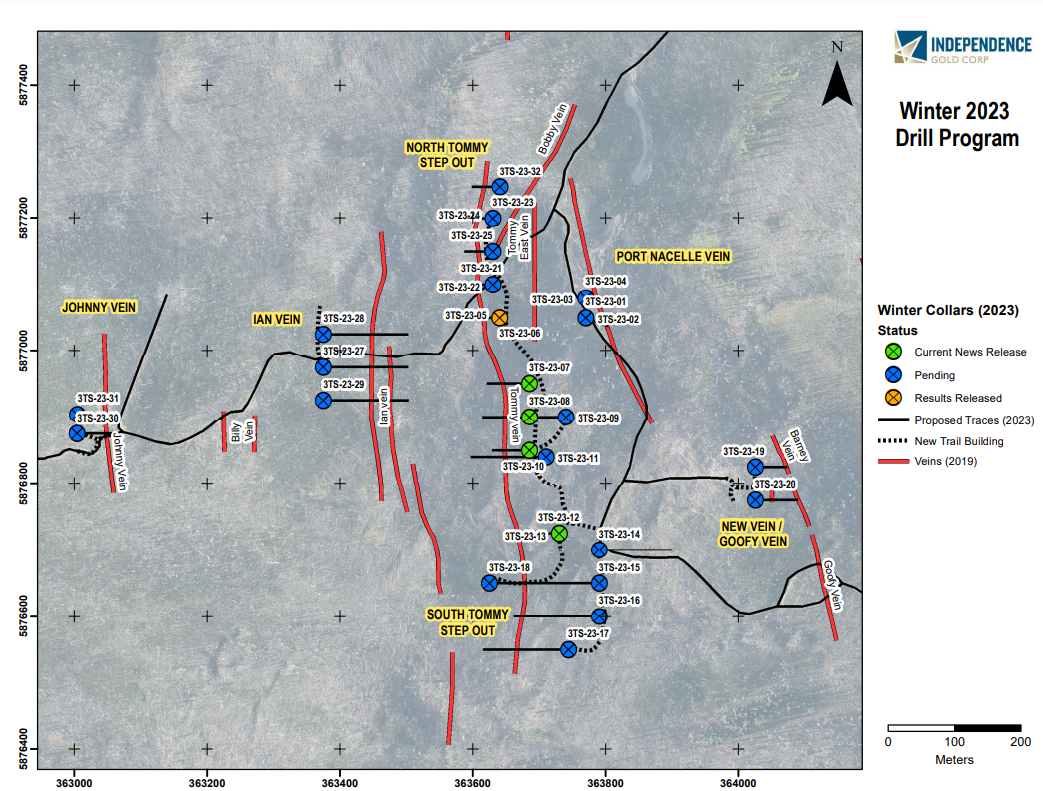

The drill holes with designations 3TS-23-07, 3TS-23-08, and 3TS-23-10 specifically targeted the central section of the Tommy vein, which is known to have a strike length of 1,075 meters. These holes were positioned within the pit shell modelled by SGS Geological Services (“SGS”), with the aim of expanding the resource model. Thirteen drill holes were strategically selected to target the pit in the current program, aiming to enhance the resource model. The aforementioned three holes were spaced 50 meters apart along a north-south line. In addition, drill hole 3TS-23-13 was located 130 meters south-southeast from 3TS-23-10, examining the continuity of the southern extension of the vein. It is worth noting that the Tommy vein system remains open along its strike length and at depth.

In addition to the Tommy vein, the drill program focused on the Ian Vein and the Johnny veins. These veins were initially discovered through historical trenching in the late 1990s and are positioned 185 meters and 585 meters west of the Tommy vein system, respectively. Three holes were directed towards the Ian Vein, while two holes were drilled in the Johnny Vein. Preliminary results indicate the presence of significant quartz veining, with intercepts measuring up to 27 meters. Further analysis is pending for all five holes, with completion expected in the following weeks. Both the Ian and Johnny veins also remain open along their strike lengths and at depth. For a visual representation of the veins and drill hole locations, interested parties can refer to the company’s website.

Providing an update on the ongoing drill program, Independence Gold Corp. stated that it began on March 7th, 2023, and is set to conclude in the last week of May. Throughout the program, a total of 4,000 meters of drill core has been recovered from 33 drill holes. As the lab processes the results, they are being released in a non-sequential order due to varying submission dates following logging and sample preparation.

All completed drill holes have been sent to SGS in Vancouver for sample preparation and analysis. To ensure reproducibility, robotic sample preparation is employed, with samples pulverized to more than 85% passing 75 microns. Subsequently, all samples undergo four acid digest with an ICP finish. Fire assay with AAS finish is utilized to determine gold grades. Samples showing gold concentration exceeding 10 parts per million and silver concentrations exceeding 100 parts per million undergo a fire assay with a gravimetric finish.

The 3Ts Project encompasses fifteen mineral claims, covering an area of approximately 5,200 hectares in British Columbia’s Nechako Plateau region. Within the project, an epithermal quartz-carbonate vein system has been identified, housing over a dozen individual mineralized veins. These veins range in width from 50 meters to over 900 meters, with true widths reaching up to 25 meters.

| Drill Hole | Host Rock | From (m) | To (m) | Drill Intercept (m)* |

Gold (g/t) |

Silver (g/t) |

| 3TS-23-07 | Quartz Veins, Rhyolite Breccia |

62.50 | 72.50 | 10.00 | 4.69 | 73.70 |

| including | 70.00 | 72.00 | 2.00 | 11.34 | 94.00 | |

| 3TS-23-08 | Quartz Veins, Rhyolite Breccia |

59.90 | 62.90 | 3.00 | 6.35 | 39.33 |

| and | 70.00 | 71.00 | 1.00 | 1.53 | – | |

| 3TS-23-10 | Quartz Veins, Rhyolite Breccia |

56.00 | 71.00 | 15.00 | 6.32 | 94.07 |

| Including | 67.50 | 69.00 | 1.50 | 26.36 | 274.67 | |

| 3TS-23-13 | Quartz Veins, Rhyolite Breccia |

128.50 | 140.00 | 11.50 | 7.72 | 172.85 |

| including | 134.50 | 137.50 | 3.00 | 16.63 | 232.00 |

*the true widths of the veins are approximately 85% of the reported interval width

**Using a cut-off grade of 0.4 g/t gold as per the resource estimate for “in-pit” grades

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The post Independence Gold (TSXV:IGO) Unveils Assay Results from 3Ts Project Winter Drill Program, Intersects 11.50 Metres Grading 7.72 g/t Gold and 172.85 g/t Silver appeared first on MiningFeeds.

tsxv

aim

gold

silver

tsxv-artg

artemis-gold-inc

artemis gold inc

tsxv-igo

independence-gold-corp

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…