GoldTalks: Going big on ASX-listed gold stocks

GoldTalks is a lot like MoneyTalks – Stockhead’s regular drill down into what stocks investors are looking at right now.

Only instead of tapping our extensive list of experts to hear what’s hot in stocks, we just call Kyle Rodda, senior financial market analyst at Capital.com and say:

“Kyle Rodda, let’s talk gold.”

Stockhead: The underlying gold price recently hit an all-time high, but can the rally in ASX-listed gold miners continue into 2024?

Kyle: ASX gold stocks have outperformed the broader market this year, with the gains accelerating into the end of the year…

Gold prices driven by expectations for US rate cuts

Two things are driving the global gold price currently, says Kyle.

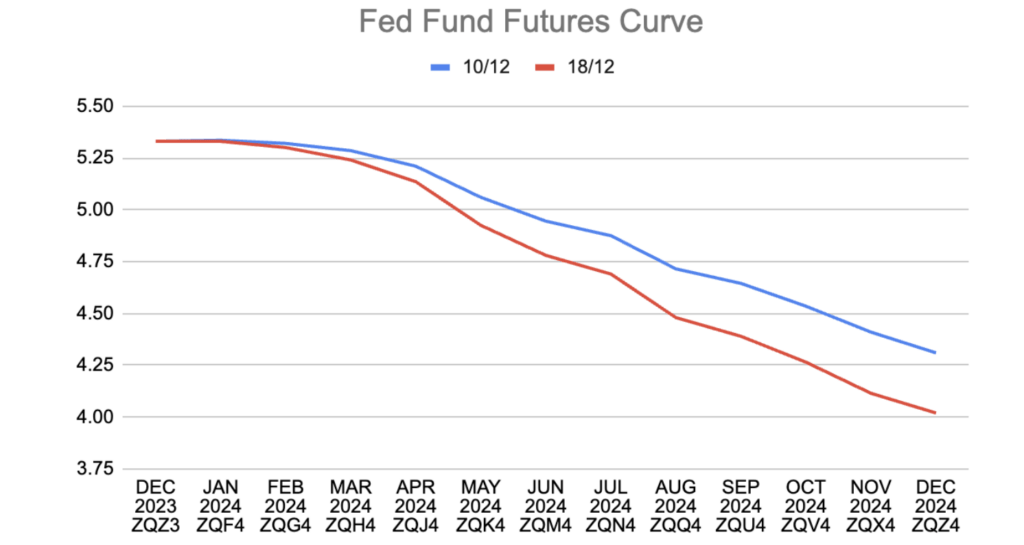

“The first is lower US real yields…

“And the second is a weaker US Dollar.”

“Both lower real yields and a weaker US Dollar are due to expectations for interest rate cuts in the US next year following signs of falling inflation and weaker economic growth, with the US Federal Reserve seemingly confirming a rate-cutting bias in 2024 at its meeting last week,” Kyle says.

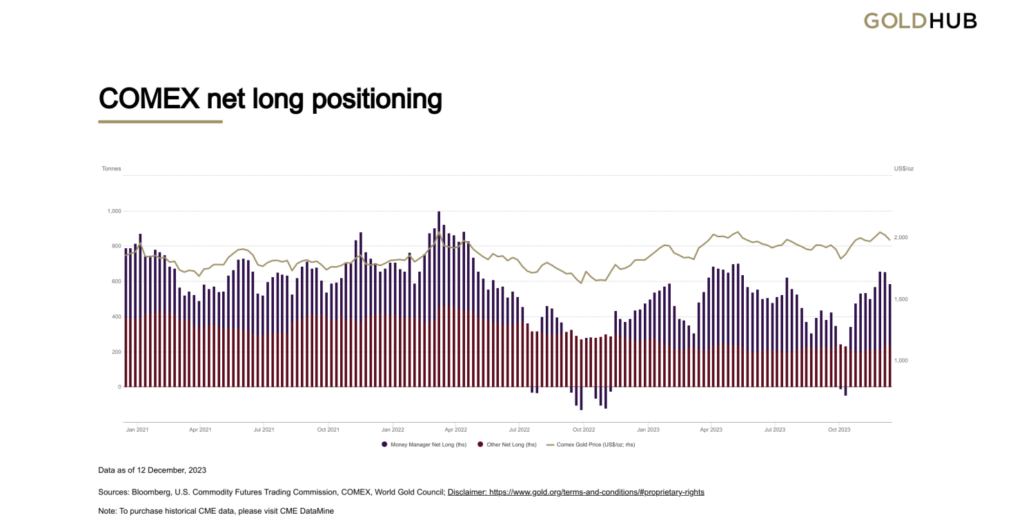

“Although gold prices are within touching distance of record highs, positioning in the market is remarkably neutral. According to data from Comex, net long positioning points to neither extremely bullish nor bearish sentiment.”

Long positioning even declined last week, says Kyle, probably as traders took profits after gold briefly hit record highs.

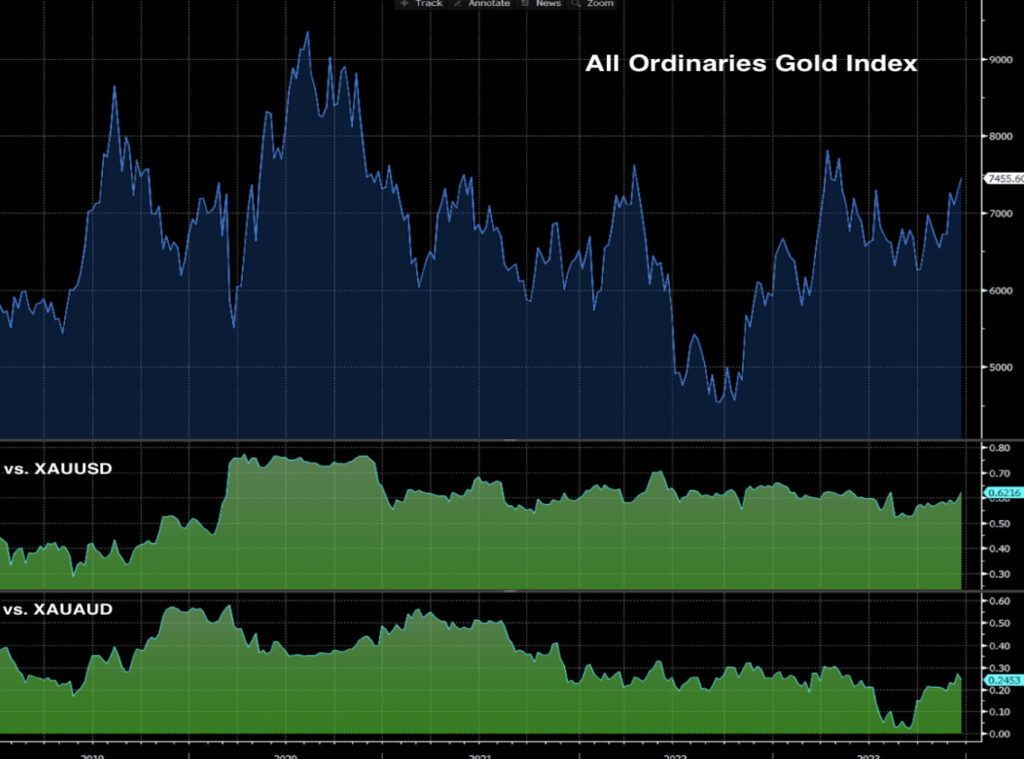

Meanwhile, the Australian Dollar gold price (XAUAUD) hasn’t kept pace with the US Dollar denominated price…

For Australian gold stocks, despite being ASX-listed and reporting profits in the local currency, the All Ordinaries Gold index is more highly correlated with the US Dollar gold price, Kyle says.

“This correlation is probably due to international investors’ high level of involvement in the market, whose portfolios are denominated in US Dollars.”

Aussie investors ‘spoiled for choice’

Kyle says Australian investors are spoiled for choice when it comes to listed gold miners. Here are three blue-chip names (further below) that could benefit if gold prices keep rising.

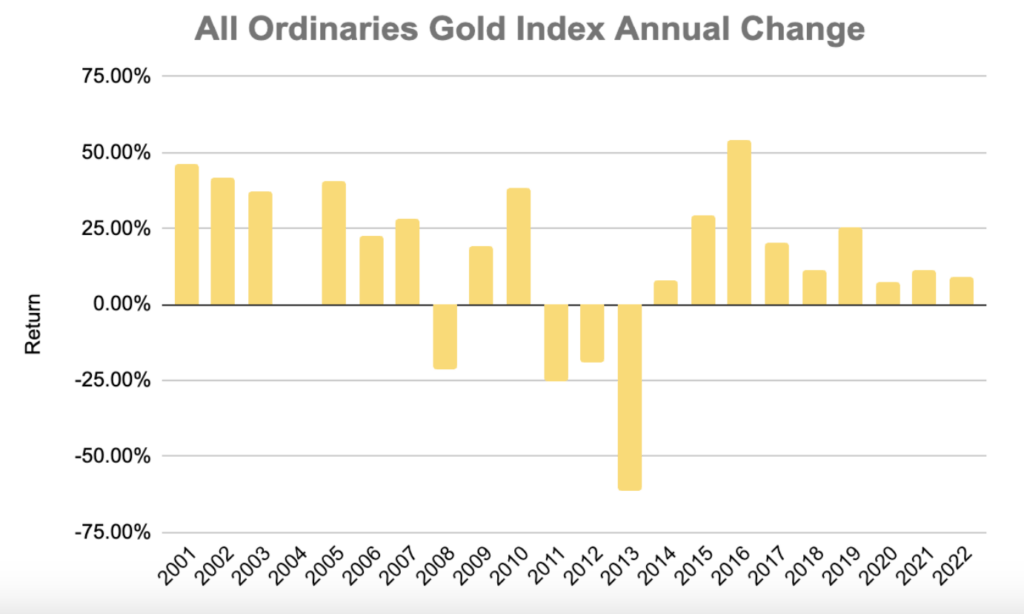

“The ASX All Ordinaries Gold Index is on track to increase 24% for 2023 and deliver its best annual performance since 2019.

“This strength raises concerns that the bull case for gold stocks is fully discounted, and the market may struggle to replicate it next year. However, history shows that on the nine occasions that the index has climbed by 25% or more in a calendar year, it has delivered a positive return the following year seven times.”

Three blue-chip ASX golden boys

Northern Star Resources (ASX:NST)

Northern Star Resources is Australia’s biggest gold miner and a favoured play for investors wishing to gain equity exposure to gold prices.

As of the 20th of December, the company’s stock has delivered a 24% year-to-date return, performing roughly in line with the All Ordinaries Gold Index.

Northern Star has run into some earnings headwinds in recent years due to rising costs, especially diesel, due to the pandemic. Cost pressures are subsiding, however, with earnings stabilising. The company delivered a $0.265 per share dividend in the last period.

Analysts remain bullish on its stocks, with a consensus buy rating. From a technical standpoint, the Northern Star stock is trading below its 2023 highs and looks range bound currently; resistance appears to be above $14.00, while buyers have bought dips around $10.

Newmont Corporation (ASX:NEM)

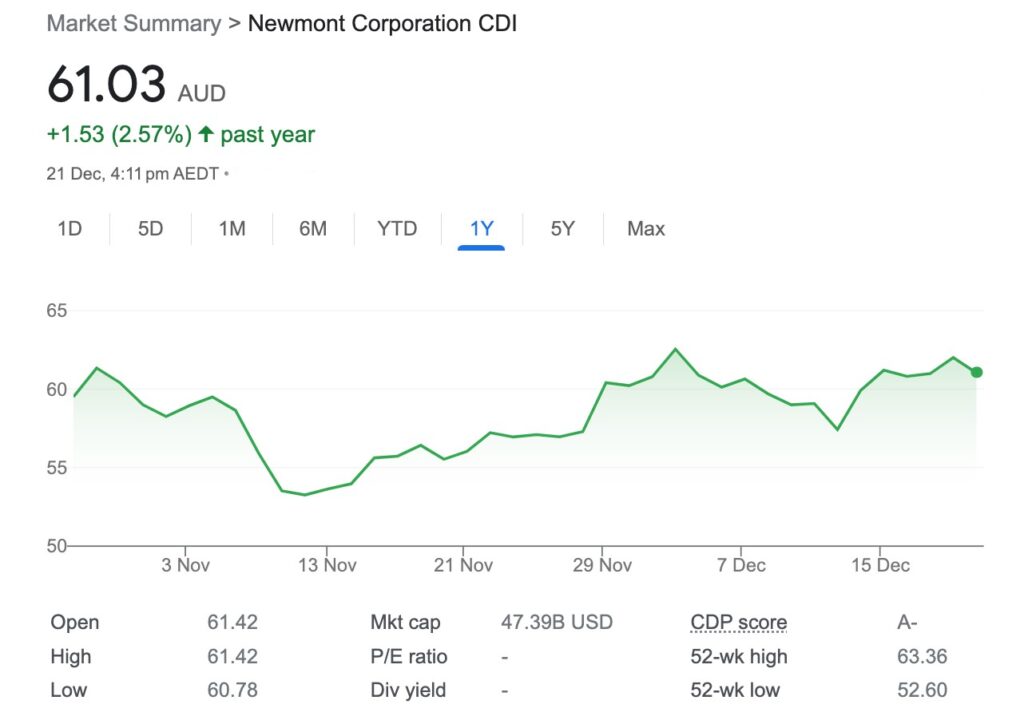

Newmont Corporation has emerged following its acquisition of Newcrest Mining for $16.8 billion. The company is dual-listed, with its US entity trading on the New York Stock Exchange, and boasts a market capitalisation of almost $US50 billion.

The company offers more diversified revenue streams than other local gold miners due to its international exposure. The assets it acquired from Newcrest in Western Australia are considered highly valuable and established, offering a relatively stable and low volatility exposure to global gold prices.

The latest survey of brokers gives the stock an overwhelming buy rating.

Evolution Mining (ASX:EVN)

Evolution Mining focuses on mining and exploration, with its major assets in Queensland. It also mines silver, offering investors exposure to another precious metal and the renewables and green energy thematic.

The company’s stock has outperformed the broader ASX and the All Ordinaries Gold Index, delivering a nearly 30% year-to-date return since as of December 20.

Analysts are neutral on Evolution’s stock, with a consensus hold rating. The company divides opinions, partly because of an aggressive growth-through-acquisition strategy as it attempts to broaden its portfolio of gold assets and diversify its business into other metals.

The miner has diluted its shares by raising equity to fund recent acquisitions. Technically speaking, Evolution Mining is in an uptrend.

However, sellers are defending $4, with buyers emerging on dips into the low $3.00 level.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

The post GoldTalks: Going big on ASX-listed gold stocks appeared first on Stockhead.

new york stock exchange

asx

gold

tsx-ngt

newmont-corporation

newmont corporation