Energy & Critical Metals

Wanderport Corp. (OTCMKTS: WDRP) On the Move as Co Tweets They Have Acquisition Agreement Almost Ready to PR this Week

Wanderport Corp. (OTCMKTS: WDRP) was up over 40% on Monday after the Santa Monica based Company stated on twitter: “After the weekend working session,…

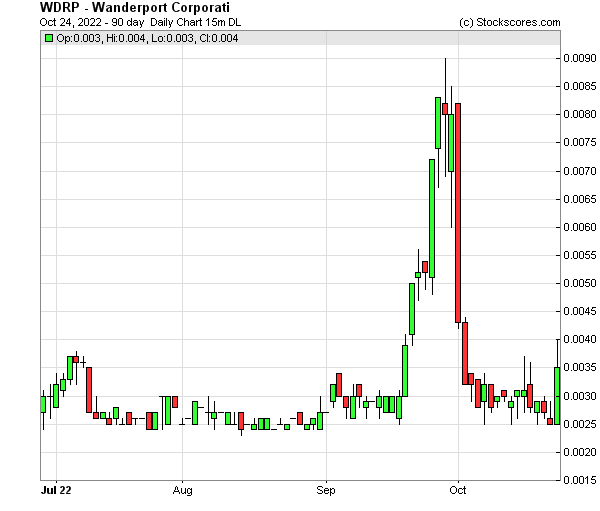

Wanderport Corp. (OTCMKTS: WDRP) was up over 40% on Monday after the Santa Monica based Company stated on twitter: “After the weekend working session, we now have a draft of the acquisition agreement almost ready for signing. Our goal is to close and provide a PR update this week. We’re working to bring the company back to current on OTC Markets either as an Alternative or SEC Fully Reporting issuer as part of the first acquisition.” This is big news for the Company which has already taken initial steps to enter the automotive sector. Its goal is to be an active participant in the burgeoning electric vehicle (EV) space via manufacturing and distribution of components as well as EV related services.

Management has also committed to strengthen the Company for growth and recently reached an agreement to secure and cancel an additional 10M shares of its Common stock, bringing the total shares to be cancelled to 30M. This is in addition to over 54M shares cancelled in 2021. Management believes that a sound path to growth is via accretive mergers and acquisitions. The Company has set a goal to uplist to a fully reporting company as soon as practicable. This will enable Wanderport to access larger investors or institutions which the Company needs in order to support its long-term growth plans. The Company will proceed to return its status to current with OTC Markets. There was no material change in its operations, share and debt issuance since the last filing.

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

Wanderport Corp. (OTCMKTS: WDRP) operating out of Santa Monica, California WDRP is a holding company formerly specializing in blockchain, digital asset and metaverse. The Company’s new focus will be in the areas of automotive, electric vehicles, energy and manufacturing.

Microcapdaily reported on WDRP in January of this year reporting at the time: “Wanderport Corp. (OTCMKTS: WDRP) has seen a significant jump in price and volume after the Company announced its move into the booming Metaverse projected to reach $800 billion in 2024 according to a recent analysis by Bloomberg, IDC, PWC, Statista, and Two Circles. The Metaverse represents the convergence of the physical and digital worlds and the next stage in the evolution of the internet, e-commerce, social networks, and digital communities. WDRP is “pink current” with less than a million in debt on the books with 690 million share outstanding and 478,200,000 free trading shares currently trading at a $3,659,827 total market valuation. On January 5 the stock traded as high as $0.015 shy of 52-week highs of $0.0205. Speculators accumulating at current levels are looking for a break over $0.0205 for confirmation of the next leg up.

We’re working to bring the company back to current on OTC Markets either as an Alternative or SEC Fully Reporting issuer as part of the first acquisition. In the meantime, here’s our current SS per our TA’s latest update. $WDRP pic.twitter.com/0Pe2swBVKd

— Wanderport (@wanderport) October 24, 2022

Faster charging and smaller battery size will help solve the EV adoption and environmental problems. This is one of the areas we’re working on. $WDRP

Has a university solved rapid charging for electric cars? https://t.co/bb3bkqH7Fo

— Wanderport (@wanderport) October 21, 2022

To Find out the inside Scoop on WDRP Subscribe to Microcapdaily.com Right Now by entering your Email in the box below

On September 29 WDRP providerd a business update including the cancellation of common shares and pivot into the automotive and energy sectors. As part of management’s commitment to strengthen its position for growth, the Company had reached an agreement to secure and cancel an additional 10M shares of its Common stock, bringing the total shares to be cancelled to 30M. This is in addition to over 54M shares cancelled in 2021. Management is open to further negotiation for share cancellation if necessary to support its future expansion efforts.

The Company has taken initial steps to enter the automotive sector. Its goal is to be an active participant in the burgeoning electric vehicle (EV) space via manufacturing and distribution of components as well as EV related services. The Company plans to accomplish this endeavor through partnerships and creating an equity portfolio of established companies that are currently serving this industry.

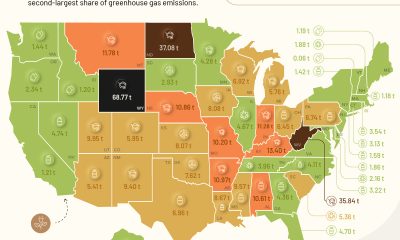

Wanderport is formulating plans to enter the green energy sector. Its main focus will be in the areas of clean renewable energy as well as products to serve the EV market such as charging equipment or stations. There has been a strong global push for electric vehicles and clean energy. Recent development in the United States includes a new $5 billion infrastructure bill that will allow every state in the US, District of Columbia and Puerto Rico to have access to federal funds for charging infrastructure projects. The Company plans to participate in this sector with related products and services for the residential and commercial usage.

Due to economic and geopolitical factors, there has been a sizable amount of corporations establishing manufacturing capability in Vietnam. This presents huge growth opportunities for the manufacturing sector and supply chain there. Aside from exporting, many of the products manufactured in Vietnam can also be sold to the fast-growing local consumer base. The Company plans to capitalize on this growth trend through mergers and acquisitions, particularly as they are related to electric vehicles and consumer goods.

The Company has been gradually divesting its current businesses to focus on the new direction. The health coffee line will be discontinued once inventory has been depleted. All blockchain related assets have been assigned to UA Multimedia, Inc. The Company will continue to collaborate with UA on future technical projects.

Wanderport CEO Miki Takeuchi stated: “Wanderport is firmly committed to creating shareholder values. After seeing the growth opportunities in our current busines model diminished, we pivoted to the areas of automotive, energy and manufacturing which we believe have strong growth potential for the foreseeable future. We have made a few initial steps into these new ventures and plan to provide additional details soon.”

$WDRP PR next week for acquisition agreement https://t.co/Oe88BapI86

— Moon (@MoonMarket_) October 24, 2022

For More on WDRP Subscribe Right Now!

Currently trading at a $1.7 million market valuation WDRP OS is 690,533,333 shares and about 478,200,000 shares in the float. The stock is on the move after the Company stated on twitter: “After the weekend working session, we now have a draft of the acquisition agreement almost ready for signing. Our goal is to close and provide a PR update this week.” On January 5 the stock traded as high as $0.015 shy of 52-week highs of $0.0205 with the exact same share strucutre of OS 690 million. Speculators accumulating at current levels are looking for a break over $0.0205 and its blue skies ahead. We will be updating on WDRP when more details emerge so make sure you are subscribed to Microcapdaily so you know what’s going on with WDRP.

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

Disclosure: we hold no position in WDRP either long or short and we have not been compensated for this article.

The post Wanderport Corp. (OTCMKTS: WDRP) On the Move as Co Tweets They Have Acquisition Agreement Almost Ready to PR this Week first appeared on Micro Cap Daily.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…