Companies

Neo Battery Materials signs MOU to recycle silicon from solar cells

NEO Battery Materials Ltd. [NBM-TSXV; NBMFF-OTCQB] signed a memorandum of understanding (MOU) with an Asia-based…

NEO Battery Materials Ltd. [NBM-TSXV; NBMFF-OTCQB] signed a memorandum of understanding (MOU) with an Asia-based producer of high-purity silicon powder through recycling silicon byproduct waste from solar photovoltaic cell and semiconductor manufacturing. Due to both strategic reasons and the sensitive nature of the information, negotiation and technology, the recycler will remain confidential until officially disclosed.

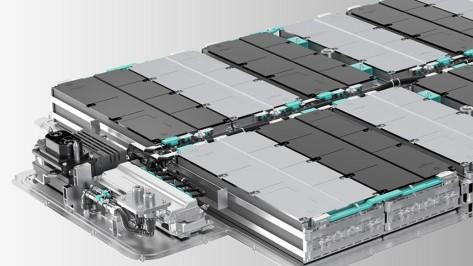

Under the terms of the MOU, the purpose is to significantly enhance the price competitiveness of silicon anode materials for electric vehicle lithium-ion batteries by integrating the recycler’s cost-reduced, recycled silicon input into NEO’s proprietary silicon anode materials, Nbmside.

Compared with the current metal silicon input for Nbmside, the Recycler’s silicon waste recycling technology may enable NEO Battery Materials to realize a substantial price reduction in the silicon input by 30% and up to 40%.

In early January, the company expects to receive recycled high-purity silicon and conduct sample testing to assess for performance, viability, and collaboration/research direction.

Further silicon input price reductions will drastically enhance Nbmside price competitiveness compared with existing high-priced competitors; the company may also uniquely secure a long-term supply and stable price of silicon input through recycled silicon byproduct waste from solar energy and semiconductor industries.

NEO has also discussed with the recycler regarding collaborative opportunities to enter the North American market. With gigafactories being constructed in Canada and the United States, the company has the potential to provide cost- and environment-friendly silicon anodes through vertically integrating silicon anode production with the recycler’s silicon waste recycling.

More collaboration and joint development activities with lithium-ion battery supply chain players are expected in the upcoming year.

In the process of manufacturing polysilicon, silicon ingots and wafers for solar cells and semiconductors, substantial amounts of byproduct waste that contains silicon particles are produced. Thus far, this byproduct waste has been disposed of due to the lack of secondary use through recycling.

The recycler has developed its recycling technology and know-how for over 20 years to recover high-purity silicon from silicon byproduct waste. This high-purity silicon can be used as input feedstock for silicon anode materials in lithium-ion batteries. As opposed to traditional, carbon-intensive methods to manufacture silicon particles, the recycler offers a low-cost silicon recovery method that enables close-looped manufacturing of silicon anode materials.

NEO Battery Materials is a Vancouver-based company focused on electric vehicle lithium-ion battery materials. NEO has a focus on producing silicon anode materials through its proprietary single-step nanocoating process, which provides improvements in capacity and efficiency over lithium-ion batteries using graphite in their anode materials. The company intends to become a silicon anode active materials supplier to the electric vehicle industry.

tsxv

otcqb

lithium

batteries

graphite

electric vehicle

tsxv-nbm

neo-battery-materials-ltd

neo battery materials ltd

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…