Energy & Critical Metals

Private Capital Investment Value In GPCA’s Markets Declined In Q3 2022

We are pleased to share with you GPCA’s Q3 2022 Industry Data & Analysis, available exclusively for Members. Key data takeaways: Private Capital…

We are pleased to share with you GPCA’s Q3 2022 Industry Data & Analysis, available exclusively for Members.

Key data takeaways:

Private Capital Investment Value Declines

- Private capital investment value in GPCA’s markets declined in Q3 2022, following record-high deal activity from 2021 through the first half of 2022.

The global investment slowdown reached all regions in Q3 – echoing declines experienced in North America, Western Europe and China earlier in the year – with financial services and fintech, as well as consumer-facing segments, most affected. Still, overall PE and VC deal value in GPCA’s markets exceeded pre-pandemic levels.

Get The Full Henry Singleton Series in PDF

Get the entire 4-part series on Henry Singleton in PDF. Save it to your desktop, read it on your tablet, or email to your colleagues

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Exit count and value also declined across most geographies in Q3, although Helios’ sale of Vivo Energy for USD2.3b to Vitol drove Africa exit value to USD6.8b year to date, a nearly 5x increase from 2021. The Vivo exit was the largest completed in Q3 2022 across all of GPCA’s markets.

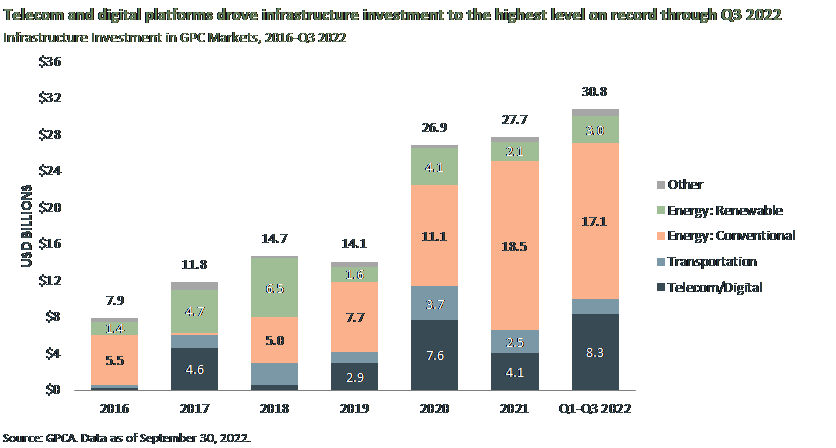

- Infrastructure, particularly digital and renewable energy, has been a bright spot amid the broader market corrections of 2022, attracting USD31b through Q3 and exceeding all prior annual totals.

Stonepeak Infrastructure Partners’ USD2.7b buyout of Latin America-focused digital infrastructure platform Cirion was the largest private capital investment recorded across GPCA’s markets in Q3.

Third-quarter investments in Poland’s Rezolv Energy (USD509m), as well as India-based Tata Power Renewables (USD501m) and Hero Future Energies (USD450m), drove private capital investment in renewable energy infrastructure to USD3b through the first nine months of the year.

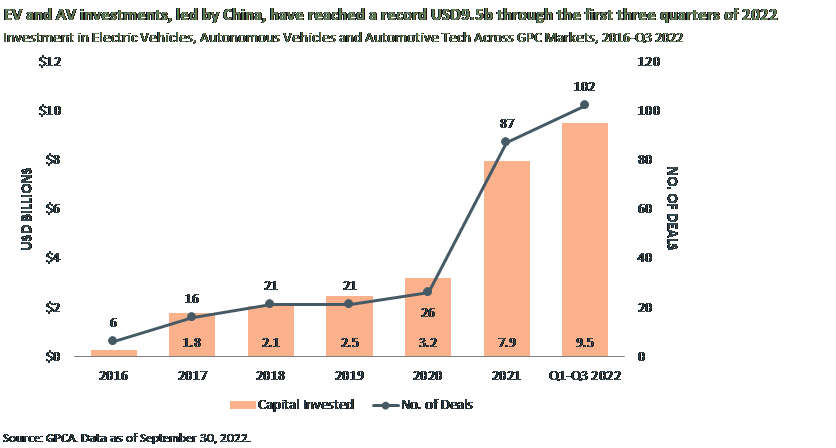

- Electric vehicles and automotive tech have been an exception to the general slowdown across the tech space.

Total investment in EV, AV and automotive tech has reached a record USD9.5b year to date, including USD4.2b in Q3.

China accounted for the largest deals and the bulk of capital invested in the space, led by rounds for Sunwoda Electric Vehicle Battery (USD1.2b), RT Advanced Materials (USD742m), IM Motors (USD444m) and Hozon Auto (USD443m). EVs have emerged as a centerpiece of the country’s industrial policy, and private capital investment in the space has followed.

As GPCA has documented in previous quarterly data releases, EV investment is also expanding to new markets. Brazil-based Leoparda Electric raised USD8.5m in seed funding from Claure Capital, Climate Capital, Construct Capital, Grupo Auteco, K50 Ventures and monashees in Q3, following previous investments in Egypt-based Shift EV, Croatia’s Rimac Energy and India’s Ola Electric Mobility earlier in 2022.

Fund Managers Target GPCA Markets

- Fund managers raised USD74b for vehicles targeting GPCA markets in the first three quarters of 2022, led by Asia-focused funds raised by established managers.

Baring Private Equity Asia closed the region’s largest fund of the year at USD11.2b.

Sequoia Capital and Qiming Venture Partners raised USD8.8b and USD3.2b, respectively, for new dollar-denominated VC funds targeting China, pointing to continued international investor interest despite recent tech policy shifts, the ongoing zero-COVID policy and turbulence in the country’s real estate sector.

Fundraising for Latin America was bolstered by interest in VC, with Valor Capital Group raising USD500m in total for early- and late-stage vehicles.

Despite the ongoing conflict in Ukraine, Horizon Capital announced a first close at USD125m for its fourth fund targeting the country and neighboring markets.

Uranium Exploration Company Announces Additional Staking in the Athabasca Basin

Source: Streetwise Reports 12/22/2023

Skyharbour Resources Ltd. announced an update from its Canada-based Falcon Project along with additional…

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla Launches New Mega Factory Project In Shanghai, Designed To Manufacture 10,000 Megapacks Per Year

Tesla has launched a new mega factory…

Giving thanks and taking stock after “a remarkable year”

An end-of-year thank you to our readers, industry colleagues and advertisers before Electric Autonomy breaks from publishing until Jan. 2

The post Giving…