Companies

Ahead of the Herd Newsletter 2023 Issue 13 GRAPHITE Special Edition

2023.03.14

Hi

War and subsidies have turbocharged the green transition

In their panic to keep the lights on, policymakers across Europe and Asia are reopening…

2023.03.14

Hi

War and subsidies have turbocharged the green transition

In their panic to keep the lights on, policymakers across Europe and Asia are reopening coal mines, keeping polluting power plants alive and signing deals to import liquefied natural gas (lng). State-owned oil giants, such as the UAE’s adnoc and Saudi Aramco, are setting aside hundreds of billions of dollars to boost output, even as private energy firms mint enormous profits. Many governments are encouraging consumption of these dirty fuels by subsidising energy use, to help citizens get through the winter.

Yet the reality is that the return of brown fuels is a subplot in a much grander story. By making coal, gas and oil scarcer and dearer—prices remain well above long-run averages, despite recent falls—Russia’s invasion of Ukraine has given renewable power, which is mostly generated domestically, a significant strategic and economic edge.

All over the world officials are raising renewables targets and setting aside huge sums to bankroll a build-out.

Graphite One could supply a major portion of North America’s graphite demands

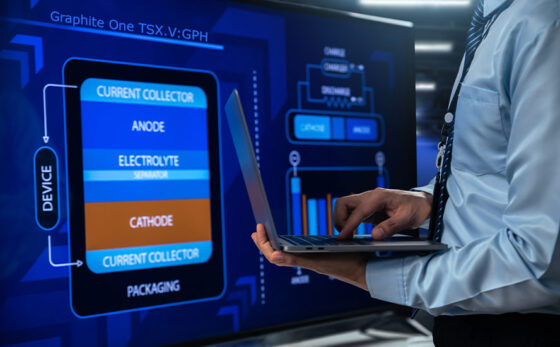

Graphite One (TSXV:GPH, OTCQX:GPHOF) is moving closer towards its goal of becoming the first vertically integrated domestic producer to serve the nascent US electric vehicle battery market.

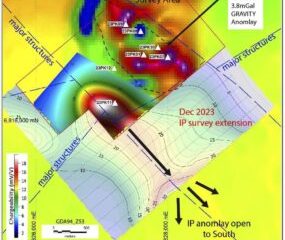

Graphite One has made a series of good-news announcements in recent weeks. The results of its 2022 drill campaign demonstrate the potential, in my opinion, for significant resource expansion.

We also have Graphite One signing a Materials Transfer Agreement with PNNL, the Pacific Northwest National Laboratory in Washington State, that will test the company’s anode-active and other materials to verify conformity to EV battery specs.

Then there’s Graphite One’s arrangement with Sandia National Laboratories in Albuquerque, New Mexico. A Graphite One subsidiary has provided Graphite Creek material to Sandia, for testing as a potentially critical mineral-rich carbonaceous feedstock, using its award-winning green extraction technology.

Both labs operate under the auspices of the U.S. Department of Energy.

Roth Capital Partners recently reiterated a Buy recommendation for GPH and upped its target price to $2.50/sh.

America’s EV Ambitions Need a Graphite Plan. Fast.

America’s energy angst was easier to gauge before the energy transition: You just looked at oil imports. Now it means also fretting about where we get stuff like lithium and… graphite. That’s right, the stuff in pencils is now part of our national neurosis — and it makes the lithium gap look easy by comparison. The electric vehicle industry needs a plan. Fast.

Besides greening the economy, President Joe Biden wants more green stuff mined and made at home, something he reemphasized in this week’s State of the Union speech. Some months before the Inflation Reduction Act passed, Biden also invoked the Defense Production Act to boost domestic sources of battery minerals. The aim is to wrest control of clean technology supply chains away from a country that has been building them assiduously for years: China.

Graphite, a form of pure carbon, is essential to batteries in electric vehicles. The Inflation Reduction Act (IRA) is expected to offer subsidies to only EVs with battery materials sourced from America or free-trade agreement countries and processed in the US. Graphite companies are responding to the IRA.

This special report profiles three graphite players in North America – Graphex Technologies, Urbix Inc. and Graphite One.

Biden’s EV Boom Needs a Graphite Rush Like China’s

Angst about China’s grip on batteries often focuses on lithium. It is, after all, the defining ingredient and China accounts for more than 70% of the world’s lithium-processing capacity. Yet the average battery contains way more graphite; indeed, it’s the biggest input by weight.

Graphite One Inc., based in Vancouver, aims to produce around 42,000 tonnes of anode-ready graphite 2 per year; not just by mining the site but then also shipping the resulting concentrate down the coast to a proposed processing facility in Washington state. Besides relative proximity, Washington also happens to host the biggest hydropower resources of any state and generates four-fifths of its electricity from zero-carbon sources. Assuming it all gets developed, this graphite chain would exemplify the interlocking demands of energy, geopolitical and climate security that now define the US critical minerals business.

Graphite One working with three EV manufacturers and two US Department of Energy labs

EV manufacturers and PNNL are testing G1’s sample battery anode materials. Sandia National Laboratories will be testing Graphite Creek material as a potentially critical mineral-rich carbonaceous feedstock.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. (TSXV:GPH). GPH is a paid advertiser on his site aheadoftheherd.com

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…