Companies

Noble Mineral Exploration – Research Report

Introduction Climate risk is something being considered when making investment decisions more today than ever. With the economy transitioning to green…

Introduction

Climate risk is something being considered when making investment decisions more today than ever. With the economy transitioning to green technology, it only makes sense that investors are adapting their portfolio’s to follow the market trends. It’s also becoming increasingly obvious that we need to build and maintain resilient critical mineral value chains in North America, because lets face it, there is no energy transition without critical minerals. Lucky for Canada, we have a wealth of critical minerals and we are well positioned to capitalize on the supply crunch the world is facing. Our governments know this and are removing red tape while investing in mining, exploration, extraction, processing, downstream product manufacturing, recycling and clean energy infrastructure. Blue chip operators are beginning to position themselves and the exploration companies holding the critical mineral assets will benefit greatly in this shift in focus and it becomes more obvious when we see auto manufacturers are scrambling to lock down supply. We are literally witnessing the birth of an industry that will rival oil and gas and this is why you need to be paying attention to Noble Minerals Exploration and their stacked portfolio of critical mineral projects.

Summary

Overview – A brief description of the company and list of assets.

Critical Mineral Outlook – Covering the last few years of macro factors that have led to the rise in value of critical minerals.

History & Projects – A brief history and comprehensive break down of each project in Noble’s portfolio.

– Project 81 – hosts diversified drill-ready gold, nickel-cobalt and base metal targets at various stages of exploration. In this section, we will take an in depth look at the various projects within the Project 81 land package in and around Timmins Ontario.

- The Crawford Nickel Project – In this section, we will discuss Crawford and the formation of Canada Nickel, highlight the benefits of the project generator model. Additionally, we will discuss 5 other projects from within Project 81 that Noble optioned to or sold to CNC and how the deal benefits Noble and their shareholders.

- Kidd 2.0 – The coveted gem of the Timmins Mining Camp is the Kidd Creek Mine, a super VMS deposit that is among the deepest mines in the world. Typically VMS deposits come to surface in clusters and like many before them, Noble is hoping to hit it big with a satellite discovery.

- Lucas Gold Project – This is one of the projects that originally brought Noble to the area. Combined with the VMS opportunities obviously. Regardless, we will look at some of the highlights of this project.

- Dargavel – Looking back at the 2020 and 2022 drill campaigns

– The Nagagami Niobium Project – Nagagami is a rare earth/ Niobium project near Hearst Ontario. In this section we will cover the acquisition of this asset, comparables to similar carbonatites and the recent drilling on the property.

– The Cousineau Boulder Project – This project is highlighted by the discovery of a boulder assaying 71.8% copper; 3.5% lead, 1.09% zinc; 252 g/T of silver, 3.79 g/T of gold; 4.43 g/T of palladium; and 2.22 g/T of platinum and consisted primarily of the mineral cuprite. Learn about the steps taken by the company to identify the source.

– The Buckingham Graphite Project – The Buckingham Graphite Project is a near surface, flake graphite deposit located in the Outaouais area of the Grenville Subprovince of Quebec and consists of 30 claims (1803 hectares) which contain 3 separate graphite occurrences.

– The Cere Villebon Nickel Project – This project contains a historical resource of 421,840 tonnes grading 0.52% copper, 0.72 % nickel and 1.08 g/t combined platinum-palladium located just outside Val D’or, Quebec.

– Island Pond Gold Project – This new acquisition consists of 576 mining claims in Central Newfoundland, covering an area totaling approximately 14,400 hectares and is contiguous to Spruce Ridge’s Foggy Pond Property and 14 km northwest of Spruce Ridge’s South Pond gold-copper discovery.

– The Laverlochere Nickel Project – The Laverlochere property near Rouyn-Noranda, Quebec and consists of 12 claims and 518 hectares. The property is road and power accessible, located about 100 kilometers south of Rouyn-Noranda.

Additional Assets – Links to more detailed information outlining the details of royalties, JV deals on certain claim blocks, holdings and assets.

Conclusion – Summary of thoughts and most current activities.

Overview

Noble Mineral Exploration Inc. is a Canadian-based junior exploration company holding several highly prospective properties in some of Canada’s most prolific mining jurisdictions. Operating as a project generator, Noble de-risks projects through data compilation and exploration in order to generate option agreements and joint venture exploration programs to benefit shareholders. Their projects include;

- Project 81 ~25,000+ ha – Nickel-Cobalt/VMS/Gold property in the Timmins-Cochrane area of Northern Ontario

- Nagagami ~ 14,600 ha – Niobium and Rare Earths in the Nagagami River Carbonatite prospect near Hearst, Ontario

- Boulder ~ 4,600 ha – VMS/Copper/Gold property just outside Hearst, Ontario

- Buckingham ~ 3,700 ha -High grade Graphite property in the Outaouais area of South Western Quebec

- Cere-Villebon ~ 482 ha – Copper-Nickel-PGM property near Val d’Or, Quebec

- Laverlochere ~ 10,152 ha – Nickel-Copper-Cobalt-Gold and PGM property near Rouyn-Noranda, Quebec

- Island Pond ~14,400 ha – VMS/Copper/Gold in Central Newfoundland

- Holdsworth ~ 304 ha – Gold Project near Wawa, Ontario

In addition to their exploration assets, Noble also holds various royalties and interest in other companies and projects within the mining and exploration sector. Operating under a project generator model has allowed Noble to capitalized on projects through JV’s and spin outs that result in Noble having a robust portfolio of equity positions.

- Canada Nickel Company Inc. – 2.9 million shares + 2% Royalty on all patented & staked claims in 5 townships in the second deal with CNC

- Spruce Ridge Resources Ltd. – 18 million shares

- Go Metals Corp. – 1.4 + 800,000 warrants

- MacDonald Mines Exploration Ltd. – 350k shares

- Private Company #11530313 Canada Inc. – 50/50 JV on certain claims within Project 81

Critical Mineral Outlook

In 2018/19 at the end of the cannabis boom, investors started shifting their focus back into metals, more specifically precious metals. Gold and silver were leading the charge in the markets but chatter really started picking up regarding critical minerals like lithium and base metals like nickel because it was becoming obvious that demand was outpacing supply, leaving everyone scrambling to figure out where the next sources were going to come from. Then disaster struck! In March of 2020, the market crashed on the back of Covid-19. While it was a short lived crash, it would mark the beginning of a period that highlighted how vulnerable we are in our reliance on other countries for critical minerals. I say critical minerals but the truth is that it was everything! Our supply chains crumbled in the wake of lock downs, our hospitals were overrun, basic food and items were running out and nobody could do anything about it, but I digress.

With rising gas prices, people started looking at green energy with more seriousness and as the interest became greater so did the demand, prompting billionaire and owner of Tesla and SpaceX, Elon Musk, to make a public call to the world to find more nickel and mine it in a more environmentally friendly way. This was a catalyst! Any company related to EV’s share prices went through the roof! Honestly though, the timing was perfect. In the US, the Democratic party lead by Joe Biden took the election with promises of large investments in transitioning to green energy and infrastructure. Auto makers were starting to pick up the phone looking for supply in North America, only to find that even though Canada has a great wealth of mineral diversity, critical mineral projects just weren’t being developed fast enough, and LME stocks where starting to dwindle.

Then in February of 2022, Russia decided it was a good time to invade Ukraine and crashed the already fragile markets. However, due to sanctions and Russia cutting off supply, it had an opposite effect on the value of critical minerals. Over the course of three trading days, the price of nickel increased by over 270%, bolstering the value of other critical minerals in conjunction.The speed and scale at which this occurred was unprecedented for a major commodity in recent times and sent shock waves through the market. You see, Russia’s invasion of Ukraine, had increased margining requirements for metals producers and traders, thus affecting liquidity in the nickel market. This is when traders began to cover short positions held in LME and OTC contracts and lead to the start of a short squeeze . For perspective, between March 4 and March 8, nearly $16bn in margin calls had been met by LME members.

While the surge was short lived, Nickel and critical minerals in general have held up their value fairly well and are still trading substantially higher than pre covid prices. With a steadying in the market both the US and Canadian governments began making substantial investments. The United States currently imports more than 80% of its rare earth elements from offshore suppliers to produce clean energy technologies. Prompting Joe Biden to issue the Defense Production Act in an effort to kick-start the domestic production and mining of critical minerals needed to make batteries for electric vehicles and long-term energy storage. In Canada, Justin Trudeau announced the roll out of the The Canadian Critical Minerals Strategy and since, has announced more than $15 billion in investments over the past 10 months in areas ranging from critical mineral mining and processing to battery component manufacturing, electric vehicle production and the country’s first gigafactory.

By 2030, electric vehicles are expected to make up nearly half of global light vehicle sales, and despite significant investment, there is still likely to be a gap between supply and demand, and new mines will need to commissioned to meet the expected increase. For example, lithium production needs to ramp up to 2mt by 2030, that’s over 4x current production! And In the absence of further mine development, the lithium market deficit is projected to reach about 700kt by 2030. Similarly, the copper demand is expected to grow by 20% and have a 4.7mt deficit by 2030 on current projections of supply while nickel is set to see a 44% growth in demand in the same time frame. Demand will be the driver of this industry.

In saying that, money will inevitably find its way down the chain to the explorers who initially find and prove out these deposits. Whether in the form of grant money from the government and strategic investments by majors or hedge funds and institutions looking to capitalize on small cap investments, money is coming back into this sector! Recognize the opportunity and take advantage of it.

History & Projects

Noble came into existence on March 2, 2012, when the company’s name was changed from Ring of Fire Resources Inc. to Noble Mineral Exploration Inc. and began trading on the TSX Venture Exchange as a Tier 2 Mining Issuer under the symbol “NOB” on March 7, 2012.

Ultimately, anything that happened prior to 2018 is irrelevant to the company at this time outside of Project 81 which we will cover under their respective headings. Therefore, instead of outlining the full history of the company in general, we will break down each project with its own associated timeline of exploration done on each.

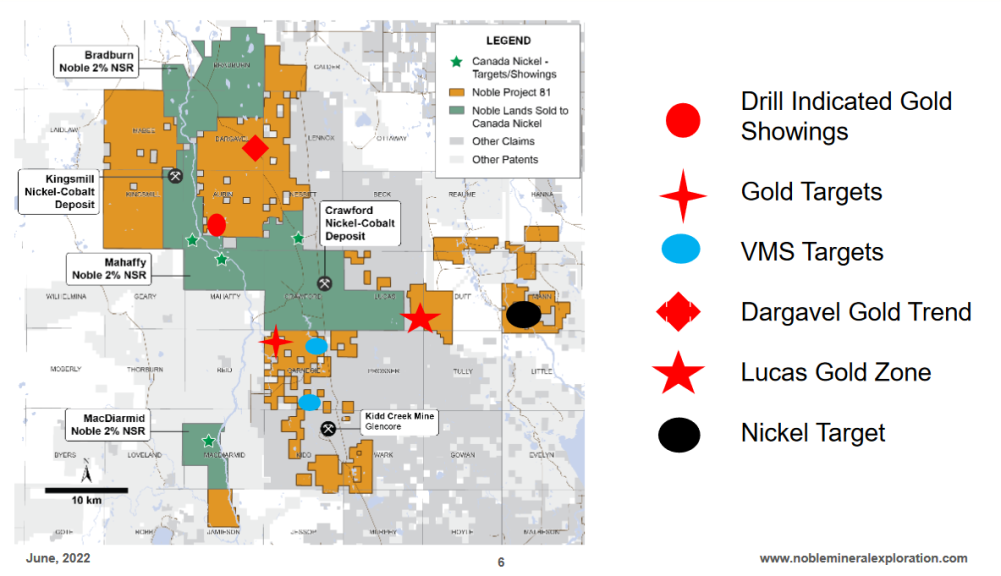

Project 81

For many years a large portion of the land that Project 81 now contains was owned by a logging company and saw little to no exploration activity while the rest of the Timmins area was being heavily explored in hopes of finding the next big gold mine. But in 1963, the discovery of the VMS deposit in Kidd Township now known as the Kidd Creek Mine, led to a flurry of exploration in and around Timmins and thus opened up new opportunity in Northern Ontario.

Originally the property was acquired by Noble because of the Kingsmill Nickel deposit and the Lucas Gold showing. In the first few years they did a range of Geophysics, ran some small drilling campaigns and continued to build out their land package by staking additional claims. Prior to the development of Canada Nickel, Noble had amassed approximately 79,000 hectares of property and tailored their business model to be a project generator whereby they could still maintain exposure to the future success of their property but not have to put out the capital to explore their large land package. Check out their 2019 Corporate video for a quick rundown on the various projects within project 81.

INCO Limited, a Canadian mining company and the world’s leading producer of nickel for much of the 20th century, did the bulk of the exploration work around the Timmins area but they were not interested in low grade high tonnage nickel deposits, as the value of these types of deposits were unknown and for the most part overlooked. So while everyone was looking for the next Kidd Creek, these already identified nickel sulphide targets, sat untouched and exploration in these townships all but stopped in the 1980’s until Noble Mineral Explorations acquired the rights to the property in 2011.

The Crawford Nickel Project

In 2017, Noble Mineral Exploration completed a 1,031.3 line km airborne helicopter MAG-EM survey and hired Orix Geoscience to conduct a data compilation of all known exploration activities on the property. This ultimately led to a joint venture deal with Spruce Ridge Resources to explore certain targets in Crawford Township, including the Crawford Ultramafic Complex (CUC).

In 2018, a fixed-wing 936.1 line km FALCON©, Airborne Gravity Gradiometer and magnetic surveys were conducted, both covering Crawford Township and the CUC. This was followed by the application of Windfall Geotek’s Artificial intelligence, CARDS technology which all but confirmed the CUC as a high priority target. Once Spruce Ridge received the targets from Windfall, they began a diamond drilling program late in the year that continued into 2019.

This was the point where Mark Selby was introduced to Vance White, CEO of Noble Mineral Explorations. Immediately upon the review of Crawford, Mark pinpointed several similarities to the Dumont project, which he spent 10 years developing from a greenfield discovery into a construction ready and fully permitted project as CEO of RNC Minerals. Knowing that he could leverage his experience, Mark opted to take part in this project and began to work with Noble and Spruce Ridge to acquire the Crawford Ultramafic Complex under a newly formed subsidiary company that was to be spun out from Noble Mineral Exploration, called Canada Nickel Company.

As they waited for approval to get a listing on the TSX venture exchange, Vance and Mark were able to acquire a long standing 5% royalty on the property held by Franco Nevada. This deal had been in the works for sometime but worked to the advantage of Canada Nickel as it was completed before the spin out. With the October 1st, 2019 announcement that Noble had created a new entity, Canada Nickel Company took control of the drilling program from Spruce Ridge Resources.

Canada Nickel was spun out and listed on the TSXV at an IPO of $.25 CAD on February 27th, 2020. The terms of the deal with Noble and Spruce Ridge are as follows.

- Noble Mineral Exploration Inc. received $2,000,000 in cash and 12,000,000 Common Shares

- Spruce Ridge Resources ltd. received 20,000,000 Common Shares

The shares received by both companies were then to be spun out to shareholders at set intervals over the next few years. Please note that only some of the shares have been re distributed to Noble and Spruce ridge shareholders with approximately 13 million still to go out. This presents an opportunity to gain exposure to CNC through 2 companies with much smaller evaluations.

Under the guidance of Mark Selby, Crawford is a much larger project today and has become part of a district scale land package, which leads me to my next point.

On March 4th, 2021, Canada Nickel Company announced to pay Noble $500,000 in cash and issue 500,000 Canada Nickel common shares to acquire the Crawford Annex property and the option to earn up to an 80% interest in 5 additional nickel targets within the Project 81 land package and in close proximity to Crawford. If the conditions to earn a 60% interest or 80% interest become satisfied, a joint venture would be formed on that basis and a 2% net smelter return royalty would be granted to Noble. Again the project generator model working in favour of Noble for long term value in assets.

First looking at them as a whole, you can see the full scale of The Crawford Annex which is comprised of 4,909 hectares located in Crawford and Lucas Townships. The other 5 option areas of Kingsmill, Nesbitt North, Crawford-Nesbitt-Aubin, Aubin-Mahaffy and MacDiarmid range in sizes of 903 to 5,543 hectares and cover a substantial land package for CNC. Let’s take a look at the 5 properties

Let’s have a look at the 5 projects that were part of this deal.

Kingsmill

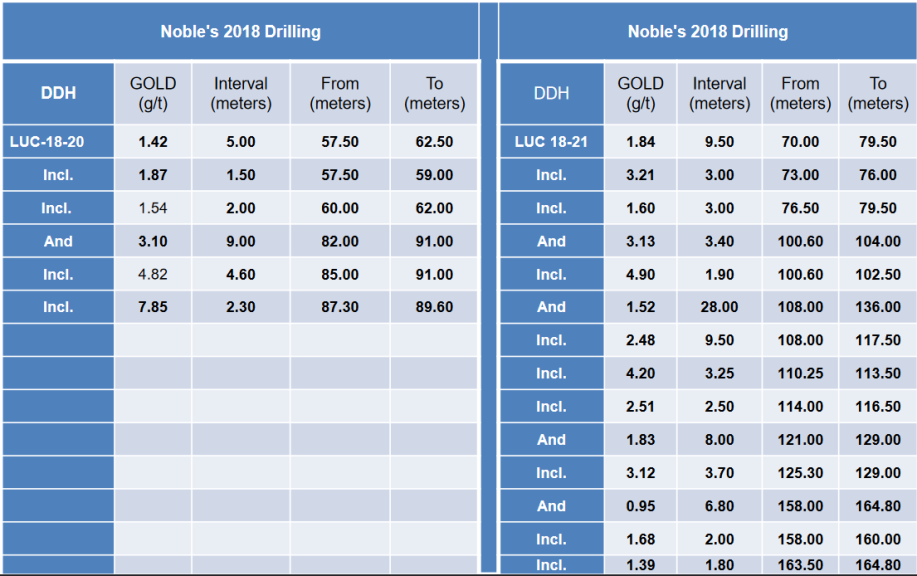

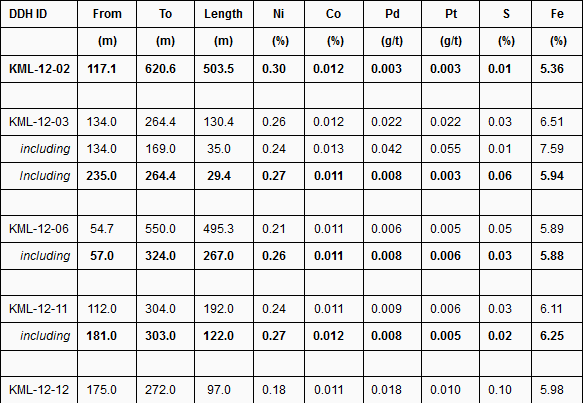

The Kingsmill target is a large serpentinized ultramafic intrusion which is 2.2 km long and between 375-600 metres wide. A thorough review of historical drilling results yielded both significant nickel and PGM intersections and the north side of the structure appears to have the same PGE enrichment as Crawford Main and East Zones: 1.0 g/t PGM over 2 metres from 96 metres within 0.3 g/t PGM over 30 metres from 69 metres in historic hole KML-12-11, 0.8 g/t PGM over 5 metres from 523 metres within 0.5 g/t PGM over 24 metres in historic hole KML-12-07.

Several large portions of the structure remain highly prospective for nickel-cobalt-PGM mineralization:

- The two sections were 1.3 km apart leaving a large portion of the overall structure completely untested.

- There are several intersections which points to the potential for relatively higher quantities of recoverable minerals

- Holes KML-12-06, KML-12-11, KML-12-12 on the Eastern section all contained intersections with significant nickel and sulphur content (which is necessary for formation of nickel sulphide minerals) across wide intersections (see Table 1 below)

- Hole KML-12-03, yielding 0.26% nickel and 0.03% sulphur over 130 metres, was the only hole (of four holes on the Western section) drilled on the northern half of the structure, which has yielded the best mineralized portions of the Crawford Main and East Zones

- Historic hole 27090 also drilled on north side of the structure in 1966 yielded 0.31% nickel over 302 metres (sulphur was not assayed)

The understanding of the mineralogy of these deposits has evolved significantly since Kingsmill drilling was completed eight years ago, particularly the controls and the deportment of potentially recoverable nickel minerals across the deposit. Initial mineralogy results from Kingsmill in 2012 were less positive as the test was conducted on one master sample compiled from all drill cores – not taking into account the significant variability in mineralogy between rock types, and that some ultramafic rock will have low amounts of potentially recoverable nickel minerals.

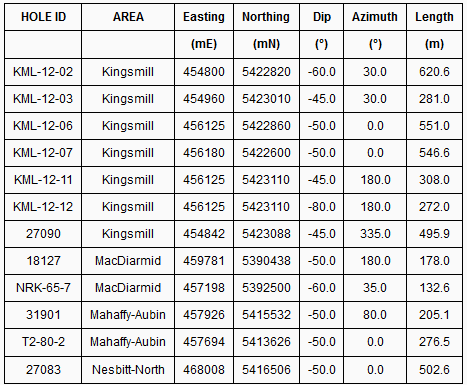

Historical Drill Tables

Kingsmill Selected Historical Drilling Key Nickel Intersections – Holes 2,3,6,11,12 Kingsmill Township, Ontario

Kingsmill Selected Historical Drilling Key PGM Intersections – Holes 7, 11, 12, Kingsmill Township, Ontario

Crawford-Nesbitt-Aubin

The Crawford-Nesbitt-Aubin Township target consists of two ultramafic units 6 km long and 150-200 metres wide containing serpentinized peridotite and much of it was not assayed. Inco drilling in 1964-66 yielded highlights including narrow intervals of up to 0.35% Ni which tested the edges of the geophysical target. For reference, the Crawford Main Zone resource is 1.7 km long and 225-425 metres wide.

Nesbitt North

Two ultramafic units 3.7 km long by 150-300 metres wide with significant nickel intersections were identified in Nesbitt township. Inco 1966 drilling highlights included 0.28% Ni over 163 m in historic hole 27083. For reference, the Crawford Main Zone resource is 1.7 km long and 225-425 metres wide.

July 14th, 2021 – Canada Nickel expanded the potential of Nesbitt to 1.8 kms of strike with a step out hole that was drilled along the geophysical anomaly that intersected 302 metres of nickel mineralization with intervals of visible disseminated sulphides just like at Crawford, highlighted the size potential of the property and given its proximity to the CUC, the potential for it to be inclusive into future Crawford plans.

MacDiarmid

A target of 3 km by 150-600 metres wide ultramafic intrusion with serpentinized peridotite has been identified, much of it was not assayed. Highlights include historic hole 18127 which intersected 142 m of mineralized peridotite which was not assayed, and narrow intervals of up to 0.22% Ni over 1.5 m in NRK-65-7 (1965). For reference, the Crawford Main Zone resource is 1.7 km long and 225-425 metres wide.

Mahaffy-Aubin

A target of 8 km by 200-500 metres wide interpreted ultramafic intrusion has been identified, much of it was not assayed. Highlights include historic hole 31901 (1966) which intersected 0.23% Ni over 127 m, and hole T2-80-2 (1980) which intersected 277 m of serpentinized ultramafic rock with no assays reported. For reference, the Crawford Main Zone resource is 1.7 km long and 225-425 metres wide.

Table 2 – Historical Drill Hole Orientation, Canada Nickel Option Properties, Ontario

The addition of these areas gives Canada Nickel a larger footprint to fully develop Crawford as each can potentially host nickel-cobalt deposits that are similar in nature to Crawford. With these additional targets Canada Nickel could grow their resource exponentially and easily become one of the top players in the nickel sector or provide a major an opportunity to produce nickel feed for many years to come in both the stainless steel and EV sectors. It also allows Noble to advance their projects without spending all of their capital. That’s smart business.

Today, Crawford is well on it’s way to production and expecting to complete the feasibility study in the coming months. Once operational, Crawford will be the largest base metal mining operation in North America.

To learn more about Canada Nickel you can access our research report at

https://insidexploration.com/canada-nickel-company-tsx-v-cnc-research-report/

Kidd Creek 2.0 VMS Project

The Kidd 2.0 drilling will be focused on the Volcanic rocks of the Kidd Munro assemblage that have been periodically intruded by Nickel Copper (“Ni-Cu”) bearing mafic to ultramafic intrusions. The importance of this assemblage is that it hosts one of the world’s largest volcanogenic massive sulphide (“VMS”) deposits at Kidd Creek, approximately 3 kms to the south of the previously mentioned Crawford Nickel Sulphide project. I could go on here but I’ll let Vance explain the basics of the project before we dive into more current exploration activities.

For the last several years, Noble has been punching holes here and there around Kidd Creek in various townships but the holes have been more for geological purposes as they try to get a handle on the regional geology. The reason for that is that the surface signatures of VMS deposits can be very small. To the point where it could just be a few hundred feet. So finding them in a region covered by overburden can be very challenging.

Current Focus

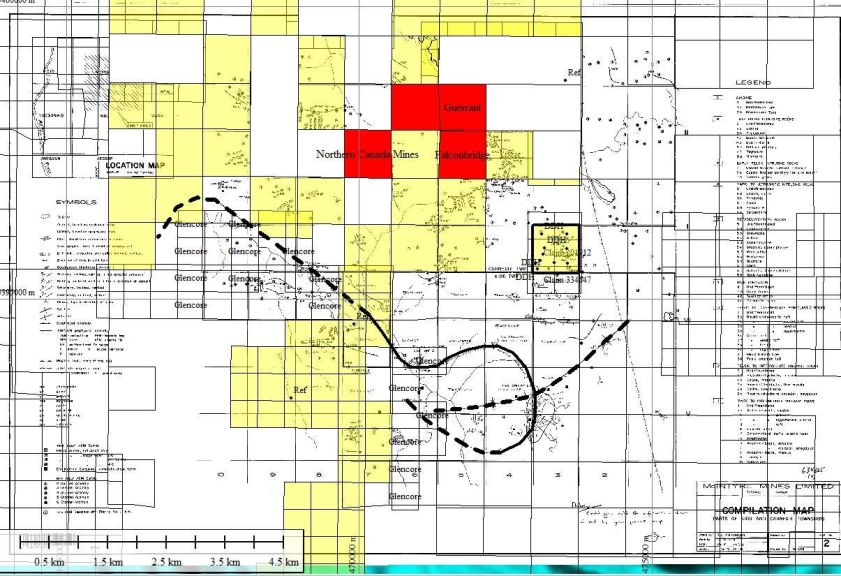

On August 24th, 2021, Noble acquired an additional 310 patented and tenure identified mining claims to add to their already robust land package. The claims are situated in Carnegie, Kidd, Wark and Prosser Townships, totaling about 6,600 hectares. The deal, was a 50/50 partnership with Private Company 11530313 Canada Inc , headed up by Robert Hirschberg and Dr. Sethu Ramon who have been very active in the Timmins mining camp over the last 20 years and were heavily involved with the formation of Canada Nickel.

The terms of the Agreement were that The Private Company paid $250,000 to Galleon Gold, and Noble issued Galleon 2,000,000 common shares, making Noble and 11530313 each 50% owners of the claims and once secured, Noble began the permitting process to drill.

Now let’s take a look at the targets and why they acquired this land.

Exploration target 1 – Fly Creek Rhyolite

The first area of interest is the fly creek rhyolite, which is a target of rhyolite intercalated with ultramafic rocks on an anticlinal structure which has been previously postulated to be the same age as the Kidd Creek mineralized rhyolites. In correlation with similar age dating, there is a report by Bleeker .W (1999)*, where he proposed that faults that slice through the Kidd Creek mine fold have displaced the northern limb of the Kidd Creek Mine up to 2 km to the north (See Figures 1 and 2).

Using this information, Noble conducted a strategic Induced Polarization surveys on this area and will follow up with drilling later this spring based on targets received in the IP report. At this time, the IP survey has not yet been received.

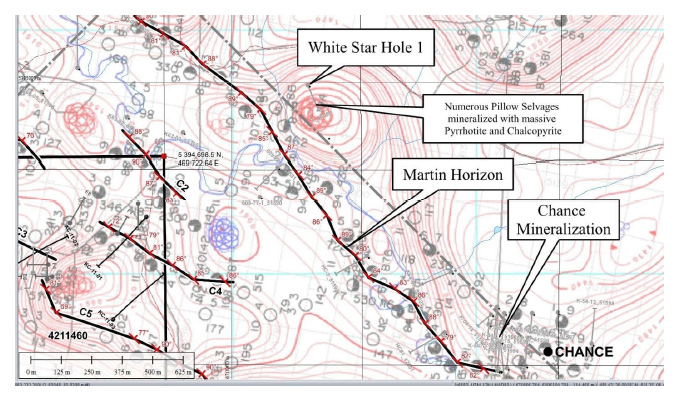

Exploration targets 2 & 3 – Martins Horizon & Chance Mineralization

While doing a review of the project 81 land holdings and researching through various reports, Wayne came across a 1977 report by McIntyre Mines (42A11NW0548), where they note a graphitic sedimentary-exhalite horizon that runs through the Kidd Creek Mine and the Chance Mineralization located about 2 km Northwest of Kidd Creek. This horizon was named the Martins Horizon and traced through drill core, electromagnetic conductors and magnetic anomalies. According to the report, mineralization along the horizon appears to be associated with flexures and folds which could be a clue in finding a satellite deposit. (See Figures 3 & 4)

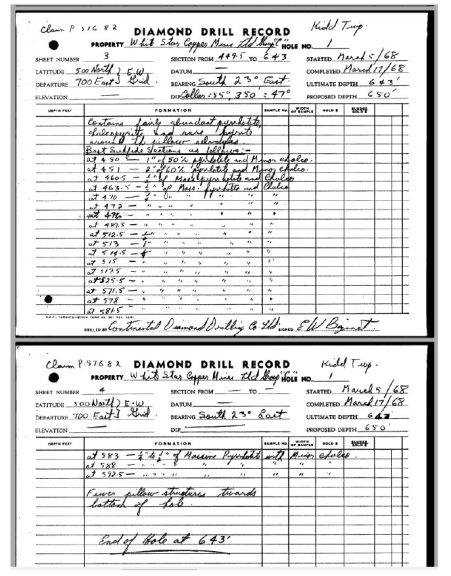

As an added bonus, Noble also discovered a hole drilled in 1967 by White Star that tested a low mag anomaly just off the martins horizon which logged almost 200 feet of mineralization in the form of pyrhidotite stringers but was never assayed for whatever reason. (Figures 5 & 6) For that reason there may be some plans to revisit this anomaly based on what comes back from the IP Surveys.

Upon receipt of the IP surveys, Noble will begin drilling sometime in the early spring of 2023. In the interim, they will continue advancing other projects.

To be updated.

The Lucas Gold Project

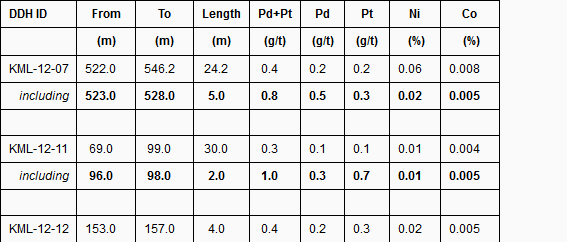

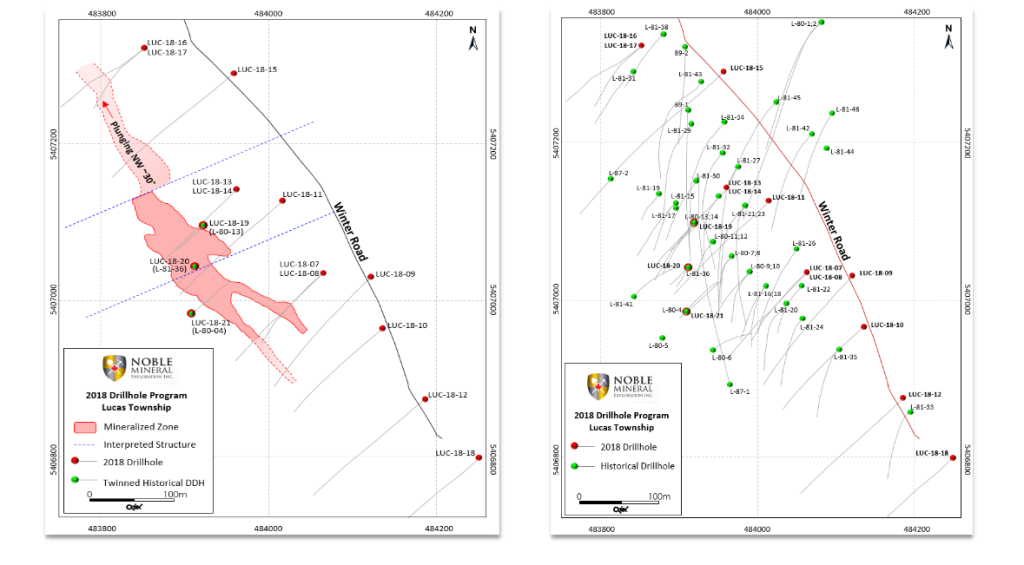

The Lucas gold project lies within Lucas township just north of Kidd Creek and east of Crawford. The property is home to some historic drilling and was one of the first projects that Noble put any focus into on Project 81. It all started with a detailed data compilation on the property and did some geophysics before moving forward with a drilling campaign in early 2018.

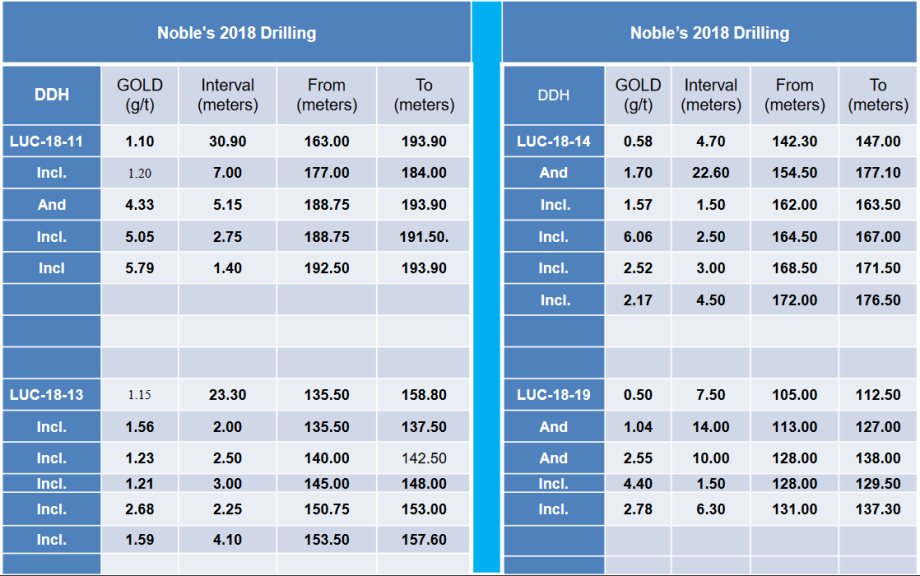

In April of 2018, Noble announced the completion of 15 NQ size diamond drill holes totaling 3,183.93m over an approximate 650m strike length (Figure 1). Noble also discovered a total of 37 historical drillhole collars during this field program and all drill collars were sealed and flagged for future references if required.

The main objectives of the 2018 diamond drilling campaign were three fold:

–Firstly, to locate the Au mineralized Pyrite+/-Chert+/-Quartz unit described in the historical drilling and to trace it along strike for approximately 650m of the 1700m strike length as interpreted from Airborne EM and MAG Surveys.

–Secondly, to determine the attitude and displacement of this mineralized unit with respect to the extensive faulting and displacement interpreted from historical drilling and Airborne Geophysical Surveys. Noble discovered additional shallow angle sub-horizontal faulting and displacement within this unit, and

–Thirdly, to determine the controls of the gold mineralizing mechanism/events, gold grade, and gold distribution within the pyrite+/-chert+/-quartz unit.

In order to realize the above objectives, 10 (ten) diamond drill holes were designed to test the attitude, displacement and strike length of the pyrite+/-chert+/-quartz mineralized unit, while 5 (five) diamond drill holes were designed to test the controls of the gold mineralizing mechanism/event. In so doing, a number of the historical drill holes were twined specifically historical drill holes L80-04, L80-13 and L81-36.

The next phase of exploration drilling on the Lucas Gold Deposit will focus on determining gold grades within the pyrite+/-chert+/-quartz zone over the 650m established to-date, and to extend by diamond drilling, the strike length of the Au mineralized pyrite+/-chert+/-quartz unit, along the 1700m EM conductor trend, as well as to define the vertical extension of the mineralized zone, which is currently open at depth. However, at this time Noble feels that the project is far enough advanced and are actively shopping for a partner to expand the project or for someone to option it out.

To be updated

Dargavel Gold Trend

The Dargavel Gold Trend is located within the Kidd-Munro assemblage of the western Abitibi Sub-province in Northern, Ontario. This assemblage is one of the most ultramafic-rich volcanic successions of any age in the world and is host to the giant Kidd Creek VMS deposit, an important example of bimodal-mafic (ultramafic) volcanic-associated massive sulphide (VMS) deposit, and the newly developing Canada Nickel Company (CNC-TSX.V-CNC) Crawford Ni-Co-Pd deposit, and NOB/CNC’s JV project, The Kingsmill Ni-Co-Pd deposit and the Lucas Gold deposit.

What first attracted Noble to this project is that it has a number of historical drill holes dating back to 1965 with anomalous gold results over 23.6 ft and anomalous platinum results over 9.6 ft. in drill hole 25013. Additional results were also promising with 3.05 g/t Gold and 2.86 g/t Platinum over 8.0 ft, but unfortunately, these holes are not 43-101 compliant.

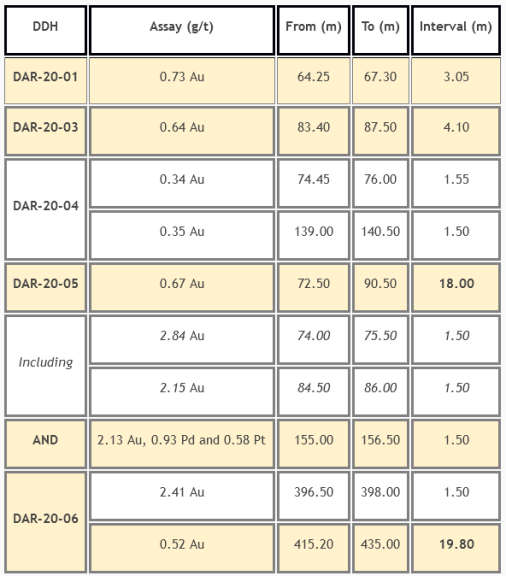

After acquiring the property, Noble did a range of geophysics, including an Airborne Magnetic Gradiometer survey by BECI which they used to complete a Magnetic Inversion 3D Study through Geophysique Camille St-Hilaire Inc. of Rouyn-Noranda, Quebec, and finally, they had Orix Geoscience do a regional geological interpretation on the Dargavel Gold Trend. Then in 2020, they announced the beginning of a drill program based on 10 targets identified for follow-up drilling (Figure 2).

In May of 2020, Noble drilled 6 NQ size diamond drill holes totaling 1390.5m resulting in 822 core samples being sent out for assaying. The program was designed to test 6.5 kms of strike length of a well-defined structural feature identified by Airborne Magnetic & Electromagnetic Surveys completed in 2012 and in follow-up orientation EM & Mag surveys in 2017. The objective of the drilling campaign was to duplicate and expand on gold, platinum and palladium results published in historical drill hole (25013) drilled in the 1960 by CANICO and drill hole (K84-03) drilled the 1980’s by Chevron Canada Resources Ltd. Learn more about the program in this short clip.

The results from the 2020 program found anomalous Au values but not with the same widths or grade as the historical. Uncertainty on the precise location of the historical drilling may be at fault. However, the program established that the Dargavel Gold Trend might be much larger and more continuous than originally thought. Here were the results from the 6 drill holes.

As a follow up to this campaign, An Induced Polarization survey was done to identify areas of increased sulphide concentration within the gold horizon. This would give Noble a clearer indication of where to drill as they planned on doing an additional 2000m worth of drilling.

In January of 2022, the Company drilled 1,253 meters in seven holes. Lucky for Noble, the provincial government set up the Ontario Junior Exploration Program to help fund mineral exploration projects and this project qualified for a $200,000 grant. The The drill program was designed to again test historic gold values intersected by previous explorers in two separate areas as noted below with additional drilling to test IP signatures along strike for approximately 5.5 km.

Targets

1) Dargavel Township (Figure 3 &4) is planned to test the area where past drilling by Chevron (1984) and Noble (2020) intersected the following values:

7.9 g/t gold over 2.0m within 2.6 g/t gold over 7.9m* (Chevron 85-4, Figure 4)

And follow-up drilling by Noble intersected:

0.44 g/t gold over 38.5m* (Noble DAR-20-06, Figure 4)

The Noble drill hole ended in mineralization and will be extended in order to define the true extent of the mineralization.

2) will test a drill hole drilled by Inco (1960’s) that intersected:

9.25 g/t gold over 0.3m plus

0.51 g/t gold over 10.7m and

1.24 g/t gold over 6.5m* (Inco Hole 27089, Figure 4)

* Historical results not 43-101 compliant, True widths not known at this time

During the campaign, one hole was abandoned in overburden but in the six holes that reached bedrock, five had anomalous gold values. (See Table 2)

As the results started coming in, Noble got very active in acquiring new projects and therefore efforts at Dargavel have slowed.

To be updated…

Nagagami Niobium and Rare Earths Project

Nagagami is a Niobium / Rare Earth mineral project just outside Hearst Ontario that is comprised of 677 claims covering over 1,400 hectares. Past work in the Nagagami area has been spotty at best and non existent in the low mag anomaly being targeted by Noble. Part of this is due to the fact that the complex is not exposed on surface.

Algoma Ore Properties performed the original airborne magnetic survey in the area that identified the complex and some limited drilling was done aimed at the magnetic ring structure in around the carbonitite while searching for iron deposits. Despite drilling in the wrong geology for niobium and rare earth metals, one of the Algoma drillholes returned 0.3% Nb205 from a grab sample of syenite taken at 230 feet downhole. Fluorite was noted in one drill hole as red-brown, waxy hydronephelite (an alteration form of nepheline) comprising 5-10% of the rock. Having said that its important to note that the existence of fluorite is characteristic of carbonatite style mineralization.

Learn more in this short clip from the field covering the projects maiden drill program.

2022 Exploration

Consultations have been initiated with the Constance Lake First Nation (CLFN)

Recent research by Noble indicated remarkable similarities between the niobium producing Niobec Mine and the Nagagami Complex. The Niobec Mine now owned by IAMGOLD started commercial production of niobium pentoxide in 1976. It is one of the major sources of niobium in the world and North America’s only source of pyrochlore. It currently produces around 7%-8% of the niobium used globally. Niobec also has a resource in rare earth metals.

A study of the magnetic data for the Nagagami Complex and the Niobec Mine both indicate a donut shaped structures with syenitic rocks forming the circular magnetic high with carbonatitic rocks forming the central magnetic low. At Niobec, it is in the central magnetic low where the Niobium and Rare Earth mineralization is hosted. (See Fig 1 and 2)

Previous work in the Nagagami area has been spotty due in part to the fact that the complex is not exposed on surface. Algoma Ore Properties performed the original airborne magnetic survey in the area that Identified the complex. Limited drilling was aimed at the magnetic ring structure in search of iron deposits. Despite drilling in the wrong geology for niobium and rare earth metals, one of the Algoma drillholes returned an assay of 0.3% Nb205 from a grab sample of syenite taken at 230 feet. Fluorite was noted in one drill hole as red-brown, waxy hydronephelite (an alteration form of nepheline) comprising 5-10% of the rock. The existence of fluorite is characteristic of carbonatite style mineralization.

About 4.5 kilometers south of the Nagagami Complex, Zenyatta Ventures is developing the Albany graphite deposit. The Albany deposit is classed as one of the largest known hydrothermal graphite deposits in the world. Hydrothermal graphite is the purest, but also the rarest, form of graphite. The graphite mineralization here appears to be related to the emplacement of the Nagagami complex resulting in the possible occurrence of similar mineralization and geology on the Noble property.

The Boulder Project

This project is of particular interest as it has all the hallmarks of becoming a major discovery! So, the story starts about 20 years ago when a local entrepreneur from Hearst, Ontario decided that a farm highlighting some of the local wildlife would be a viable tourist attraction. While making improvemnts to his property we decided to dig out a pond. While digging with a backhoe hit a boulder (which he cursed) that was blocking his progress. With some difficulty he was able to pull the boulder out of the hole and place it off to the side with the other material from the excavation and didn’t really think about it beyond that because he had no idea what he had discovered!

The boulder sat there for some time, covered with mud but the rain eventually washed the surface of the boulder and exposed the glimmering sheen of raw metal. Now Andre had always had an interest in the rocks on his farm and area and would pick up samples when something caught his fancy but this rock didn’t stand out until it was clean. He eventually realized that this was no ordinary looking boulder and loaded it up in his truck and put it in his garage…and there it sat…for 20 years.

Friends would drop in and he would invariably show them the boulder until one day a friend said, “Why don’t you call the Resident Geologists Office in Timmins and get them to take a look at it”, and that’s when he contacted Ed van Hees, the Resident Geologist in the Timmins Area at the time. Ed took a look at it and, at first glance, determined it was some sort of iron formation with some really interesting characteristics, and asked if he could send a piece out to the government lab for analysis. The first thought is was could this be a meterorite as he also considered that it was from the Hearst area, where there are virtually no known metal deposits, besides some iron.

In 2019 Ontario Geological Survey analyzed a sample from the 140kg boulder and determined that the boulder contained:

When Ed received the results, he could not believe his eyes and thought, there must be some mistake. But nope! He verified the results with the lab that they corresponded to the sample that was submitted… There was not a lab error. To his surprise the results indicated that the boulder was composed of 71.8% copper; 3.5% lead, 1.09% zinc; 252 g/T of silver, 3.79 g/T of gold; 4.43 g/T of palladium; and 2.22 g/T of platinum and consisted primarily of the mineral cuprite. Now, for context, in mines such as Kidd Creek in Timmins, the average copper content is 1.8%.

Andre took the boulder to the Timmins Mining Show and had some general inquiries, but then COVID-19 hit and in Andre’s words, “Everything went quiet.” Ed filed his report in the Annual Report of the Resident Geologist in Timmins, and everyone hunkered down for the pandemic.

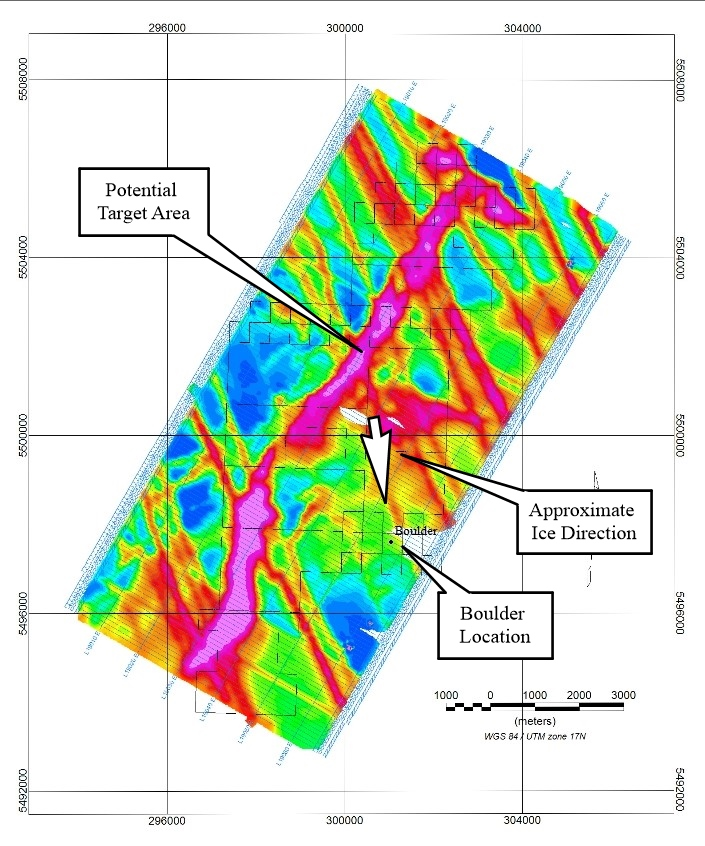

Fast forward to Winter 2021. Wayne Holmstead (geologist) is flipping through Ed’s report and comes across a one-page description of the boulder with a photo. Boulder tracing has always been an interest of his and has historically led to the discovery of some important ore deposits, including the large Eleonore gold deposit in Quebec. So he contacted some of his colleagues and they raised a small amount of money in order to stake claims and do some initial research on the boulder location and potential sources.

One of the people he contacted was Vance White of Noble Mineral Exploration. He knew that Vance was always interested in new ideas and was willing to take a chance on a longshot. So Vance hooked and with Wayne (now Exploration Manager for Noble) drafted an agreement for Noble to acquire 100% interest in the project and got to work. First thing first they needed to figure out where it came from.

During the Fall of 2021 Noble launched an exploration program on the property to in an effort to identify the source of the boulder. Basal till samples collected from two fence lines of hand auger holes, located about 100 m and 1 km north of the boulder location, produced 35 gold grains. These gold grains defined a southeast-northwest trending dispersion train that indicates they were transported southeast by a glacial transport from a source area located to the northwest. The dispersion train appears to begin near a northeast trending magnetic anomaly to the northwest of the property. The gold grains are predominantly reshaped (24) but also include modified (7) and pristine (4), supporting evidence of local source.

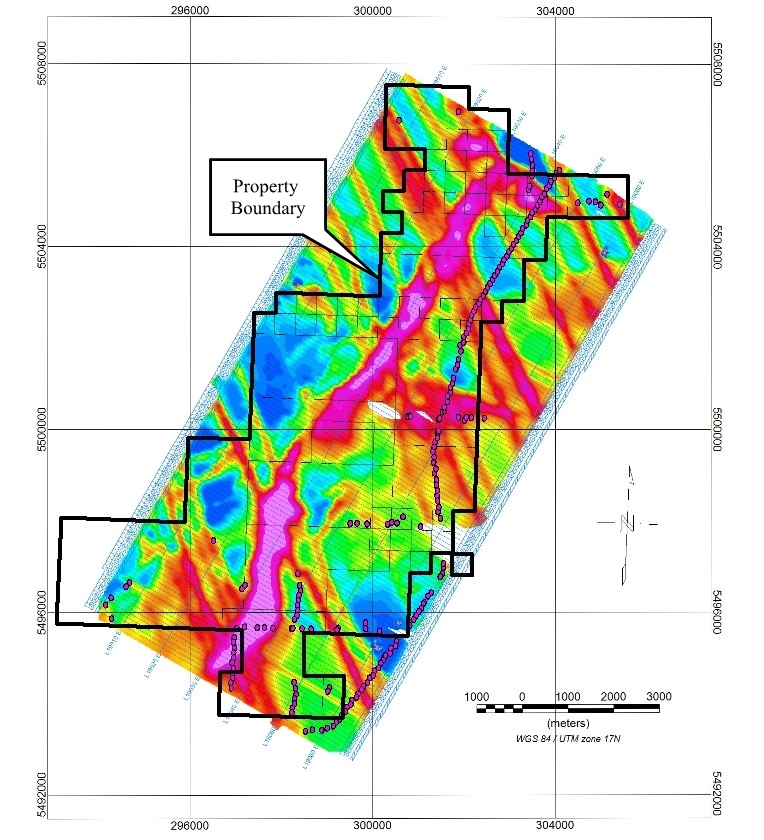

Next up, they flew geophysics in 2022, to get an updated look and more defined structure of the high mag Anomaly that they believe is the sources.

Upon a detailed analysis, Noble Mineral identified several exploration targets using the recently completed magnetic and electromagnetic airborne survey. Some targets were located on property adjacent to the existing Boulder Project property and so they acquired 88 additional mining claims to cover geophysical anomalies near the existing land package.

The next steps being taken to prepare for exploration on the Noble Minerals’ Boulder Project property will include;

- submitting an exploration permit application to the Ontario Mining Lands Administration System (MLAS) for the planned diamond drilling program;

- organizing a prospecting program to explore for outcrop/boulders that could explain the geophysical targets;

- follow up talks with surface rights owners above Noble’s mining claims to arrange access for drill rigs to the exploration targets located on or near their properties;

- and meetings in the communities near Hearst to open dialogue on the project.

Just a friendly note… The metal value of the grades contained in the boulder are in excess of $10,000CDN per tonne of material or equivalent to ~138 grams of gold per tonne or for those that like the old method, 4.4 oz/ton gold.

To be updated

Buckingham Graphite Project

The Buckingham graphite property is located in Southern Quebec in the Outaouais area of the Grenville Subprovince. The property consists of 30 claims (1803 hectares) which contains 3 separate graphite occurrences. Lets look at them.

The first and main occurrence (McGuire) was worked by Stratmin Inc. in 1985-86 when a ground electromagnetic survey was done following a regional airborne survey and three diamond drill holes were completed to intersect the electromagnetic anomalies, 2 of which intersected graphite mineralization. The graphite was found to be hosted by marble and gneissic rocks.

Hole Graphite Length

86-40 10.9% 2.00m*

86-45 9.1% 3.65m*

Hole 86-41 did not intersect the electromagnetic anomaly but additional visual estimations of the graphitic horizons were noted in the log descriptions but were not analyzed for graphite.

Hole Interval(m) Width(m) Visual Graphite(Gp)

86-40 11.3-12.95 1.65* 10-15% Gp

86-40 13.9-14.05 0.15* 8-10% Gp

86-40 18.25-18.75 0.50* 5-10% Gp

86-40 21.2-21.35 0.15* 12-15% Gp

86-40 21.6-21.95 0.35* 10% Gp

86-45 66.35-66.55 0.20* 10-12% Gp

86-45 67.65-68.10 0.45* 3-6% Gp

* (True width not known at this time)

Although the nature of the graphite on the Buckingham Property has not been determined, graphite concurrences in this area are normally coarse grained, flake graphite. This type of graphite is the most desirable of the naturally occurring types that is used to produce lithium-based batteries. Lithium-based batteries are required for a variety of ‘green’ technologies, including electric vehicles and the global demand for these types of products is expected to rise as world governments lean towards environmentally friendly products rather than petroleum-based ones.

The second graphite occurrence (Cummings) is described as a “deposit in the form of narrow bands of graphite occurring in gneiss and marble over a length of 300 m and a width of 30 m. The graphite occurs in several irregular bands within the 30 m zone.” The Cummings Occurrence is located about 1.5 km southeast of the McGuire Occurrence.

The third graphite showing on the property is called the Robidoux Occurrence and is located about 4 km east of the McGuire Occurrence. It was described by the Quebec Superintendent of Mines in a 1910 report as a “partially uncovered graphitic bed over a length of about forty feet. Some shallow pits have also exposed graphitic outcrops, presumably of the same bed, for an additional distance of 75 to 100 feet. The bed where exposed by the main stripping is about four feet thick and dips into the side of a low hill at an angle of 40 to 50 degrees.” It was also noted that “the graphite ore contains over 30% carbon.”

(Note: the exploration work, descriptions and analysis are historic and not 43-101 compliant)

A trenching program was initiated in 2014 based on the airborne survey results and limited ground geophysics. Trench T1 measured approximately 48 meters in length and 2.5 meters in width. Twenty-five channel samples were collected from the stripped area. All samples returned graphite mineralized intersections with a best result of 8.2% Cg (total carbon in graphite form) over 4.75* meters, including 12.1% Cg over 1* meter and 12.5% Cg over 3.5* meters. (Figure 1). Trench 22C was excavated about 75 m NE of Trench T1. Thirty-nine channel samples were collected of which 35 returned Cg contents above 8%. One section yielded 21.6% Cg over 14.5* meters and 16.8% Cg over 3.9* meters (Figure 1). (*-True widths not known at this time.)

In 2015, a 20 kilogram bulk sample was taken from Trench 22C and subjected to initial flotation testing for graphite. These tests were carried out by SGS Canada Inc. of Lakefield, Ontario. The bulk sample was submitted to a simple flotation test, without process optimization or chemical treatment, such as addition of acid leach or alkaline roast. The sample head grade was 20.7% Cg and returned an overall combined flotation concentrate purity of 94.8%. The results of the testing indicated 32% of the flakes were large (+65 mesh) to jumbo (+28 mesh) in size and the purity obtained in these large fractions ranged from 94.8 to 96.1%.

Three phases of diamond drilling were completed on the property from November 2015 to December 2016 for a total of 3,782 meters. Results of the respective drill programs can be viewed in Tables 1 and 2. A photograph of semi-massive graphite mineralization can be seen below.

In June 2021, Noble acquired the Buckingham graphite property and in July they acquired additional claims in the vicinity of Buckingham and with this addition of the 2 map-staked claims, it brings the Buckingham Property total to 32 claims or 1,923 hectares.

The additional 2 claims cover the Buck Graphite Occurrence that has been explored as recently as 2016. In 2013, a high-resolution heliborne magnetic (MAG) and time domain electromagnetic (TDEM) survey covered the area surrounding and the newly acquired claims. One anomaly outlined a 1-kilometer-long conductor historically known to host graphite mineralization.

The 2022 field work program was to consist of a two-phase program to include:

Phase 1

- Re-processing of air borne data from the 2013 survey

- Property visit to locate trenches, grab samples and drill hole collars

- Beep Mat survey to locate new graphite mineralization

Phase 2

- 2,000 meters of diamond drilling

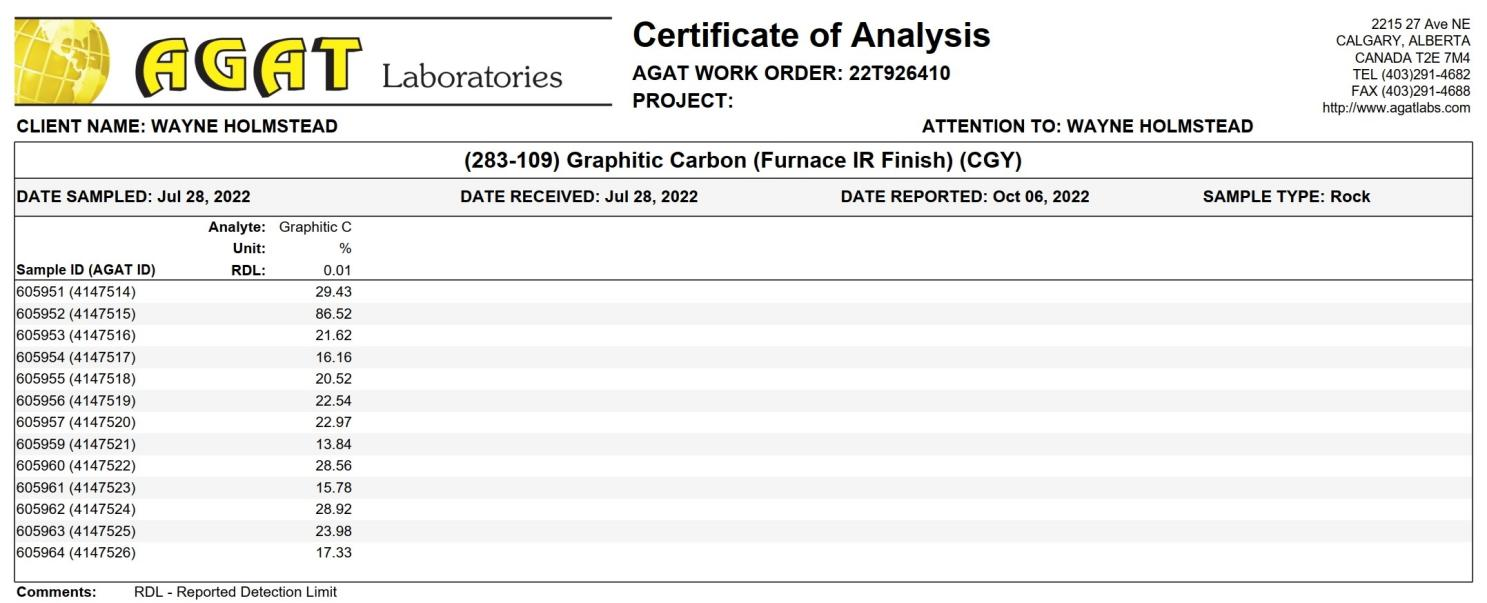

A total of 13 grab samples were taken from various locations on the property during their ground truthing campaign. Some of the highest values were from a section of the property that had not been previously drilled. Across the program Graphitic Carbon values varied from 13.84 to 86.52%.

In January, Isabelle Robillard MSc. P. Geo has been commissioned to update a 43-101 report on the Buckingham Graphite Project. Ms. Robillard was responsible for the planning, execution and monitoring of the drilling programs conducted in 2016 for Ashburton Ventures. The author has also supervised the splitting and sampling of the core material for Ashburton.

To be updated

Island Pond Gold Project

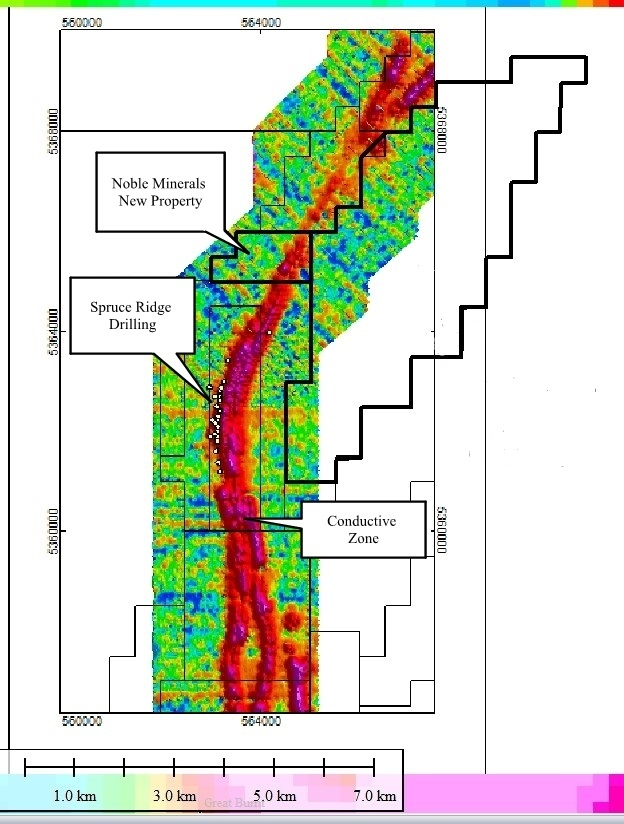

On December 23rd, 202, Noble acquired 576 mining claims in Central Newfoundland, covering an area totaling approximately 14,400 hectares. The Island Pond project is contiguous to Spruce Ridge’s recently staked Foggy Pond Property and is located 14 km northwest of Spruce Ridge’s South Pond gold-copper discovery and 56 km southeast of the historic Buchans high-grade zinc mine.

The property, is located within an area of Central Newfoundland that is geologically mapped as a single unit of Cambrian-Ordovician siliclastic sediments trapped between a series of non-magnetic Devonian Plutons to the west and southeast. The plutons themselves are not considered to be of exploration interest but they could have altered the rocks around them. From the regional magnetic data, a strong magnetic trend exists within the siliclastics that is interpreted to be an unmapped volcanic intrusion. A preliminary structural interpretation, based solely on regional scale aeromagnetic surveys, suggests a multi-fold metamorphic history with a very high potential for repetition of stratigraphy within these newly staked claims. Spruce Ridge Resources (SHL) Foggy Pond Property, contiguous to the east, shows a similar magnetic feature. SHL has reported their preliminary interpretation indicating the possibility for a repetition of known copper and gold mineralization on a western limb. Preliminary interpretation of recently acquired high resolution magnetic data over Foggy Pond show localized magnetic anomalies that could be ophiolite slivers along a major northeast trending structure analogous to the Grub Line located just east of New Found Gold’s high-grade gold discovery located approximately 75 km to the east.

Historic exploration on the Spruce Ridge Great Burnt and South Pond Property was found to contain economic concentrations of copper and possibly gold within volcanic rocks that intruded the siliclastic sediments. The magnetic trend at Island Pond is over 22 km in strike length and up to 3.5 km wide. This region of Newfoundland has received almost no exploration due to the thin but extensive overburden cover and lack of forest suitable for the logging industry (which would have resulted in a road infrastructure).

On January 17th, 2023, Noble announced that they acquired more claims in Newfoundland from a local prospector. The property covers the northern extension of the Spruce Ridge Property (see Figure 4) where recent drilling intersected 51.00 metres averaging 1.69 grams of gold per tonne (g/t Au) in hole SP21-01, 15.00 metres of 2.36 g/t Au (including 4.00 metres of 5.29 g/t Au) in SP21-03, 21.20 metres of 1.75 g/t Au in SP21-08, 17.60 metres of 1.34 g/t Au in SP21-11 and 21.00 metres of 2.06 g/t Au in SP21-14

The company will fly geophysics over the property in the spring of 2023.

To be updated

Cere Villebon

June 24, 2021 – Noble announced that it had acquired the Cere Villebon property near Val d’Or, Quebec. The property consists of 15 claims (483 hectares) and is road and power accessible, located only 4 kilometers east of Highway 117, the highway that connects Montreal to Val d’Or.

The Cere Villebon property consists of pyrrhotite and chalcopyrite mineralization in fracture fillings hosted by ultramafic rocks in the metamorphic halo of the Freville Batholith. The copper, nickel, platinum group mineralization is located in two zones, the North and the South Zone

Drilling and resource estimates done by the Groupe La Fosse Platinum Inc., in 1987, evaluated a historical resource of 421,840 tonnes grading 0.52% copper, 0.72 % nickel and 1.08 g/t combined platinum-palladium (Groupe La Fosse Platinum Inc., 1987 Annual Report). This estimate is historical in nature, non-compliant to NI 43-101 Mineral Resources and Mineral Reserves standards, and therefore should not be relied upon. A Qualified Person has not done sufficient work to classify the historical estimate as current mineral resources, and these estimates should only be considered as an indication of the mineral potential of the Property.

Diamond Drill Hole FV-87-1 drilled by LaFosse Platinum in 1987 into the North Zone intersected 27.38* meters of 0.70% nickel, 0.68% copper, 0.23 g/t platinum, 0.64 g/t palladium and 0.08 g/t gold including 7.65* meters of 0.94% nickel, 1.02% copper (See Figure 1). Future work will include a complete compilation of past drilling and a drill program to verify past results and extend the two zones along strike and at depth.

Exact width not known at this time

A 2,500 meter drill program is currently underway and this report will be updated as the results come through.

Laverlochere

The Laverlochere property near Rouyn-Noranda, Quebec and consists of 12 claims and 518 hectares. The property is road and power accessible, located about 100 kilometers south of Rouyn-Noranda.

The Laverlochere property is located on the southern part, of the east-west trending Belleterre-Angliers greenstone belt that is made up of an assemblage of sedimentary and volcanic rocks of Archaen age (See Figure 1). Several Nickel-Copper-Platinum Group occurrences and showings have been discovered in the Belleterre-Angliers greenstone belt. Approximately 30 km east of the Laverlochere property, the Lac Kelly property reportedly contains of 1.4 million tonnes of 0.7% Copper, 0.7% Nickel, 0.33 g/t Platinum+Palladium with a potential for minor amounts of Cobalt and Rhenium. In the same general area, Blondeau Nickel has outlined 227,000 tonnes of mineralization grading 0.45% Copper and 0.45% Nickel. Historic exploration in the area has outlined four separate zones of Nickel-Copper-Platinum Group mineralization in gabbroic bodies interbedded in mafic to felsic volcanics (the above estimates are historic in nature not 43-101 compliant).

The Lorraine Mine, located about 24 km east of the Laverlochere property operated from 1964 to 1968 and reported to have produced 600,000 tonnes grading 0.47% Nickel, 1.08% Copper, 6.86 g/t Silver and 0.67 g/t Gold from basaltic and gabbroic rocks.

On the Laverlochere property, historic trenching and drilling on the north shore of Lac Rousselot led to the discovery of a band of iron formation, striking N60°E. The iron formation is brecciated and contains pyrite-rich lenses and veinlets of quartz. A trench, approximately 1,080 m to the southeast of the iron formation, exposed a silica bearing that contains considerable veinlets or dike-like masses of quartz that are well mineralized with chalcopyrite and pyrite. A 1.8 by 3.0 m shaft was sunk on a 3 m long by 30 cm wide, mineralized quartz lens. The lens strikes northwest and cuts across N30°W striking sheared andesites. The mineralization is primarily chalcopyrite and a 30 cm sample across the quartz lens analyzed 0.57% copper and 2.6 g/t gold.

In 1969, Inco drilled three holes under Lac Rousselot (See image below). Drill hole 32375 was drilled to a depth of 309 m and in the upper section (0 to 93.9 m) intersected mainly andesitic and gabbroic rocks that were locally, weakly mineralized in pyrite, pyrrhotite and chalcopyrite. The lower part of the hole (from 93.9 to 309 m) intersected serpentinized peridotite that was systematically analyzed for copper, nickel and cobalt. The analyses reportedly revealed a 214.7 meter mineralized interval grading 0.01% Copper, 0.29% Nickel and 0.02% Cobalt (Exact width not known at this time).

Drill hole 32376, intersected mainly intermediate volcanics, gabbroic, and dioritic rocks down to 97.6 m that were weakly mineralized with pyrite, chalcopyrite and pyrrhotite. From 97.6 m to the bottom of the hole at 108.8 m peridotite was intersected. Eight samples of core from the gabbro, andesite and a chlorite bearing schist were analyzed for copper, nickel, zinc, platinum group and gold. Analyses from the peridotite graded 0.02% Copper and 0.224% Nickel over the 11.2 meter interval. In addition, combined Platinum-Palladium was 0.72 g/t and Gold 0.34 g/t (Exact width not known at this time). These analytical results are historic and have not been verified by Noble)

Future work will include a complete compilation of past work, geophysical surveys and a drill program to verify past results.

Additional Assets

Because Noble is a project Generator, they have amassed a series of holdings, royalties and joint ventures. Many of which have been previously noted but the details of each transaction are complex. Therefore, we encourage you to visit https://www.sedar.com/GetFile.do?lang=EN&docClass=7&issuerNo=00013291&issuerType=03&projectNo=03486988&docId=5350870 and go through the most recent MD&A to get the finer details.

Portfolio of assets

- Canada Nickel Company Inc. – 2.9 million shares + 2% Royalty on all patented & staked claims in 5 townships in the second deal with CNC

- Spruce Ridge Resources Ltd. – 18 million shares

- Go Metals Corp. – 1.4 + 800,000 warrants

- MacDonald Mines Exploration Ltd. – 350k shares

- Private Company #11530313 Canada Inc. – 50/50 JV on claims within Project 81

Conclusion

Noble Mineral Exploration has proven beyond a doubt to be a very effective project generator in the last several years. Shareholders have enjoyed dividends from the Canada nickel spin out and have watched as the company made creative deals that allow them to maintain exposure to the projects they are developing. With a slew of critical mineral projects, look for noble to be very active in 2023. These types of projects are getting lots of attention right now creating the perfect environment for more value added partnerships.

Heading into March 2023, Investor should be paying attention to the current drill campaigns at Cere Villebon and Kidd 2.0. However, in our opinion the story to really watch is the boulder project. Given that the rock is estimated to be worth $10, 000 per ton, If Noble hits even a few meters, the movement on the stock could be of epic proportions. Thoughts of Kidd Creek, Voiseys Bay, Hemlo and the diamond rush of the 90’s with the Ekati and Diavik diamond mines linger, as the possibility of a similar type move is very much in play. At today’s market cap, Noble is a steal!

Disclosure

Noble Mineral Exploration Inc. is a sponsor of Insidexploration.

Disclaimer

tsx

tsxv

tsx venture

otc

gold

silver

lithium

cobalt

rare earths

nickel

copper

zinc

iron

niobium

rhenium

diamond

tsxv-cnc

canada-nickel-company-inc

canada nickel company inc

tsxv-nob

noble-mineral-exploration-inc

noble mineral exploration inc

tsxv-shl

spruce-ridge-resources-ltd

spruce ridge resources ltd

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…