Companies

Gold Digger: Victor Smorgon’s gold exposure led to strong March gains. These are the ASX stocks in its portfolio

Which ASX gold stocks does fund manager Victor Smorgon like? The kind of gold stocks that easily beat the ASX … Read More

The post Gold Digger: Victor…

- Fundie Victor Smorgon says strong emphasis on gold stocks in Global Multi-Strategy Fund led to a 3.4% return in March

- Smorgon’s gold stock picks returned 16.8% for the month

- Favourites include Westgold, Ramelius, Northern Star, Newcrest and Red 5

Our Gold Digger column wraps all the news driving ASX stocks with exposure to precious metals.

Melbourne based fund manager Victor Smorgon says a strong emphasis on gold stocks in its Global Multi-Strategy Fund led to a 3.4% return to investors in March.

This result — better than the ASX 200 (down 0.16%) and the Dow (up 1.89%) — represents a return to form for the fund, which fell 5.6% in February.

Smorgon’s gold stock picks returned 16.8% for the month as markets began to price in the effects of an easing in the Fed’s interest rate hiking cycle.

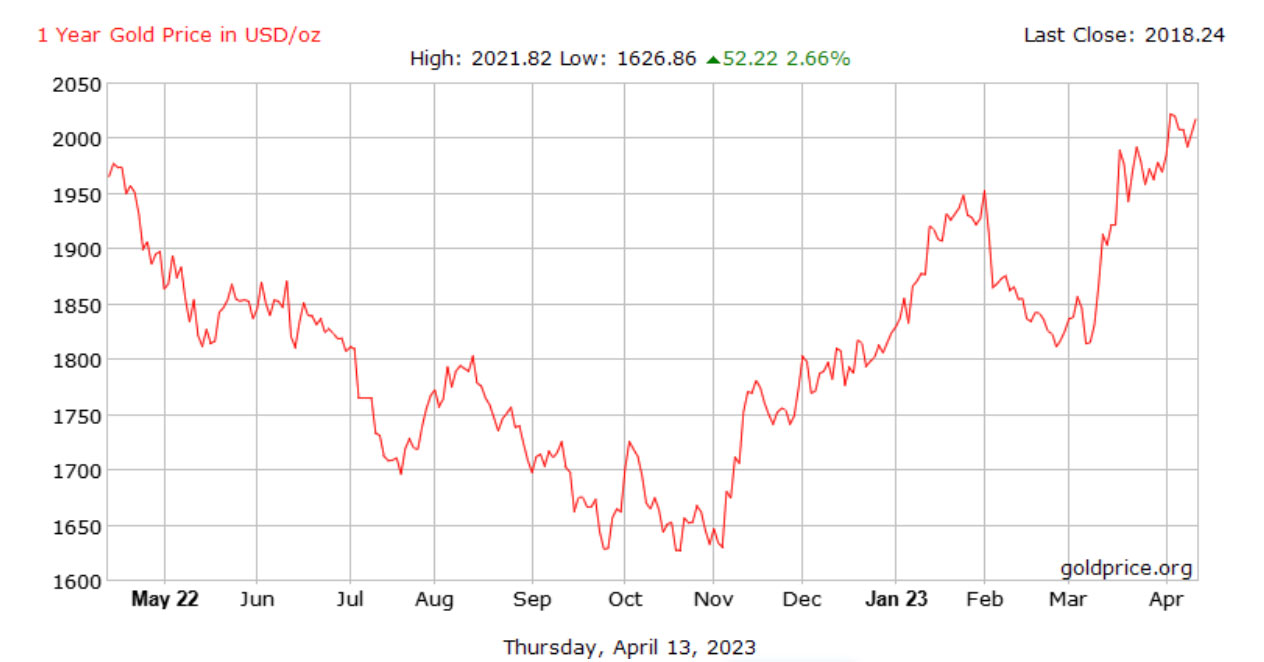

“Declining bond yields and slowing economic growth acted as a tailwind for the gold price, with the precious metal breaching the key US$2,000/oz level intra-month,” says Peter Edwards, executive chair of Victor Smorgon Partners and co-CIO of the fund, and Joseph Sitch co-CIO.

“There was broad-based buying across gold equities, with the USD gold price increasing by 7.8% throughout the month.”

Which ASX gold stocks does Victor Smorgon like?

At the portfolio level, performance was driven by exposures to resurgent mid-cap producers Westgold Resources (WGX) and Ramelius Resources (RMS).

Westgold, up almost 68% year to date, and Ramelius, up more than 50% YTD, are producers in the 250,000ozpa range who struggled with costs, labour and Covid last year.

But they trade at around half of the EV/oz of the majors and “are expected to release strong March quarter results over the coming weeks,” say Edwards and Sitch.

Large-cap gold producer Northern Star (ASX:NST) also performed strongly in March, attributing 0.43% to overall fund performance.

The gold portfolio also has exposure to 2Mozpa takeover target Newcrest (ASX:NCM).

“Newcrest is the target of an acquisition by US gold giant, Newmont Mining, at a valuation of $29.4b,” say Edwards and Sitch.

“This represents a 46.4% premium to its valuation before the first offer was made.”

Red 5 ‘has significant upside value’

On the smaller side is Red 5 (ASX:RED), which announced record monthly production of 17,550 ounces (210,600 ounces per annum on a run-rate basis) at its King of the Hills gold mining operation.

This was met with a positive response by the market, say Edwards and Sitch.

It expects to deliver 95,000-105,000oz at $1750-1950/oz over the latter half of FY23.

The company was pummelled in Feb after returning to equity markets for the second time in under six months, but it has staged a recovery since then.

“At the time of writing, the company is trading at $0.18/share,” say Edwards and Sitch.

“We believe the company has significant upside value above the current share price.”

Stubbornly high inflation stunting gold’s run

“Inflation is not slowing enough for gold to make that record run,” OANDA senior analyst Ed Moya said yesterday.

“Gold prices initially rallied after Wall Street saw consumer prices post the slowest rise since May 2021.

“This inflation report is promising for disinflation trends but it doesn’t mean the Fed’s tightening work is done.

“Gold’s bullish outlook remains intact, but it seems prices may be stuck in a consolidation phase until we have a clearer outlook for the economy.”

Gold was paying ~US$2026/oz at 9pm EST Thursday. Silver was also sitting pretty at US$25.61/oz.

How did precious metals stocks perform yesterday?

Like Wednesday, most stocks above $1bn market cap finished flat or eked out a small win.

All up, 75 stocks on our list went up, 76 went down, and 122 stayed the same.

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected]

| CODE | COMPANY | THURSDAY RETURN % | 1 WEEK RETURN % | YTD RETURN % | 12 MONTH RETURN % | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|---|

| CLZ | Classic Min Ltd | 50% | -25% | -84% | -99% | 0.0015 | $3,093,095 |

| TG1 | Techgen Metals Ltd | 32% | 43% | 6% | -40% | 0.087 | $4,244,535 |

| PUA | Peak Minerals Ltd | 25% | 25% | -17% | -72% | 0.005 | $4,165,506 |

| MTH | Mithril Resources | 25% | 25% | -29% | -77% | 0.0025 | $6,526,180 |

| REZ | Resourc & En Grp Ltd | 23% | 0% | 0% | -64% | 0.016 | $6,497,475 |

| WCN | White Cliff Min Ltd | 23% | 14% | -43% | -73% | 0.008 | $5,096,354 |

| SI6 | SI6 Metals Limited | 22% | 10% | -8% | -39% | 0.0055 | $6,729,276 |

| NMR | Native Mineral Res | 18% | 18% | -64% | -81% | 0.04 | $4,084,717 |

| DRE | Dreadnought Resources Ltd | 16% | 22% | -26% | 77% | 0.078 | $221,952,791 |

| HMG | Hamelingoldlimited | 16% | 26% | -24% | -27% | 0.11 | $10,450,000 |

| ARV | Artemis Resources | 15% | 15% | -40% | -79% | 0.015 | $20,298,439 |

| NSM | Northstaw | 15% | 0% | -3% | -46% | 0.15 | $15,616,510 |

| AVW | Avira Resources Ltd | 14% | 33% | 33% | -33% | 0.004 | $7,468,265 |

| KTA | Krakatoa Resources | 11% | 15% | -30% | -73% | 0.031 | $9,651,878 |

| SKY | SKY Metals Ltd | 10% | 38% | 15% | -45% | 0.055 | $18,839,174 |

| MRZ | Mont Royal Resources | 10% | 5% | -34% | -69% | 0.115 | $7,190,680 |

| GBR | Greatbould Resources | 9% | 8% | 8% | -21% | 0.098 | $40,406,847 |

| HXG | Hexagon Energy | 8% | 8% | -24% | -69% | 0.013 | $6,154,991 |

| VMC | Venus Metals Cor Ltd | 8% | 5% | 48% | 3% | 0.2 | $32,944,556 |

| MKG | Mako Gold | 8% | 5% | 8% | -51% | 0.043 | $18,866,054 |

| MEI | Meteoric Resources | 7% | -2% | 112% | 603% | 0.1125 | $182,083,869 |

| LCY | Legacy Iron Ore | 7% | 0% | -21% | -44% | 0.015 | $89,695,567 |

| LRL | Labyrinth Resources | 7% | 36% | -12% | -63% | 0.015 | $13,432,823 |

| TGM | Theta Gold Mines Ltd | 7% | 6% | 10% | -52% | 0.075 | $43,400,635 |

| GED | Golden Deeps | 7% | 0% | -11% | -58% | 0.008 | $8,664,200 |

| CDT | Castle Minerals | 7% | -20% | -24% | -71% | 0.016 | $16,867,395 |

| SBR | Sabre Resources | 7% | -4% | -37% | -66% | 0.024 | $6,558,439 |

| RDT | Red Dirt Metals Ltd | 6% | 15% | -14% | -22% | 0.41 | $171,366,384 |

| ADT | Adriatic Metals | 6% | 0% | 18% | 47% | 3.73 | $780,456,306 |

| BNZ | Benzmining | 6% | 4% | 4% | -36% | 0.425 | $29,221,920 |

| PUR | Pursuit Minerals | 6% | 6% | 13% | -42% | 0.018 | $43,912,431 |

| RDN | Raiden Resources Ltd | 5% | 5% | -16% | -71% | 0.004 | $6,287,413 |

| CPM | Coopermetalslimited | 5% | 16% | 36% | -19% | 0.32 | $12,533,975 |

| AAR | Astral Resources NL | 5% | 6% | 21% | -16% | 0.087 | $55,229,028 |

| GSN | Great Southern | 5% | 10% | -24% | -63% | 0.022 | $13,933,647 |

| KAI | Kairos Minerals Ltd | 5% | 5% | -4% | -24% | 0.022 | $41,245,963 |

| PNM | Pacific Nickel Mines | 5% | 10% | 7% | -19% | 0.089 | $32,300,360 |

| KIN | KIN Min NL | 5% | 10% | -31% | -53% | 0.045 | $50,660,474 |

| MAT | Matsa Resources | 5% | 5% | 24% | -34% | 0.046 | $18,128,203 |

| CDR | Codrus Minerals Ltd | 4% | 47% | -4% | 33% | 0.125 | $4,851,600 |

| LEX | Lefroy Exploration | 4% | 13% | 0% | -19% | 0.26 | $40,114,501 |

| HCH | Hot Chili Ltd | 4% | 1% | 22% | -24% | 1.07 | $123,028,562 |

| LM8 | Lunnonmetalslimited | 4% | 5% | 31% | 13% | 1.17 | $124,160,024 |

| BNR | Bulletin Res Ltd | 4% | -2% | -5% | -57% | 0.088 | $24,955,244 |

| TTM | Titan Minerals | 4% | 7% | -12% | -38% | 0.059 | $80,442,572 |

| MBK | Metal Bank Ltd | 3% | -12% | -12% | -50% | 0.03 | $8,018,080 |

| ALK | Alkane Resources Ltd | 3% | 13% | 73% | -23% | 0.925 | $535,919,370 |

| S2R | S2 Resources | 3% | 7% | -9% | -9% | 0.155 | $61,513,728 |

| RRL | Regis Resources | 3% | 8% | 13% | 5% | 2.325 | $1,698,808,331 |

| GMR | Golden Rim Resources | 3% | 6% | 13% | -53% | 0.035 | $20,114,005 |

| LYN | Lycaonresources | 3% | -8% | -36% | -57% | 0.175 | $5,596,188 |

| AM7 | Arcadia Minerals | 3% | -10% | -12% | -29% | 0.18 | $8,172,131 |

| KCC | Kincora Copper | 3% | 7% | -1% | -35% | 0.072 | $8,348,219 |

| ANX | Anax Metals Ltd | 3% | 1% | 38% | -30% | 0.073 | $29,067,033 |

| AAU | Antilles Gold Ltd | 3% | 0% | 23% | -42% | 0.037 | $17,543,190 |

| TMB | Tambourahmetals | 2% | -4% | -17% | -65% | 0.087 | $3,501,371 |

| SFR | Sandfire Resources | 2% | 10% | 28% | 27% | 6.94 | $3,106,865,110 |

| DEG | De Grey Mining | 2% | 4% | 29% | 32% | 1.66 | $2,544,702,071 |

| NVA | Nova Minerals Ltd | 2% | -34% | -55% | -63% | 0.305 | $63,266,933 |

| SMS | Starmineralslimited | 1% | 1% | 1% | -63% | 0.073 | $2,170,209 |

| FAL | Falconmetalsltd | 1% | 3% | 32% | 4% | 0.37 | $64,605,000 |

| ERM | Emmerson Resources | 1% | -4% | 0% | -46% | 0.075 | $40,308,524 |

| CHN | Chalice Mining Ltd | 1% | 5% | 26% | 14% | 7.95 | $2,955,110,473 |

| TBR | Tribune Res Ltd | 1% | 7% | 0% | -18% | 4.03 | $208,822,946 |

| ARL | Ardea Resources Ltd | 1% | -13% | -43% | -77% | 0.405 | $68,601,109 |

| PRU | Perseus Mining Ltd | 1% | 2% | 16% | 29% | 2.44 | $3,296,589,764 |

| IGO | IGO Limited | 1% | 3% | -5% | -6% | 12.73 | $9,526,429,088 |

| AZS | Azure Minerals | 1% | 7% | 93% | 26% | 0.435 | $167,801,511 |

| GOR | Gold Road Res Ltd | 1% | 1% | 7% | 13% | 1.815 | $1,935,766,397 |

| CMM | Capricorn Metals | 1% | 3% | 7% | 12% | 4.9 | $1,822,427,149 |

| BGL | Bellevue Gold Ltd | 1% | 9% | 31% | 56% | 1.485 | $1,659,832,978 |

| BRB | Breaker Res NL | 1% | 8% | 55% | 83% | 0.495 | $160,172,269 |

| SPD | Southernpalladium | 1% | -11% | -38% | 0% | 0.505 | $21,539,164 |

| SLR | Silver Lake Resource | 1% | 3% | 6% | -41% | 1.26 | $1,162,180,416 |

| SMI | Santana Minerals Ltd | 1% | 1% | 23% | 39% | 0.805 | $119,022,078 |

| NST | Northern Star | 0% | 6% | 26% | 27% | 13.75 | $15,754,252,802 |

| MRR | Minrex Resources Ltd | 0% | -11% | -50% | -77% | 0.016 | $17,357,880 |

| NPM | Newpeak Metals | 0% | 0% | 0% | 0% | 0.001 | $9,145,132 |

| FFX | Firefinch Ltd | 0% | 0% | 0% | -45% | 0.2 | $236,569,315 |

| DCX | Discovex Res Ltd | 0% | 0% | 0% | -61% | 0.003 | $9,907,704 |

| AQX | Alice Queen Ltd | 0% | -33% | -50% | -85% | 0.001 | $2,530,288 |

| SLZ | Sultan Resources Ltd | 0% | 0% | -54% | -75% | 0.039 | $4,028,091 |

| KSN | Kingston Resources | 0% | 10% | 42% | -34% | 0.115 | $47,800,170 |

| PNX | PNX Metals Limited | 0% | 0% | -29% | -42% | 0.003 | $16,141,874 |

| TMX | Terrain Minerals | 0% | 20% | 0% | -40% | 0.006 | $6,499,196 |

| NXM | Nexus Minerals Ltd | 0% | -6% | -23% | -54% | 0.155 | $50,445,263 |

| CST | Castile Resources | 0% | -7% | -2% | -45% | 0.093 | $22,496,926 |

| YRL | Yandal Resources | 0% | -4% | -10% | -62% | 0.088 | $13,886,671 |

| FAU | First Au Ltd | 0% | 20% | 50% | -60% | 0.006 | $6,568,700 |

| GWR | GWR Group Ltd | 0% | -3% | 42% | -46% | 0.084 | $26,982,199 |

| IVR | Investigator Res Ltd | 0% | 13% | 50% | -9% | 0.063 | $90,541,459 |

| GTR | Gti Energy Ltd | 0% | 13% | -17% | -63% | 0.009 | $16,132,352 |

| IPT | Impact Minerals | 0% | 9% | 71% | -5% | 0.012 | $29,776,447 |

| MOH | Moho Resources | 0% | 0% | -24% | -72% | 0.016 | $3,322,595 |

| BBX | BBX Minerals Ltd | 0% | 16% | -5% | -17% | 0.1 | $50,572,148 |

| MVL | Marvel Gold Limited | 0% | -6% | -35% | -63% | 0.017 | $11,986,604 |

| PRX | Prodigy Gold NL | 0% | 9% | 0% | -39% | 0.012 | $20,974,594 |

| RND | Rand Mining Ltd | 0% | -5% | -2% | -13% | 1.33 | $75,645,028 |

| CAZ | Cazaly Resources | 0% | 0% | -21% | -34% | 0.027 | $10,039,188 |

| BMR | Ballymore Resources | 0% | 10% | 7% | -20% | 0.16 | $15,410,793 |

| KAL | Kalgoorliegoldmining | 0% | 0% | -40% | -69% | 0.05 | $3,876,051 |

| SIH | Sihayo Gold Limited | 0% | 0% | 0% | -60% | 0.002 | $12,204,256 |

| WA8 | Warriedarresourltd | 0% | -4% | -21% | -4% | 0.135 | $58,192,940 |

| WRM | White Rock Min Ltd | 0% | 0% | -5% | -69% | 0.063 | $17,373,121 |

| CTO | Citigold Corp Ltd | 0% | 0% | 0% | -25% | 0.006 | $17,241,955 |

| M2R | Miramar | 0% | 0% | -45% | -75% | 0.044 | $3,437,357 |

| MHC | Manhattan Corp Ltd | 0% | 0% | -9% | -64% | 0.005 | $14,681,393 |

| GRL | Godolphin Resources | 0% | 0% | -22% | -48% | 0.065 | $7,694,014 |

| TRY | Troy Resources Ltd | 0% | 0% | 0% | 0% | 0.0295 | $62,920,961 |

| CGN | Crater Gold Min Ltd | 0% | 0% | 0% | 0% | 0.014499 | $17,965,037 |

| SVG | Savannah Goldfields | 0% | 3% | -13% | -31% | 0.165 | $31,159,992 |

| EMC | Everest Metals Corp | 0% | -3% | -13% | -51% | 0.069 | $7,343,885 |

| GUL | Gullewa Limited | 0% | 0% | -8% | -23% | 0.055 | $10,767,521 |

| G50 | Gold50Limited | 0% | -5% | -20% | -17% | 0.2 | $11,388,600 |

| ADV | Ardiden Ltd | 0% | 0% | 14% | -38% | 0.008 | $21,506,683 |

| VKA | Viking Mines Ltd | 0% | 0% | 10% | 0% | 0.011 | $11,277,843 |

| LCL | Los Cerros Limited | 0% | 0% | -49% | -73% | 0.029 | $23,034,829 |

| ADG | Adelong Gold Limited | 0% | 27% | 100% | -53% | 0.014 | $7,473,512 |

| RMX | Red Mount Min Ltd | 0% | 0% | -20% | -58% | 0.004 | $9,087,404 |

| XTC | Xantippe Res Ltd | 0% | 0% | -20% | -69% | 0.004 | $42,320,399 |

| NML | Navarre Minerals Ltd | 0% | -3% | -20% | -62% | 0.033 | $49,595,012 |

| MAU | Magnetic Resources | 0% | -3% | -21% | -53% | 0.68 | $156,068,419 |

| EM2 | Eagle Mountain | 0% | 3% | -12% | -65% | 0.15 | $45,745,029 |

| MEU | Marmota Limited | 0% | 3% | -17% | -13% | 0.04 | $42,352,023 |

| DCN | Dacian Gold Ltd | 0% | 4% | -20% | -71% | 0.08 | $97,344,075 |

| SVL | Silver Mines Limited | 0% | 2% | 23% | 2% | 0.245 | $343,984,813 |

| PGD | Peregrine Gold | 0% | -5% | 0% | -19% | 0.385 | $18,513,598 |

| ICL | Iceni Gold | 0% | 4% | -13% | -36% | 0.07 | $8,973,750 |

| FG1 | Flynngold | 0% | 16% | -6% | -42% | 0.094 | $9,670,112 |

| AL8 | Alderan Resource Ltd | 0% | 14% | 14% | -67% | 0.008 | $4,859,271 |

| GMN | Gold Mountain Ltd | 0% | 17% | -50% | -50% | 0.0035 | $6,894,764 |

| MEG | Megado Minerals Ltd | 0% | -2% | -7% | -62% | 0.042 | $6,008,333 |

| TBA | Tombola Gold Ltd | 0% | 0% | 0% | -43% | 0.026 | $33,129,243 |

| FML | Focus Minerals Ltd | 0% | -3% | -25% | -22% | 0.19 | $54,446,143 |

| VRC | Volt Resources Ltd | 0% | 10% | -27% | -42% | 0.011 | $43,333,663 |

| HRN | Horizon Gold Ltd | 0% | 0% | 10% | -18% | 0.34 | $42,561,758 |

| CLA | Celsius Resource Ltd | 0% | 0% | -6% | -40% | 0.015 | $28,090,775 |

| QML | Qmines Limited | 0% | -3% | -9% | -50% | 0.15 | $13,531,355 |

| TCG | Turaco Gold Limited | 0% | -3% | 17% | -38% | 0.068 | $29,084,733 |

| DTM | Dart Mining NL | 0% | 9% | 36% | -6% | 0.075 | $11,671,542 |

| AUC | Ausgold Limited | 0% | 4% | 13% | -32% | 0.053 | $107,562,151 |

| EMU | EMU NL | 0% | 0% | -59% | -87% | 0.002 | $2,900,043 |

| SFM | Santa Fe Minerals | 0% | 0% | -25% | -50% | 0.06 | $4,369,127 |

| X64 | Ten Sixty Four Ltd | 0% | 0% | -11% | -36% | 0.57 | $130,184,182 |

| BGD | Bartongoldholdings | 0% | -2% | 15% | -2% | 0.23 | $19,856,612 |

| KWR | Kingwest Resources | 0% | 3% | 0% | -78% | 0.035 | $9,860,439 |

| AGC | AGC Ltd | 0% | 0% | -8% | -35% | 0.055 | $5,500,000 |

| RVR | Red River Resources | 0% | 0% | 0% | -68% | 0.073 | $37,847,908 |

| RGL | Riversgold | 0% | 0% | -50% | -79% | 0.015 | $14,182,016 |

| OKR | Okapi Resources | 0% | 0% | -10% | -67% | 0.135 | $24,784,085 |

| CBY | Canterbury Resources | 0% | -8% | -15% | -46% | 0.035 | $5,058,324 |

| TMZ | Thomson Res Ltd | 0% | 0% | -74% | -90% | 0.005 | $4,349,755 |

| TAM | Tanami Gold NL | 0% | -3% | 0% | -35% | 0.039 | $45,828,785 |

| WMC | Wiluna Mining Corp | 0% | 0% | 0% | -73% | 0.205 | $74,238,031 |

| IDA | Indiana Resources | 0% | 0% | -9% | -21% | 0.05 | $25,135,241 |

| GSM | Golden State Mining | 0% | 6% | -16% | -60% | 0.036 | $4,212,511 |

| THR | Thor Energy PLC | 0% | 13% | -25% | -72% | 0.0045 | $6,642,508 |

| BAT | Battery Minerals Ltd | 0% | -17% | 25% | -44% | 0.005 | $14,676,212 |

| POL | Polymetals Resources | 0% | -5% | -27% | 50% | 0.18 | $8,132,885 |

| RDS | Redstone Resources | 0% | 0% | 0% | -38% | 0.008 | $5,894,659 |

| NAG | Nagambie Resources | 0% | -11% | -39% | -18% | 0.04 | $21,427,752 |

| KAU | Kaiser Reef | 0% | 0% | 9% | -18% | 0.18 | $25,505,583 |

| HRZ | Horizon | 0% | 22% | -2% | -54% | 0.06 | $41,819,021 |

| MXR | Maximus Resources | 0% | 5% | 5% | -44% | 0.042 | $13,400,342 |

| CXU | Cauldron Energy Ltd | 0% | 0% | 0% | -64% | 0.007 | $6,520,981 |

| ALY | Alchemy Resource Ltd | 0% | -6% | -35% | -12% | 0.015 | $17,671,144 |

| OBM | Ora Banda Mining Ltd | 0% | 15% | 79% | 188% | 0.15 | $241,632,137 |

| ZAG | Zuleika Gold Ltd | 0% | 0% | -38% | -59% | 0.013 | $6,799,658 |

| SBM | St Barbara Limited | 0% | 0% | -17% | -56% | 0.645 | $526,669,361 |

| SAU | Southern Gold | 0% | -5% | -16% | -60% | 0.021 | $6,305,991 |

| CEL | Challenger Exp Ltd | 0% | 0% | -6% | -48% | 0.165 | $172,696,981 |

| ARN | Aldoro Resources | 0% | -3% | 13% | -33% | 0.18 | $20,324,217 |

| A8G | Australasian Metals | 0% | 6% | -8% | -64% | 0.175 | $7,204,836 |

| NES | Nelson Resources. | 0% | 50% | -14% | -61% | 0.006 | $3,531,566 |

| RMS | Ramelius Resources | 0% | 8% | 56% | 1% | 1.45 | $1,266,210,573 |

| PKO | Peako Limited | 0% | 0% | -38% | -50% | 0.009 | $4,236,583 |

| ICG | Inca Minerals Ltd | 0% | 0% | -22% | -86% | 0.018 | $8,703,261 |

| OAU | Ora Gold Limited | 0% | 0% | -50% | -75% | 0.0025 | $9,842,313 |

| GNM | Great Northern | 0% | 0% | -25% | -50% | 0.003 | $5,127,153 |

| KRM | Kingsrose Mining Ltd | 0% | 10% | 5% | -15% | 0.068 | $51,171,803 |

| BTR | Brightstar Resources | 0% | -19% | -24% | -58% | 0.013 | $10,824,175 |

| TRM | Truscott Mining Corp | 0% | 0% | 15% | 2% | 0.047 | $7,856,382 |

| DEX | Duke Exploration | 0% | 0% | 0% | -67% | 0.053 | $5,587,240 |

| MOM | Moab Minerals Ltd | 0% | 0% | -22% | -75% | 0.007 | $4,773,744 |

| KNB | Koonenberrygold | 0% | 0% | -3% | -37% | 0.06 | $4,545,387 |

| SNG | Siren Gold | 0% | 11% | -42% | -72% | 0.105 | $14,097,175 |

| STN | Saturn Metals | 0% | 0% | 8% | -50% | 0.195 | $29,551,962 |

| USL | Unico Silver Limited | 0% | 3% | 0% | -28% | 0.17 | $42,390,719 |

| ANL | Amani Gold Ltd | 0% | 0% | 0% | 0% | 0.001 | $24,693,441 |

| HAV | Havilah Resources | 0% | 3% | -9% | 58% | 0.3 | $94,991,763 |

| PNT | Panthermetalsltd | 0% | -13% | -44% | -54% | 0.105 | $3,228,750 |

| GMD | Genesis Minerals | 0% | 0% | -12% | -40% | 1.1 | $456,618,702 |

| FEG | Far East Gold | 0% | -8% | -41% | 2% | 0.285 | $43,618,740 |

| ORN | Orion Minerals Ltd | 0% | 7% | -6% | -38% | 0.015 | $81,986,412 |

| SSR | SSR Mining Inc. | 0% | 0% | 2% | -23% | 23.58 | $433,476,682 |

| EVN | Evolution Mining Ltd | 0% | 5% | 18% | -22% | 3.52 | $6,477,607,606 |

| WAF | West African Res Ltd | 0% | 3% | -11% | -21% | 1.045 | $1,074,756,634 |

| CHZ | Chesser Resources | -1% | -4% | -4% | -25% | 0.082 | $48,559,611 |

| NCM | Newcrest Mining | -1% | 5% | 43% | 6% | 29.45 | $26,522,883,511 |

| KCN | Kingsgate Consolid. | -1% | 2% | -10% | -14% | 1.55 | $394,408,984 |

| WGX | Westgold Resources. | -1% | 1% | 68% | -21% | 1.47 | $703,329,754 |

| MI6 | Minerals260Limited | -1% | 2% | 31% | -10% | 0.445 | $105,300,000 |

| A1G | African Gold Ltd. | -1% | -13% | -4% | -45% | 0.08 | $13,714,208 |

| RXL | Rox Resources | -1% | 14% | 126% | 5% | 0.395 | $89,741,704 |

| RXL | Rox Resources | -1% | 14% | 126% | 5% | 0.395 | $89,741,704 |

| SXG | Southern Cross Gold | -1% | -4% | -6% | 0% | 0.75 | $68,267,733 |

| TIE | Tietto Minerals | -1% | 3% | 4% | 46% | 0.735 | $810,207,980 |

| BM8 | Battery Age Minerals | -1% | -1% | -28% | -28% | 0.36 | $27,089,629 |

| SVY | Stavely Minerals Ltd | -1% | -9% | -32% | -62% | 0.1675 | $55,466,532 |

| TUL | Tulla Resources | -1% | 0% | -1% | -46% | 0.33 | $107,804,341 |

| GML | Gateway Mining | -2% | -3% | -3% | -52% | 0.058 | $15,713,679 |

| AUT | Auteco Minerals | -2% | 9% | -2% | -40% | 0.05 | $117,954,651 |

| HMX | Hammer Metals Ltd | -2% | -2% | 41% | -9% | 0.096 | $80,497,920 |

| RSG | Resolute Mining | -2% | 0% | 140% | 55% | 0.48 | $1,043,213,219 |

| MGV | Musgrave Minerals | -2% | 5% | 5% | -35% | 0.22 | $133,021,789 |

| BC8 | Black Cat Syndicate | -2% | -3% | 24% | -36% | 0.44 | $119,954,004 |

| AGG | AngloGold Ashanti | -2% | 5% | 34% | 25% | 7.89 | $721,690,819 |

| CYL | Catalyst Metals | -3% | -2% | -19% | -48% | 0.96 | $172,064,551 |

| EMR | Emerald Res NL | -3% | 12% | 43% | 41% | 1.69 | $1,030,244,706 |

| HAW | Hawthorn Resources | -3% | 3% | -35% | -32% | 0.075 | $25,796,202 |

| MZZ | Matador Mining Ltd | -3% | -9% | -36% | -70% | 0.074 | $23,956,631 |

| RED | Red 5 Limited | -3% | -3% | -15% | -57% | 0.175 | $578,113,060 |

| PDI | Predictive Disc Ltd | -3% | 6% | -3% | -10% | 0.175 | $321,413,766 |

| DTR | Dateline Resources | -3% | 0% | -54% | -86% | 0.017 | $11,266,842 |

| AME | Alto Metals Limited | -3% | -7% | 0% | -22% | 0.067 | $42,284,268 |

| CWX | Carawine Resources | -3% | 2% | -5% | -55% | 0.095 | $19,288,112 |

| ENR | Encounter Resources | -3% | 3% | -17% | -6% | 0.15 | $55,106,496 |

| ZNC | Zenith Minerals Ltd | -3% | -9% | -45% | -65% | 0.145 | $52,755,907 |

| MKR | Manuka Resources. | -3% | -5% | 2% | -71% | 0.087 | $45,252,138 |

| PGO | Pacgold | -3% | 4% | 18% | -40% | 0.425 | $24,183,199 |

| AMI | Aurelia Metals Ltd | -3% | -7% | 12% | -70% | 0.14 | $179,428,396 |

| TSO | Tesoro Gold Ltd | -4% | -4% | -25% | -65% | 0.027 | $29,498,352 |

| MM8 | Medallion Metals. | -4% | -7% | -16% | -54% | 0.13 | $31,135,390 |

| CY5 | Cygnus Metals Ltd | -4% | 14% | -34% | 52% | 0.25 | $48,652,295 |

| AAJ | Aruma Resources Ltd | -4% | 4% | 40% | -47% | 0.074 | $12,086,036 |

| GCY | Gascoyne Res Ltd | -4% | 14% | -28% | -53% | 0.12 | $86,704,763 |

| ADN | Andromeda Metals Ltd | -4% | -2% | 7% | -57% | 0.047 | $152,390,413 |

| PRS | Prospech Limited | -4% | 114% | 68% | -1% | 0.045 | $4,772,539 |

| BYH | Bryah Resources Ltd | -4% | 0% | -15% | -59% | 0.022 | $6,468,830 |

| ASO | Aston Minerals Ltd | -5% | -19% | 31% | -32% | 0.105 | $122,620,403 |

| OZM | Ozaurum Resources | -5% | 29% | -5% | -35% | 0.063 | $8,382,000 |

| GSR | Greenstone Resources | -5% | 0% | -38% | -46% | 0.02 | $25,361,258 |

| NWM | Norwest Minerals | -5% | -2% | -26% | -33% | 0.04 | $10,389,591 |

| STK | Strickland Metals | -5% | -5% | -5% | -31% | 0.038 | $62,197,150 |

| CAI | Calidus Resources | -5% | 22% | 2% | -72% | 0.275 | $127,469,744 |

| GAL | Galileo Mining Ltd | -5% | 0% | -20% | 233% | 0.7 | $146,242,446 |

| BCN | Beacon Minerals | -6% | -3% | 18% | -3% | 0.033 | $131,486,886 |

| MTC | Metalstech Ltd | -6% | -6% | -38% | 8% | 0.32 | $60,334,561 |

| WWI | West Wits Mining Ltd | -6% | 0% | 0% | -52% | 0.016 | $36,706,069 |

| PNR | Pantoro Limited | -6% | 9% | -28% | -77% | 0.0695 | $224,132,722 |

| MLS | Metals Australia | -6% | -4% | -13% | -74% | 0.0385 | $24,888,484 |

| SRN | Surefire Rescs NL | -6% | 7% | 88% | 41% | 0.0225 | $37,952,723 |

| TAR | Taruga Minerals | -6% | 0% | -38% | -35% | 0.015 | $11,296,429 |

| XAM | Xanadu Mines Ltd | -6% | 5% | 52% | 57% | 0.044 | $76,977,737 |

| GBZ | GBM Rsources Ltd | -7% | -10% | -35% | -77% | 0.028 | $16,894,817 |

| TLM | Talisman Mining | -7% | -7% | -4% | -21% | 0.135 | $27,222,227 |

| AQI | Alicanto Min Ltd | -7% | -11% | -9% | -61% | 0.039 | $18,740,972 |

| MEK | Meeka Metals Limited | -7% | 16% | -25% | 4% | 0.051 | $58,718,491 |

| BMO | Bastion Minerals | -8% | -8% | -29% | -86% | 0.024 | $4,144,701 |

| G88 | Golden Mile Res Ltd | -8% | 64% | 13% | -62% | 0.023 | $6,585,806 |

| NAE | New Age Exploration | -8% | -8% | -21% | -58% | 0.0055 | $8,615,393 |

| KZR | Kalamazoo Resources | -8% | 3% | -21% | -55% | 0.165 | $27,196,301 |

| RML | Resolution Minerals | -8% | -8% | -31% | -68% | 0.0055 | $6,478,477 |

| ASR | Asra Minerals Ltd | -9% | 0% | -50% | -63% | 0.01 | $16,138,305 |

| BEZ | Besragoldinc | -10% | 48% | 342% | 276% | 0.23 | $90,234,781 |

| AVM | Advance Metals Ltd | -10% | 0% | -10% | -44% | 0.009 | $5,820,441 |

| M24 | Mamba Exploration | -11% | 22% | -17% | -11% | 0.12 | $8,232,751 |

| SPQ | Superior Resources | -12% | -25% | -21% | 5% | 0.044 | $85,061,021 |

| AWJ | Auric Mining | -13% | -15% | -14% | -36% | 0.055 | $8,244,154 |

| MDI | Middle Island Res | -14% | -14% | -18% | -75% | 0.031 | $4,407,056 |

| GIB | Gibb River Diamonds | -18% | 11% | -17% | -19% | 0.05 | $12,902,076 |

| MCT | Metalicity Limited | -20% | 0% | -33% | -65% | 0.002 | $8,761,348 |

| AYM | Australia United Min | -25% | -25% | 0% | -50% | 0.003 | $7,370,310 |

The post Gold Digger: Victor Smorgon’s gold exposure led to strong March gains. These are the ASX stocks in its portfolio appeared first on Stockhead.

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…