Companies

First Closing of Financial Offering & Launch of Manicouagan Fall Exploration Campaign

MONTRÉAL, QC – November 1, 2022 / St-Georges Eco-Mining Corp. (CSE:SX)(OTCQB:SXOOF)(FSE:85G1) is pleased to announce the closing of a first tranche…

MONTRÉAL, QC – November 1, 2022 / St-Georges Eco-Mining Corp. (CSE:SX)(OTCQB:SXOOF)(FSE:85G1) is pleased to announce the closing of a first tranche of a non-brokered private placement offering of “flow-through” units at a price of $0.25 for total gross proceeds of up to $1,425,000.

Each FT Unit is comprised of one (1) common share in the capital of the Company on a “flow-through” basis (each, a “FT Share”) and half a FT Share purchase warrant (each, a half “FT Warrant”). Each half FT Warrant entitles the holder thereof to purchase half a Share at an exercise price of $0.29 per share. The warrants will expire 36 months after their issuance or 30 days after the issuance of a press release accelerating the expiration of the warrants.

In the event that the trading price of the Shares on the Canadian Securities Exchange (the “CSE”) reaches $0.65 per Share on any single day, the Corporation may, at its option, accelerate the Warrant Expiry Date by delivery of notice to the registered holders (an “Acceleration Notice”) thereof and issuing a press release (a “Warrant Acceleration Press Release”), and, in such case, the Warrant Expiry Date shall be deemed to be 5:00 p.m. (Montreal time) on the 30th day following the later of (i) the date on which the Acceleration Notice is sent to warrant holders, and (ii) the date of issuance of the Warrant Acceleration Press Release.

The Corporation will use the proceeds of the Offering to further advance the exploration effort on the Manicouagan Project in Québec. A 6% finder’s fee and broker’s warrants have been paid in connection with the offering. The securities issued in connection with the Offering are subject to the applicable statutory four months and one day hold period.

Two institutional investors have subscribed to the bulk of the Offering, and institutions have requested a second closing later before the end of the year. Insiders have subscribed for a total of $175,000 to the Offering (Mark Billing $25,000 – Frank Dumas $75,000 – Enrico Di Cesare $75,000).

The previously announced flow-through offering is cancelled. The total amount to be raised for the Manicouagan Project this year, including this first closing, is reduced to a maximum of $2,500,000. All money raised is expected to be spent before the end of December.

The exploration campaign on the Manicouagan Project will be initiated this week and suspended from mid to late December, depending on the weather. A significant effort is expected to restart in late February as the team on site will be finalizing the winterization of Camp Helene on Manicouagan in parallel with the current campaign.

Related Party Transaction MI 61-101

Certain insiders of the Corporation subscribed for a total of 700,000 Units under the Offering, which is a “related party transaction” within the meaning of Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions (“MI 61-101”). The issuances to the insiders are exempt from the valuation requirement of MI 61-101 by virtue of the exemption contained in section 5.5(b) as the Corporation’s shares are not listed on a specified market and from the minority shareholder approval requirements of MI 61-101 by virtue of the exemption contained in section 5.7(a) of MI 61-101 in that the fair market value of the consideration of the securities issued to the related parties did not exceed 25% of the Corporation’s market capitalization. The Corporation did not file a material change report more than 21 days before the expected closing of the Offering as the details of the Offering and the participation therein by related parties of the Corporation were not settled until shortly prior to closing and the Corporation wished to close on an expedited basis for sound business reasons.

The Manicouagan Project

The Company is providing this more comprehensive release of all drilling completed on the Manicouagan Project to date. The recently released tables have been combined for simplicity and corrections of certain intersections were made with incremental changes to thickness and grades.

- Figure 1 depicts all of the known core holes on the Company’s 100% owned Manicouagan Project.

- Table 1 now includes results for all drill holes, whether mineralized or not.

- Table 2 now provides coordinates for each core hole drilled.

The drill core assays contain individual results up to 5.11 g/t of platinum, up to 18.29 g/t of palladium, up to 1.73 g/t rhodium, up to 2.63 g/t ruthenium, up to 2.2% copper, up to 0.45% cobalt, and up to 9.49% nickel ranging in thickness from 0.22 to 0.5 meters. True thickness is believed to be 70 to 90 percent, depending on individual intercepts.

As previously stated, nearly all the historical core was recovered from the campsite. The Company initiated an extensive program of re-logging and sampling portions of the core not previously sampled while leaving intact portions that were historically sampled.

Changes to Table 1 include the addition of all holes drilled with composite results. Nickel has been a consistent element assayed throughout all work programs. A cut-off of +0.075% nickel was used in composite values. However, an occasional single value under this cut-off was used to maintain a continuous interval. Sampling of certain holes indicate significant values greater than 0.075% nickel but were incompletely sampled or inconsistently mineralized. These holes are listed as mineralized only with from and to depths. No widths are given for these intervals due to a lack of complete assay intervals. Other elements are listed in Table 1 when consistently available.

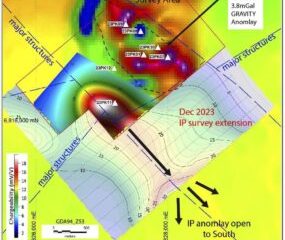

Recent and historical work has provided evidence for the identification of a new discovery referred to as the Bob Zone carrying high-grade mineralization that has dimensions of 270 meters in length in an east-west trend and at least 80 meters in depth based on drill intercepts (Figure 2). Within this zone, 20 of 22 holes encountered semi-massive to massive sulfide mineralization, including significant grades of nickel-copper-cobalt and all platinum group elements. The historic electro-magnetic (EM) anomalies are, in part, associated with these massive sulfide lenses, which are highly deformed and suggest the potential for a larger coherent body to exist within the Company’s extensive land holding .

With the further compilation provided in Table 1, it appears that the above-mentioned high-grade Bob Zone exists within an envelope of low-grade mineralization. This envelope extends over 410 meters in length and to depths of over 200 meters, as defined by drilling. The envelope is open to depth and along strike. Management believes this is further confirmed by Figure 3, where nickel-in-soil sampling remains untested 50 meters further east of the easternmost hole at Bob and in geophysical anomalies. Figures 4 and 5 are cross-sections through the Bob Zone, indicating continuity and relative consistency.

In addition to the above Bob Zone, there are multiple holes that have intercepted the same quality of mineralization as Bob (Ni-Cu-Co-PGE). These targets stretch over 4 kilometers along strike (Figure 1, Tom and Carl targets). The location of some holes and alteration zones suggests the potential for parallel zones to exist over a 1 to 2-kilometer-wide corridor (Figure 1A, Chance, New Bob, and Corbeau). To that end, the Company plans to focus its exploration along trend and to depth at Bob and complete a property-wide geophysical survey to prioritize additional areas within the project boundaries

Figure 1: All known core holes on the Company’s 100% owned Manicouagan Project

Figure 1A: Holes and alteration zones suggesting potential for parallel zones to exist over a 1-2 km corridor

Figure 2: Bob Zone high-grade mineralization; 270 meters in length in an east-west trend and at least 80 meters in depth

Figure 3: Bob Zone envelope of low-grade mineralization; Nickel-in-soil sampling

Figure 4: Bob Zone cross-section indicating continuity and relative consistency

Figure 5: Bob Zone cross-section indicating continuity and relative consistency

Figure 6: Cross section for the Chance target

Table 1: Summary table of assay results from the Manicouagan Project

| Hole ID | From (m) | To (m) | Width (meter) | Nickel% | Copper % | Cobalt % | Platinum g/t | Palladium g/t | ||

| 07-01 | 8.00 | 55.00 | Mineralized | |||||||

| 07-02 | No Significant Values | |||||||||

| 07-03 | 24.24 | 24.46 | 0.22 | 9.49 | 0.07 | 0.45 | 1.170 | 7.880 | ||

| and | 30.13 | 50 | 19.87 | 0.13 | 0.007 | |||||

| 07-04 | 20.00 | 22.47 | 2.47 | 0.18 | 0.01 | |||||

| and | 24.27 | 24.94 | 0.67 | 2.39 | 0.84 | 0.15 | 1.287 | 5.990 | ||

| and | 32.00 | 40.00 | 8.00 | 0.12 | 0.007 | |||||

| 07-05 | 42.28 | 44.23 | 1.95 | 1.65 | 0.23 | 0.05 | 0.999 | 2.273 | ||

| includes | 42.28 | 42.9 | 0.62 | 3.03 | 0.33 | 0.09 | 1.925 | 4.425 | ||

| 07-06 | 47.86 | 48.67 | 1.44 | 1.24 | 0.53 | 0.04 | 0.985 | 2.135 | ||

| includes | 47.86 | 48.67 | 0.81 | 1.79 | 0.79 | 0.06 | 1.460 | 3.170 | ||

| 07-07 | No Significant Values | |||||||||

| 07-08 | 8.00 | 14.50 | 6.50 | 0.17 | 0.01 | 0.28 | ||||

| and | 52.00 | 88.00 | 36.00 | 0.15 | 0.01 | 0.22 | ||||

| and | 94.80 | 99.00 | 4.20 * | 0.16 | 0.008 | 0.14 | ||||

| 07-09 | 23.16 | 23.55 | 0.39 | 0.53 | 0.07 | 0.05 | 0.120 | 0.470 | ||

| 07-10 | 24.69 | 24.9 | 0.21 | 1.04 | 0.47 | 0.09 | 0.200 | 0.640 | ||

| 07-11 | No Significant Values | |||||||||

| 07-12 | No Significant Values | |||||||||

| 07-13 | No Significant Values | |||||||||

| 07-14 | No Significant Values | |||||||||

| 07-15 | No Significant Values | |||||||||

| 07-16 | No Significant Values | |||||||||

| 07-17 | 48.00 | 57.00 | 11.00 | 0.66 | 0.17 | 0.04 | 0.622 | 1.823 | ||

| 51.4 | 53.44 | 2.04 | 1.98 | 0.48 | 0.09 | 2.053 | 6.204 | |||

| 07-18 | No Significant Values | |||||||||

| 07-19 | No Significant Values | |||||||||

| 07-20 | 52.05 | 53.06 | 1.01 | 0.32 | 0.21 | 0.05 | 0.009 | 0.620 | ||

| includes | 52.3 | 53.06 | 0.76 | 0.40 | 0.15 | 0.06 | 0.108 | 0.818 | ||

| 07-21 | 54.19 | 55.11 | 0.92 | 0.42 | 0.47 | 0.05 | 0.082 | 0.125 | ||

| 07-22 | No Significant Values | |||||||||

| 07-23 | No Significant Values | |||||||||

| 07-24 | No Significant Values | |||||||||

| 07-25 | 15.77 | 16.06 | 0.29 | 0.61 | 0.71 | 0.70 | <0.010 | 0.045 | ||

| 07-26 | 15.23 | 32.00 | 16.77 | 0.13 | <0.01 | 0.01 | NA | NA | ||

| and | 36.00 | 41.00 | 5.00 | 0.15 | <0.01 | 0.009 | NA | NA | ||

| 07-27 | No Significant Values | |||||||||

| 07-28 | No Significant Values | |||||||||

| 07-29 | No Significant Values | |||||||||

| Hole ID | From (m) | To (m) | Width (meter) | Nickel% | Copper % | Cobalt % | Platinum g/t | Palladium g/t | ||

| 07-30 | No Significant Values | |||||||||

| 07-31 | 56.51 | 63.08 | 12.39 | 0.28 | 0.04 | 0.02 | NA | NA | ||

| Incl | 62.67 | 63.08 | 0.41 | 1.85 | 0.24 | 0.06 | 2.030 | 2.270 | ||

| 07-32 | 56.78 | 68.00 | 13.22 | 0.34 | 0.11 | 0.02 | 0.265 | 0.636 | ||

| Incl | 57.46 | 57.71 | 0.25 | 2.30 | 0.75 | 0.08 | 0.710 | 0.960 | ||

| Incl | 60.09 | 60.9 | 0.81 | 0.54 | 0.03 | 0.02 | 0.520 | 1.665 | ||

| 07-33 | 6.24 | 8.2 | 1.96 | 0.56 | 0.21 | 0.05 | 0.268 | 2.205 | ||

| or | 7.08 | 8.2 | 1.12 | 0.70 | 0.27 | 0.07 | 0.350 | 2.930 | ||

| 08-01 | 84.95 | 86.26 | 1.31 | 0.45 | 0.25 | 0.03 | 0.560 | 0.820 | ||

| includes | 84.95 | 85.30 | 0.35 | 0.82 | 0.25 | 0.05 | 1.100 | 1.600 | ||

| and | 112.6 | 125.72 | 13.12 | 0.14 | 0.01 | 0.009 | NSV | NSV | ||

| 08-02 | 82.66 | 100.92 | 18.26 | 0.60 | 0.26 | 0.02 | 0.591 | 0.918 | ||

| includes | 86.46 | 90.80 | 4.34 | 0.97 | 0.32 | 0.03 | 1.188 | 1.849 | ||

| includes | 92.06 | 93.18 | 1.12 | 1.09 | 0.75 | 0.04 | 0.833 | 1.272 | ||

| 08-03 | 85.53 | 85.86 | 0.33 | 2.71 | 0.07 | 0.06 | 1.020 | 1.370 | ||

| and | 92.58 | 93.22 | 0.64 | 0.91 | 0.26 | 0.03 | 0.580 | 0.280 | ||

| and | 109.43 | 113.00 | 3.57 | 0.16 | ,0.01 | 0.009 | NSV | NSV | ||

| 08-04 | 81.10 | 81.93 | 0.83 | 0.40 | 0.90 | 0.45 | NA | NA | ||

| includes | 81.87 | 81.93 | 0.06 | 0.65 | 2.20 | 0.10 | 2.050 | 4.610 | ||

| and | 90.86 | 92.49 | 1.63 | 1.77 | 0.22 | 0.05 | 2.177 | 1.930 | ||

| 08-05 | No Significant Values | |||||||||

| 08-06 | 76.73 | 86.5 | 9.77 | 0.10 | <0.01 | 0.004 | NSV | NSV | ||

| 08-07 | 72.30 | 75.00 | 2.70 | 0.18 | <0.01 | 0.008 | NSV | NSV | ||

| 81.70 | 95.10 | 13.4 | 0.17 | <0.01 | 0.009 | NSV | NSV | |||

| 08-08 | 82.35 | 86.40 | 4.05 | 0.50 | 0.18 | 0.04 | 0.448 | 1.814 | ||

| includes | 84.43 | 85.91 | 1.48 | 0.75 | 0.28 | 0.05 | 0.618 | 2.521 | ||

| and | 90.00 | 95.41 | 5.41 | 0.15 | 0.03 | 0.01 | 0.062 | 0.108 | ||

| 08-09 | 88.75 | 94.15 | 5.40 | 0.10 | <0.01 | 0.01 | NA | NA | ||

| 08-10 | 37.59 | 43.00 | 5.41 | 0.11 | <0.01 | 0.009 | NA | NA | ||

| 235.00 | 240.00 | 5.00 | 0.18 | <0.01 | 0.01 | NA | NA | |||

| 244.00 | 288.00 | 44.00 | 0.16 | <0.01 | 0.009 | NSV | NSV | |||

| 21-01 | No Significant Values | |||||||||

| 21-02 | 52 | 60 | 8 | 0.10 | <0.01 | 0.009 | NSV | NSV | ||

| 21-03 | No Significant Values | |||||||||

| 21-04 | No Significant Values | |||||||||

| 21-05 | No Significant Values | |||||||||

| 21-06 | No Significant Values | |||||||||

| 21-07 | No Significant Values | |||||||||

| 21-08 | No Significant Values | |||||||||

| 21-09 | No Significant Values | |||||||||

| 21-10 | No Significant Values | |||||||||

| 21-11 | 84 | 120* | 44 | Mineralized | ||||||

| 21-12 | 90.5 | 142.3 | 51.8 | Mineralized | ||||||

| Hole ID | From (m) | To (m) | Width (meter) | Nickel% | Copper % | Cobalt % | Platinum g/t | Palladium g/t | ||

| 21-13 | No Significant Values | |||||||||

| 21-14 | 40 | 49 | 8 | 0.10 | <0.01 | 0.008 | NSV | NSV | ||

| 21-15 | 115 | 119 | 4 | 0.10 | <0.01 | 0.009 | 0.02 | 0.03 | ||

| 21-16 | 104 | 106.3 | 2.3 | 0.10 | <0.01 | 0.008 | NSV | NSV | ||

| and | 109 | 111 | 2 | 0.12 | <0.01 | 0.008 | NSV | NSV | ||

| and | 127 | 138.5 | 11.5 | 0.11 | <0.01 | 0.009 | NSV | NSV | ||

| 21-17 | 61 | 68 | 7 | 0.18 | 0..8 | 0.01 | 0.02 | 0.04 | ||

| 65.4 | 65.9 | 0.5 | 0.83 | 0.58 | 0.03 | 1.51 | 0.83 | |||

| 21-18 | 46 | 53 | 7 | 1.19 | 0.34 | 0.09 | 0.783 | 2.604 | ||

| Incl | 47.5 | 49.5 | 2.0 | 3.22 | 0.44 | 0.19 | 2.110 | 6.880 | ||

| 21-19 | 87 | 88.33 | 1.33 | 0.62 | 0.17 | 0.2 | 0.504 | 0.565 | ||

| includes | 87.55 | 88.33 | 0.78 | 1.04 | 0.32 | 0.03 | 1.04 | 1.12 | ||

| and | 95 | 97 | 2 | 0.22 | <0.01 | 0.009 | NSV | NSV | ||

| and | 104.12 | 107 | 2.88 | 0.15 | <0.01 | 0.009 | NSV | NSV | ||

*End of Hole

NA – No Assay

NSV – No Significant Values

Table 2: Location and angle of core holes from the Manicouagan Project

| Hole ID | UTM Nad83 E | UTM Nad83 N | Depth (meter) | Azimuth | Dip |

| 07-01 | 456673 | 5784502 | 100.5 | 180 | -45 |

| 07-02 | 456273 | 5784544 | 102 | 360 | -45 |

| 07-03 | 455239 | 5784710 | 101 | 30 | -45 |

| 07-04 | 455306 | 5784702 | 98 | 360 | -45 |

| 07-05 | 455306 | 5784702 | 51 | 360 | -85 |

| 07-06 | 455275 | 5784673 | 60 | 360 | -55 |

| 07-07 | 455275 | 5784673 | 81 | 360 | -85 |

| 07-08 | 455281 | 5784772 | 99 | 180 | -45 |

| 07-09 | 456504 | 5785299 | 89 | 360 | -45 |

| 07-10 | 456504 | 5785299 | 60 | 360 | -60 |

| 07-11 | 456692 | 5785301 | 93 | 360 | -45 |

| 07-12 | 456884 | 5784907 | 45 | 360 | -45 |

| 07-13 | 456884 | 5784907 | 60 | 360 | -80 |

| 07-14 | 455177 | 5784527 | 69 | 360 | -45 |

| 07-15 | 455177 | 5784527 | 57 | 360 | -80 |

| 07-16 | 455454 | 5784177 | 102 | 360 | -45 |

| 07-17 | 455183 | 5784718 | 101 | 360 | -45 |

| 07-18 | 456086 | 5785092 | 102 | 360 | -45 |

| 07-19 | 456086 | 5785092 | 42 | 360 | -80 |

| 07-20 | 455896 | 5785364 | 69 | 360 | -45 |

| 07-21 | 455896 | 5785364 | 60 | 360 | -56 |

| Hole ID | UTM Nad83 E | UTM Nad83 N | Depth (meter) | Azimuth | Dip |

| 07-22 | 455689 | 5785085 | 99 | 360 | -45 |

| 07-23 | 455689 | 5785085 | 69 | 360 | -60 |

| 07-24 | 455695 | 5785204 | 101 | 360 | -45 |

| 07-25 | 455704 | 5785397 | 102 | 360 | -45 |

| 07-26 | 455894 | 5785536 | 102 | 360 | -45 |

| 07-27 | 454289 | 5785075 | 102 | 360 | -45 |

| 07-28 | 454289 | 5785075 | 51 | 360 | -70 |

| 07-29 | 454679 | 5784783 | 99 | 360 | -45 |

| 07-30 | 455186 | 5784851 | 102 | 360 | -45 |

| 07-31 | 455183 | 5784718 | 101.1 | 360 | -60 |

| 07-32 | 458183 | 5784718 | 102 | 360 | -80 |

| 07-33 | 455328 | 5784736 | 102 | 360 | -45 |

| 07-34 | 456920 | 5784966 | 94.5 | 360 | -45 |

| 08-01 | 455303 | 5784616 | 222 | 360 | -45 |

| 08-02 | 455183 | 5784658 | 153 | 360 | -43 |

| 08-03 | 455183 | 5784658 | 141 | 360 | -65 |

| 08-04 | 455183 | 5784658 | 201 | 360 | -84 |

| 08-05 | 454777 | 5784665 | 132 | 360 | -44 |

| 08-06 | 455226 | 5784680 | 162 | 360 | -43 |

| 08-07 | 455226 | 5784680 | 162 | 360 | -69 |

| 08-08 | 455129 | 5784680 | 129 | 360 | -45 |

| 08-09 | 455129 | 5784680 | 129 | 360 | -66 |

| 08-10 | 454977 | 5784485 | 339 | 360 | -45 |

| 21-01 | 456153 | 5784699 | 201 | 360 | -45 |

| 21-02 | 456691 | 5784423 | 129 | 360 | -45 |

| 21-03 | 456259 | 5783870 | 150 | 360 | -45 |

| 21-04 | 456264 | 5783938 | 147 | 360 | -45 |

| 21-05 | 456162 | 5784248 | 147 | 300 | -45 |

| 21-06 | 458677 | 5785393 | 108 | 300 | -65 |

| 21-07 | 458677 | 5785393 | 120 | 300 | -45 |

| 21-08 | 458559 | 5785463 | 121 | 315 | -45 |

| 21-09 | 459263 | 5785213 | 123 | 310 | -65 |

| 21-10 | 445263 | 5785213 | 102 | 315 | -45 |

| 21-11 | 459288 | 5785191 | 120 | 315 | -60 |

| 21-12 | 459288 | 5785191 | 144 | 360 | -45 |

| 21-13 | 454879 | 5784634 | 111 | 360 | -45 |

| 21-14 | 455070 | 5784500 | 87 | 360 | -45 |

| 21-15 | 455075 | 5784652 | 240 | 360 | -65 |

| 21-16 | 455075 | 5784652 | 194 | 360 | -45 |

| 21-17 | 455357 | 5784646 | 162 | 360 | -45 |

| 21-18 | 455360 | 5784690 | 111 | 20 | -45 |

| 21-19 | 455140 | 5784690 | 120 | 360 | -45 |

ON BEHALF OF THE BOARD OF DIRECTORS

“Neha Tally”

NEHA EDAH TALLY

Corporate Secretary of St-Georges Eco-Mining Corp.

About St-Georges Eco-Mining Corp.

St-Georges develops new technologies to solve some of the most common environmental problems in the mining sector, including maximizing metal recovery and full-circle battery recycling. The Company explores for nickel & PGEs on the Manicouagan and Julie Projects on Quebec’s North Shore and has multiple exploration projects in Iceland, including the Thor Gold Project. Headquartered in Montreal, St-Georges’ stock is listed on the CSE under the symbol SX and trades on the Frankfurt Stock Exchange under the symbol 85G1 and on the OTCQB Venture Market for early stage and developing U.S. and international companies. Companies are current in their reporting and undergo an annual verification and management certification process. Investors can find Real-Time quotes and market information for the company on www.otcmarkets.com .

The Canadian Securities Exchange (CSE) has not reviewed and does not accept responsibility for the adequacy or the accuracy of the contents of this release.

cse

canadian securities exchange

otcqb

cobalt

nickel

copper

cse-sx

st-georges-eco-mining-corp

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…