Companies

2023, The Dawn of the Silver Boom

Source: Chen Lin 12/12/2023

Chen Lin shares his silver outlook as well as two stocks he believes are worth looking into.2023 saw another year…

Source: Chen Lin 12/12/2023

Chen Lin shares his silver outlook as well as two stocks he believes are worth looking into.

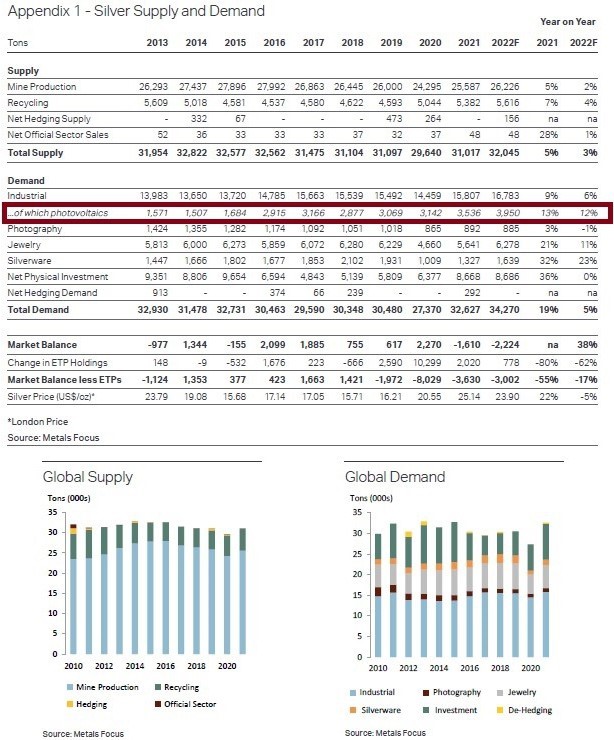

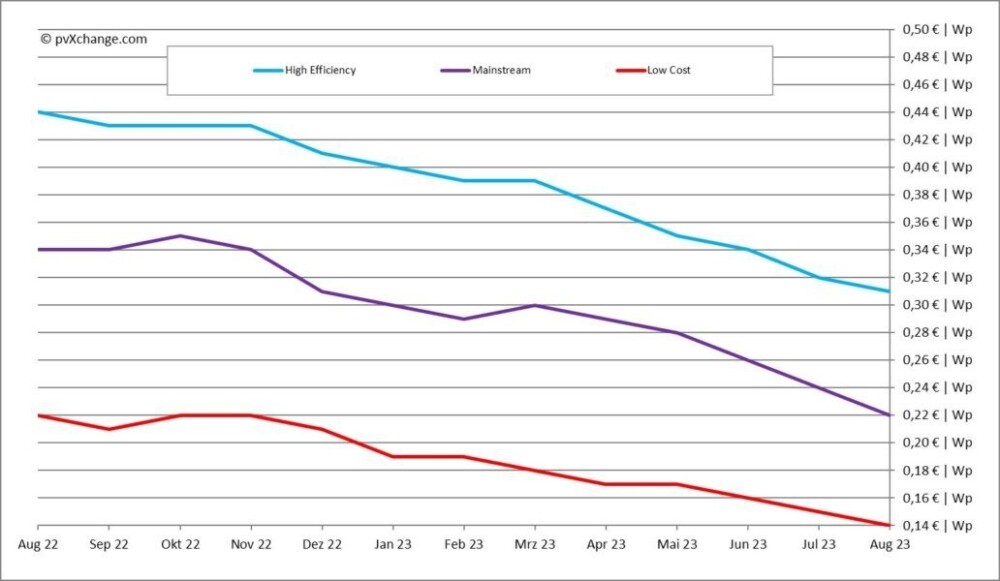

2023 saw another year of a huge supply-demand deficit in silver despite heavy investment selling. The most significant increase in demand came from solar panels. In 2021, the Silver Institute and Metal Focus group were looking at PV (solar panel) using 110 million oz, growing at 12-13% per year.

But in November 2023, the Silver Institute and Metal Focus group revised the 2023 estimate to about 200 million oz! In other words, in the past two years, over 100 million oz of silver was taken by the PV industry “unexpectedly”!

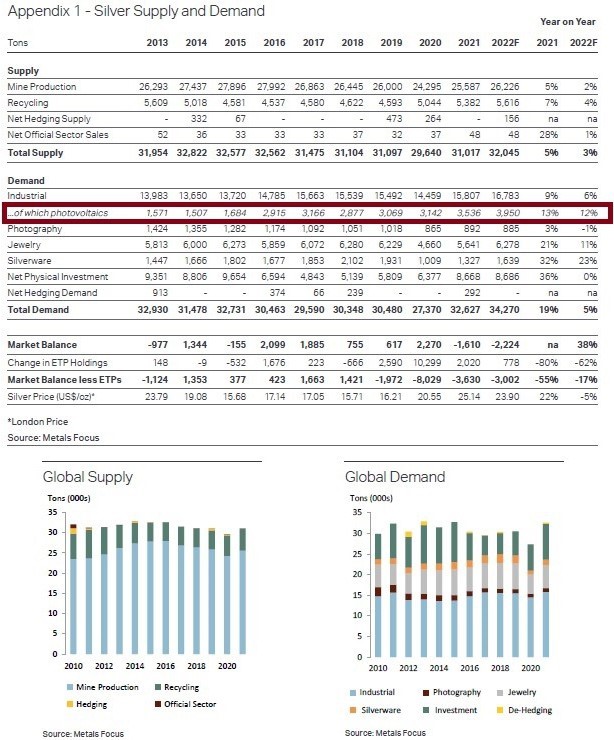

2023 is also another year that we saw rapid progress in the solar panel industry. We saw huge drops in solar panel prices while the technology advanced. The drop in solar panel prices is making solar panels very affordable. In addition, the drop in the lithium and lithium battery prices is making PV the cheapest energy in human history.

Solar panel innovation, meanwhile, has reached an inflection point. In order to increase efficiency, 25-150% more silver is needed for the future generation of solar panels.

Tunnel oxide passivated contact (TOPCon) technology took off in 2023, increasing silver loading in solar panels by at least 25%. In 2024, more than 50% of solar panels are expected to be based on TOPCon.

Another development in the solar industry, heterojunction technology (HJT), is projected to require double the silver load in solar panels in 2025 and beyond.

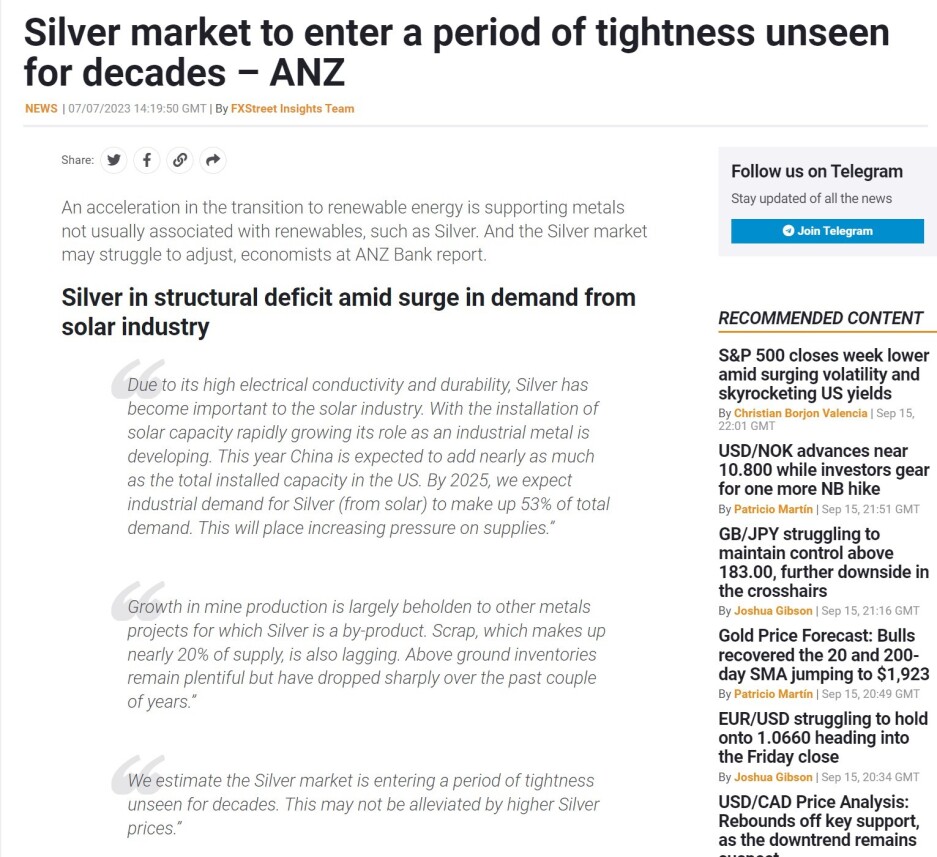

As a result, most people are very optimistic about the growth of solar panels in the next few years. ANZ is expecting PV to take more than 50% of the industry’s silver demands by 2025, a huge jump from 20% in 2021.

All these are pointing to a structural silver shortage for decades to come. Silver is mainly a primary metal by-product. In order for silver production to catch up with demand, many new primary silver mines need to be built and the silver price needs to be high for an extended period of time.

Over one week ago, gold broke the $2,100-per-ounce barrier for the first time, and silver jumped to nearly $26, followed by both metals pulling back, which is a pattern that I have seen in the past.

The rally was a reaction to a series of developments:

- Depreciating S. dollar

- Falling bond yields

- Safe-haven demand

- Dovish tone from central banks of the world, signaling a halt to the recent cycle of interest rate increases

My take is that the precious metals run was partially driven by a group of funds squeezing the shorts in a thinly traded market. This happens in a bull market and usually marks the short-term top of gold.

I have seen this many times. The most famous one was the financial crisis of 2008 when Bear Stearns went under. There was a Sunday night pop in gold, and I took advantage of it. This kind of topping pattern is manufactured, and a lot of pundits will surely proclaim, “This is the top of gold!”

However, such a sequence is usually a foreshadowing of higher gold and silver prices, and it is a buying opportunity on any significant pullback – like the one we saw this week.

Historically, silver tends to do well in the later stage of a gold rally and usually hits a new high. That means silver will likely test the 50-dollar mark and is likely to exceed it.

While precious metals equities have rallied overall in recent weeks, most stocks are close to their 52-week low as the market remains risk-off with investors in a holding pattern. Investors looking to invest in precious metals can take advantage of the pullback and historically low stock prices.

You may know that I am neither a “gold bug” nor a “silver bug.” I invest in a variety of sectors, and it is always about value and timing.

When it comes to precious metals, I pick my spots.

During the chaos of late 2008, I bet big on gold miners and was rewarded very nicely. In 2012, taking a hard look at the fundamentals, I exited gold and silver stocks.

In March 2020, with silver at $12 and a pandemic on the way, I pounded the table. The gains were tremendous.

Well, I have a strong “buy” feeling once again. These are my top two picks recently published on the Streetwise interview: (For more details and updates, subscribe Chen’s letter at https://chenpicks.com/)

Silvercorp Metals Inc. (SVM:TSX; SVM:NYSE) – a Canadian pure-play silver mining company operating several low-cost and long-life mines in China. The company has US$189 million in cash, no debt, and is buying back shares and paying dividends. Silvercorp’s strong balance sheet is funding a plethora of growth projects at its operations and strategic M&A for increased diversification. Mining entrepreneur Dr. Rui Feng is the founder, chairman, and chief executive officer of the company.

Cerro de Pasco Resources Inc. (CNSX:CDPR; OTCMKTS:GPPRF) – focused on the development of the El Metalurgista mining concession in Peru and the exploration of the Quiulacocha Tailings.

Project at the site. They are very close to getting the presidential easement, the 5th in Peruvian history, to access the largest above-ground silver resource in the world.

You can read my latest interview with Streetwise Reports here.

References:

- https://www.kitco.com/news/2023-12-04/Gold-price-powers-to-record-high-backs- html

- https://www.fxstreet.com/news/silver-price-analysis-xag-usd-faces-downward-rally- after-reachingm-multi-month-highs-rising-yields-202312041624

- https://www.benzinga.com/analyst-ratings/analyst-color/23/12/36058685/peter-schiff- says-gold-stocks-show-extreme-bearishness-despite-yellow-metals-record

- https://www.benzinga.com/analyst-ratings/analyst-color/23/12/36058685/peter-schiff- says-gold-stocks-show-extreme-bearishness-despite-yellow-metals-record

- Silver Looks Like a Real Bargain Right Now | SchiffGold

- Global Silver Industrial Demand Forecast to Achieve New High in 2023 | (silverinstitute.org)

- https://thesilverindustry.substack.com/p/silver-use-surges-as-solar-skyrockets

- https://chenpicks.com/

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- [Chen Lin]: I, or members of my immediate household or family, own securities of: [All]. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Chen Lin Disclaimer: This publication is for entertainment and education purpose only. It contains no recommendation to buy or sell any stocks or any other financial instruments. It includes certain “forward-looking statements” within the meaning of applicable securities laws. All statements, other than statements of historical fact, included herein including, without limitation, statements relating to future financial performance, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “plans”, “expects”, “anticipates”, “budgets”, “believes”, “intends”, “estimates”, “potential”, “possible” and similar expressions, or statements that events, conditions or results “will”, “may”, “could”, or “should” occur or be achieved. These forward-looking statements may include statements regarding perceived merit of properties; anticipated production; exploration results and budgets; mineral reserves and resource estimates; work programs; capital expenditures; timelines; strategic plans; completion of transactions; market price of precious base metals; or other statements that are not statements of fact. Forward-looking statements involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from our expectations include the uncertainties involving [risks of construction and mining projects such as accidents, equipment breakdowns, bad weather, non-compliance with environmental and permit requirements, unanticipated variation in geological structures, ore grades or recovery rates; unexpected cost increases; fluctuations in metal prices and currency exchange rates; the need for additional financing to explore and develop properties and availability of financing in the debt and capital markets; uncertainties involved in the interpretation of drilling results and geological tests and the estimation of reserves and resources; the need for cooperation of government agencies in the development and operation of properties; the need to obtain permits and governmental approvals;] and other risk and uncertainties disclosed in reports and documents filed to applicable securities regulatory authorities from time to time. The forward-looking statements made herein reflect our beliefs, opinions and projections on the date the statements are made. Except as required by law, we assume no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change.

tsx

nyse

gold

silver

tsx-svm

silvercorp-metals-inc

silvercorp metals inc

cse-cdpr

cerro-de-pasco-resources-inc

cerro de pasco resources inc

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…