Uncategorized

Wild in Wyoming: Why Uvre has saddled up in the Cowboy State

Until recently, Aussie investors had little interest in Wyoming. Thanks to some lithium and uranium explorers, the Cowboy State is … Read More

The post…

- Wyoming has emerged as a new frontier for lithium following the successful IPO of Chariot Corporation and the arrival of Uvre in recent months

- Known affectionately as the ‘Cowboy State’, Wyoming is home to several advanced uranium plays but no systematic exploration for hard rock lithium has ever taken place

- Uvre’s largest shareholder is Delta Lithium, which previously owned the company’s flagship East Canyon project in Utah in a former life

Up until recently, Aussie investors had next to no interest in Wyoming – unless perhaps it had something to do with purchasing a Paramount+ subscription to stream the critically acclaimed series Yellowstone starring the ageless Kevin Costner.

Uranium hopeful Peninsula Energy (ASX: PEN) has long flown the flag for ASX-listed resources companies with a foothold in America’s least populous but 10th largest state by size. With investor sentiment sensationally returning to the yellowcake sector in recent months, only now is the company’s efforts to restart production at its flagship Lance project being recognised more broadly.

GTI Energy (ASX:GTR) is another Wyoming-based uranium developer also catching the eye of investors but undoubtedly what really put the “Cowboy State” on the map was the recent arrival of Chariot Corporation (ASX: CC9) and its apparent ‘mountain of lithium’.

Chariot’s share price peaked at $1.36 shortly after its ASX debut and a fairly dry market announcement it had started maiden drilling at its Black Mountain lithium project where 60cm long spodumene crystals were first observed way back in 1997.

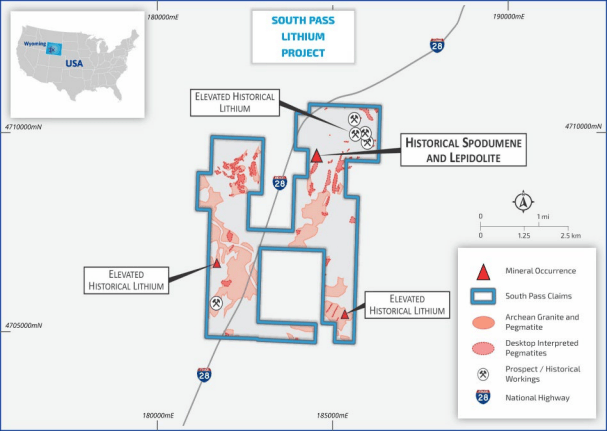

Last month Uvre (ASX: UVA) crossed the border from Utah to try its (exploration) luck at the South Pass lithium project where several large outcropping pegmatites are set to be sampled and tested in more detail next year once the snow melts away in Wyoming.

“Wyoming is just under-invested,” Uvre managing director Peter Woods tells Stockhead.

“No one’s ever done any systematic hard rock lithium exploration in the state so there’s now a whole bunch of opportunities just screaming for investment.”

The next lithium frontier in the US

Having laid the initial foundations for its East Canyon uranium-vanadium project in Utah – plus a desire to diversify its portfolio – Uvre decided to cast its net to other parts of the US in search of a complementary asset to its critical minerals focus.

Another uranium project was atop the company’s wish list, although Woods concedes it was always going to be a challenge to locate a quality asset in a Tier-1 jurisdiction such as the US. So the search quickly pivoted to lithium and, in particular, states where other explorers were having success identifying pegmatites and occurrences of spodumene.

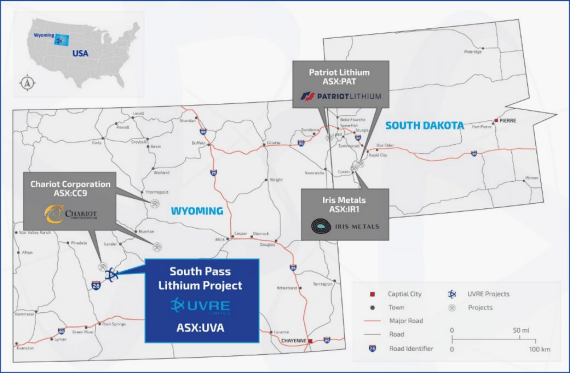

Uvre looked over opportunities in North Carolina and South Dakota where the likes of Piedmont Lithium (ASX:PLL), Iris Metals (ASX:IR1) and Patriot Lithium (ASX:PAT) have found and – and in the case of the former, also developing – solid packages of prospective lithium ground. Unfortunately for Woods and his team, what they coveted just wasn’t available for purchase.

“We had some success finding hard rock lithium, but there was a mad staking rush in those states, particularly in South Dakota, so with Wyoming being the adjoining state, we thought it seemed like the next, most likely frontier to go and have a look at,” Woods says.

“So we did and fortunately we came across several areas with lots of outcropping pegmatites and some historical occurrences of outcropping spodumene with high-grade lithium.

“Unfortunately we got beaten on a couple of projects but we ended up staking South Pass because it had swarms of outcropping pegmatites that went up to 2km long. There was also an old US Geological Survey report which noted there were some lithium-bearing minerals – being spodumene and lepidolite – with the project area.”

Woods adds the company had also been aware Chariot had been systematically pegging lithium ground in Wyoming for about two years prior to its recent IPO, giving Uvre further confidence it was looking in the right place.

A prolific shareholder and some timely news flow

Uvre listed on the ASX in June last year after Woods – a director of boutique Perth-based advisory firm Bluebird Capital – regained control of the East Canyon project.

Woods previously vended East Canyon into TNT Mines back in 2020 but it quickly became a non-core asset after the company picked up the Mt Ida gold-lithium project and changed its name to Red Dirt Metals.

Ringing a bell? Red Dirt changed its name to Delta Lithium (ASX: DLI) earlier this year, but remains Uvre’s largest shareholder.

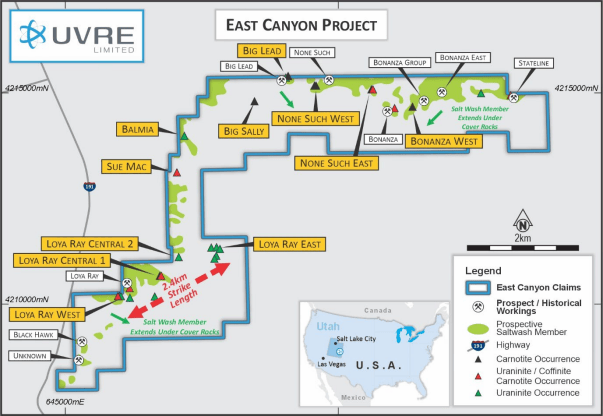

Anyway, back to East Canyon… Uvre has spent the past 18 months undertaking mapping, sampling and a range of surveys at the project despite inclement weather in Utah not being particularly kind to the exploration crews.

Last week the company reported more than 30 uranium occurrences had been picked up at surface with field work also flagging a 2.4km strike length at the Loya Ray prospect. Uranium anomalism was also observed at the nearby Big Sally prospect.

Exploration is set to resume at East Canyon in late Q1 or early Q2 next year.

It has been a timely bit of exploration success with yellowcake prices breaking through US$85/lb for the first time in 15 years this week.

“We set the company up with the idea that we wanted to grow over time but also knowing that uranium was going to be running hot in the near future,” Woods says.

“With this lithium acquisition in Wyoming, we’re now in two of the better sectors that are attracting a lot of investment and capital at the moment. And we’re exploring in a first-world jurisdiction.”

Remaining on the lookout for the next frontier

Woods admits while the company has found some of the regulatory process in the US to be “a little archaic at times”, Uvre remains anything but closed to new project opportunities which could potentially open up elsewhere across the country.

“Lithium obviously plays into our spot, we think it’s a low-risk addition to complement our portfolio and slightly diversify, but it also opens the company up to a whole other pool of investors and eyes,” he says.

“Being in Wyoming, it also opens us up to a couple of new opportunities and acquisitions, not only in the uranium and vanadium space, but now in the lithium sector.”

At Stockhead we tell it like it is. While Uvre was an advertiser at the time of writing, it did not sponsor this article.

The post Wild in Wyoming: Why Uvre has saddled up in the Cowboy State appeared first on Stockhead.