Uncategorized

What the ETF: Aussie sector comeback continues in November as ASX China ETFs rally

Australia’s ETF industry continued to rally in November with AUM growing 3.4% The share market bounce contributed to the bulk … Read More

The post…

- Australia’s ETF industry continued to rally in November with AUM growing 3.4%

- The share market bounce contributed to the bulk of last month’s growth

- ASX China and Asia focused ETFs led the way on hints of Covid-confidence

As global and local share markets continued to rally in November, the Aussie ETF industry recorded another strong month of performance.

According to the latest BetaShares monthly Australian ETF industry report, assets under management (AUM) grew 3.4% for a total monthly market cap increase of $4.4 billion.

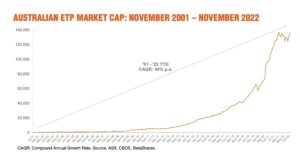

The industry ended the month at $136.1bn, edging closer to the all-time record level of $136.9bn set in December 2021.

The sharemarket rally once again contributed the bulk of the industry growth in November, with ~25% of the growth attributable to net flows (net new money), which amounted to $1.1 billion.

But unlike October, ASX ETF trading value decreased 9% month on month for a total of $9.7 billion. Industry growth over the last 12 months remains positive, albeit slow, with an increase of 2.5% year on year, or $3.3B.

JP Morgan enters Aussie ETF market

Two actively managed strategies focused on sustainability from JP Morgan were launched in November, marking the entrance into the Australian ETF industry by the US multinational investment bank and financial services holding company.

The company launched the JPMorgan Climate Change Solutions Active ETF (ASX: T3MP) to provide access to companies poised to benefit from growing demand for climate change solutions.

The JPMorgan Sustainable Infrastructure Active ETF (ASX: JPSI) provides access to businesses building a more sustainable future when structural changes such as climate change, shifts in demographic and urbanisation place huge demand on infrastructure.

The BetaShares Interest Rate Hedged Australian Corporate Bond ETF (ASX: HCRD) launched in November, the first interest rate hedged ETF in Australia.

The Global X Copper Miners ETF (ASX:WIRE) was launched in November, tracking the Solactive Global Copper Miners Total Return Index, designed to track the performance of companies that have or are expected to have significant exposure to the copper mining industry.

After delisting their crypto equities fund in October Cosmos delisted their remaining two funds (Ethereum and Bitcoin) in November as the crypto winter continued.

China re-opening boost

Chinese and Asian focused ETFs rallied in November as China worked to soften its Covid-19 zero policy and markets in the region rose, after what has been a very difficult period for performance.

According to the BetaShares report Asian exposures were the best performers in November – this included China Large Cap, as well as our Asia Technology Tigers ETF (ASX: ASIA) which recorded ~23% monthly performance.

As Stockhead’s Eddy Sunarto recently reported investors are starting to flock back to Chinese tech stocks.

Fixed income leads flows in November

Fixed income was the asset class category recording the highest level of flows in November with more than $333m in net flows as investors increasingly perceiving that ‘the worst may be over’ for further yield increases.

Australian equities followed with $330m as buying in broad market Australian equity exposures continued. Overall net flows at a category level were muted and primarily came from gold and cash outflows.

Positivity but still some caution

BetaShares chief commercial officer Ilan Israelstam said despite a volatile year on markets, the ETF industry has continued to see positive flows as investors use ETFs to build long term wealth – a trend that will likely continue through December and into 2023.

“Another feature of November was the fact that ETF trading values were relatively muted over the past month, as investors showed a degree of caution, likely due to rising interest rates and inflation,” he said.

“Meanwhile, innovation and product development for the industry continued apace over November with four new ETFs commencing trading.”

Israelstam said fixed income was also topical for ETF investors in November along with China.

“After falling out of love with the market for some time now, Asian and Chinese equities finally had some good news as hopes of a possible re-opening in China and potential move away from their Covid-zero policy saw ETFs covering these exposures rally in terms of performance,” he said.

The post What the ETF: Aussie sector comeback continues in November as ASX China ETFs rally appeared first on Stockhead.