Uncategorized

Venture jumps into farm-in deal, bringing SensOre’s AI tech to lithium and copper exploration at Golden Grove North

Venture Minerals will get the benefit of SensOre’s cutting edge AI technology to target lithium and copper at its Golden … Read More

The post Venture…

Venture Minerals will get the benefit of SensOre’s cutting edge AI technology to target lithium and copper at its Golden Grove North project while locking in drilling at its high grade Vulcan REE prospect in a significant farm-in deal with the mineral technology and exploration player.

SensOre can earn up to 70% in all mineral rights sans rare earths by spending up to $4.5m in two stages.

The farm out of rights for commodities like lithium and copper, where SensOre’s proprietary AI technology has already highlighted major exploration potential at Golden Grove North, will come on the proviso SensOre drills at least 300m of RC or diamond core into the Vulcan target on Venture’s (ASX:VMS) behalf.

That must be completed in the first 12 months of the two year farm in.

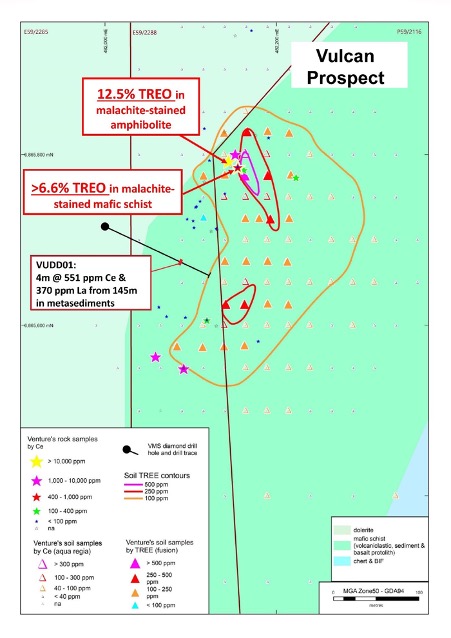

Results at Vulcan included a number of values over 1% total rare earth oxide, ranging up to 12.5% TREO with 5460ppm (0.55%) praseodymium oxide and 14,575ppm (1.46%) neodymium oxide.

Those are the two rare earth metals most associated with the permanent magnets essential to electric vehicle motors.

“The Farm-in with SensOre provides Venture with the exposure to its AI technology for a potential new copper and lithium discovery, whilst retaining the rights to rare earths,” Venture MD Andrew Radonjic said.

“The recent results from Vulcan and the fact SensOre have agreed to drill test this high priority target is a great outcome for Venture and its shareholders and allows Venture to continue to grow its Rare Earth exposure.

“We look forward to working with SensOre and their team in the upcoming exploration and drill program and are excited about unlocking the potential of Golden Grove North for our shareholders.”

Exploration upside

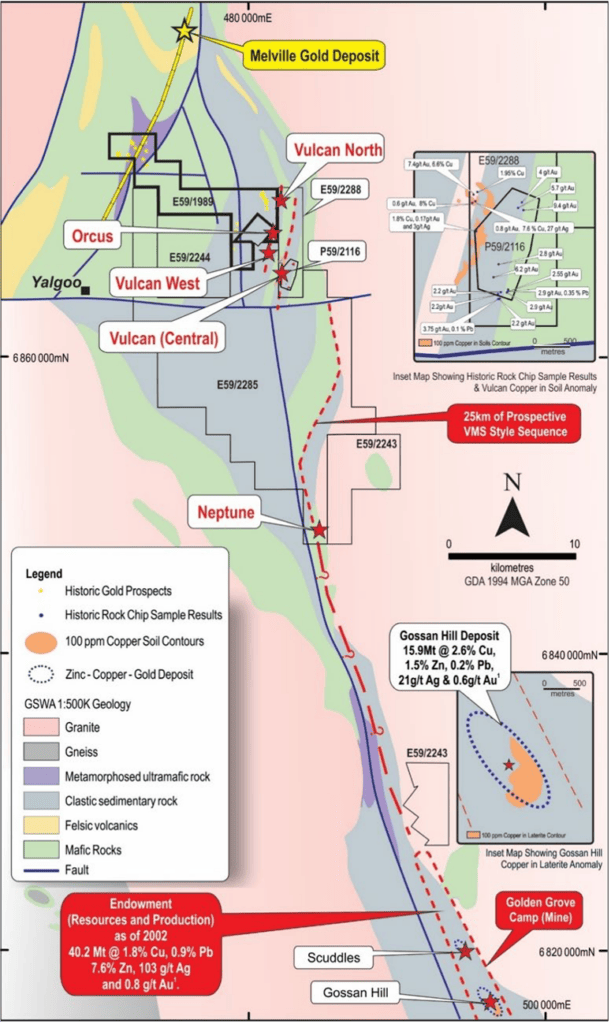

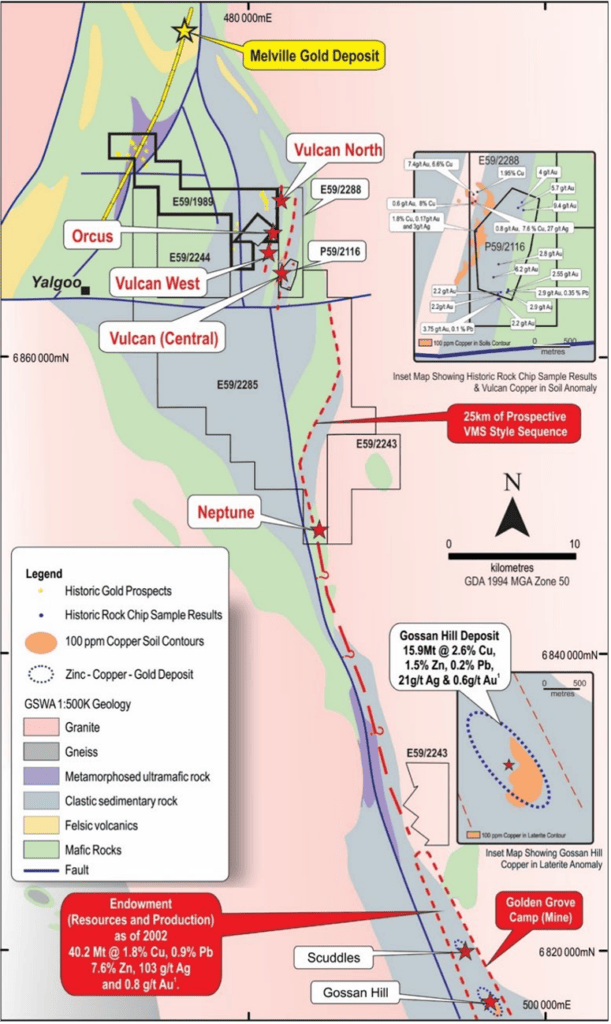

Located over 288km2 just 10km north of the polymetallic Golden Grove mine currently producing a cornucopia of base metals for $500 million capped 29Metals, the Golden Grove North project contains 25km of largely untested strike along a prospective geological sequence for VMS style mineralisation.

Early exploration success has already yielded the Vulcan and Neptune VMS targets, with EM surveys at Vulcan identifying four high priority VMS drill targets.

Historic exploration has shown hints of gold, copper, zinc, lead and silver.

Shallow drill intersections reported to the market in 2018 including gold strikes of 10m at 1.4g/t gold from 16m, 8m at 2.1g/t Au from 6m, 6m at 2.3g/t Au from 6m and 3m at 3.6g/t Au from 95m.

Historic surface rock chip sampling has returned assays including 9.4g/t gold, 7.4g/t gold and 6.6% copper, 6.2g/t gold, 5.7g/t gold, 4.0 g/t gold, 3.8g/t gold and 3.1% lead, 7.6% copper and 0.1% zinc, 8.0% copper, 2.0% copper, 1.8% copper and 3g/t silver.

The new REE target at Vulcan is supported by soil sampling for VMS mineralisation that was also assayed for lanthanum and cerium.

Recent soil sampling for the full 14 metal suite of REES aside from promethium but including yttrium confirmed and defined the discovery.

A previous diamond drill hole targeting VMS mineralisation also hit anomalous lanthanum and cerium but was not drilled deep enough to test the target.

Farming in on the land

SensOre can earn a 51% interest in the non-rare earth mineral rights in the JV by sole-funding $1.5m of expenditure over the first two years.

It can earn another 19% by spending another $3m, with Venture holding an option to claw back 10% of the project within the first two years.

It means Venture will still be able to benefit significantly from any future lithium discoveries made with SensOre’s unique technology.

“We are excited about both the copper and lithium potential of the area. With our partners at Deutsche Rohstoff, we are building a compelling portfolio of lithium projects and honing new techniques for discriminating lithium fertility over large areas,” SensOre CEO Richard Taylor said.

“We bring to the joint-venture with Venture Minerals a growing body of R&D from Western Australia to New South Wales on how to narrow in on Australia’s next generation lithium targets.”

Vulcan is part of a major push by Venture, which owns the Mount Lindsay tin-tungsten project and Riley iron ore mine in Tasmania and has Chalice farming into its nickel, copper and PGE prospects in WA’s South West, into rare earths.

This article was developed in collaboration with Venture Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Venture jumps into farm-in deal, bringing SensOre’s AI tech to lithium and copper exploration at Golden Grove North appeared first on Stockhead.

asx

gold

silver

lithium

rare earths

ree

yttrium

lanthanum

cerium

praseodymium

neodymium

promethium

copper

zinc

iron

tungsten

diamond