Uncategorized

These Tassie explorers are looking to the State’s renewable energy options to power their projects

There is no doubt that Tasmania is Australia’s leader in renewable energy – the entire state is 100% self-sufficient in … Read More

The post These…

There is no doubt that Tasmania is Australia’s leader in renewable energy – the entire state is 100% self-sufficient in renewable electricity generation and has been net zero for six out of the past seven years.

And the goal is to increase capacity, to reach 150% renewable electricity generation by 2030 and 200% by 2040.

The state has a plethora of renewable energy projects in the pipeline– around 25,000GWh – currently seeking approval and aiming to start operation by 2030.

This means the mining sector, which supports more than 5,200 jobs across the island and provides around 60 per cent of the States’ export earnings, is perfectly placed to pursue ‘green’ projects powered by wind and hydro.

“The sector provides many key minerals, including tin and tungsten, needed for everyday life and to support the world’s transition to a renewable energy future,” Tasmanian Minister for Resources the Hon Felix Ellis said back in January.

“Thanks to our rich mineral endowment and supported by our renewable energy capacity, Tasmania is in an enviable position to capitalise on increasing global demand for these minerals.”

In fact, there’s a lot of opportunity for companies in Tassie to utilise green energy.

Venture Minerals (ASX:VMS) is one example, with the company looking into developing an underground mine at its Mount Lindsay tin-tungsten project with the Environmental, Social and Governance (ESG) benefit of its connection to hydro power.

Mount Lindsay contains in excess of 80,000 tonnes of tin metal within the same mineralised body a globally significant tungsten resource containing 3,200,000 mtu of WO3.

Tin in particular, is now recognised as a fundamental metal to the battery revolution with the International Tin Association recently estimating that $1.4 billion is needed to deliver 50,000 tpa more tin by 2030” (world tin consumption was 380,600t in 2022).

Consumers and investors are becoming extremely focused on ESG-compliant sourcing of tin, which bodes well for the company.

Plus, extensive tin-boron rich zones were unveiled during the June quarter that have not previously been assessed in any mining studies at the project.

Boron has recently included in the European’ Commission’s Critical Raw Material Act and is considered vital to the green energy transition, and boron’s use in solar panels, up to 50kg of boron material is required in the construction of Electric Vehicles (EVs).

The company believes the inclusion of tin-rich borates into the current underground feasibility study could deliver major economic benefits.

VMS share price today:

Who else is jumping on renewables in Tasmania?

Stellar Resources (ASX:SRZ)

In July the company reported “outstanding” drilling results at Severen, the largest deposit at the Heemskirk project (7.6Mt at 1.1% tin) where Hole ZS162 returned a highlight 20m at 1.16% tin from 312m.

“These results finish off a highly successfully Phase 2B drilling campaign at the Severn deposit and are expected to contribute significantly to increasing the Heemskirk Tin Project Indicated Mineral Resource Estimate,” Fietz said.

The updated resource is scheduled for late August. A Pre-Feasibility Study on the sustainable tin supply from Heemskirk is planned for H2 2023.

Notably, Heemskirk will be supplied by 100% renewable energy, with 7 hydro power stations and the Granville Harbour Wind Farm all within 30kms of the project.

Group 6 Metals (ASX:G6M)

Group 6 plans to return the Dolphin tungsten mine on King Island, located in the Bass Strait between Victoria and Tasmania, to production this year.

The project contains a mineral reserve of 4.43Mt at 0.92% WO3 from a mineral resource of 9.6Mt at 0.9% WO3, and G6M plans to produce a 63% WO3 concentrate to supply the ammonium paratungstate tungsten market via an eight-year open cut and six-year underground.

Tungsten is used in electric vehicle batteries, defence systems, construction and aviation.

Back in March, G6M nabbed a $1.64m grant from the Rockliff Government to assist with the costs establishing the energy infrastructure required to recommence mining operations at the Dolphin Mine at Grassy, King Island.

The plan was to use renewable energy, with Hydro Tasmania establishing a grid connection by upgrading the existing HV transmission line, but shortly afterwards the company announced itself and Hydro Tasmania had decided this was not “the optimum solution.”

Instead, the grant funds would be applied towards dedicated interim diesel power station on-site at the mine and completing a feasibility study into the potential integration of renewable energy to complement the diesel-generated power supply.

“Group 6 Metals is targeting, over the next 3 years, replacing more than 50% of Dolphin’s initial diesel generation capacity with renewable power, resulting in lower emissions and power costs,” the company said at the time.

“To this end, the Company has advanced discussions with a significant global participant in renewable energy and technologies.”

Since then, G6M has entered into a renewable power – including hydrogen – MOU with Fortescue Future Industries for the mine, which MD Keith McKnight says advances the company’s goal of sustainably producing tungsten.

So far, the power plan seems to be working. Just the other day, G6M announced production was ramping up at the mine, with the second deliver of high-grade concentrate ready for shipment and drill and blast operations expected to provide a steady supply of ore to the process plant from mid-August.

Metals X (ASX:MLX)

Metals X owns a 50% equity interest in the Renison mine through its 50% stake in the Bluestone Mines Tasmania Joint Venture (BMTJV).

The company is working on its tailings retreatment project – or ‘Rentails’ – to re-process an estimated 22.5 million tonnes of tailings at an average grade of 0.44% tin and 0.23% copper from the historical processing of tin ore at Renison.

The plan is for the facility to operate with net zero emissions, using wind and hyro as well as potential the world’s first use of green hydrogen in tin fuming.

A box fuming furnace trial is scheduled for Q3 CY23.

On the production side, the June quarter saw an increase in tin production of 15% over Q1 CY2023 at 2,292 tonnes, and the shipment of 2,001 tonnes.

Access to the higher-grade Area 5 and Leatherwood stopes was also established during the period which the company says should lead to a further increase in tin production in the second half of 2023.

Grange Resources (ASX:GRR)

The Chinese controlled Tasmanian high grade iron ore producer nabbed a $2.6 million grant from the Tasmanian Renewable Hydrogen Development Funding program last year to investigate the potential to use hydrogen to replace natural gas for industrial heating within its pelletising facility at Port Latta.

Grange estimated that it would require a 90-100 MW renewable hydrogen production facility to replace its current natural gas consumption whilst a study into electrical heating and recuperation of process air to reduce natural gas and hydrogen usage has commenced.

“The study confirmed that, at a concept level, the conversion from natural gas to hydrogen in Grange’s furnaces is technically possible but there are economic challenges to overcome with converting furnaces to hydrogen,” the company said at the time.

This year, the company’s June quarter results took a bit of a hit, with rising production costs and lower iron ore prices eating into its margins.

Costs fell from $141.75/t to $133.53/t at the Savage River mine and concentrate plant in Tassie in the June quarter as concentrate production rose from 594,000t to 665,000t.

But realised iron ore prices fell from US$156.21/t ($227.93/t) to US$108.12/t ($160.62/t), precipitating a drop in its cash and trade receivables from $279.29m and $66.69m to $242.34m and $43.20m.

“We are continuing to complete the optimisation and definitive feasibility studies on the Southdown Magnetite Project and the underground transition at the Savage River North Pit mine,” CEO Honglin Zhao said.

“These two significant projects are planned to be completed and the results released in the upcoming months.”

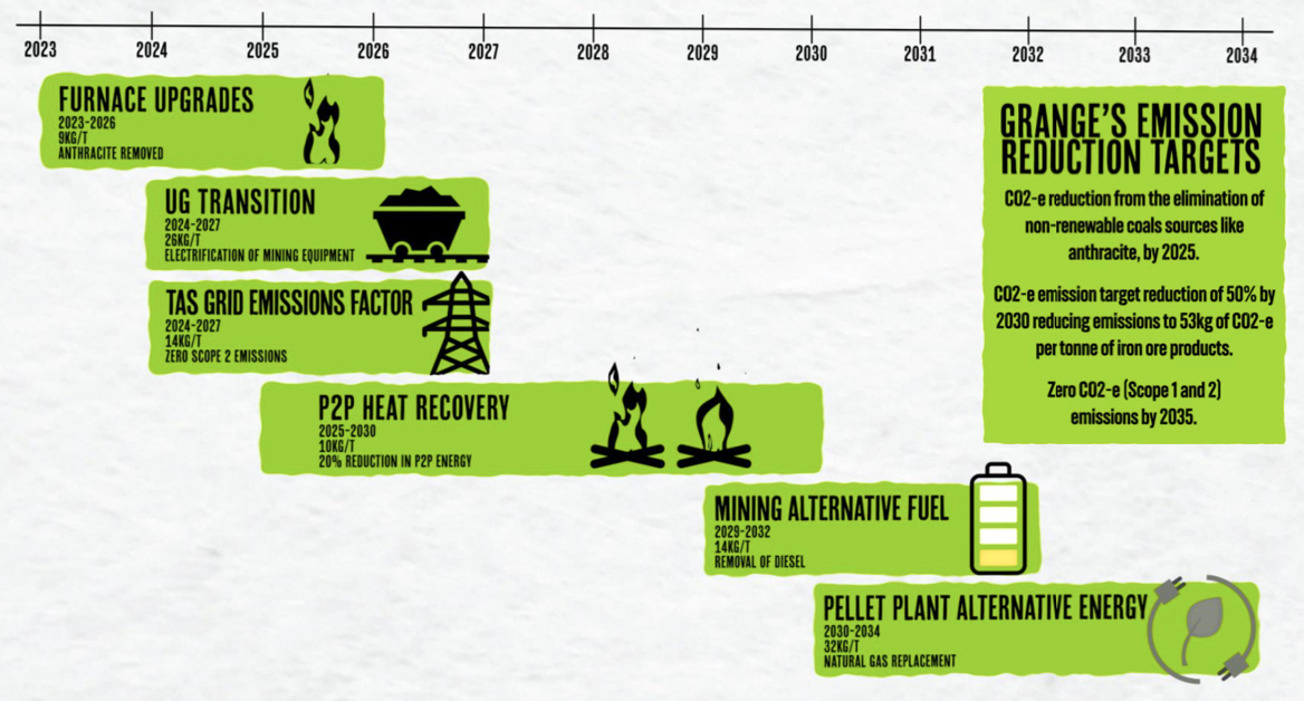

The company is also working on an emissions reductions roadmap, which would be a more detailed version of this:

And finally, a special mention to unlisted player Mallee Resources who’re looking to restart the Avebury nickel mine, powered predominantly by renewables, with a path to zero carbon in the works.

The mine has a resource of 29.3mt of 0.9% nickel for 264kt of contained nickel and is actually in production right now, exporting nickel-cobalt concentrate to the world, with nameplate capacity of 900,000tpa and crush circuit the company believes could hit 1.2mtpa.

Recently the company has hit some financial hurdles, after shareholders rejected the Incremental Secured Facility (ISF) with the company’s largest shareholder Hartree Partners, leading to a standstill agreement.

But Tassie premier Jeremy Rockliff sort of came to the rescue in the short-term, offering an immediate support package of payroll tax reimbursement and plans to make a further package of payroll tax relief available.

“The mine directly employs 200 Tasmanians and supports opportunities for local business that supply the mine with equipment and services,” Premier Rockliff said.

“We remain committed to supporting the continued operations of Avebury and securing the important jobs of locals.

“This offer is a strong show of support for the mine, and we hope it will assist Mallee in securing its future.”

SRZ, G6M, MLX and GRR share prices today:

At Stockhead we tell it like it is. While Venture Minerals is a Stockhead advertiser, it did not sponsor this article.

The post These Tassie explorers are looking to the State’s renewable energy options to power their projects appeared first on Stockhead.