Uncategorized

These Are The 10 Biggest Companies With Under 10% Institutional Ownership

Institutional investors are companies or organizations that invest on the behalf of others. These include insurance companies, mutual funds, hedge funds,…

Institutional investors are companies or organizations that invest on the behalf of others. These include insurance companies, mutual funds, hedge funds, and more. Such investors are known to be more knowledgeable, and hence, companies with high institutional ownership are seen to possess high potential.

On the other hand, many believe that companies neglected by Wall Street could hold potential as well because they are still undiscovered. Let’s take a look at the 10 biggest companies with under 10% institutional ownership.

Get The Full Series in PDF

Get the entire 10-part series on Charlie Munger in PDF. Save it to your desktop, read it on your tablet, or email to your colleagues.

Q3 2022 hedge fund letters, conferences and more

Ten Biggest Companies With Under 10% Institutional Ownership

We have used the institutional ownership data from finviz.com to develop this list of the 10 biggest companies with under 10% institutional ownership. For our list of the 10 biggest companies with under 10% institutional ownership, we have only considered stocks with a market capitalization of more than $1 billion. Here are the 10 biggest companies with under 10% institutional ownership:

-

Nutex Health

Founded in 2011 and headquartered in Houston, Texas, this company offers technology-enabled healthcare services. Nutex Health Inc (NASDAQ:NUTX) shares are down by over 53% year to date and down almost 8% in the last three months.

As of this writing, Nutex Health shares are trading above $1.89 with a 52-week range of $0.50 to $52.80, giving the company a market capitalization of more than $1.20 billion.

-

RXO

Founded in 2022 and headquartered in Charlotte, N.C., this company offers asset-light transportation solutions. RXO Inc (NYSE:RXO) shares are down by almost 15% in three months. The company just went public last month.

As of this writing, RXO shares are trading above $16 with a 52-week range of $14.75 to $25.50, giving the company a market capitalization of more than $1.90 billion.

-

Eve Holding

Founded in 2020 and headquartered in Melbourne, Fla., it is a special purpose acquisition company that focuses on the aviation sector. Eve Holding Inc (NYSE:EVEX) shares are down by almost 26% year to date and down almost 32% in the last three months.

As of this writing, Eve Holding shares are trading above $7.50 with a 52-week range of $5.30 to $13.34, giving the company a market capitalization of more than $2 billion.

-

HighPeak Energy

Founded in 2019 and headquartered in Fort Worth, Texas, it is an independent oil and natural gas company. Highpeak Energy Inc (NASDAQ:HPK) shares are up by almost 35% year to date and down over 18% in the last three months.

As of this writing, HighPeak Energy shares are trading above $19.70 with a 52-week range of $13.44 to $38.21, giving the company a market capitalization of more than $2.20 billion.

-

Rumble

Founded in 2013 and headquartered in Longboat Key, Florida, this company allows video creators to host, livestream, manage, distribute, and create OTT feeds. Rumble Inc (NASDAQ:RUM) shares are down by almost 27% year to date and down over 34% in the last three months.

As of this writing, Rumble shares are trading above $7.90 with a 52-week range of $6.35 to $18.52, giving the company a market capitalization of more than $2.20 billion.

-

Prospect Capital

Founded in 2004 and headquartered in New York City, this company lends to and invests in private businesses, as well as invests in debt and equity instruments. Prospect Capital Corporation (NASDAQ:PSEC) shares are down by almost 14% year to date and down over 1% in the last three months.

As of this writing, Prospect Capital shares are trading above $7.20 with a 52-week range of $6.09 to $8.95, giving the company a market capitalization of more than $2.80 billion.

-

AMC Entertainment Holdings

Founded in 1920 and headquartered in Leawood, Kan., this company is in the theatrical exhibition business. AMC Entertainment Holdings Inc (NYSE:AMC) shares are down by over 66% year to date and down almost 38% in the last three months.

As of this writing, AMC Entertainment Holdings shares are trading above $5.60 with a 52-week range of $5.05 to $21.09, giving the company a market capitalization of more than $2.90 billion.

-

Amerco

Founded in 1945 and headquartered in Reno, Nev., this company offers insurance, as well as moving and storage services. Amerco (NASDAQ:UHAL) shares are down by over 91% year to date and down almost 88% in the last three months.

As of this writing, Amerco shares are trading above $61 with a 52-week range of $50.00 to $731.57, giving the company a market capitalization of more than $11 billion.

-

Ubiquiti

Founded in 2003 and headquartered in New York City, this company sells networking equipment, as well as offers related software platforms. Ubiquiti Inc (NYSE:UI) shares are down by almost 10% year to date and down over 10% in the last three months.

As of this writing, Ubiquiti shares are trading above $279 with a 52-week range of $218.15 to $350.63, giving the company a market capitalization of more than $17 billion.

-

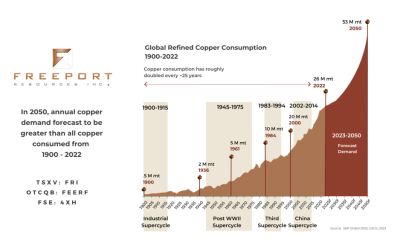

Southern Copper

Founded in 1952 and headquartered in Phoenix, Ariz., this company develops and explores copper, molybdenum, zinc, and silver. Southern Copper Corp (NYSE:SCCO) shares are down by almost 3% year to date but are up over 28% in the last three months.

As of this writing, Southern Copper shares are trading above $58 with a 52-week range of $42.42 to $79.32, giving the company a market capitalization of more than $47 billion.