Uncategorized

The pros and cons of owning US stocks, and how to go about buying them

Aussie traders could diversify their portfolio by buying US stocks Which brokers offer access to Wall Street? We discuss the … Read More

The post The…

- Aussie traders could diversify their portfolio by buying US stocks

- Which brokers offer access to Wall Street?

- We discuss the tax implications as well as benefits of buying US stocks

In 2022, the US S&P 500 suffered its worst first half in more than 50 years as it plunged 21%.

The index has since picked up, now down by 15% as we head into the last few weeks of the year.

It may not seem like the best time to plough money into stocks, but here’s the thing: History shows time and again that a bear market is the best time to buy stocks.

With share prices of US household names – especially those in the tech sector – being crushed, it’s a rare opportunity.

The world’s most valuable company Apple is down almost 20% in 2022. Tesla is down 50%, Alphabet by 30%, Microsoft 25% while Amazon has plunged by 45%.

While a recession is certainly on the cards for the world’s biggest economy, these price falls could be a good entry point for those seeking long term bargains.

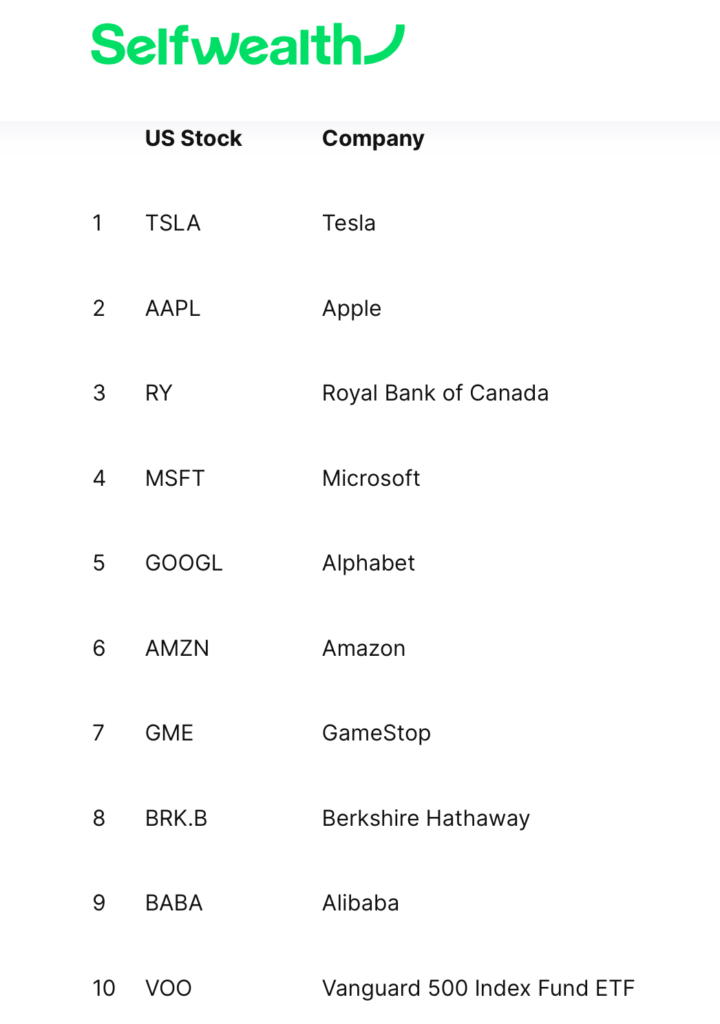

According to listed trading platform Selfwealth (ASX:SFW), these are the most held US stocks by Australian investors (data as of end of October).

Brokers with access to US stocks

If you want to buy US shares from Australia, you’ll need to sign up with a broker that has access to the US market – simple as that.

Many licensed brokers in Australia have that access, and the process of opening an account is pretty quick and easy.

If you’re looking for bigger and more established players backed by big banks – Commsec, Westpac, ANZ and the NAB – trade platforms could be the best options.

International brokers like IG, Interactive Brokers and CMC Markets are also reliable platforms that give you access to Wall Street.

Fees or commissions could vary, but according to comparison site Finder, these are some of the online platforms that allow you to buy US or global stocks on zero commission:

- eToro

- IG

- CMC Markets

- Stake

- Superhero

- Goodments

- Monex Securities

There’s also a host of new apps coming to market, and most of these online-only brokers to provide access to the US markets.

Pearler, Tiger and Selfwealth come to mind. The popular trading app Robinhood meanwhile is currently still unavailable for Australians.

When choosing a broker, you should also consider factors other than fees.

Ease of use, the ability to access other global markets, the quality of research provided, and the availability of customer support are also important considerations.

Some platforms also provide education resources such as explainer videos, but these might be charged at an additional cost.

Tax implications for buying US stocks

Australian tax residents are subject to tax on worldwide income.

This includes investment income (dividends) and capital gains from overseas investments.

In order to prevent double taxation, Australia has entered into “tax treaties” with more than 40 jurisdictions, including the US.

The US/Australia tax treaty can provide Australian tax residents with a reduced rate of tax on US-sourced income, provided you fit the definition of an Australian resident for tax purposes.

You should read more about it on the ATO website, but here’s one quick detail you need to know – when you sign up for a US brokerage account, you will need to have an up-to-date W-8BEN-E form.

The W-8BEN is basically a form issued by the US Internal Revenue Service (IRS) that allows foreign investors to establish their foreign status. This allows you to claim beneficial ownership as a non-US resident and pay a reduced rate of withholding tax.

Failure to provide W-8BEN when requested may lead to you paying the maximum withholding tax of 30%.

When preparing your Australian income tax return, you may be able to claim any US withholding tax that has been withheld from your dividend as a foreign income tax offset (FITO).

The rules of FITO are complex and you’re advised to discuss it with an accountant, but FITOs may reduce the Australian tax you would otherwise have to pay on foreign earnings.

Why invest in the US?

There are many benefits from investing in the US stock market.

The most obvious one is geographical diversification, but if you drill down further, there are also benefits like sector diversification.

This is because the Aussie share market is incredibly top heavy, with Mining and Banking making up close to 50% of the ASX 200.

The ASX 200 breakdown

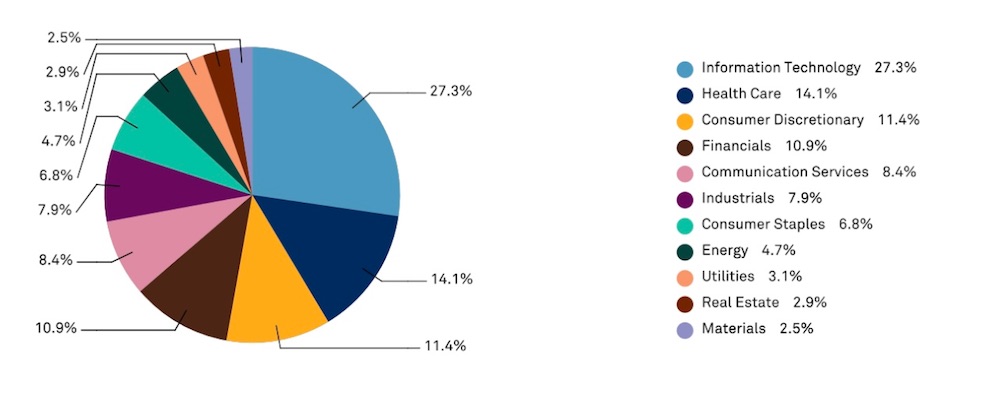

While the US S&P 500 also has a bias towards tech, making up 27% of the index, it is more evenly diversified across the board.

The US S&P 500 breakdown

The other thing worth understanding about Australian stocks is that they tend to be more cyclical than US stocks.

Our miners are sensitive to changes in commodity prices (like iron ore), and the banks are sensitive to changes in interest rates.

By comparison, US stocks – especially US tech stocks and healthcare stocks – which are like the miners and the banks of Australia and make up a large portion of their share markets, are less cyclical.

“These trends, unlike the price of iron ore for example, are likely to continue trending up, regardless of what’s happening more broadly in the global economy,” says Shane Watson of trading app Syfe.

“They aren’t cyclical, in technical terms: they are secular.”

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

The post The pros and cons of owning US stocks, and how to go about buying them appeared first on Stockhead.