Uncategorized

TECH HEAVY: The FANG+ Index lost -5% last week as September continues to dismember the Nasdaq

The Wall Street Week That Was “We know that in September, we will wander through the warm winds of … Read More

The post TECH HEAVY: The FANG+ Index…

The Wall Street Week That Was

“We know that in September, we will wander through the warm winds of summer’s wreckage. We will welcome summer’s ghost.” – Henry Rollins

T’was the the top end of a tech-laden Wall Street which led the slippery slide across US indices last week as the big ticket growth stocks quailed in the face of stonking, rising US long bond yields. In New York, the FANG+ Index lost almost -5%, wildly underperforming the more broad-based S&P500.

The tech-heavy Nasdaq Composite is down almost -6% in September as growth stocks bore the brunt of the sell-off, likely logging its biggest monthly loss since Christmas.

That’s volatility for you. The VIX, or Wall St’s Gauge of Fear jumped almost 25% as US investors got the death wobbles following Jerome Powell’s speech on Wednesday. Conversely, The UK FTSE enjoyed a far better week after the BOE surprised many pundits by leaving interest rates unchanged:

US stocks fell again on Friday, and all three major US indices booked more weekly losses for September and nine of 11 S&P sectors ended in the red, with Technology and Energy being the two gainers.is it possible even Wall St is starting to believe the bull run is done?

Friday’s decline marked the fourth straight downer for the S&P 500 down -0.25% while the tech-heavy Nasdaq Composite slipped a more moderate -0.09%.

“But when fall comes, kicking summer out on its treacherous ass as it always does one day sometime after the midpoint of September, it stays awhile like an old friend that you have missed.” – Stephen King

Last week’s declines marked the third straight negative week and worst weekly performance since March for both averages.

The blue-chip Dow is off by a more modest 2.2% this month.

Already we long for the S&P 500 index and its 14-month highs which now seem two years ago and not two months ago.

With a week to play in September, The S&P 500 has fallen -4.3% so far – its worst month since December.

For the week, the S&P 500 and the Nasdaq Composite dropped 2.9% and 3.6%, respectively. The blue-chip Dow gave up 1.9% on the week.

“My favourite poem is the one that starts ‘Thirty days hath September’ because it actually tells you something.” – Groucho Marx

The S&P500 fell -2.9% over the week after the US Fed left interest rates unchanged, but Chair J. Powell’s statement was copped as a hawkish blow by the punters, firing up enthusiasm for safer waters as bond yields jumped to new multi-year highs.

In London, the FTSE wobbled but -0.5% after the Bank of England (BOE) surprised by leaving rates on hold after 14 straight hikes. The data’s been good for Uk inflation, but more will be needed before bets come in hard they’ve passed peak interest rates.

The Nikkei crashed -3.3% after the Bank of Japan (BOJ) kept short-term interest rates unchanged at -0.1% and their 10-year Bonds capped at zero. Another world, really. And recall that Japanese equities have had a terrific run, and are just off all-time highs.

The glum run across the three very averages were in direct correlation to the deflating hawkish comments post-Federal Reserve meet on inflation – and their attempts to curb it.

The Fed reiterated that it intended to keep interest rates higher for longer, pumping expectations for more rate hikes, just as investors continue to bet that the spike in hikes has now, actually, spiked.

“After the chaos and carnage of September 11th, it is not enough to serve our enemies with legal papers.” – George W. Bush

Among the big names to suck the fun out of Wall St – Salesforce (CRM), Microsoft (MSFT), IBM (IBM) and Intel (INTC).

Notably, Apple (AAPL) rose, adding 0.5% as the tech giant is expected to see a boost in new titanium-shiny iPhone 15 shipments.

Perhaps most reflective of the turnover of high-concept tech is the imminent extinction of Bird as a listed entity. Last week the SPAC-driven start-up said the NYSE will suspend trading of its stock after Bird failed to keep its market cap above US$15 million for 30 consecutive days.

Once a leader in the now ubiquitous bike/electric scooter bombers which left their products everywhere and became – first a hip alternative to ride sharing, and then a pandemic pick up to rent-ride about the empty city – Bird raised – ahem – over half a billion US dollars, and was worth some at US$2.5 billion in a 2019 VC round led by Sequoia Capital.

Tonight in a different US, the company’s shares will trade on the over-the-counter exchange, according to this statement:

Bird Global, Inc. (NYSE:BRDS) (“Bird” or the “Company”) a leader in environmentally friendly electric transportation, today announced it received notice from the New York Stock Exchange (“NYSE”) that NYSE will suspend trading of, and commence proceedings to, delist shares of Bird’s Class A common stock, effective at the open of business eastern standard time on September 25, 2023.

The Week That Will be

You know, people talk about this being an uncertain time. You know, all time is uncertain. I mean, it was uncertain back in – in 2007, we just didn’t know it was uncertain. It was – uncertain on September 10th, 2001. It was uncertain on October 18th, 1987, you just didn’t know it.

– Warren Buffett

Shocking to contemplate, but we will soon know if the US is going to shut itself down this weekend.

On Capitol Hill, Republicans aren’t even united in their various lines of opposition to the Government spending plan and its gauntlet run through both chambers looks dire.

On Sunday night, CNBC reported that the US Congress is mired in a stalemate on the federal budget, “as GOP hard-liners refuse to budge on further spending cuts.”

The current spending laws expire on Saturday.

That means if Congress does not reach an agreement before 12:01 a.m. on Oct. 1, the government will shut down. House Republicans on Thursday sent the chamber into recess, delaying further developments in the negotiations.

If there is no agreement by midnight Saturday in NY (Sunday morning in Sydenham), the government will shut down and an awfully long line of federal workers will begin to be furloughed and the problems begin.

But hey, outside of that, inflation data and it’s direction will again take hold of US investors over the next few sessions.

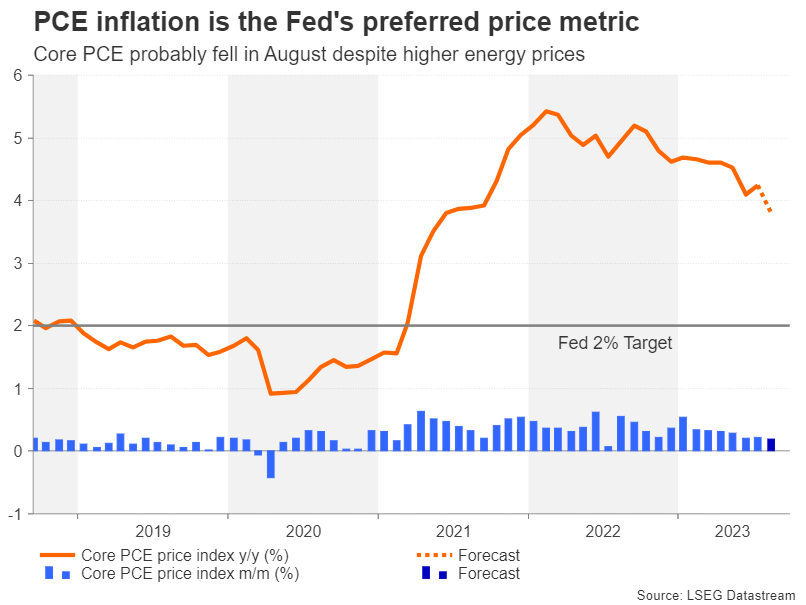

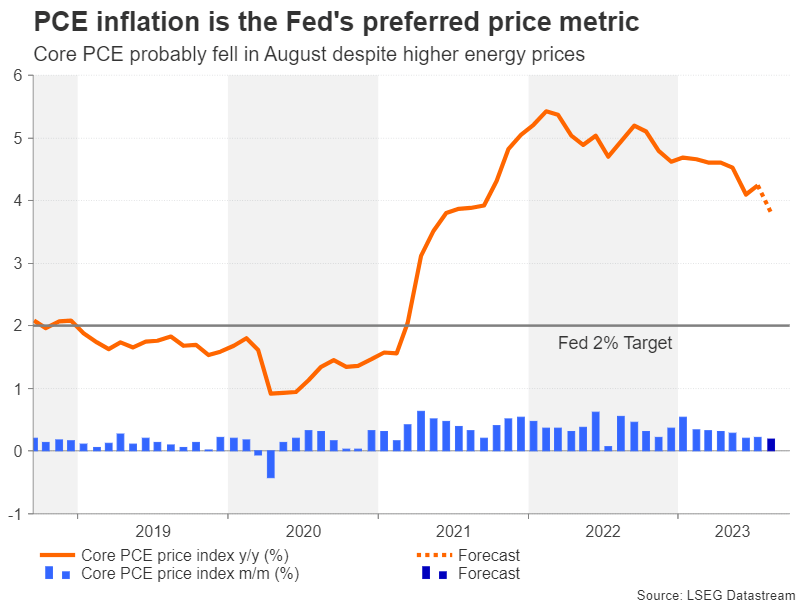

The critical PCE inflation reading and flash CPI reports from Europe are due to be released, while stateside investors will watch durable goods, consumer confidence, new home sales, and the advanced goods trade balance.

A growing mob of US analysts think the overall balance of data releases could confirm a cooling economy.

Core PCE inflation – that’s by far team J. Powell’s preferred inflation gauge, is expected to be up 0.2% month-over-month squeezing the year-over-year rate down to 3.8%.

September is my favourite month, particularly in Cornwall. I felt, even as a child, that if you get a wonderful day in September, you think: ‘This could be one of the last, the summer is nearly over.’ If you get a wonderful day in May, you think: ‘So what, there’s more coming.’

– Tim Rice

“For our view that US tech can make new highs into Christmas to work, the likelihood is that bond yields will need to reverse their recent gains over the coming months,” Market Matters’ James Gerrish wrote on Monday morning in Sydney.

“We remain bullish on the influential US tech stocks, but a test of the psychological 7000 area for the FANG+ Index wouldn’t surprise, around 5% lower.”

Highlights on the Wall Street earnings watch this week include releases from Micron Technology (MU), Costco (COST), Nike (NKE), and Jefferies Financial Group (JEF).

On the company news front, this week will see Meta Platforms (META) will host its joyously-anticipated Meta Connect and in dark and evil telco news, China’s naughty Huawei will hold a key product event.

US Earnings to Watch this Week

Micron (MU)

Wall Street expects Micron to lose US$1.18 per share on revenue of US$3.91 billion, not up to the same time last year quarterly earnings came to US$1.45 per share on revenue of $6.64 billion.

Micron is an “AI stock” these days, which is how the price has found almost 20% over the last 2 x quarters, vs around 9% on the benchmark S&P 500.

After reporting its worst ever quarter in March, Deutsche Bank last week upgraded the stock saying AI is providing a much-needed lift with the worst of the chip down cycle behind MU. Analysts in the AI end of town say that the memory supply chain hassles should be sorted by 2H 2023.

And then comes the cyclical recovery in early 2024. Considering the geopolitical interference being run out of Beijing and Washington, I wouldn’t be confident betting in cycles revolving in the same ways.

Year to date MU has gained 37%. The stock performance aside, the euphoria surrounding the potential of generative AI can’t be ignored when evaluating Micron and its implications for the semiconductor sector. Aggressive production and cost cuts have set MU toward its lofty forward guidance as strong demand on the AI servers front could help revive its fortunes, according to DB.

BlackBerry (BB)

Wall Street expects BlackBerry to lose 6 cents per share on revenue of $132.03 million. This compares to the year-ago quarter loss of 5 cents per share on revenue of $166.67 million.

BlackBerry shares have rebounded impressively so far this year, rising 57% year date, but in its move to power-up the BB balance sheet, it’s sold off various golden geese – namely highly-prized patents.

However, CEO John Chen recently boasted confidence about the company’s direction and competitive position, saying, “We’ve got a stable and focused leadership team that’s driving that business in a very focused way.”

Nike (NKE)

Wall Street expects NKE to earn 74 cents per share on revenue of US$13 billion, Vs the year-ago quarter when earnings came to 93 cents per share on revenue of US$12.69 billion.

Shares of the sports apparel and shoe-making retail weathervane are down almost 25% this year.

Erste Group brokers just cut the NKE rating to Hold from Buy as well, citing the current macroeconomic backdrop.

“The fact that consumer sentiment has also deteriorated significantly, particularly in the important sales market of China, and sales there have fallen, is currently having a negative impact,” according to Erste analysts.

The Everyone Else Economic Calendar

Monday September 25 – Friday September 29

MONDAY

Chicago Fed National Activity Index (August)

Dallas Fed Index (September)

ECB President Lagarde Speech

TUESDAY

US Building

US Permits final (August)

FHFA Home Price Index (July)

US S&P/Case-Shiller comp.20 HPI (July)

US Consumer Confidence (September)

US New Home Sales (August)

Richmond Fed Index (September)

WEDNESDAY

US Durable Orders (August)

US Earnings: Micron Technology

THURSDAY

US Continuing Jobless Claims (Q2)

US Initial Claims (9/23)

US Pending Home Sales Index (August)

Kansas City Fed Manufacturing Index (September)

US Earnings: Nike

US Earnings: Blackberry

FRIDAY

PCE Deflator (August)

US Personal Consumption Expenditure (August), Personal Income (August)

US Wholesale Inventories (August)

Chicago PMI (September)

Michigan Sentiment final (September)

The post TECH HEAVY: The FANG+ Index lost -5% last week as September continues to dismember the Nasdaq appeared first on Stockhead.