Uncategorized

T&E report suggests smaller EVs could reduce demand for critical metals significantly

Demand for battery raw materials in Europe will increase rapidly between now and 2050/ The region can curb the expected consumption of key metals from…

Demand for battery raw materials in Europe will increase rapidly between now and 2050/ The region can curb the expected consumption of key metals from electrifying passenger transport by up to 49% over that period, according to new analysis. Environmental NGO Transport & Environment, which conducted the study, said governments and the EU must take action to reduce battery and car sizes—the single most effective measure to reduce metals demand.

To decarbonize its fleet between now and 2050, Europe will require 200 times the battery raw materials it consumed last year, unless action is taken, the report finds. However, policies to incentivize small affordable entry-level BEVs, adopt innovative battery chemistries and reduce private car journeys, could cut demand for key metals lithium, nickel, cobalt and manganese by 36-49%.

T&E developed three scenarios for the demand of battery raw materials, notably lithium, nickel, cobalt and manganese, between today and 2050. All of the scenarios assume full electrification of passenger transport by 2050 and an accelerated uptake of battery electric vehicles up to then to maximize the CO2 savings.

-

The “Business as Usual”—BaU—scenario takes the currently expected industry trends on battery size and chemistry, as well as the status quo private car activity.

-

The “Accelerated Innovation and Fewer Car km”—or Accelerated—scenario assumes a substantial shift to smaller batteries, a faster uptake of battery chemistries with less critical metals (e.g. lithium batteries without cobalt or nickel (LFP), or sodium-ion batteries) and fewer km driven by private car.

-

The final “Aggressive Innovation and Fewer Car km”—or Aggressive—scenario takes these assumptions up another notch to more radical changes.

Demand for raw materials increases in all the three scenarios, with annual volumes in 2050 estimated to be 4 to 10 times higher than today, and cumulatively up to 200 times higher than the 2022 EV battery industry consumption.

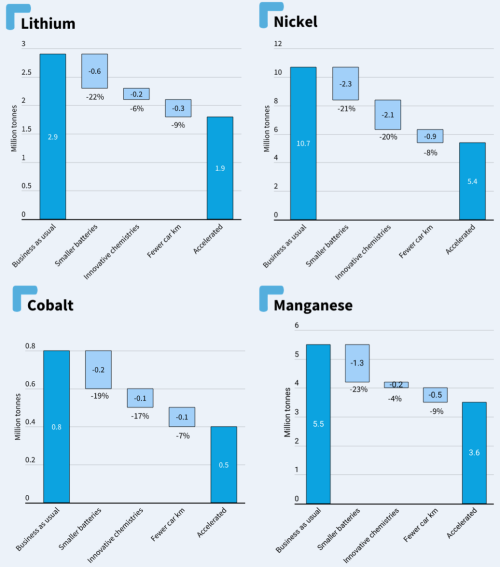

27 TWh of batteries will be needed cumulatively until 2050 in BAU, equivalent to 2.9 million tonnes (Mt) of lithium, 10.7 Mt of nickel, 0.8 Mt of cobalt and 5.5 Mt of manganese. This European demand represents up to 11% of the known global reserves for lithium and nickel, 10% for cobalt and 1% for manganese, according to the analysis.

The Accelerated scenario would require a total of 19 TWh of batteries, or a third less. This means that compared to the BaU scenario, the raw material requirements are:

-

1.9 Mt of lithium, or over a third less

-

5.4 Mt of nickel, or around half

-

0.5 Mt of cobalt, or 44% less

-

3.6 Mt of manganese, or over a third less.

The Aggressive scenario would require nearly half the amount of batteries cumulatively by 2050 compared to the BAU scenario, resulting in an even larger decrease in the demand of critical metals: 57% less lithium; 59% less nickel; 56% less cobalt; and 45% less manganese.

Smaller batteries represent the single factor bringing the largest impact, 19%-27% reduction in raw materials cumulatively across the Accelerated and Aggressive scenarios. In the Accelerated scenario, shifting to smaller batteries results in a 19%-23% reduction in the raw materials demand. Switching to less resource intensive chemistries brings an additional 4-20% reduction. Reducing the km driven by private cars is responsible for 7%-9% of the reduction. Source: T&E Roadmap

Europe needs to electrify its entire fleet by 2050, but with that comes a growing demand for battery metals. If we are serious about not repeating the mistakes of insatiable oil dependency, then resource efficiency has to play a big role. In a supply constrained world, smaller electric cars are not just an environmental must, but a sound economic and industrial policy.

—Julia Poliscanova, Senior Director, Vehicles & Emobility Supply Chains, at T&E

T&E said a Europe-wide strategy is needed to shift to smaller, more affordable and resource light electric vehicles than the large SUV models coming to market today. National measures should include tax incentives for smaller models, while at EU level, battery efficiency standards and requirements on automakers to produce more entry-level models are needed, the organization said.

Smaller electric cars are also suited for batteries built with less resource-intensive chemistries that can reduce metal demand by up to 20%. Strong industrial policy is needed to scale up European production of new technologies such as iron-based (LFP) and sodium-based (Na-ion) batteries. Reducing journeys by private cars can deliver a further 7-9% reduction in demand. T&E calls for a range of measures including building fewer roads, cutting the space available for private cars and charging for parking. Governments should also promote public and shared transport and active travel.

Making smaller electric cars is the single biggest thing we can do to curb our consumption of battery raw materials. An EU efficiency standard could require carmakers to finally provide more resource-light vehicles which will actually be more affordable than today’s bulky models. There is a market for millions of small BEVs in Europe, but people can’t find them on the forecourt.

—Julia Poliscanova