Uncategorized

Stakes Raised for Wests Bid To Boost Uranium Output

Source: McAlinden Research 08/30/2023

McAlinden Research Partners shares a deep drive into a market driver with what it believes is alpha generating…

Source: McAlinden Research 08/30/2023

McAlinden Research Partners shares a deep drive into a market driver with what it believes is alpha generating potential.

For all the Russian products that have essentially been cut off from Western economies throughout the past year and a half following Russia’s formal invasion of Ukraine, enriched uranium sold by state-owned nuclear giant Rosatom has been mostly untouched in its overseas shipment. Rosatom could be considered directly complicit in Russia’s war effort, as it has taken charge of operations at Zaporizhzhia Nuclear Power Plant (ZNPP) since the power station was occupied by Russian forces in March 2022. The ZNPP, located in southern Ukraine, is Europe’s largest nuclear power plant.

While the European Union has enacted bans on Russian crude oil shipments (with exemptions for some countries in Eastern Europe), along with similar restrictions on the import of coal and refined oil products, Bloomberg notes that Russia fulfills about 30% of the EU’s demand for enriched uranium, on a separative work units (SWU) basis. The U.S. has implemented its own bans on those same products but relied on Russian supplies for 24% of the enriched Uranium demand in 2022. There are 18 nuclear power plants in the EU that use Russian designs and rely on Russian imports, making it unlikely that the EU will stifle imports of components and fuels from Rosatom in the near term.

The White House has previously rolled out a spate of sanctions against Rosatom subsidiaries, but this appears to have done little to halt imports of Russian uranium thus far. Russian news outlet Sputnik recently claimed U.S. federal statistical system data shows the U.S. bought 416 tonnes of uranium from Russia in the first half of 2023, which is 2.2x greater than purchases in the same period a year ago. That would be the largest volume of uranium imports from Russia since 2005. The cost of the uranium amounted to US$696.5 million, which is the highest value in over two decades. A bill banning Russian uranium imports to the U.S. has had some success in the U.S. Congress, receiving committee approval in the House of Representatives last May, but has not been brought up for a vote. Rosatom currently supplies a quarter of America’s 92 nuclear reactors.

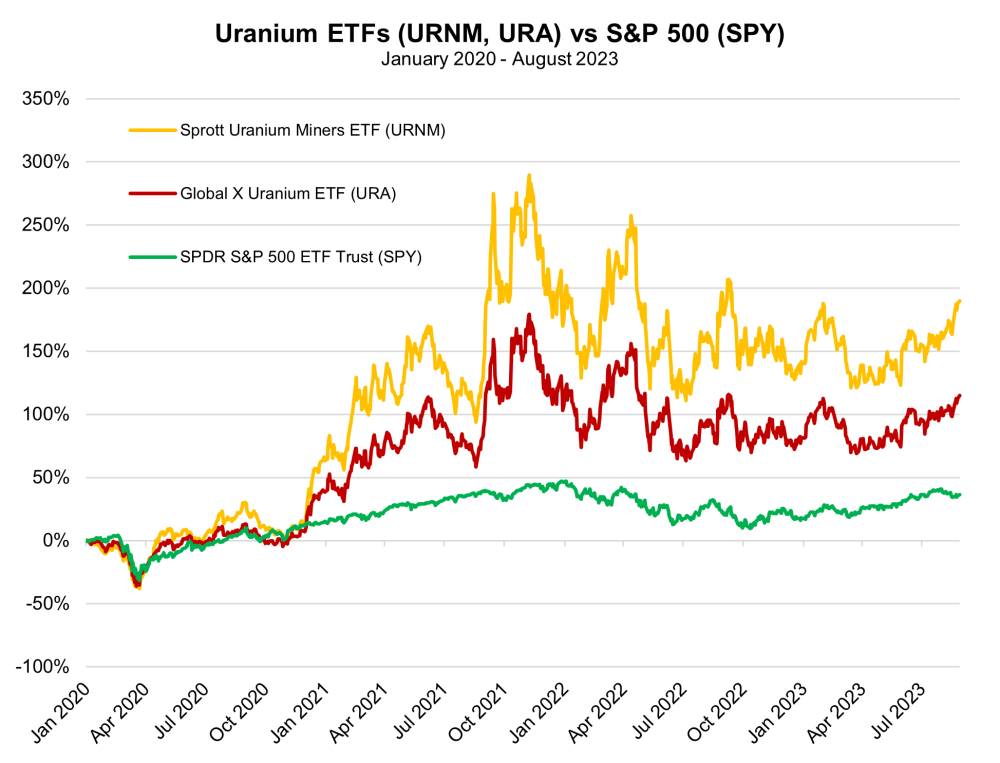

Investors can gain exposure to uranium miners and the production of nuclear components via the Sprott Uranium Miners ETF (URNM:NYSE ARCA) and Global X Uranium ETF (URA:NYSE).

Following a July military coup in Niger that overthrew and imprisoned the elected President, Mohamed Bazoum, Europe may find it even harder to break free of its dependence on Russia’s uranium. As MRP highlighted in an extensive Intelligence Briefing regarding the coup, Niger is Africa’s second-biggest uranium producer and the leading supplier for European utilities. Demonstrations by pro-coup supporters in the wake of the President’s detention have taken on a particularly “anti-imperialist” tone, decrying French influence in West Africa, specifically. Niger’s military junta has become increasingly aggressive toward France’s diplomats, ordering the French ambassador and his envoy to leave their embassy in Niamey, Niger’s capital, and return to France.

Though Reuters has disputed this claim, African and Middle Eastern media sources reported that Niger would be halting the nation’s uranium exports to France in early August. France is particularly reliant on uranium to fuel its nuclear power capacity, responsible for 75% of the country’s electricity generation. Per Le Monde, France imported more than 20% of its Uranium from Niger in 2022 — most of which comes from mines owned by French state-owned enterprises like Orano. It remains to be seen how rising aggression toward France’s presence in Niger and the surrounding region will impact these interests.

Rosatom leads the world in uranium enrichment, and it is ranked third in uranium production and fuel fabrication, according to its 2022 annual report. MRP has highlighted some urgency in recent years to revive uranium mining and enrichment in North America to counter the disproportionate presence of Russia in the global nuclear and uranium trade, but it has followed several years of output cuts meant to clear a glut of uranium that built up in the 2010s and depressed prices. Slimmer global supplies have helped the long-term prices of the yellow metal rise to a 12-year high of almost US$57.00 per pound.

With a strong economic incentive now in place, as well as an ongoing revival of interest in nuclear power plants and associated technologies, an expansion of North American uranium industry should begin to accelerate. Last week, US-based Westinghouse, owned by Brookfield Business Partners, signed on to license and supply VVER-440 fuel assemblies to Slovakian utility firm Slovenské elektrárne. Approximately 59% of the electricity produced in Slovakia is generated by nuclear power plants, of which Slovenské elektrárne operates four. Ukraine, which also runs its grid-primarily on nuclear power and was previously a massive buyer of Russian uranium, recently signed onto a 12-year deal to source all of the uranium fueling its reactors from Canadian miner Cameco Corp.

Investors can gain exposure to uranium miners and the production of nuclear components via the Sprott Uranium Miners ETF (URNM:NYSE ARCA) and Global X Uranium ETF (URA:NYSE).

Charts

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

McAlinden Research Partners Disclosures

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.