Uncategorized

St George eyes 80pc stake in Mt Holland lithium and nickel tenements

Special Report: St George Mining has entered a binding agreement to potentially acquire an 80% interest in the lithium and … Read More

The post St George…

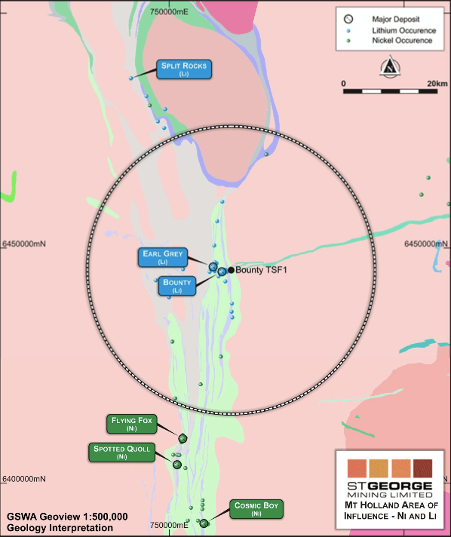

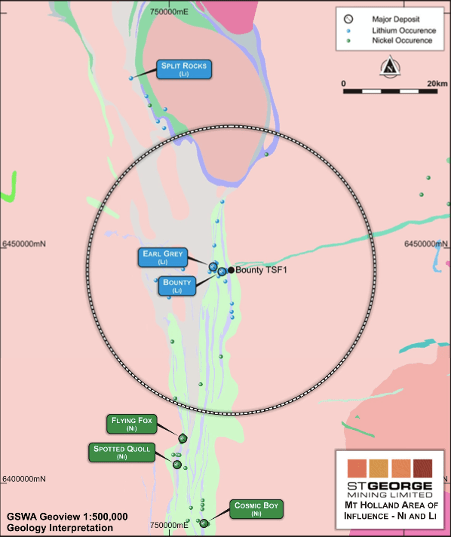

St George Mining has entered a binding agreement to potentially acquire an 80% interest in the lithium and nickel rights of certain tenements covering parts of the Mt Holland region of WA.

The ‘Area of Influence’ agreement with private player Cacique Resources includes the Earl Grey lithium project owned by Covalent Lithium, a joint venture between Wesfarmers (ASX:WES) and Sociedad Química y Minera de Chile S.A. (SQM).

Plus, an interpreted 40km strike of the Forrestania nickel belt is interpreted to occur within the Area of Influence, which the company says supports the potential for nickel sulphide mineralisation.

Building a lithium and nickel portfolio

St George Mining (ASX:SGQ) says the agreement complements its focus on building a portfolio of highly prospective lithium and nickel projects and interests within Western Australia.“We are very pleased to have concluded the binding agreement for this opportunity which relates to part of the world class Mt Holland‐Forrestania lithium and nickel province,” executive chairman John Prineas said.

“The agreement provides St George with an option to potentially acquire a foothold in this highly prospective region and to further build upon St George’s high‐quality portfolio of lithium and nickel projects in Western Australia.

“As we prepare to resume drilling at our Mt Alexander lithium project in a matter of days, we are also excited to have expanded our project pipeline into one of the most significant addresses in WA for hard‐rock lithium and nickel sulphide mineralisation.”

Option to acquire 80%

The company will have the exclusive right to enter into an option to acquire 80% of the lithium and nickel rights of any tenement that Cacique applies for or acquires in the Area of Influence.

If the option is executed, St George and Cacique will form a joint venture pursuant to which Cacique is free carried to a decision to mine.

Cacique will retain 100% of other mineral rights including gold.

This article was developed in collaboration with St George Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post St George eyes 80pc stake in Mt Holland lithium and nickel tenements appeared first on Stockhead.