Uncategorized

Spodumene confirmed: GreenTech hits a home run at Osborne lithium JV in the Pilbara

Special Report: Sampling confirms the lithium within GreenTech Metals’ Osborne JV in Western Australia is predominantly hosted in spodumene – … Read…

- XRD analysis confirms lithium predominantly hosted in spodumene at Osborne

- Rock sampling recently returned up to 3.6% Li2O at the project

- Osborne sits east of Greentech Metals’ Ruth Well project which returned 1.8% Li2O

- Further exploration at Osborne and maiden drilling at Ruth Well are planned

Sampling confirms the lithium within GreenTech Metals’ Osborne JV in Western Australia is predominantly hosted in spodumene – the most valued hard rock lithium ore source.

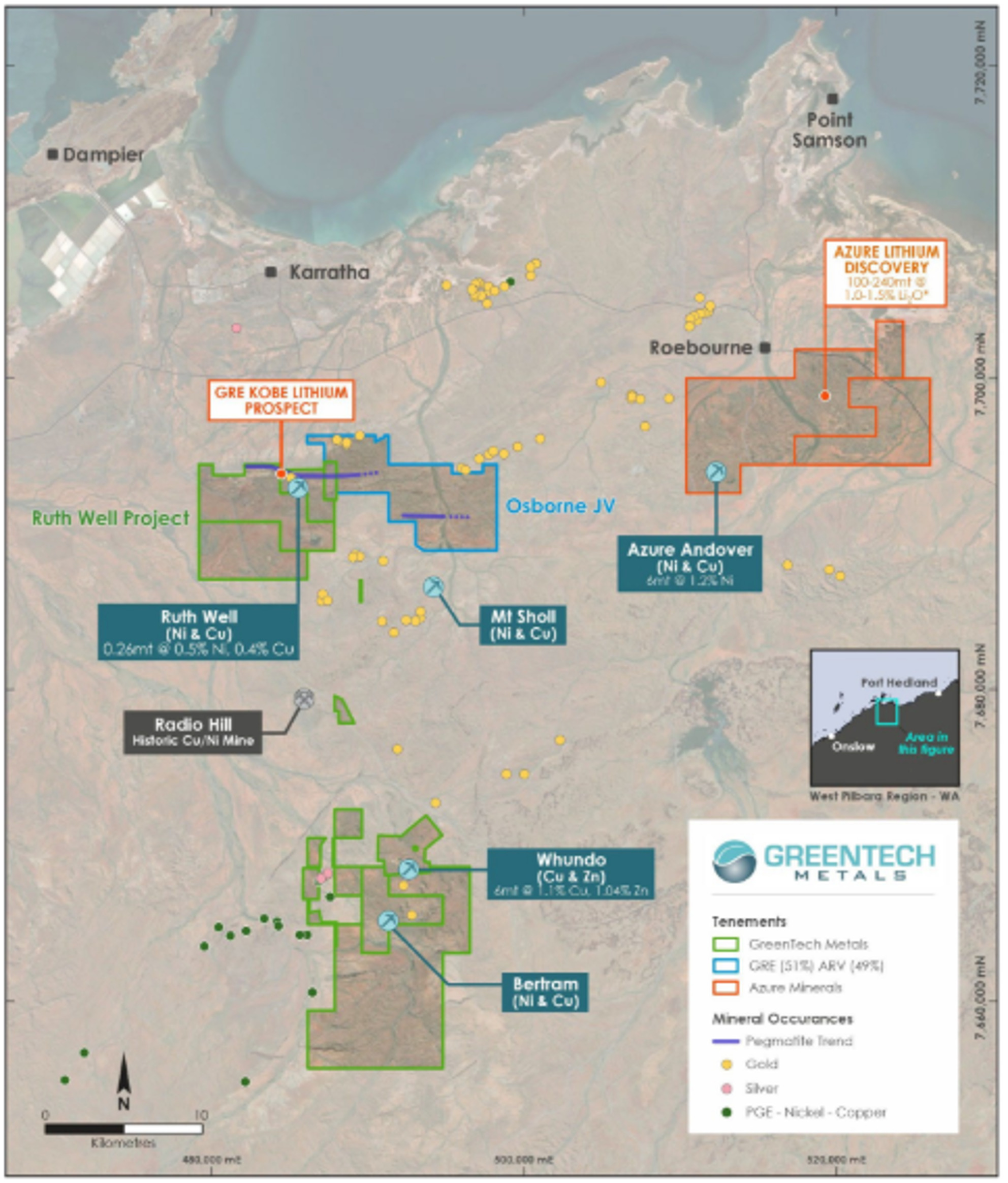

Greentech Metals’ (ASX:GRE) Pilbara ground, including the Osborne JV with Artemis Resources (ASX:ARV), is a proverbial stone’s throw from Azure Minerals’ (ASX:AZS) monster Andover lithium discovery.

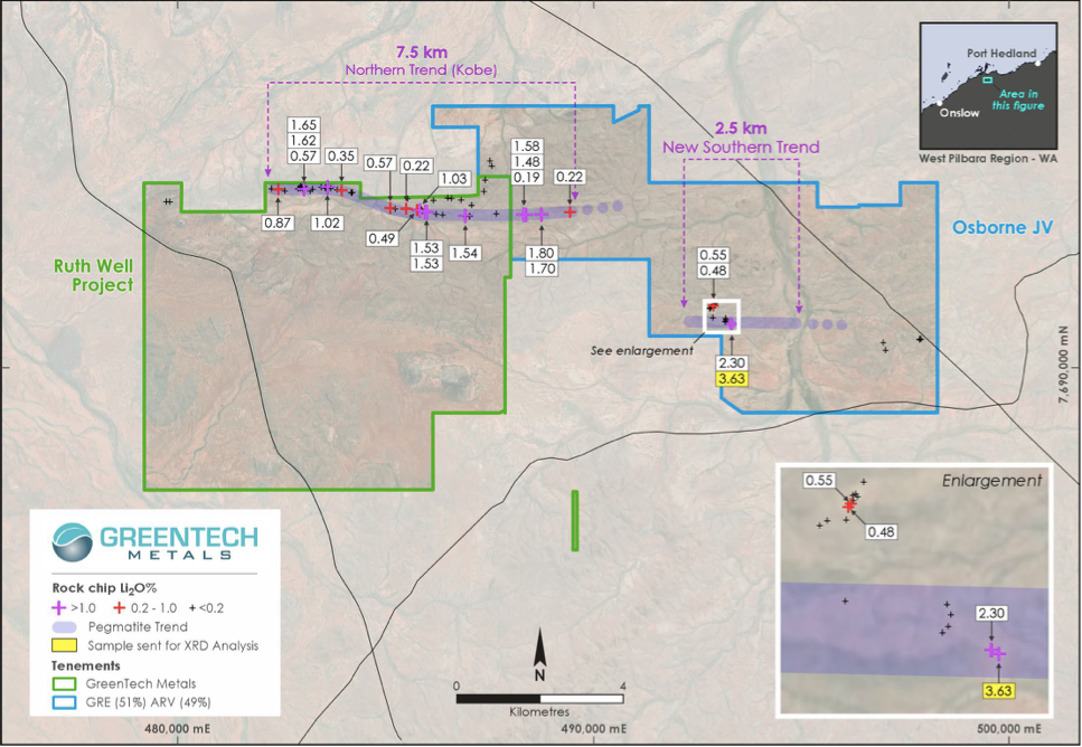

The Osborne JV sits to the east of the GreenTech’s Ruth Well nickel-copper project, where laboratory analysis of rock chips to date returned 1.8% Li2O at the Northern trend (Kobe prospect) and confirmed a consistent mineralised zone more than 7.5km long.

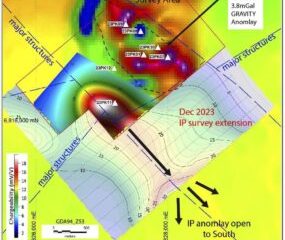

XRD lab analysis now confirms the lithium at both Osborne’s Northern and Southern trends is predominantly hosted in spodumene, an important ore which underpins most of the world’s big lithium mines.

Recent geochemical analysis undertaken reported lithium assays of up to 3.6% Li2O at the Osborne JV, hosted predominantly in spodumene. This bodes well for the project’s exploration and future development potential, Greentech says.

Lithium exploration drive

GreenTech is advancing towards the commencement of its maiden lithium drilling program at Ruth Well, with a heritage clearance submission lodged with the Ngarluma Aboriginal Corporation to undertake heritage surveys to allow the undertaking of drill programs.

Meanwhile, follow-up field work continues to target new pegmatite trends and extensions of known trends across its tenure.

New potential lithium targets have been identified from both historic and new datasets, some of which are located to the south of the Kobe trend and lie within the company’s 100% owned tenements.

The location of these targets may suggest a separate mineralised event to the Kobe trend as well as the new pegmatite trend recently reported at the Osborne JV tenement, according to the company.

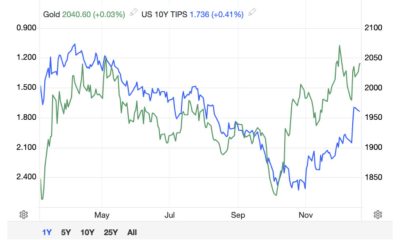

Lithium demand continues

Global demand for high-quality lithium continues to grow as the world seeks to decarbonise through the likes of lithium-ion batteries – namely those used in electric vehicles. McKinsey and Company reported in June that Australia’s role in the global lithium market will only bring on more dependency as Tesla, for example, expects its lithium carbonate equivalent needs to grow by roughly 1,000 kilotons per year by 2030.

This increase in demand is up to 16 times what it was in 2022. In total, the global electric vehicle market could expand by 26% per year through to 2030. As of today, Australia is the world’s largest producer of lithium spodumene.

This article was developed in collaboration with Greentech Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Spodumene confirmed: GreenTech hits a home run at Osborne lithium JV in the Pilbara appeared first on Stockhead.