Uncategorized

Secrets of Successful Investing: The Key to Financial Growth

Contrarian Investing: The Key to Successful Investing in Changing Markets The financial markets are constantly changing and can be incredibly difficult…

Contrarian Investing: The Key to Successful Investing in Changing Markets

The financial markets are constantly changing and can be incredibly difficult to predict. The key to successful investing is having a well-defined strategy and sticking to it, no matter what the market conditions may be. One such strategy is contrarian investing, which goes against the crowd and seeks to take advantage of market corrections and undervalued opportunities.

Contrarian investing is based on the premise that the crowd is often wrong and that markets are often over-reacted to in either direction. By taking a position that is contrary to the masses, contrarian investors aim to benefit from market corrections and capitalize on undervalued opportunities. The key to successful investing is to have a good understanding of the market and be able to anticipate market movements.

The Art of Successful Investing: Why Contrarian Strategies Pay Off

Contrarian investors also have a long-term perspective and are willing to hold onto their positions for extended periods, even in the face of short-term market volatility. This allows them to ride out market corrections and reap the benefits of a well-diversified portfolio over time.

However, it’s important to note that contrarian investing is not for everyone. It can be incredibly risky and requires a high level of discipline and patience. Contrarian investors must also be able to make quick decisions in response to market movements, as they often invest in undervalued opportunities that may not last for long.

The Key to Successful Investing: Strategy, Discipline, and a Long-Term Perspective

The key to successful investing is to have a well-defined strategy and stick to it, no matter what the market conditions may be. Whether you prefer mass psychology or contrarian investing, it is essential to have a long-term perspective and be ready to make quick decisions in response to market movements. The key to successful investing is also to be well-informed and have a good understanding of the financial markets.

In conclusion, the key to successful investing is to have a well-defined strategy and stick to it, no matter what the market conditions may be. Contrarian investing is a highly contrarian strategy that seeks to take advantage of market corrections and undervalued opportunities. However, it requires a high level of discipline, patience, and a long-term perspective. The key to successful investing is to be well-informed and have a good understanding of the financial markets. The key to successful investing is to have a well-diversified portfolio and to be patient, disciplined, and informed in your investment decisions. The key to successful investing is to not be swayed by emotions, misinformation, and groupthink. The key to successful investing is to have a long-term focus and to capitalize on market trends.

Other Articles of Interest

Understanding the Kansas City Financial Stress Index

Read More

Minimize the Risk of Losing Money in the Stock Market

Read More

Securing Your Future: The Power of Long-Term Investments

Read More

Investment style: Going Against the Grain

Read More

Mastering Money: Your Financial Playbook

Read More

The Importance of Keeping a Trading Journal: A Path to Better Investment Decisions

Read More

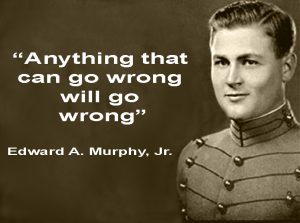

Exploring the Intersection of Investing & Murphy’s Law

Read More

War of Attrition: Strategies for Thriving in Times of Crisis through Investment

Read More

Dow Jones Outlook: Understanding the Dangers & Rewards of Crisis Investing

Read More

Financial Stress: The Surprising Opportunity for Savvy Investors in the Stock Market

Read More

Financial anxiety

Read More

Investment Opportunity & Market Crashes

Read More

Copper outlook VIA CPER

Read More

Existing home sales

Read More

Stock Market Crashes in History

Read More

Stock market crash history

Read More

Broad Market Review

Read More

Worst 25 year period in stocks?

Read More

Russian Update: Ruble, Neon Gas and more

Read More

Summer Stock market Rally?

Read More

Intelligent Investing: Harnessing the Power of Data-Driven Approaches

Read More

The post Secrets of Successful Investing: The Key to Financial Growth appeared first on Tactical Investor.