Uncategorized

Resources Top 5: Nearology is No.1 for these high flying niobium, rare earths and lithium stocks

The region is abuzz after Encounter (ASX:ENR) uncovers “extraordinary” targets next door to WA1’s company-making Luni niobium-REE discovery. ……

- Encounter uncovers “extraordinary” new targets next door to WA1’s company-making Luni niobium-REE discovery

- Lycaon has project down the road from ENR and WA1, also flies

- Lithium Energy keeps hitting thick lithium brines at flagship Solaroz project, next to producer Allkem

Here are the biggest small cap resources winners in early trade, Friday May 12.

ENCOUNTER RESOURCES (ASX:ENR)

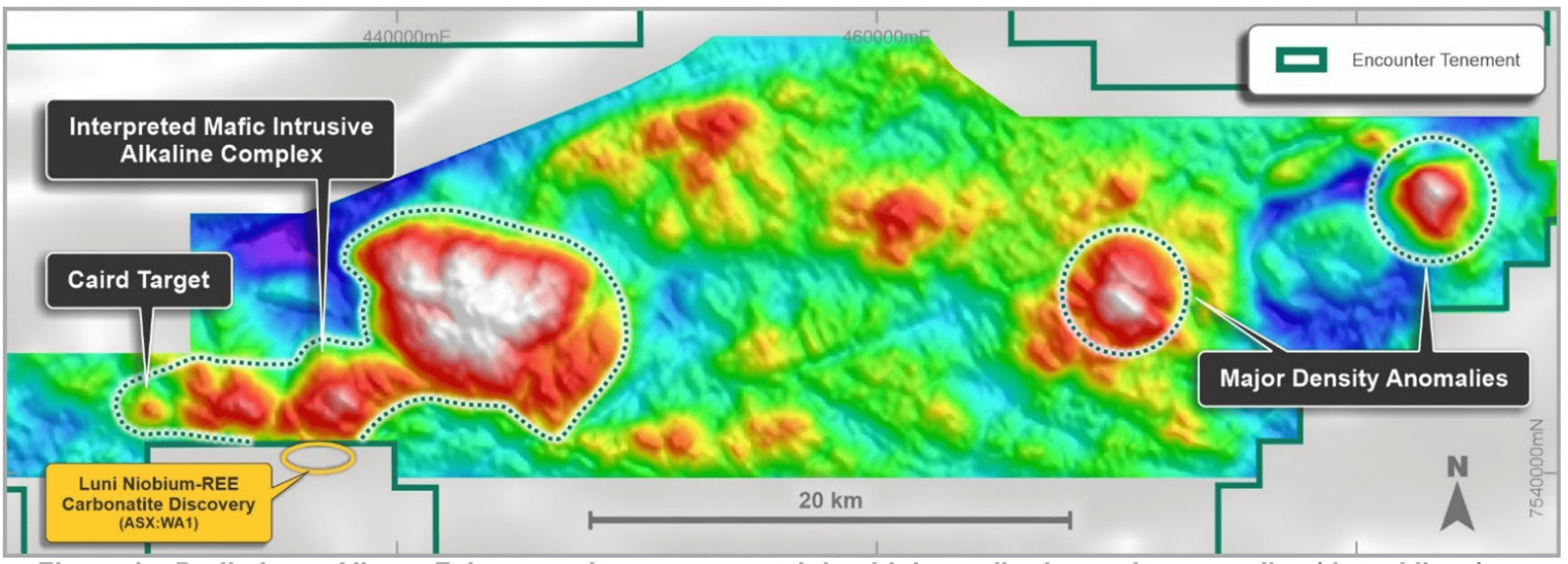

ENR says airborne gravity survey data has outlined “extraordinary” new targets at the Aileron project, right next door to WA1 Resources’ (ASX:WA1) company-making Luni niobium-REE discovery in the West Arunta of WA.

Gravity surveys are a crucial exploration tool used calculate the density of subsurface rock. The higher the gravity values, the denser the rock beneath.

ENR’s new survey has defined a monstrous, high amplitude gravity anomaly that encompasses its Caird target and the adjacent Luni discovery:

“The survey has unveiled some extraordinary new density features that are interpreted as potential alkaline intrusions highly prospective for carbonatite-hosted critical minerals and base metals,” ENR MD Will Robinson says.

Carbonatites are associated with economic deposits of metals like REEs and niobium.

“We will interpret and integrate these new datasets and are already planning programs to test these exceptional targets,” Robinson says.

Diamond drilling is ongoing at the Caird, Crean and Worsley targets defined in prior geophysical surveys, with first results expected in June-July 2023.

The $90m capped stock is up 45% in 2023. It had $4.2m in the bank at the end of March.

LYCAON RESOURCES (ASX:LYN)

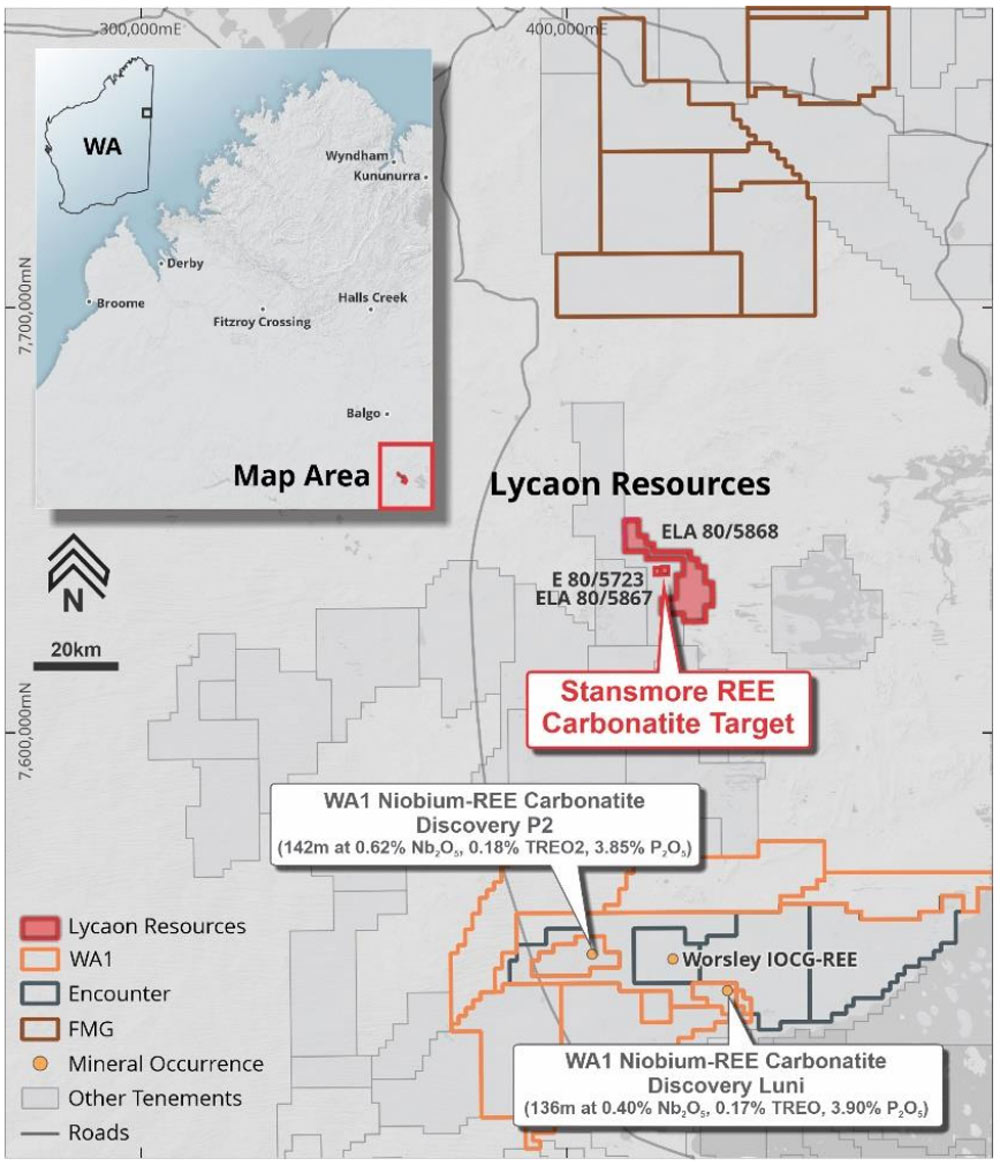

LYN has a project down the road from ENR and WA1 in the West Arunta, which could explain its share price action today.

The Stansmore carbonatite target consists of a regionally prominent 700m long magnetic feature analogous to WA1’s discoveries and ENR’s Worsley prospect, it says.

Historical drilling at Stansmore by BHP in 1982 intersected intrusives and strong carbonate alteration that may be related to REE-carbonatite mineralisation, LYN says.

But the mining giant was looking for diamonds and so walked away from the project. No exploration has been conducted since.

Importantly, the six shallow RAB holes drilled at Stansmore by BHP to a max depth of 12m showed prospective geology is under very shallow cover of 5-10m, “which further enhances discovery potential”.

The company is currently working through the approvals processes for drilling.

COSMO METALS (ASX:CMO)

CMO believes its Minjina prospect “could be the beginning of a meaningful polymetallic mineral discovery” after drilling into decent silver grades up to 123g/t.

Drilling highlights like 11m @ 1.03% Zn, 0.22% Pb, 0.15% Cu, 33.50g/t Ag from 212m were unexpected, in a good way.

“Although we haven’t hit the high-grade base metals zone we are targeting, the wider Pb-Zn intersections now with Cu and higher-grade silver associated with massive sulphides in MIRC013 is an unexpected, but important result, supporting our interpretation that this is the tip of a larger, potentially higher-grade Zn-Pb-Ag-Cu VMS system,” CMO MD James Merrillees says.

VMS deposits are rich in base and precious metals like copper, zinc, lead, gold and silver.

Because these deposits tend the ‘cluster’ together, VMS camps can often be mined for a very, very long time.

Copper grades appear to be increasing with depth, CMO says. The company also identified a strong conductor called MJ1 via downhole survey, which it plans to hit with two 200m RC holes.

“The identification of a strong conductor from DHEM modelling in MIRC012, which stopped short of the massive sulphide zone intersected in MIRC013, is another exciting development with the MJ1 target, 150m south of the high-grade silver hits in MIRC013 opening a significant area for drill testing,” Merrillees says.

The $3m capped minnow is down 30% year to date. It had $850,000 in the bank at the end of March.

LITHIUM ENERGY (ASX:LEL) (& STRIKE RESOURCES (ASX:SRK))

Yesterday, news of a $1bn merger between Livent Corp (NYSE:LTHM) and Allkem (ASX:AKE) delivered a boost to ASX lithium stocks with ground near AKE and LTHM’s soon-to-be-integrated brine operations in Argentina’s portion of the Lithium Triangle.

That included LEL, which holds ~12,000ha in the Salar de Olaroz lithium brine basin alongside Allkem and fellow big hitter Lithium Americas.

Drilling at its flagship Solaroz project is now hitting massive intersections of brine up to ~780m depth, and counting.

Holes 4 and 5 are hitting at least 473.5m of conductive brines with lithium brine concentrations of +480mg/L encountered as drilling enters into the lower aquifer (Deep Sand Unit).

There’s potential for brine intersections to extend even further, with sampling and assays pending for a further ~140m in hole 4 and a further ~73.5m intersection in Hole 5.

Both are currently at depths of ~787.5m and ~650m respectively in the Deep Sand Unit. Drilling of hole 6 will begin soon.

“As previously reported, the significance of these intersections at SOZDD004 and SOZDD005 cannot be overstated as they highlight the continuity of massive zones of lithium rich brines along a ~15 kilometre zone between previously drilled Solaroz drillholes SOZDD001 and SOZDD003,” LEL exec chairman William Johnson says.

“With three rigs soon to be operating concurrently, we are excited to be rapidly advancing towards defining our maiden JORC resource at Solaroz and consider the Allkem/Livent merger as a clear endorsement of our strategy to accelerate the development of Solaroz alongside Allkem.”

The $60m capped junior is up 88% since late April, and 30% year to date.

Junior iron ore miner Strike Resources (ASX:SRK) is also flying thanks to a $34.41m (36.2%) shareholding in LEL, which was spun-out of SRK under a $9m IPO in May 2021.

The post Resources Top 5: Nearology is No.1 for these high flying niobium, rare earths and lithium stocks appeared first on Stockhead.

nyse

asx

ax

silver

lithium

rare earths

ree

copper

zinc

iron

niobium

diamond