Uncategorized

Resources Top 5: Emerging graphite, zinc giants and an accidental rare earths discovery

A maiden 94Mt resource positions Earaheedy as “one of the largest zinc sulphide discoveries globally in the last decade”, Rumble … Read More

The…

- Pinnacle Minerals hits elevated REEs in a hole drilled to test historical nickel geochemical results

- Drilling results from Buxton Resources’ flagship 4Mt Graphite Bull project in WA have over delivered “on grade, thickness and additional strike”

- Rumble Resources unveils maiden 2.2Mt zinc, 600,000t lead and 12.6Moz silver resource at Earaheedy

Here are the biggest small cap resources winners in early trade, Wednesday April 19.

PINNACLE MINERALS (ASX:PIM)

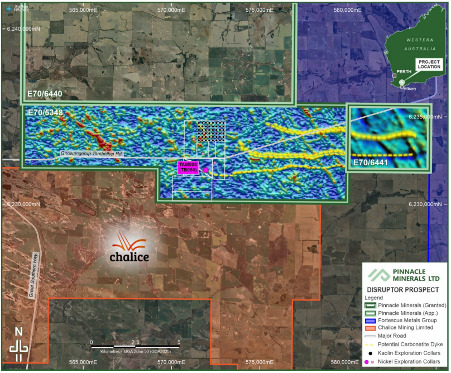

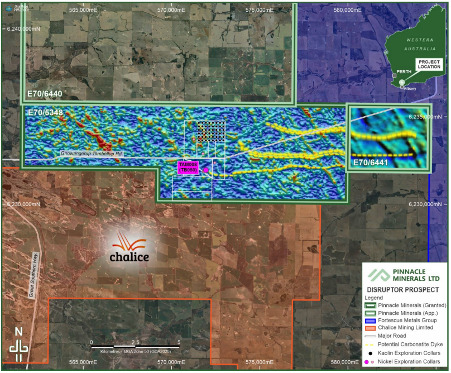

PIM, which listed May last year as an advanced WA kaolin project developer, has accidentally discovered rare earths at the Disruptor prospect.

A hole drilled to test historical elevated nickel geochemical results returned elevated REEs in the bottom 40m, including a maximum value of 626.3ppm TREO.

Given the geochemistry of the rock and the overlaying clay regolith, this opens the potential for both hard rock and clay hosted rare earth deposits, PIM says.

Based upon these results PIM has approved an immediate follow up, targeted reverse circulation (RC) drilling program to further test Disruptor, which abuts ground held by Chalice Mining (ASX:CHN) and Fortescue (ASX:FMG).

“Having only scratched the surface of this unique prospect, the team at Pinnacle is excited about returning to conduct follow up drilling to thoroughly test for mineralisation at depth with the aim ofdefining zones more enriched with rare earth oxides and testing the extent of any clay hosted REE mineralisation,” PIM MD Nic Matich says.

The $3m capped, tightly held minnow is up 30% year-to-date. It had $3.3m in the bank at the end of December.

BUXTON RESOURCES (ASX:BUX)

Drilling results from the flagship 4Mt Graphite Bull project in WA have over delivered “on grade, thickness and additional strike”, the company says.

New highlights include 33m @ 18.7% TGC, 32m @ 17.7% TGC and 5m @ 24.8% TGC.

With +2km of high grade, thick graphite mineralisation – which remains open – Graphite Bull is becoming a project of scale.

The current high grade (16% TGC) resource “is merely the tip of the iceberg”, BUX says.

In 2022, the explorer refocused on the wholly owned project in WA, which was shunted to the basement of its portfolio ~7 years prior.

The company reckons this outcropping orebody is perfect for making spherical graphite for the burgeoning battery sector.

“According to Benchmark Mineral Intelligence, by 2040 the mining industry needs to be producing nearly eight times as much graphite as it currently does to supply the world’s lithium-ion battery anode market,” it says.

“Graphite Bull is therefore a very attractive investment proposition, being a high-grade deposit located in a Tier 1 mining jurisdiction, with outstanding resource growth potential.”

BUX is also free-carried on three other assets – Copper Wolf, Narryer and West Kimberley – which are subject to farm in deals with miner and major shareholder (19.9%) IGO (ASX:IGO).

The $32m capped stock is up 110% in 2023. It had $3.1m in the bank at the end of December.

RUMBLE RESOURCES (ASX:RTR)

A maiden inferred resource of 94Mt @ 3.1% zinc+lead and 4.1g/t silver positions Earaheedy in WA as “one of the largest zinc sulphide discoveries globally in the last decade”, RTR says.

The project, a 75-25 JV with Zenith Minerals (ASX:ZNC), now has 2.2Mt of zinc, 600,000t of lead and 12.6Moz of silver within optimised pit shells.

There’s also more growth to come as the Chinook, Tonka and Navajoh deposits remain open downdip and along strike.

Meanwhile, less than 35% of the targeted 45km, shallow and flat lying, mineralised Unconformity Unit that hosts the potentially open pittable Zn-Pb resources has been effectively drill tested.

There’s also potentially some high grade stuff at depth.

“This exceptional resource estimate is a major milestone for Rumble, confirming the Earaheedy project as one of the largest zinc sulphide discoveries globally over the last decade,” RTR MD Shane Sikora says.

“Achieving a maiden JORC compliant Mineral Resource Estimate of this size and significance in 24 months post discovery is a tremendous effort by the technical team and especially [geologist, RTR head of technical] Brett Keillor.

“Myself and the team are really excited as we believe we have only scratched the surface on the discovery front, and can’t wait to see the drill rigs turning again next month.”

The next phase of drilling, due to begin May, will focus on resource extensions and new discoveries. Beneficiation and initial scoping studies will occur in parallel with the exploration campaign.

$132m capped RTR – which peaked at ~75c/sh post discovery in 2021 — is flat year-to-date. It had $9.5m in the bank at the end of December.

STELLAR RESOURCES (ASX:SRZ)

Tin prices surged by more than 10% on Monday on threats of supply disruptions from Myanmar, a major global supplier.

Having closed on Friday at US$24,853/t, LME tin prices for three-month delivery surged to US$27,367/t overnight Monday.

Tin is a metal essential to electronics and electrification. Around half of demand in the ~400,000tpa tin market comes from its use in lead-free electronic solder on circuit boards.

The 22,000tpa solar tin market is forecast by the International Tin Association to rise to 55,000tpa by 2030. Another 10,000tpa will come from EVs and another 10,000tpa from the expansion of 5G networks.

Tassie explorer/project developer SRZ is focused on Heemskirk, which it calls “the highest-grade undeveloped tin resource in Australia and the third highest grade tin resource globally”.

SRZ just wrapped up drilling to upgrade the resources at Severn, the largest deposit at the 7.6Mt @ 1.1% tin (81,976t contained tin) Heemskirk project.

The resource upgrade is due mid-year and will feed into a pre-feasibility study on the project planned for H2 2023.

READ: Nickel, copper, cobalt? Nope, tin is now the battery metal stealing the limelight

BESRA GOLD (ASX:BEZ)

The ‘flavour of the month’ gold mine developer is up again in early trade, despite announcing that Pangaea Resources – a co associated with BEZ chair Jocelyn Bennett – had offloaded 2.23m CDIs on market.

The problem was a trading blackout period had commenced, something the Pangaea director that authorised the sale was not aware of, BEZ says.

“The sale of the CDIs was initiated as a consequence of an existing contractual obligation that required the cash payment, by Pangaea, of $500,000 to an unrelated third party,” BEZ says.

“Besra has been advised by Pangaea that the sale of the 2,250,000 CDIs by Pangaea was authorised by another director of Pangaea and that Ms Bennett did not authorise the sale of the CDIs and indeed (due to the time difference between Australia and Greece) was not aware of the sale of the CDIs until after the sale was completed on Friday 14 April 2023.”

Anyway, it clearly didn’t ruffle any feathers.

$90m capped BEZ is now up ~500% since inking a $US300m non-binding offtake and funding deal with bullion dealer and major shareholder Quantum Metal Recovery Inc in March.

This cash – paid over 30 months against future production ounces — would cover development of its 3Moz ‘Bau’ project in Malaysia’s Sarawak region.

To settle the facility, BEZ would deliver up to 3Moz “according to an agreed percentage of production at an agreed floating gold reference price, but subject to a floor price (115% of AISC)”.

BEZ has now received initial payment of $US2m from Quantum ahead of finalising the offtake funding facility. It is entitled to a further US$3m upon execution of the agreement, expected late April 2023.

Meanwhile, the company is updating a dusty old feasibility study completed back in 2013, with initial results due in the second half of 2023. Pilot production is also pencilled in for later this year.

The post Resources Top 5: Emerging graphite, zinc giants and an accidental rare earths discovery appeared first on Stockhead.

aim

asx

gold

silver

rare earths

ree

rare earth oxides

nickel

copper

zinc