Uncategorized

Q+A: Why Argent Minerals’ sees value in unearthing a 100-year VMS deposit with modern exploration

Argent Minerals’ (ASX:ARD) Kempfield deposit belongs to a peer group of VMS deposits known as the Eastern Australian Palaeozoic deposits … Read More

The…

- During the course of 2023, Argent Minerals conducted a deep drilling program in the main resource area at Kempfield, which found the lead and zinc grades increase with depth

- ARD believes the story at Kempfield is only just getting started with seven key geochemical anomalies spanning between 400m up to 1.7km in strike yet to be drill tested

- The explorer plans to dispatching a technical team on the ground in ’24 to start following up on some of the high-grade historic surface copper, silver, lead and zinc mineralisation

Argent Minerals’ (ASX:ARD) Kempfield deposit belongs to a peer group of VMS deposits known as the Eastern Australian Palaeozoic deposits which includes well-known, rich assets like Rosebery, Que River, Hellyer and Thalanga.

Collectively, these projects have been a major source of base metals in Australia for more than 100 years but ARD managing director Pedro Kastellorizos believes the story at Kempfield is far from over.

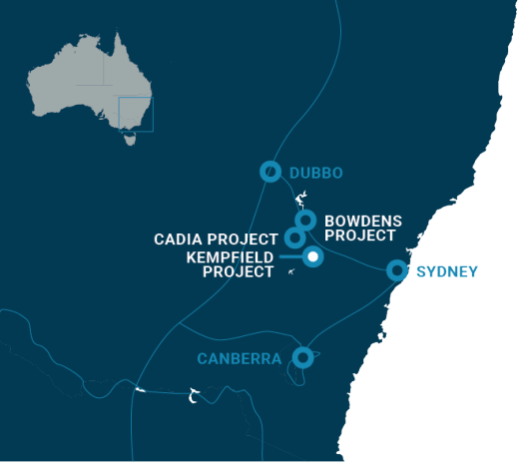

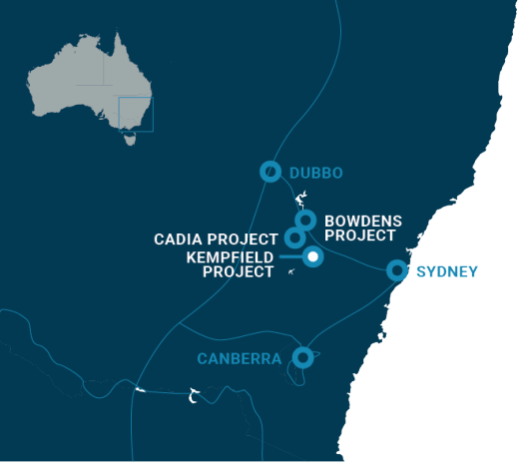

The company has identified a growing number of lead, zinc, silver and gold trends that position Kempfield – within the richly mineralised Lachlan Orogen that extends from northern Queensland, NSW and through Victoria into Tasmania – as a potential major provider which has been enhanced further by an upgrade to resources at the project by 28% to 39.9Mt.

Most of the resource – 22.5Mt at 109g/t silver equivalent – is contained within the higher confidence indicated category, which has sufficient data for preliminary mine planning.

Stockhead sat down with Argent Minerals managing director Pedro Kastellorizos to talk about the emerging silver project and what’s in store for 2024.

What influenced your decision to come on as managing director in 2022?

“Argent Minerals has owned the Kempfield project since inception of the company in 2008,” Kastellorizos says.

“There was a whole lot of work done to it previously, yet the story hasn’t been told by a long shot and that is the main reason why I came on as managing director – because I’ve worked on this style of mineralisation in the past.

“What immediately stood out to me was the fact that this is an advanced project with a very large resource area – most companies when they come across this sort of mineralisation don’t realise that these systems are quite large.

“It is a matter of systematically exploring key areas but being very specific in what you are actually targeting because obviously exploration is a very expensive process.

“If you can identify some key indicators, then that will accelerate the project very quickly.”

What are some of the most exciting aspects about the project?

“Historically, the resource area has only been defined down to 100 vertical metres and that was based on just chasing the silver,” Kastellorizos says.

“During the course of 2023, we decided to put some further deeper drill holes into the actual main resource area and what we found was that the lead and zinc grades increase with depth, which was previously unknown to us.

“We also found out that the deeper we drill, the zinc substantially increases in grade and there’s at least two ounces of silver associated with that.

“The lead and the zinc are giving us extra credits in the initial resource area, and at the same time, adding a lot more value and tonnage which makes it more economic moving forward.”

Why do you think your resources stand out among your peer group?

“While our resource is quite large, it’s still pretty much undiscovered,” Kastellorizos says.

“It requires more work, but people have known about the Kempfield deposit for the last 15 years and over that time, it’s fallen off the radar.

“However, when we compare our resource in terms of its upside, we believe we have one of the largest deposits in NSW straight off the bat, if not in Australia at this stage it’s just about the actual marketing of it.

“Plus, when you look at our share price versus our market cap per ounce, we are undervalued between six and 10 times, when compared to the other silver players on the ASX.”

What global resources do you think your project is comparable to?

“There are only two projects that we can compare to – one is the Paris project which Investigator Resources has and also Silver Mines with their Bowdens deposit,” Kastellorizos says.

“When we look at our results compared to those two particular resources, our initial shallow silver is very high grade so in terms of its economic potential, our mineralisation starts from one to two metres below the surface, as opposed to some of those other deposits, which are a lot deeper.

“In terms of mining, strip ratios and economics, Kempfield is definitely one of those projects that could be in production quite easily and quite readily.”

How do silver players gain better traction in the market when it’s not really talked about as widely as other commodity types?

“Silver’s always been traded on the back of gold, it is classified as a precious metal, but silver is starting to become a major focus in the green energy sector given its use in solar panels that are coming out of China at the moment,” Kastellorizos says.

“Manufacturers are starting to remove copper out of those cells and replacing it with silver and the reason they are doing that is because copper will start degrading after five or six years within the actual solar panel and once the copper goes, that material becomes redundant.

“There’s new technology now that is like a silver paint or paste, which they put on top of the actual panel and by doing that they’re getting a lot more longevity out of that cell.

“Silver is a very good conductor of electricity, which a lot of people don’t know. It’s even a better conductor of electricity as opposed to copper. It doesn’t corrode so in terms of the durability of those cells, they can get three or four times more life out of the cells.

“We believe that silver will become more of an industrial type of commodity for the clean energy sector, given that the US is already trying to shore up their domestic silver supply of silver and has allocated nearly half a trillion dollars in the next 10 years to do so.

“Historically, the silver has always been purchased from Mexico and what we’re finding now, is that the US is trying to firm up its critical minerals from Australia to preserve its movement forward from fossil fuels to the green energy sector.

“At the moment the US government has flagged major solar farms in Nevada and California and Australia will play a critical role in supplying all those raw commodities to the US.”

You’ve got a scoping study planned for next year. What other key milestones have you got coming up in 2024?

“We’ll be conducting a regional exploration program out to the east of the Kempfield resource area,” Kastellorizos says.

“Over the course of 2023 we identified at least seven key geochemical anomalies spanning between 400m up to 1.7km in strike so in the first quarter of 2024 we plan to dispatch a technical team on the ground to start following up on some of the high-grade historic surface copper, silver, lead and zinc.

“On the basis of that, we’re looking to – depending on the numbers that come back from the survey – put a few shallow drill holes into those newly identified areas.”

Argent Minerals’ share price today:

This article was developed in collaboration with Argent Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Q+A: Why Argent Minerals’ sees value in unearthing a 100-year VMS deposit with modern exploration appeared first on Stockhead.