Uncategorized

New World flags drill targets, strategic investment and new COO to push US copper project

Special Report: New World Resources has flagged some exceptional drill targets at its Javelin copper Volcanogenic Massive Sulphide (VMS) project … Read…

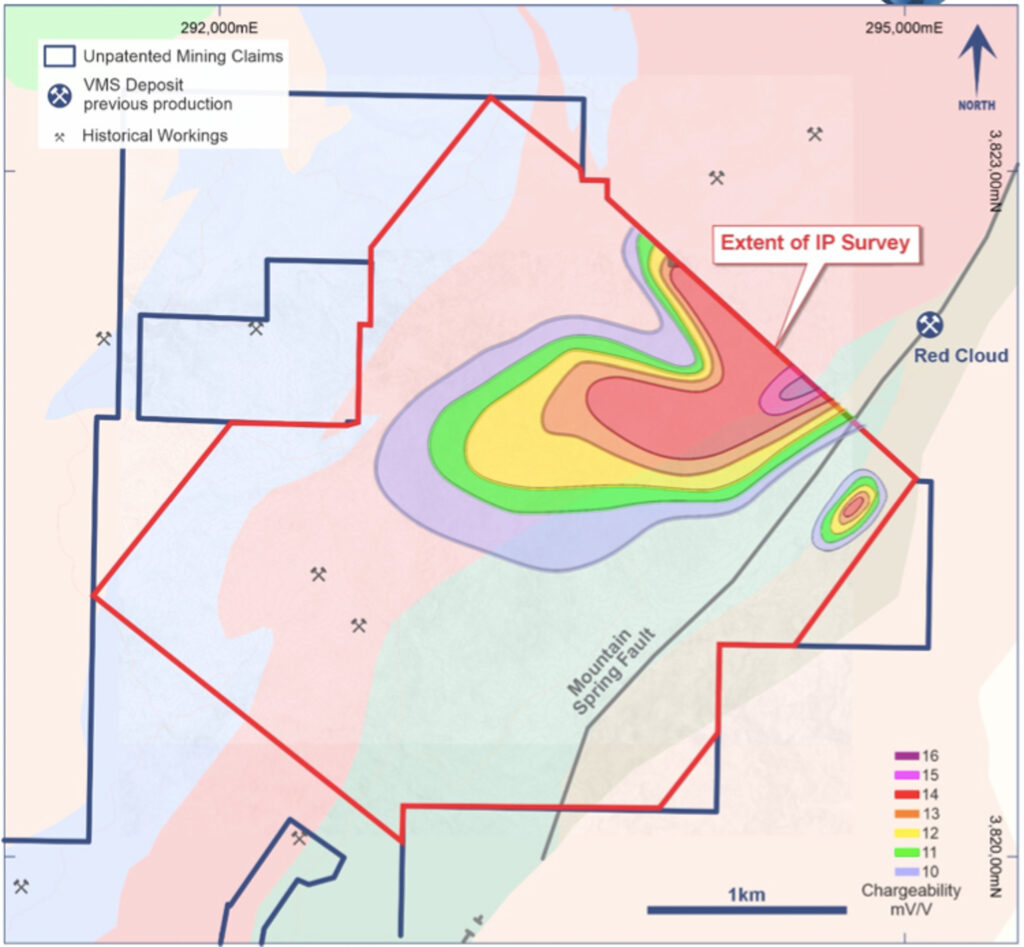

New World Resources has flagged some exceptional drill targets at its Javelin copper Volcanogenic Massive Sulphide (VMS) project in Arizona, USA from a recent Induced Polarisation (IP) survey.

For context, VMS deposits are often associated with copper, lead and zinc, and can also produce economic gold and silver by-products.

New World Resources (ASX:NWC) says the survey results indicate very strong chargeability anomalies, which provide excellent opportunities to discover shallow VMS and potentially deeper porphyry copper mineralisation.

Notable IP anomalies include a shallow chargeability anomaly on line 6900N along with a strong but slightly deeper chargeability anomaly on adjoining line 6700N, which suggests these two responses may arise from a chargeable source with more than 200m of strike which plunges from north to south.

These anomalies lie in a position in the geological sequence where VMS deposits are expected to occur, and therefore represent compelling exploration targets, NWC says.

In addition, a deeper, very strong IP chargeability anomaly was found which sits just 7km southwest of Freeport’s Bagdad porphyry copper deposit – which is the fifth largest copper mine in the US.

The company says that while this IP response may arise from deep VMS mineralisation, it is more akin to the response expected over a buried porphyry copper deposit.

Multiple holes will be drilled to evaluate this large, highly prospective target.

Drilling scheduled for Q4 2023

A drill permit application has been submitted, with approval expected during Q4 2023

and drilling to begin immediately after.

“With past production from six very high-grade VMS deposits in the immediate vicinity, coupled with its proximity to the fifth largest copper mine in the US, the Bagdad Porphyry Copper Deposit, the Javelin Project always had considerable exploration potential,” NWC MD Mike Haynes said.

“However, the IP results we received recently have exceeded our expectations.

“We have defined a very strong, distinct, shallow IP anomaly that lies in the exact position in the geological sequence where we would expect to find VMS mineralisation.

“What’s even more encouraging is that we have defined a different, but also very strong, deeper chargeability anomaly that extends over a 1.2km by 1.0km area.

“While this anomaly may arise from deep VMS mineralisation, the response is more akin to the IP response that would be expected over a buried porphyry copper deposit – in a district that hosts a world-class porphyry copper deposit.

“These are compelling exploration targets.

“We have already applied for a drill permit, and we expect to commence drilling to test these targets in the fourth quarter of this year.”

Javelin could be a satellite deposit for Antler

Notably, the Javelin project is 75km to the southeast (and within trucking distance) of the company’s high-grade Antler Copper Project in Arizona, where an updated scoping study was recently completed.

In line with this, the company has been assessing growth opportunities in the district surrounding the Antler Project where additional high-grade mineralisation could be discovered and developed as ‘satellite’ deposits, with mineralisation potentially mined and trucked to the processing plant at Antler – like its Javelin project – which could further enhance the economics of, and potentially extend the scale and/or life of Antler.

While reconnaissance exploration has been undertaken previously, including mapping that identified numerous highly anomalous characteristics that could be associated with VMS mineralisation, there are no records of any drilling being undertaken within the boundaries of the Javelin project area.

The IP survey was subsequently undertaken to refine and prioritise targets in advance of the company’s maiden drilling program.

US private equity firm makes strategic investment

In other news today, the company has also welcomed a strategic investment from US private equity firm Resource Capital Funds (RCF) Management, who’ve entered into a binding agreement to make a $5m equity investment in NWC to become a 6.9% shareholder in the company.

“We are very pleased to welcome one of RCF’s recently established investment funds as a shareholder in New World,” Haynes said.

“Following an extensive due diligence process, which included two site visits and the advice of specialist consultants, RCF has agreed to make an initial investment in New World.”

RCF has a 25-year history with, and understanding of, mining in the US, including Arizona, hence New World considers that this investment is a strong endorsement of its strategy to develop and expand the Antler project.

“RCF is a large, Denver-based, group of commonly managed resources funds,” Haynes added.

“They understand, better than most, the mining business in the US.

“We consider the fact that they have decided to invest in us, a copper developer in Arizona, is a strong affirmation of our project and our corporate strategy – which is to bring our very high-grade Antler copper deposit into production as quickly as practicable while concurrently expanding the resource base.”

New COO to advance Antler PFS and mine permitting

And if that wasn’t enough news for one day, the company has also appointed experienced mining engineer and non-executive director Nick Woolrych as executive director and chief operating officer to accelerate mine permitting and Pre-Feasibility Study (PFS) work at Antler.

Effective immediately, Woolrych will work with New World on a full-time basis to help finalise the preparation of a Mine Plan of Operations (MPO) – the key document required to commence the mine permit approval process for Antler.

He will also manage the ongoing PFS into the development of the project.

“Since commencing as a non-executive director seven months ago, Nick has made a very significant and valued contribution, providing invaluable assistance with ongoing work programs designed to take our high-grade Antler copper project into production,” Haynes said.

“We are very confident that Nick will continue to be of great assistance as we expedite Antler towards production.”

The MPO will propose underground mining only for the project and is scheduled to be submitted to the Bureau of Land Management (BLM) during Q3 2023.

The PFS is scheduled for completion in late 2023.

This article was developed in collaboration with New World Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post New World flags drill targets, strategic investment and new COO to push US copper project appeared first on Stockhead.