Uncategorized

Missing the resources down in Africa? ‘Hurry boy they’re waiting there for you!’

Africa is in desperate need of more domestic energy supplies for power generation and developing its industries. These ASX companies … Read More

The…

As sure as Mt Kilimanjaro rises like Olympus above the Serengeti, so is Africa’s burgeoning resources scene, with ASX-listed companies adding to the nation’s energy mixes in an era of booming electricity needs for the fastest-growing population on the planet.

Whether you’ve seen the sunrise while camping in the Chimanimani mountains, mistakenly eaten a bunch of crunchy Lekker Locusts and thrown up in a bullet-proof van, or even just traversed through the variety of landscapes that is Africa, you’d realise this place is old the centrepiece of what we refer to as Pangea, back when the continents of Earth were joined.

History hasn’t been kind to Africa, yet the future looks bright – especially in terms of a push for ethical resource extraction practices and projects that add value to domestic development.

Underexplored and untapped reserves of uranium, onshore and offshore oil and gas are all right here at the birthplace of humanity and Africa is fast becoming a pivotal engine of our global clean energy transition.

In part one of our two-part series on Africa’s energy evolution, we look at how future demand for uranium, oil and gas provides opportunities for both foreign investment and domestic development.

Power struggles

The death of oil and gas has been highly exaggerated as demand for electricity rises – especially with the electrification goals of governments around the world for smart cities, battery storage and the shift from combustible to electric vehicles.

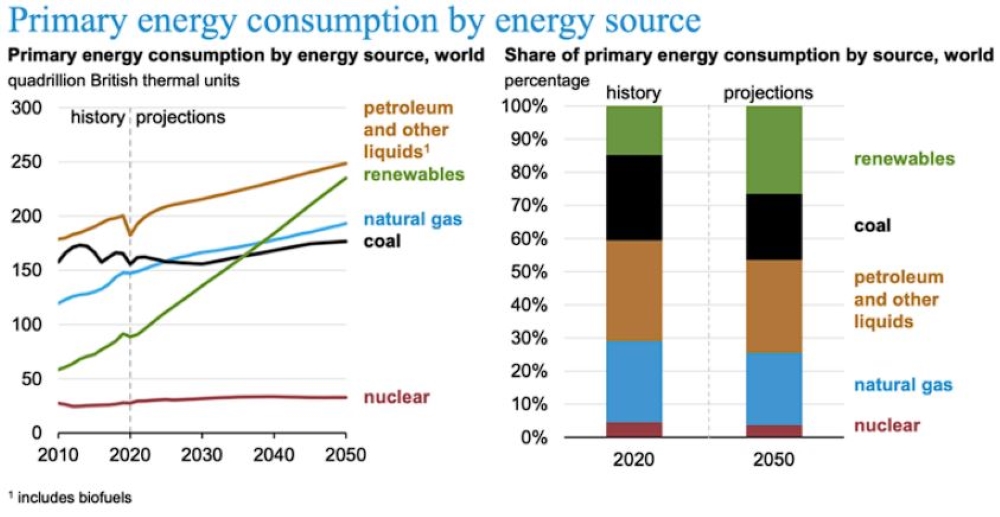

At current power generation projection levels, the Energy Information Administration projects global energy consumption and CO2 emissions will increase nearly 50% by 2050 due to population and economic growth and barely put a dent in other sources of energy consumption except coal.

Gas is a relatively cheap source of energy and is crucial for the developing world to feed and grow domestic downstream processes such as refining and manufacturing – something Africa desperately lacks.

“Between now and 2030, Africa’s domestic demand for both oil and gas accounts for around two-thirds of the continent’s production,” the International Energy Association says.

“This puts greater emphasis on developing well-functioning infrastructure within Africa, such as storage and distribution infrastructure, to meet domestic demand for transport fuels and LPG.”

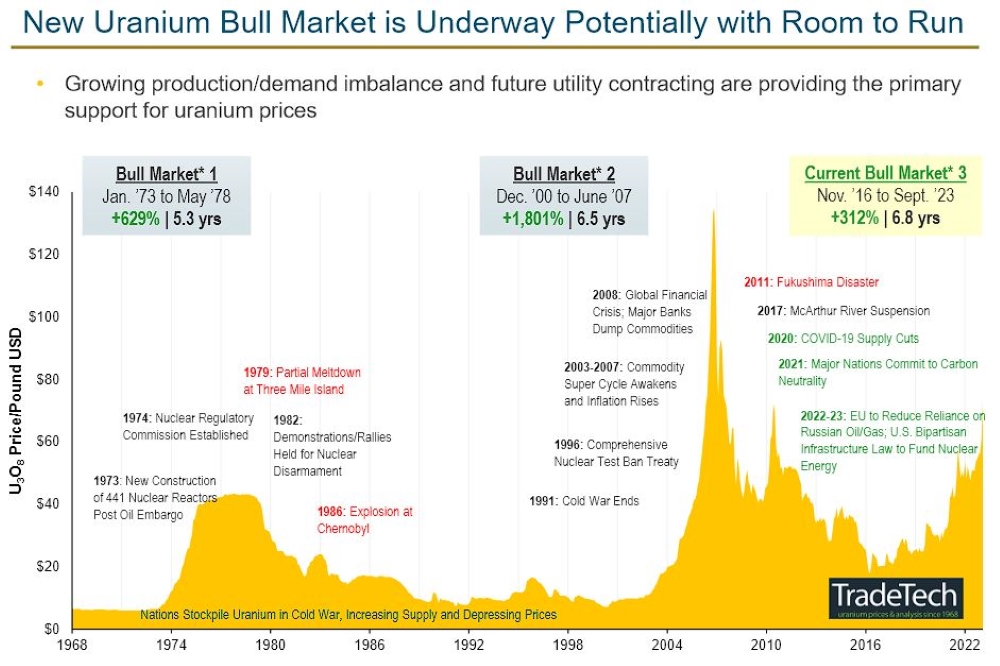

And one of the cleanest sources of electricity is nuclear power, yet since the Fukushima disaster in 2011 uranium prices had been in the doldrums and major projects with proven resources dotted across the world have shuttered and exploration halted.

Governments around the world have now changed their tune about nuclear power, as they recognise they need more baseload energy supplies with low CO2 emissions to meet electricity demand.

This has skyrocketed uranium prices from uneconomic lows of US$18/lb, rising massively this year up to September highs of US$73/lb, and the bulls reckon it’s on its way up to and above US$100/lb in the near future.

Reflected in South Africa’s ongoing energy crisis with a plethora of generation difficulties, there’s a growing necessity for new sources in Sub-Saharan Africa to avoid economic downturns.

Stockhead spoke to Botala Energy (ASX:BTE) CEO Kris Martinick, who reckons the whole Sub-Saharan region is hungry for more energy, with current supply options in certain regions either ageing fast or unable to meet demand.

Martinick says, in South Africa, “it’s causing inflation to rise at a rapid rate and has caused rolling blackouts for 360 days of load-shedding in the last 365 days”.

“The strain that load-shedding is causing is crushing small businesses within SA and we’re hoping that our Pitse project, partnered with solar energy R&D, will help to alleviate these types of pressures and provide ongoing support to current energy production in Africa.”

Which ASX juniors are out on safari?

Drilling is underway at Botala’s Serowe-3.3 well, the second of four wells at Project Pitse, which encompasses coal bed methane (CBM) deposits and near-term commercial pilot production with an end goal to fuel Botswana’s existing Orapa gas power station for about 20 years.

“We are the first energy company in the Serowe area to progress to a commercial pilot program and with our successful flaring in September we have moved forward in our journey to producing a viable energy source to support Botswana,” Martinick says.

The company’s vision is to first develop Serowe and commercialise it with a 20-megawatt solar-gas hybrid system that will lower both emissions and electricity costs in the region.

“With our solar projects, our aim is to produce quality tier one panels, which are at a higher quality and manufactured using sustainable practices. These projects will help to bring jobs and renewable energy to Botswana,” Martinick says.

“We believe that this gives us a strong base to launch the Pitse project into a successful enterprise to create a sustainable and reliable energy source within Botswana.”

After recently acquiring a 51% interest in Afro Energy for $6.5m, South Africa-focused Kinetiko Energy (ASX:KKO) is progressing with advanced shallow conventional gas opportunities at the flagship Amersfoort gas project and nearby tenements to supply the regional market.

Kinetiko says it’s “in advanced negotiations with potential gas off-takers for both intermediate and large-scale gas production from new fields”.

Pancontinental (ASX:PCL) has completed a US$353m 3D seismic survey over its Saturn Turbidite Complex in the Orange Basin offshore of Namibia, of which Woodside Energy (ASX:WDS) has an option to farm in to.

Meanwhile, Invictus Energy (ASX:IVZ) is currently drilling the Mukuyu-2 well at its Cabora Bassa project in Zimbabwe.

Yellowcake hunters

Namibia is the world’s largest producer of uranium and has long had a robust infrastructure and supply network for the export of yellowcake for the giant Rossing and Husab uranium mines in the country’s Erongo region.

There are a few ASX juniors swimming about in Erongo, notably Paladin Energy (ASX:PDN) and its revival of its 77Mlbs U3O8 Langer Heinrich mine, targeting a production restart in Q1 next year.

There’s also Bannerman Energy’s (ASX:BMN) world-class 207Mlbs U308 Etango-8 project, where mine design has just been completed and a final investment decision (FID) is pegged for early next year.

Elevate Uranium (ASX:EL8) owns the Koppies, Hirabeb, Marenica and Namib IV projects, where the company is undergoing extensive drilling, and Deep Yellow (ASX:DYL) is progressing the Omahola project.

In Malawi, Lotus Resources (ASX:LOT) is continuing the advancement of its 19.3Mlbs U3O8 Kayelekera uranium project where it recently completed a DFS that will see an annual production rate of 2.4Mlbs/year over a 10-year period.

It also recently announced a merger with A-Cap Energy which will see it exposed to the monster 190Mlbs U3O8 Lethakane uranium project in Botswana.

At Stockhead we tell it like it is. While Magnis Energy Technologies, Sovereign Metals, Botala Energy, DY6 Metals and First Lithium are Stockhead advertisers, they did not sponsor this article.

The post Missing the resources down in Africa? ‘Hurry boy they’re waiting there for you!’ appeared first on Stockhead.