Uncategorized

Mastering Money: Your Financial Playbook

The stock market is a complex and dynamic entity that can be difficult to predict, even for the most experienced investors. While some market players may…

The stock market is a complex and dynamic entity that can be difficult to predict, even for the most experienced investors. While some market players may aim to manipulate the market by setting up both the bulls and the bears for a so-called “massacre,” a contrarian approach to investing can provide a hedge against such market manipulation and be a valuable addition to any financial playbook.

Contrarian investing is based on the idea of going against the crowd and taking a counter-intuitive approach to investing. This means investing in assets that are out of favor or undervalued and avoiding assets that are overvalued or popular. This strategy can be a valuable component of a financial playbook, particularly for investors looking to reduce the impact of market manipulation.

For example, in the scenario described above, where market players aim to trick both bullish and bearish investors by breaking through downtrend lines and creating the illusion of a new bull market, a contrarian investor may choose to go against the trend and avoid buying into the market at this time. Instead, they may wait for a pullback or look for opportunities to short the market, potentially profiting from the market’s subsequent decline. This approach is just one example of how a contrarian strategy can be incorporated into a financial playbook.

Of course, it’s important to note that contrarian investing is not without risk, and a contrarian approach may not always be successful. It’s also crucial for individual investors to do their own research and to consult with a financial advisor before making any investment decisions.

While market manipulation can lead to significant volatility in the stock market, a contrarian approach to investing can provide a hedge against such manipulation and potentially offer an opportunity for profit. Incorporating a contrarian approach into your financial playbook can help diversify your investment portfolio and potentially reduce the impact of market manipulation.

Conclusion

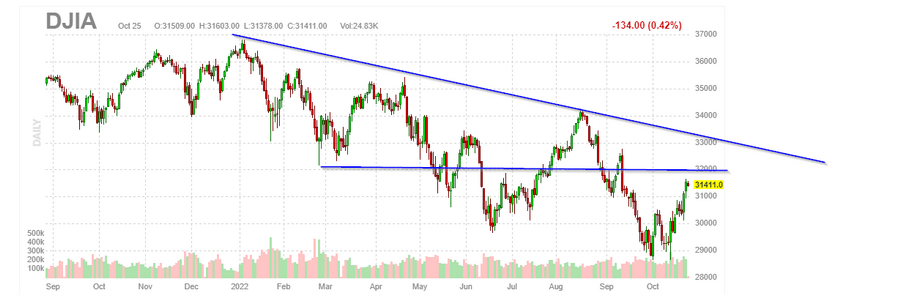

This chart provides an overview of how the big players will probably try to set both the bulls and the bears for a massacre.

The notion that market manipulators face limitations in profits when they single out one particular group of investors is a prevalent belief among the investment community. It is quite possible that these manipulators, in a bid to maximize their profits, may resort to using some of the tricks from their financial playbook to deceive both bullish and bearish investors.

Manipulators don’t make as much coin when they target only one group. One sure way to trick both the bears and the bulls would be to make the Dow and several other indices break through their downtrend lines and create the illusion of a new bull. In this case, this would correlate to a move to the 34,300 to 34,650 range. In pulling off this feat, the bears would throw in the towel, propelling the markets higher due to short covering. The bulls thinking that all is well would buy the rip, and then when everything looks fine and dandy, the guillotine is likely to fall.

Additional reading material

These references and resources can help provide a solid foundation for building a financial playbook that incorporates contrarian ideas.

The Little Book of Contrarian Investing by Anthony Gallea: This book provides a comprehensive overview of contrarian investing and how to apply this strategy to your investment portfolio. https://www.amazon.com/Little-Book-Contrarian-Investing/dp/0735204405

Contrarian Investing by Steven D. Levitt and Stephen J. Dubner: This book provides insights into how to think like a contrarian investor and profit from going against the crowd. https://www.amazon.com/Contrarian-Investing-Steven-D-Levitt/dp/0060978833

Contrarian Investment Strategies: The Psychological Edge by David Dreman: This book explores the psychology of market behavior and how to apply contrarian strategies to your investment portfolio. https://www.amazon.com/Contrarian-Investment-Strategies-Psychological-Investing/dp/0471552249

Investopedia’s article on Contrarian Investing: This article provides a comprehensive overview of contrarian investing and its applications in the stock market. https://www.investopedia.com/terms/c/contrarianinvesting.asp

Forbes’ article on Contrarian Investing: This article provides insights into the benefits and risks of contrarian investing and how to incorporate this strategy into your investment portfolio. https://www.forbes.com/investing/what-is-contrarian-investing/?sh=6ef8e04b4967

Other Articles of Interest

Mastering Money: Your Financial Playbook

Read More

The Importance of Keeping a Trading Journal: A Path to Better Investment Decisions

Read More

Exploring the Intersection of Investing and Murphy’s Law: Supporting Research and Insights

Read More

War of Attrition: Strategies for Thriving in Times of Crisis through Investment

Read More

Dow Jones Outlook: Understanding the Dangers & Rewards of Crisis Investing

Read More

Financial Stress: The Surprising Opportunity for Savvy Investors in the Stock Market

Read More

Financial anxiety

Read More

Investment Opportunity & Market Crashes

Read More

Copper outlook VIA CPER

Read More

Existing home sales

Read More

Stock Market Crashes in History

Read More

Stock market crash history

Read More

Broad Market Review

Read More

Worst 25 year period in stocks?

Read More

Russian Update: Ruble, Neon Gas and more

Read More

Summer Stock market Rally?

Read More

Intelligent Investing: Harnessing the Power of Data-Driven Approaches

Read More

Trading volatility: A whole New Stock Market Game

Read More

Stock Market Crash 2022

Read More

Trading Journal; The invaluable tool for traders

Read More

Trending markets; Only The Trend is your friend

Read More

The post Mastering Money: Your Financial Playbook appeared first on Tactical Investor.