Uncategorized

Marmota is back in the uranium game

Special Report: Marmota has engaged the services of well-known yellowcake expert Mark Couzens following the recent decision to resume exploration … Read…

- Marmota appoints uranium expert Mark Couzens to design first re-start program and conduct technical review of Junction Dam uranium project

- Junction Dam is adjacent to Boss Energy’s Honeymoon mine, which will restart production in the current quarter

Marmota has engaged the services of well-known yellowcake expert Mark Couzens following the recent decision to resume exploration at its Junction Dam uranium project in South Australia and significantly grow the size of Marmota’s uranium resource.

Marmota (ASX:MEU) started listed life as an uranium play, spending more than $8m by 2014 to develop a uranium JORC resource at Junction Dam. It then put the project on ice in the wake of Fukushima and subsequent downturn in the yellowcake market. Since then, Marmota has become a highly successful gold explorer, including the discovery of Aurora Tank which has been yielding multiple bonanza grades of over 100 g/t Au.

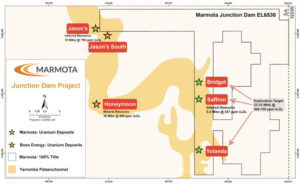

The first hint that the company would return to its uranium roots came in October 2021 when it moved to secure 100% ownership of the Junction Dam tenement. Marmota’s Junction Dam uranium project already has a resource of 5.4 million pounds (Mlbs) of uranium oxide (U3O8) at an average grade of 557 parts per million U3O8 within the Saffron deposit, and an exploration target between 22Mlb and 33Mlb at 400-700ppm U3O8.

For context, this is similar to the average grades at $1.6 billion market cap Boss Energy’s (ASX:BOE) adjacent Honeymoon uranium mine, which hosts one of four permitted plants in Australia.

With Honeymoon due to resume production in the current quarter, this also rather neatly offers a potential route to process resources. BOE has flagged that it is looking to grow its inventory to underpin increases in mine life and production rate.

Of course, uranium sentiment has never being better with the energy metal a top performer in 2023, rising from $49/lb to over US$70/lb as buyers realise that demand will rapidly outstrip existing inventories and supplies.

Restarting exploration

Junction Dam bookends both sides of the palaeochannel hosting the Honeymoon uranium mine. Pic: Supplied (MEU).

These developments undoubtedly underpinned the company’s decision announced on 26 October 2023 to recommence exploration at Junction Dam to substantially grow its uranium resource.

Both Bridget and Yolanda already have proven uranium from previous drilling but have not yet been included in the project’s resource estimate.

Adding further interest, the tenement bookends both sides of the palaeochannel that runs through Honeymoon with the eastern extent already covered by Saffron while the north hosts the untested NW Bend, which is adjacent to BOE’s highest-grade Jason deposit.

Uranium expert engaged

To further its goal of increasing uranium resources, MEU has now appointed uranium expert Mark Couzens from Indepth Geological Services to design the first re-start program, including a full technical analysis of the stratigraphy and mineralisation at Junction Dam.

The technical review will include the Saffron, Bridget and Yolanda areas, which are all adjacent to the Honeymoon mine, along with new high priority untested targets.

Couzens is a specialist uranium geologist with experience exploring for sediment-hosted uranium at Beverly and Four Mile in South Australia, Bennett Well in WA and in Argentina.

He was part of the exploration team that discovered the Four Mile uranium deposit while playing a key role in increasing the Bennett Well resource from 4.8Mlb to 30.9Mlb U3O8.

Couzens said:

“The Junction Dam project is one of the most exciting uranium projects I have worked on in Australia. There are nearly 200 holes drilled by Marmota to date which enables a very detailed stratigraphic review to be carried out on the project.”

“Work will be commencing on the identification of high-grade uranium bearing palaeochannels through the existing deposits, and also identifying high potential targets for high-grade extensions where very little drilling has been completed to date.”

This article was developed in collaboration with Marmota, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Marmota is back in the uranium game appeared first on Stockhead.