Uncategorized

Market Highlights: Morgan Stanley says Big 4 Aussie banks safest in the world, and 5 small caps to watch today

The ASX will open higher on Friday. Overnight, US real estate and tech stocks extended a Wall Street rally of … Read More

The post Market Highlights:…

- The ASX is poised to open higher on Friday in line with movements in New York

- Australian banks are the best capitalised banks in the world – Morgan Stanley says

- Elizabeth Warren says she is “building an anti-crypto army”

Aussie shares are set to open higher again on Friday, tracking stocks in New York. At 7.30am AEDT, the April futures contract was pointing up by 0.55%.

Overnight, US real estate and tech stocks extended a Wall Street rally of around half a per cent.

End of March is usually the time of the year when portfolio managers sell their losers and add strong earnings stocks in preparation for April’s client review.

Struggling retailer Bed Bath & Beyond crashed 26% after announcing it would sell up to US$300 million in diluted new shares to rescue itself.

Charles Schwab slumped 5% after Morgan Stanley downgraded the stock. This comes as the average bonus paid to Wall Street analysts for 2022 has reportedly fallen to $US176,700, down from $US240,000 in 2021.

Tesla is looking to build a battery plant in the US, partnering with Contemporary Amperex Technology.

On the data front, unemployment claims in the US rose to 198,000, up by 7,000 from the prior week.

Lots of Fedspeak overnight too, where most officials said they favoured another 25bp hike in the next meeting.

Boston Fed President Susan Collins and Richmond Fed President Thomas Barkin both said they expect a 25bp hike to be delivered in April.

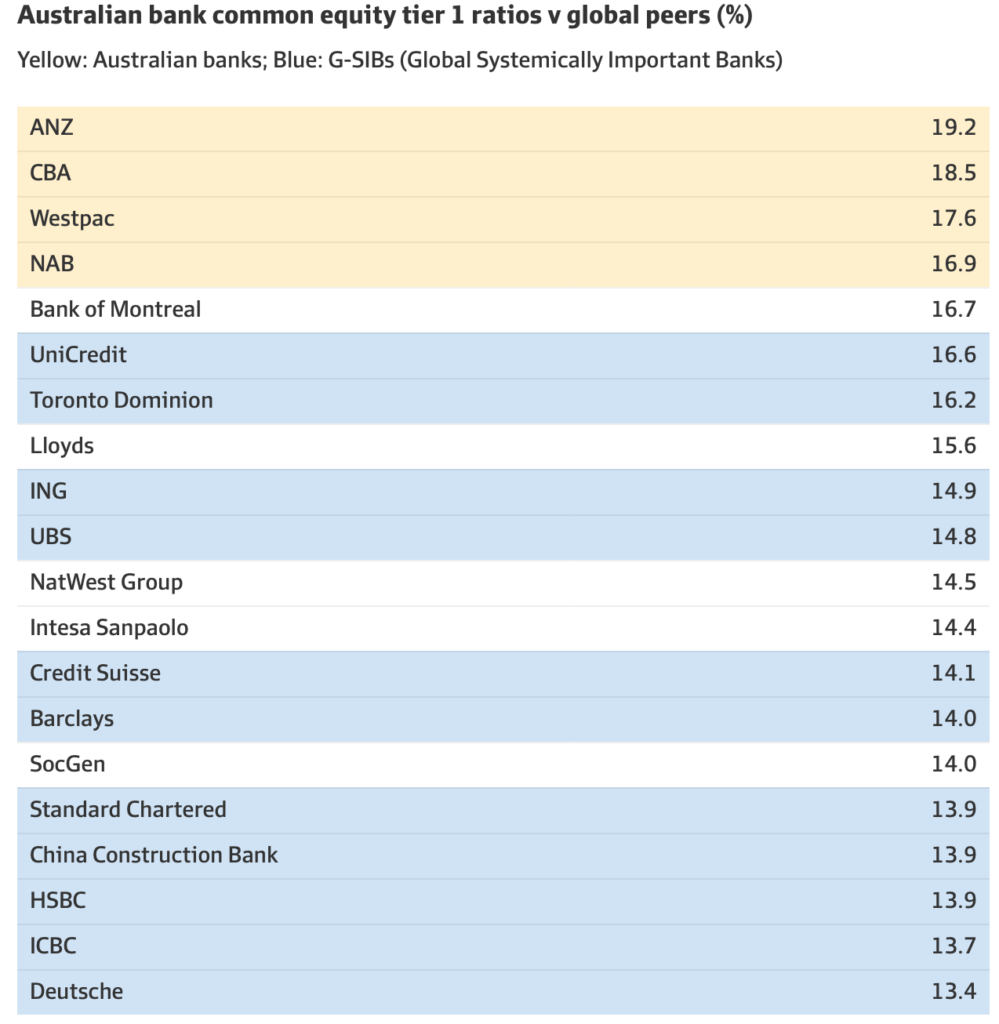

Australian banks meanwhile, are the best capitalised institutions in the world according to data from Morgan Stanley

The Big 4 banks came on top in list of global banks ranking:

In other markets….

Crude prices jumped 2%, taking its weekly gain to over 6%.

With the recent banking turmoil abating, the economic outlook is looking slightly better and that has seen oil prices recovering.

Gold has given back a small portion of its recent gains, but it continues to trade not far from the highs of the last couple of weeks at US$1,979.94 an ounce.

The reason for that is mainly interest rates – expectations have not changed that much since the banking turmoil which suggests investors see that credit markets could tip the economy into recession.

“And that may require multiple rate cuts later in the year,” said Oanda analyst, Craig Erlam.

Iron ore was up another +2% to $US125.15 a tonne, while Bitcoin slipped 0.9% in the last 24 hours to US$28,130.

Democrat senator Elizabeth Warren says she is “building an anti-crypto army” as part of her re-election campaign, while crypto lobby firm Coin Center says that a crackdown on TikTok could pave the way for a future Bitcoin ban.

Now read: The short video party is almost done in China

5 ASX small caps to watch today

Lunnon Metals (ASX:LM8)

Updated Mineral Resource estimate (MRE) for Warren deposit increased to 445,000 tonnes at 2.5% Ni for 11,200 contained nickel tonnes. This result increases Lunnon’s global MRE across its Kambalda Nickel Project to 2.9 million tonnes @ 3.1% nickel for 87,800 contained nickel tonnes, a 125% increase in contained metal since Lunnon listed in June 2021.

Civmec (ASX:CVL)

Civmec says it has been awarded about $100 million worth of new contracts to carry out manufacturing, construction and maintenance activities for the resources sector. This brings its total order book to $1.2 billion as of 30 March.

BBX Minerals (ASX:BBX)

BBX has secured an nvestment of $3m from Lind Global Fund to accelerate its strategic plan. As part of the deal, the initial investment of $3m may be followed by additional investments of up to $6m subject to mutual agreement. The investment is a staged private placement over a maximum 24-month period.

Adslot (ASX:ADS)

Adslot has initiated a series of cost reductions to reduce cash burn. These costs reductions will refocus the company’s efforts on activation of already contracted clients. Given the current investment climate, the company says the cost cuts will reduce its normalised cash burn, based on FY22 revenues, to approximately $2m.

Green Technology Metals (ASX:GT1)

Maiden assays have been received for the first three diamond holes at the Root Bay Prospect, including RB-23-001:79.7m down dip grade continuity intersections, and RB-23-003: 12.1m @ 1.30% Li2O from 67.4m.

The post Market Highlights: Morgan Stanley says Big 4 Aussie banks safest in the world, and 5 small caps to watch today appeared first on Stockhead.