Uncategorized

Lithium Co. Will Be a Substantial Outperformer

Source: Michael Ballanger 12/19/2023

Michael Ballanger of GGM Advisory Inc. shares a quick note about why he has faith in Volt Lithium Corp.Volt…

Source: Michael Ballanger 12/19/2023

Michael Ballanger of GGM Advisory Inc. shares a quick note about why he has faith in Volt Lithium Corp.

Volt Lithium Corp. (VLT:TSV;VLTLF:US) announced the findings of Sproule Inc. in their Preliminary Economic Assessment.

Rainbow Lake PEA Highlights 1

- Production growing from 1,000 to over 23,000 metric tonnes per year (average over the years 5 to 19) of battery grade LHM 2 spanning a 19-year period;

- Pre-tax $1.5 Billion NPV at 8% discount rate (” NPV 8 “) and IRR of 45%;

- After-tax $1.1 Billion NPV 8 and IRR of 35%;

- Volt has entered into a capital expenditure recovery program and cost-sharing arrangement with a private oil and gas company (the ” E&PCo “), which is expected to allow Volt to significantly enhance overall project economics 3 ;

- OPEX of approximately $3,276/tonne LHM in the Muskeg formation, with an average grade of 92 mg/L, and approximately $4,545/tonne in the Keg River formation, with an average grade of 49 mg/L; and

- Project economics assumed $25,000/tonne LHM and provided strong leverage to higher lithium prices.

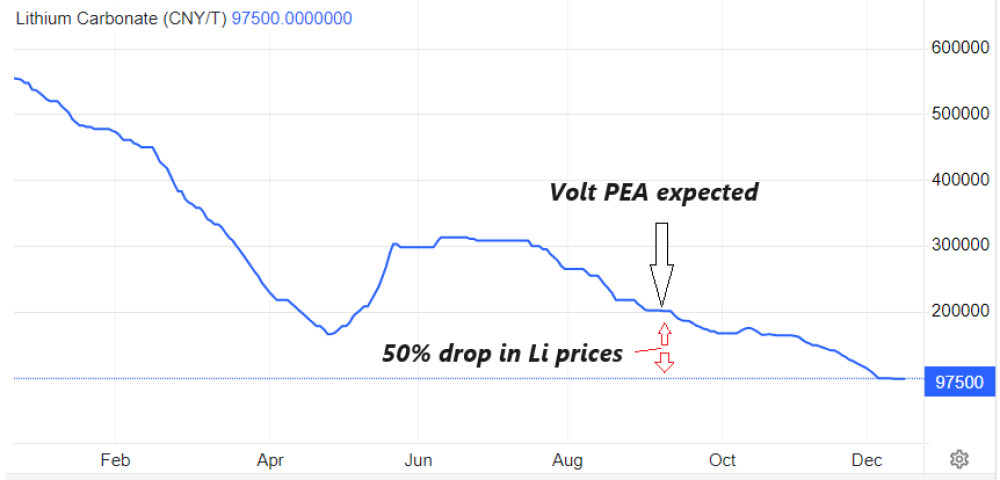

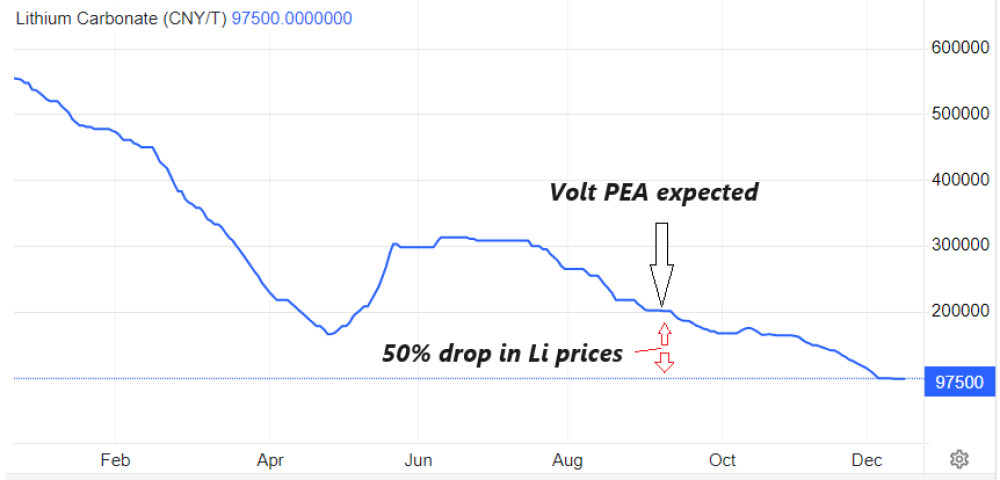

Had Volt come with these results in September, as indicated last May, the response in the market would have been substantially better than this week’s response. Lithium prices have retreated sharply since September, and the junior lithium space has responded accordingly.

The results, nevertheless, were impressive, at least on paper.

However, the major headwind for all lithium deals is seen in the chart below.

The big change since I first mentioned this name, outside of the crashing lithium price, is the most recent outlook provided by Trading Economics:

“EV sales pessimism in China limited lithium demand for battery manufacturers in their typical restocking season. Instead, firms took advantage of high inventories following the supply glut caused by extensive subsidies from the Chinese government throughout 2021 and 2022. These developments drove key market players to forecast the next lithium deficit to return only in 2028, an aggressive twist from speculations of persistent shortfalls that took lithium prices to CNY 600,000 in November 2022.”

Despite the possibility of no lithium deficit until 2028 being a major headwind, I continue to hold VLT/VLTLF on the assumption that if CEO Alex Wiley can execute, the stock will be a substantial outperformer.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- [Volt Lithium Corp.] has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Volt Lithium Corp.].

- [Michael Ballanger]: I, or members of my immediate household or family, own securities of: [All]. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

( Companies Mentioned: VLT:TSV;VLTLF:US,

)