Uncategorized

Ivers & Younger: The Hounds of Earningsville or, Undead ASX Halloween mid caps I have loved

FY guidance was ‘cautious, with a subdued bias’ and the ASX is likely to struggle, says Morningstar. We don’t mind: … Read More

The post Ivers &…

That last ASX full year reporting season pretty much foreshadowed what followed, as an ordinary August splintered into a messy September and so far, one can add, an ugly October.

On the benchmark ASX 200 index some 131 companies dropped their duds and coughed up full-year 2023 results.

CommSec’s 22/23 end of season tale of the tape (worth even more of a read after September’s troubles and we salute you both Craig James and Ryan Felsman) sums it up nicely.

Focussing on just the full-year results, aggregate revenue rose 8.9% over the FY, with expenses up by 13.9%.

As a result, net statutory profit fell by 42.9%.

Earnings per share fell by 27.7%, dividends fell by 2.5% and cash balances were cut by 9.7% to $199.2 billion.

Cut out one company out of that picture – The Very Big Australian (BHP) – and the aggregate ASX200 profits fell by 37% over the year to June.

The 151 ASX200 full-year reporters:

• Revenues rose for 76% of companies

• Expenses rose for 86% of companies

• Profits rose for 40% of companies and fell for 60% (long-term average, 58.5% profit increases)

• 84% of companies issued a profit while 16% recorded a statutory loss (average 87.6%)

• 87% of companies paid a dividend (average 85.1%)

• 47% of companies lifted dividends while 26% cut dividends and 14% maintained dividends while 13% didn’t pay a dividend

• 56% of companies lifted cash holdings while 44% cut cash

• Total cash holdings of all ASX 200 companies at June 30 were $228bn, down $26bn or 10% over the year

Tracking the money, it was evident that revenues appreciably eased down in the second half – and we’ve all seen that continue into the first quarter of 2024.

Forward guidance was very ordinary.

By CommSec calculations the number of companies which downgraded guidance for FY24 blitzed those which provided outlook upgrades by 3 to 2.

Which is why the volume of broker downgrades has noticeably increased.

According to Morningstar head of equities Peter Warnes it was a full year earnings where the most meaningful share price movements were ‘determined by guidance commentary rather than results.’

“A feature of this reporting season was very high impairments and restructuring costs of over AUD 20 billion, led by consumer discretionary and utilities… The forward guidance was mixed but with a cautious and subdued bias overall.”

Morningstar says the market is likely to remain under pressure, trading in ‘a relatively narrow band’ (between 6,800 and 7,200) throughout this December quarter.

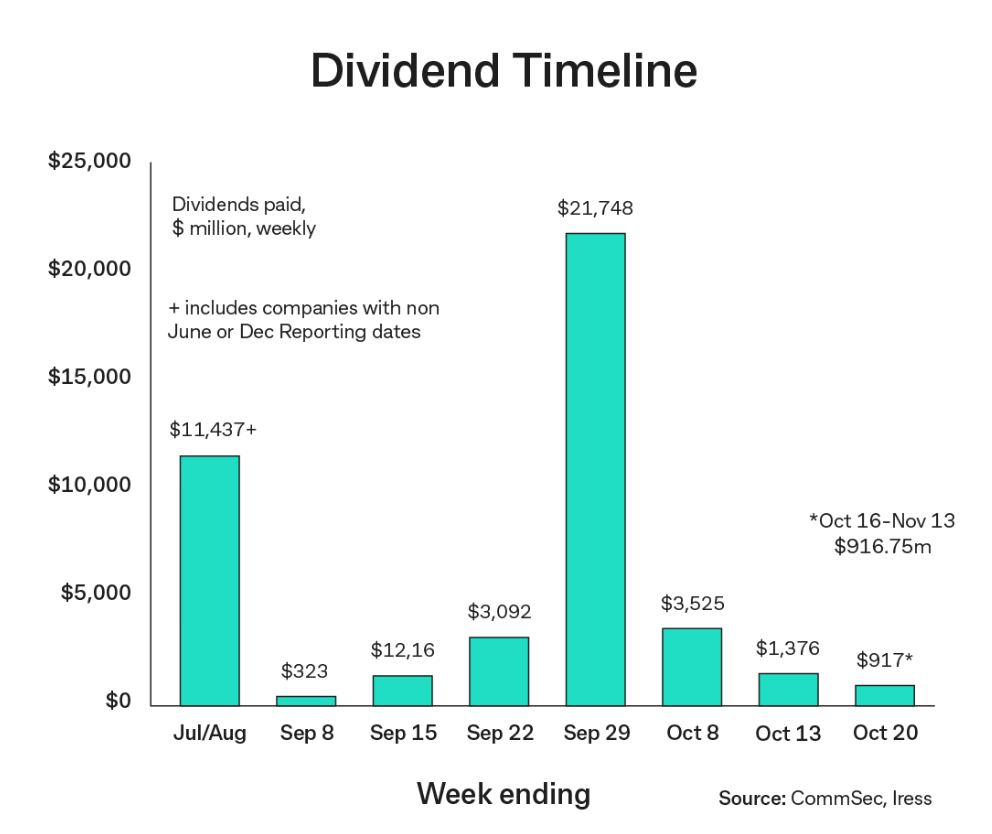

Get your divvies

Meantime, we’re still in the (tail end) of payout season. Always nice.

While ASX co’s have been doshing out what will be circa $32bn to shareholders between August and October, that’s down. Way down. Almost a full quarter (- 24%) down on a year ago.

But if one was to also include the Big 4 banks which handed out some juicy profits back in July, then dividends are only 12% less than a year ago at around $43.5bn.

Faced with rising costs, slowing consumer demand and a weakening Chinese economy, companies lowered their dividends in the recent reporting season.

And CommSec again notes, that was most especially the case of the large iron ore producers in the latest round of earnings. Profits are down over the past year reflecting lower realised iron ore prices.

Iron ore under payout pressure

And the outlook continues to suggest that lower iron ore prices lie ahead, according to CommSec.

Unsurprising then that analysts cut dividend payout estimates at a pace not seen since 2009 (outside of Covid-19 period).

“In fact, forward 12-month dividend per share estimates have been cut by 14 per cent year-over-year to September 6, 2023. The 12-month forward estimated dividend yield for the S&P/ASX 200 index is currently 4.06 per cent, below the long-run average near 4.7 per cent since 2005,” James and Felsman said.

Bloomberg thinks the average ASX dividend payout ratio is now close enough to decade lows (at 62%) when compared with the 72% just before the pandemic came to play.

The games afoot, my dear Younger

That said, the co-mingled brains behind one of the most successful small to mid-cap funds, Prime Value Asset Management portfolio managers Richard Ivers and Mike Younger, told Stockhead look past the panic and potential returns on Aussie stocks remains far more fun than the rising returns on term bank deposits, fickle bonds and overseas shares with grossed-up dividend yields of around 5.7%

For the S&P/ASX 200 index, the historic dividend yield stands at 4.5%, above the decade-average of 4.07%.

Ivers and Younger say forward earnings in aggregate for the market were brought down around 3 or 4 percentage points, and the number of downgrades outnumbered the number of upgrades in the order of 2 to 2.5 times.

“Cyclicals were the weakest part of the market as you’d expect,” Mike told Stockhead.

“With so many rate rises that started back in May 2022, areas like advertising or the media sector, retail and residential housing were all pretty weak in terms of their results.”

“Not necessarily versus expectations,” Richard cuts in, “but weak in the results that they reported… But not wholesale.”

“No. There were standouts,” Mike adds.

“And they’re the stocks worth watching these next months,” Richard adds, after a weird silence. Possibly because he likes to have the final word. I’m not sure. He seems difficult to work with.

However, Stockhead resisted the urge to ask Mike exactly that and stayed on target.

Stockhead: So let’s go through the stocks which kicked the goals for you both in FY23. Name names – what’s the smart money on heading into Christmas?

AUB Group (ASX:AUB)

“In terms of what surprised us in reporting season, there were a couple of stocks that stood out for me,” Richard says.

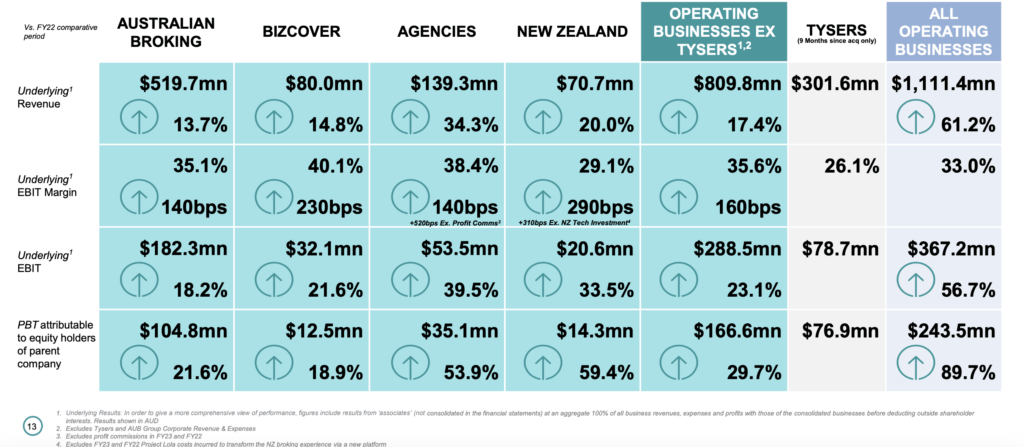

“One was AUB Group, where we saw strength across every single one of their five divisions.”

And it wasn’t just at the revenue line, it was also margin expansion coming through, which is being driven by the premium rate cycle.

And while the stock has been a very strong performer, it’s really only kept up with the earnings growth that’s coming through.

AUB Performance across all divisions

And so from a valuation perspective, Richard says, it’s still lagging its two other key listed peers on a PE basis and looks mighty attractive.

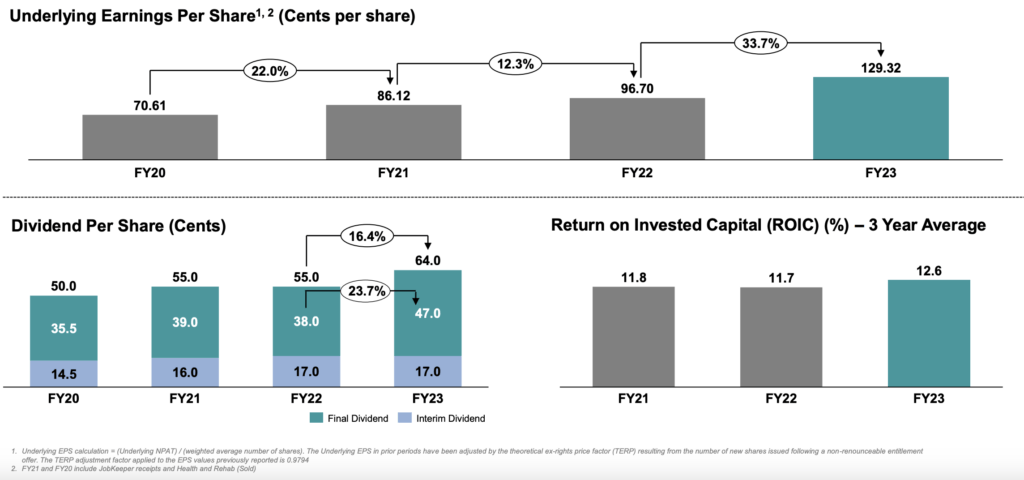

Stockhead: And divvy payouts?

“Yep. These are good – 33.7% uplift in Underlying EPS; FY23 final dividend of 47 cents,” he adds.

Hansen Technologies (ASX:HSN)

Hansen is a global software and services provider to the energy, water/utilities and telecommunications industries and Mike reckons HSN is hitting FY24 with some encouragingly stout momentum and a few new tricks in the form of several software upgrades in the post.

“I thought a standout was Hansen, where it’s a relatively low top line growth business, but they did come through with a bit stronger revenue growth and similarly, like AUB Group, some margin expansion as well,” Richard says.

“And then looking forward, they’ve guided to even stronger revenue growth ahead, which is really vindicated by the strong contract win momentum they’ve had in the last couple of years.”

Here’s Hansen’s FY23: a beat on both guidance and expectations:

- Revenue $312m (+5.2% pcp).

- EBITDA $100m (flat).

- Operating cashflow of $79m and since 2019 Hansen has returned ~$212m to shareholders and banks

- Strong 2H in particular with +9% revenue growth and 33.5% EBITDA margins

- Strong balance sheet

Mike continues, saying HSN revenue consists of materially higher recurring and repeatable revenue (86%) than many have given it credit for across Support and Maintenance services with a highly-diversified customer base where top 10 customers make up 33% of revenue.

“The other element with Hansen is it’s a business that’s grown by acquisition and with a pristine balance sheet. It’s really well positioned now to continue that M&A journey, particularly where valuation multiples across the market have come down,” Mike says.

“HSN has a pipeline of M&A opportunities, decent sized ones too – up to a half billion”

For Richard, this is a cash rich company, the balance sheet is good to go and the right target at the right price, circa $270-$330m, could be materially accretive.

“M&A is highly attractive for HSN and the company has the track record of hitting the right notes.”

Lindsay Australia (ASX:LAU)

“A couple that really looked interesting to me at the smaller end of the market cap spectrum were Lindsay and EQT,” Mike says.

“Lindsay reported a result with EPS growth of 95%, which is an exceptional result given it was all organic.”

That’s Richard.

He says FY24 is looking good as well – as their largest competitor, Scott’s – went into liquidation in about the fourth quarter of the financial year. So they get the market share gains that they got in that fourth quarter for the whole 12 months of FY24.

“They’ve also announced an acquisition of WB Hunter and on a PE of eight times FY24. That’s well below the market.

“In fact, (and here he seems to be talking to Ivers) it’s less than half the market multiple, so I’m surprised that stock is not a lot higher.”

EQT Holdings (ASX:EQT)

Mike:

“EQT was another interesting one. The result wasn’t particularly above expectations or special. There’s a little bit of cost growth coming through, but when they went through the earnings drivers over the next few years, that was particularly interesting. So they’ve got the accretion and synergies coming through from AET acquisition that they did last year, along with the exit from the loss making UK and Ireland operations. It’s also really, really attractive on a valuation basis.

Still Mike:

“So again, it’s trading on a multiple below market, and for a business I would consider as a much higher quality than the average business in the small cap space. You’ve got this really attractive risk reward playing off with that stock that I think makes it a really good one for the next few years.”

Stockhead: Rightio. Let’s talk the low end of town. How are small caps positioned in the current macroeconomic fireworks?

Richard:

“Well, what we know is that small caps tend to underperform large caps in times when the market falls, but similarly outperform when the market rises. And we’ve seen this in the last 18 months since the interest rate hiking cycle started, where small caps have underperformed large caps by more than 20%. As we come out of this downturn, we’d similarly expect that small cap companies will outperform and that the new business cycle, as that emerges, will be the key catalyst.”

MIke:

“While we don’t profess to be able to pick exactly when earnings are going to bottom, we do know that markets tend to react 6 to 9 months before the economic data does. With interest rates and inflation levels having now found some sort of equilibrium, the level of uncertainty and volatility in the market is likely to reduce. And as a result, small cap companies are going to be very well positioned to start the new business cycle ahead.

“We tend to invest in businesses that are less cyclical than most out there, so we’re not particularly exposed to the economic cycle and the shape of that potential rebound. However, we have picked up some high quality cyclicals over the last twelve months, including Domain Holdings and Corporate Travel. We also hold small weightings in a bunch of other what we would call cyclical businesses that have the potential to double or triple. They are relatively small weightings in the portfolio given we focus on less cyclical businesses.

“While reporting season came through okay, we’re still keeping a pretty close eye on the health of the consumer because cost of living pressures are still very evident.”

Richard:

“You’ve got the COVID savings that everyone accumulated now just starting to unwind. The full impact of interest rates rising is yet to actually flow through to the consumer. Around 30% of that is still to hit.”

Mike:

“And then you’ve got inflation, which – while it’s easing by historical standards – is still very high.”

The views, information, or opinions expressed in the interview in this article are solely those of the brokers and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

The post Ivers & Younger: The Hounds of Earningsville or, Undead ASX Halloween mid caps I have loved appeared first on Stockhead.