Uncategorized

How much is a buyer willing to pay for Azure, one of the hottest ASX lithium stocks of 2023?

Hot ASX lithium stock Azure (ASX:AZS) is now in a trading halt pending a takeover offer, or "potential change of … Read More

The post How much is a buyer…

- Azure in trading halt pending “a potential change of control transaction”

- Azure rebuffed $2.31/sh offer from miner SQM in August, calling it ‘undercooked’

- Meanwhile, SQM has bought into the Pirra Lithium, JV, MinRes is running the ruler over red hot explorer Wildcat

- The hottest ASX lithium stocks over the last week: Wildcat, Maximus, Prospect, Lithium Power International

A cooling lithium market in 2023 has knocked the froth off project developers, putting them in the crosshairs of acquisitive miners like SQM, Ablemarle, and MinRes.

It’s a lithium M&A frenzy, and things aren’t cooling down anytime soon.

Chilean state miner Codelco is even getting in the action, lobbing a cheeky bid for brines play Lithium Power International (ASX:LPI).

Prior to Codelco’s 57c/sh bid being confirmed last week, LPI was (and still is) down substantially from its April 2022 peak of 91c/sh.

Not so for one of the hottest ASX lithium stocks of 2023, Azure Minerals (ASX:AZS), which is now in a trading halt pending “a potential change of control transaction”.

SQM, which already has a major stake in the Mark Creasy-backed billion-dollar explorer, was rebuffed in a takeover bid only a couple of months ago.

Maybe it came back to the table with something better for AZS, which is already up 1000% year-to-date.

Assuming it comes in well above the rebuffed $2.31/sh offer from SQM in August – which AZS called ‘undercooked’ — a huge payday awaits for those shareholders who bought in when the stock was paying just ~20c in January this year.

READ: Azure lithium takeover in the works, Syrah stonks

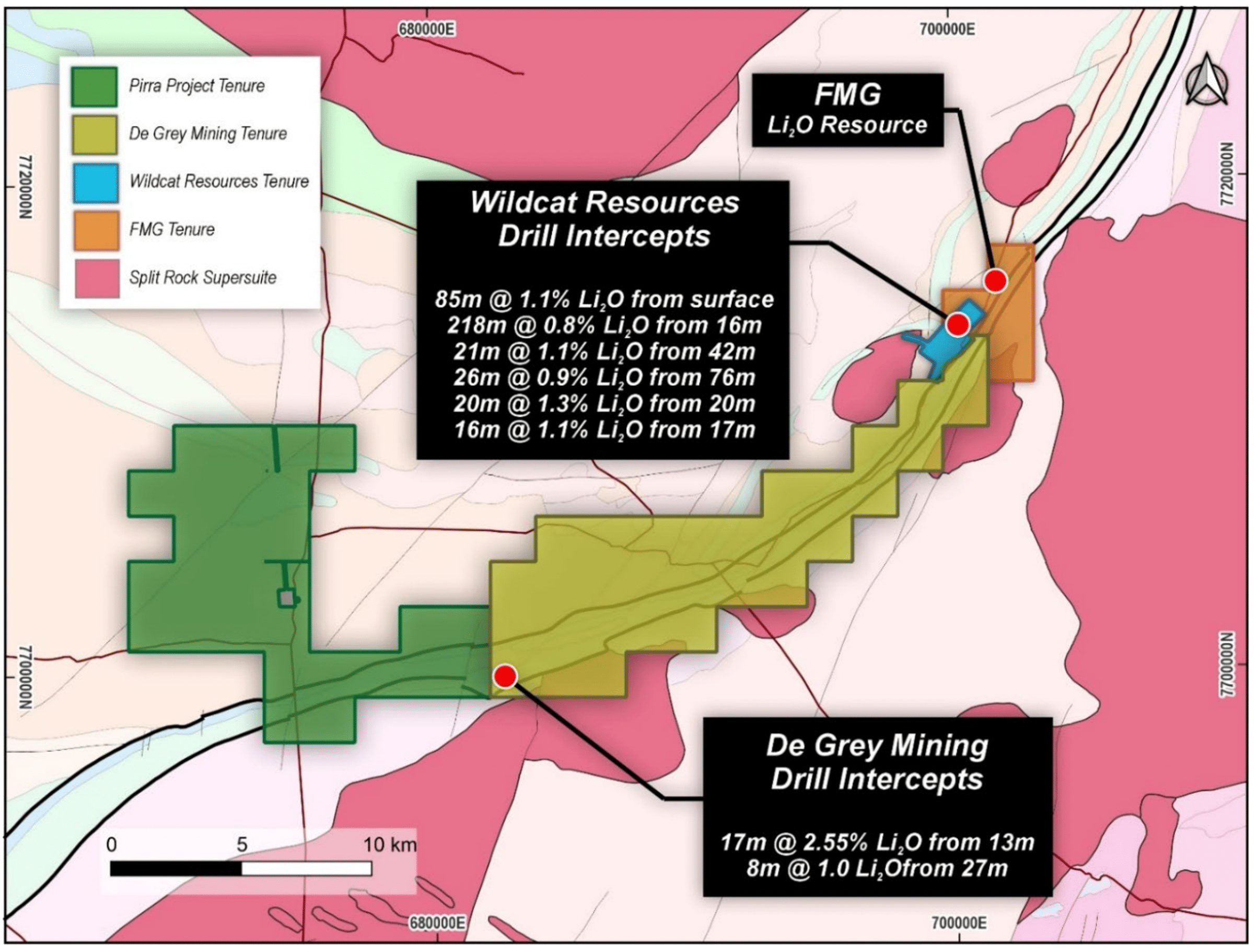

Meanwhile, SQM has inked a deal to buy a 30% stake the Pirra Lithium JV in WA with Calidus Resources (ASX:CAI) from Haoma Mining.

It will end up with a 40% stake (CAI 40%, Haoma 20%) after injecting an additional $3m into the JV for exploration.

“SQM’s acquisition of a large stake in Pirra is a big vote of confidence in the prospectivity of the company’s lithium exploration acreage in the Pilbara,” CAI managing director Dave Reeves says.

“With an increased landholding of over 1,411km2 in the Pilbara, Pirra is now funded to rapidly progress exploration across these tenements.

“An initial focus will be the Tabba Tabba South tenements which lie immediately along strike from known lithium occurrences and on a belt that hosts significant lithium resources.”

Those lithium occurrences include Wildcat Resources’ (ASX:WC8) Tabba Tabba flagship:

Like Azure, WC8 has bucked the trend to be a huge winner in 2023. It is currently all rigs blazing at Tabba Tabba, an old tantalum occurrence once explored by Pilbara Minerals (ASX:PLS) in its pre-Pilgangoora days.

It now looks like investor buzz is translating to proper drill results, with the company announcing a number of thicc, high grade spodumene hits to the market on Monday.

Highlights include a couple of estimated true width 85m intersections grading between 1.3-1.5% lithium.

There were even a couple of super high-grade chunks, like 9m at 3%, and 13m at 2.3%.

The news sent the former penny dreadful to all-time highs.

The Leia peggie – which is the current focus — is now 1.5km long, 50m wide, goes to 250m depth from surface, and remains open.

“We continue to be encouraged by the Leia Pegmatite’s scale, grade and tabular consistency having still not found the edges of it with drilling,” WC8 managing direct Sam Ekins says.

“It really feels as though we are in the midst of a Tier 1 lithium discovery at Tabba Tabba.”

Unsurprisingly, aggressive WA hard rock acquirer MinRes is sniffing around.

Incredible new intersections today. #WC8 is the new sheriff in town. Going to be a monster

— Dwayne Sparkes (@sparkes_dwayne) October 22, 2023

Who’s Hot:

The week’s biggest gains

Wildcat Resources (ASX:WC8) +36%

Maximus Resources (ASX:MXR) +32%

Prospect Resources (ASX:PSC) +26%

Lithium Power International (ASX:LPI) +22%

Who’s Not:

The week’ s biggest falls

Avira Resources (ASX:AVW) -50%

MTM Critical Metals (ASX:MTM) -36%

Liontown Resources (ASX:LTR) -35%

Here’s how Aussie lithium stocks are tracking:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected]

| CODE | COMPANY | 1 WEEK RETURN | 1 MONTH RETURN | YTD RETURN | 12 MONTH RETURN | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|---|

| WC8 | Wildcat Resources | 36% | 58% | 2338% | 1728% | 0.585 | $478,790,772 |

| MXR | Maximus Resources | 32% | 32% | -8% | -18% | 0.037 | $12,183,019 |

| PSC | Prospect Res Ltd | 26% | 11% | -21% | -6% | 0.0945 | $42,065,611 |

| TMX | Terrain Minerals | 25% | 0% | -17% | -17% | 0.005 | $5,030,575 |

| MHC | Manhattan Corp Ltd | 25% | -29% | -9% | -29% | 0.005 | $14,684,899 |

| LPI | Lithium Pwr Int Ltd | 22% | 121% | 20% | -5% | 0.53 | $333,495,907 |

| SRI | Sipa Resources Ltd | 16% | 5% | -31% | -56% | 0.022 | $5,019,479 |

| TKM | Trek Metals Ltd | 15% | -37% | -50% | -34% | 0.038 | $15,426,843 |

| CHR | Charger Metals | 14% | -18% | -64% | -66% | 0.16 | $8,696,012 |

| PGD | Peregrine Gold | 14% | -5% | -26% | -52% | 0.285 | $14,887,067 |

| PFE | Panteraminerals | 14% | 34% | -39% | -36% | 0.067 | $6,077,630 |

| FG1 | Flynngold | 13% | 21% | -32% | -35% | 0.068 | $9,274,016 |

| BUR | Burleyminerals | 13% | -3% | -18% | 6% | 0.18 | $18,233,416 |

| YAR | Yari Minerals Ltd | 12% | -24% | -15% | -46% | 0.0145 | $6,270,652 |

| NWM | Norwest Minerals | 10% | -3% | -41% | 14% | 0.032 | $8,914,655 |

| ALY | Alchemy Resource Ltd | 10% | 0% | -52% | -58% | 0.011 | $12,958,839 |

| RDN | Raiden Resources Ltd | 9% | -26% | 426% | 229% | 0.025 | $51,389,034 |

| AUN | Aurumin | 8% | 12% | -54% | -67% | 0.028 | $9,234,849 |

| ASN | Anson Resources Ltd | 7% | 7% | -16% | -47% | 0.155 | $186,432,180 |

| MLS | Metals Australia | 6% | 0% | -21% | -15% | 0.035 | $20,593,194 |

| LLO | Lion One Metals Ltd | 6% | 7% | -5% | 46% | 1.11 | $16,921,847 |

| NVA | Nova Minerals Ltd | 4% | 10% | -61% | -62% | 0.265 | $55,885,840 |

| BYH | Bryah Resources Ltd | 4% | -18% | -45% | -43% | 0.014 | $5,020,474 |

| L1M | Lightning Minerals | 4% | 4% | -15% | 0% | 0.14 | $5,905,134 |

| EMH | European Metals Hldg | 3% | -8% | 1% | -19% | 0.645 | $90,500,336 |

| FTL | Firetail Resources | 3% | -5% | -38% | -50% | 0.1 | $13,699,311 |

| ANX | Anax Metals Ltd | 3% | -31% | -32% | -39% | 0.036 | $15,046,637 |

| LEL | Lithenergy | 3% | -9% | -25% | -50% | 0.575 | $58,715,700 |

| AZS | Azure Minerals | 2% | -5% | 984% | 787% | 2.44 | $1,087,665,095 |

| MHK | Metalhawk. | 1% | -15% | -48% | -54% | 0.085 | $7,246,933 |

| TMB | Tambourahmetals | 0% | -34% | 19% | -17% | 0.125 | $9,538,141 |

| SGQ | St George Min Ltd | 0% | 0% | -41% | -2% | 0.04 | $31,323,274 |

| AX8 | Accelerate Resources | 0% | 30% | 30% | -14% | 0.03 | $13,048,061 |

| AZL | Arizona Lithium Ltd | 0% | -6% | -76% | -81% | 0.015 | $44,725,655 |

| EMS | Eastern Metals | 0% | -6% | -58% | -79% | 0.031 | $1,996,195 |

| AAJ | Aruma Resources Ltd | 0% | -3% | -36% | -52% | 0.034 | $6,497,420 |

| 1MC | Morella Corporation | 0% | -8% | -54% | -75% | 0.0055 | $33,762,606 |

| AVZ | AVZ Minerals Ltd | 0% | 0% | 0% | 0% | 0.78 | $2,752,409,203 |

| PAM | Pan Asia Metals | 0% | -7% | -51% | -45% | 0.2 | $31,764,287 |

| CTN | Catalina Resources | 0% | 0% | -60% | -43% | 0.004 | $4,953,948 |

| WML | Woomera Mining Ltd | 0% | -17% | -47% | -28% | 0.01 | $9,561,946 |

| KAI | Kairos Minerals Ltd | 0% | -13% | -4% | -21% | 0.02 | $52,418,244 |

| LSR | Lodestar Minerals | 0% | -17% | 0% | 0% | 0.005 | $10,116,987 |

| AOA | Ausmon Resorces | 0% | 0% | -57% | -57% | 0.003 | $2,935,948 |

| MNS | Magnis Energy Tech | 0% | -6% | -80% | -79% | 0.074 | $88,762,863 |

| WMC | Wiluna Mining Corp | 0% | 0% | 0% | 0% | 0.205 | $74,238,031 |

| LLL | Leolithiumlimited | 0% | 0% | 4% | -13% | 0.505 | $498,553,663 |

| PAT | Patriot Lithium | 0% | -8% | -36% | 0% | 0.17 | $10,860,875 |

| PL3 | Patagonia Lithium | 0% | 20% | 0% | 0% | 0.15 | $7,350,525 |

| RMX | Red Mount Min Ltd | 0% | 0% | -20% | -27% | 0.004 | $10,694,304 |

| XTC | Xantippe Res Ltd | 0% | 0% | -67% | -76% | 0.001 | $17,528,005 |

| ADG | Adelong Gold Limited | 0% | -13% | 0% | -13% | 0.007 | $4,174,256 |

| OLY | Olympio Metals Ltd | 0% | -11% | 10% | -11% | 0.16 | $10,175,920 |

| SCN | Scorpion Minerals | 0% | -8% | -21% | -23% | 0.055 | $19,415,547 |

| RAG | Ragnar Metals Ltd | 0% | 9% | 110% | 1% | 0.024 | $11,849,524 |

| G88 | Golden Mile Res Ltd | 0% | -46% | -2% | -24% | 0.02 | $6,917,180 |

| AS2 | Askarimetalslimited | 0% | -7% | -56% | -60% | 0.19 | $15,360,043 |

| GLN | Galan Lithium Ltd | -1% | 5% | -36% | -46% | 0.6825 | $264,916,710 |

| JNO | Juno | -1% | -14% | -18% | -25% | 0.078 | $10,581,324 |

| EUR | European Lithium Ltd | -1% | 0% | -7% | -23% | 0.069 | $96,202,503 |

| GRE | Greentechmetals | -2% | -39% | 96% | 72% | 0.275 | $15,563,778 |

| PNN | Power Minerals Ltd | -2% | -18% | -54% | -51% | 0.245 | $19,530,464 |

| MMC | Mitremining | -2% | -2% | -16% | 31% | 0.235 | $9,750,272 |

| A8G | Australasian Metals | -2% | 33% | 5% | -27% | 0.2 | $10,424,099 |

| RIO | Rio Tinto Limited | -3% | -5% | -4% | 21% | 111.46 | $42,548,802,449 |

| WES | Wesfarmers Limited | -3% | -5% | 12% | 15% | 51.21 | $58,139,791,835 |

| LIT | Lithium Australia | -3% | -9% | -31% | -39% | 0.031 | $38,499,038 |

| PMT | Patriotbatterymetals | -3% | -12% | 55% | 0% | 1.165 | $435,470,131 |

| CAI | Calidus Resources | -3% | -12% | -46% | -60% | 0.145 | $79,024,382 |

| MQR | Marquee Resource Ltd | -4% | -24% | -30% | -57% | 0.026 | $10,747,994 |

| KGD | Kula Gold Limited | -4% | -4% | -50% | -69% | 0.0125 | $4,478,543 |

| FL1 | First Lithium Ltd | -4% | 39% | 39% | 56% | 0.25 | $17,162,658 |

| ZNC | Zenith Minerals Ltd | -4% | 3% | -64% | -68% | 0.096 | $33,476,184 |

| KZR | Kalamazoo Resources | -4% | -7% | -56% | -48% | 0.093 | $16,110,457 |

| LPD | Lepidico Ltd | -4% | 10% | -31% | -50% | 0.011 | $76,383,079 |

| VMC | Venus Metals Cor Ltd | -4% | -20% | 40% | 35% | 0.11 | $20,870,155 |

| DAF | Discovery Alaska Ltd | -5% | -14% | -41% | -49% | 0.019 | $4,450,459 |

| IR1 | Irismetals | -5% | -22% | 35% | -9% | 1.57 | $170,006,175 |

| KTA | Krakatoa Resources | -5% | -18% | -59% | -70% | 0.018 | $7,393,265 |

| MAN | Mandrake Res Ltd | -6% | -15% | -15% | 0% | 0.034 | $20,357,837 |

| DRE | Dreadnought Resources Ltd | -6% | -24% | -60% | -60% | 0.0425 | $148,074,092 |

| TEM | Tempest Minerals | -6% | -16% | -65% | -73% | 0.008 | $3,835,376 |

| MRR | Minrex Resources Ltd | -6% | 14% | -50% | -63% | 0.016 | $17,357,880 |

| TYX | Tyranna Res Ltd | -6% | -17% | -38% | -67% | 0.015 | $49,296,380 |

| AZI | Altamin Limited | -6% | -13% | -26% | -28% | 0.059 | $24,286,439 |

| ESS | Essential Metals Ltd | -7% | -4% | 40% | -12% | 0.455 | $125,019,885 |

| ARN | Aldoro Resources | -7% | -23% | -45% | -65% | 0.088 | $11,846,889 |

| LRD | Lordresourceslimited | -7% | -17% | -63% | -79% | 0.062 | $2,376,456 |

| AM7 | Arcadia Minerals | -8% | -12% | -53% | -68% | 0.097 | $9,923,559 |

| WCN | White Cliff Min Ltd | -8% | 9% | -14% | -37% | 0.012 | $14,455,713 |

| WR1 | Winsome Resources | -8% | -23% | -7% | 200% | 1.14 | $216,619,159 |

| GL1 | Globallith | -8% | -14% | -33% | -52% | 1.245 | $328,723,784 |

| INF | Infinity Lithium | -8% | -6% | -31% | -61% | 0.083 | $39,320,328 |

| ZEO | Zeotech Limited | -8% | -19% | 0% | 21% | 0.047 | $85,296,153 |

| AGY | Argosy Minerals Ltd | -8% | -8% | -69% | -66% | 0.175 | $245,771,312 |

| GSM | Golden State Mining | -8% | -15% | -21% | -7% | 0.034 | $6,497,001 |

| BNR | Bulletin Res Ltd | -8% | 51% | 18% | -8% | 0.11 | $30,827,066 |

| SBR | Sabre Resources | -8% | -27% | -13% | -40% | 0.033 | $10,202,017 |

| EPM | Eclipse Metals | -8% | -15% | -31% | -45% | 0.011 | $24,336,718 |

| IGO | IGO Limited | -9% | -16% | -21% | -32% | 10.62 | $8,451,108,793 |

| FIN | FIN Resources Ltd | -9% | 75% | 11% | 5% | 0.021 | $11,799,672 |

| BM8 | Battery Age Minerals | -9% | -28% | -58% | -58% | 0.21 | $18,718,746 |

| SRZ | Stellar Resources | -9% | -23% | -23% | -23% | 0.01 | $9,053,678 |

| DTM | Dart Mining NL | -9% | -31% | -64% | -76% | 0.02 | $3,460,245 |

| QPM | Queensland Pacific | -9% | 2% | -46% | -64% | 0.059 | $120,750,169 |

| LM1 | Leeuwin Metals Ltd | -9% | 4% | 0% | 0% | 0.295 | $13,435,500 |

| ICL | Iceni Gold | -10% | -32% | -19% | -16% | 0.065 | $15,590,714 |

| LIS | Lisenergylimited | -10% | 10% | -28% | -47% | 0.23 | $140,844,051 |

| VKA | Viking Mines Ltd | -10% | -14% | -10% | 13% | 0.009 | $9,227,326 |

| IPT | Impact Minerals | -10% | -25% | 29% | 29% | 0.009 | $28,647,039 |

| CMD | Cassius Mining Ltd | -10% | 9% | 75% | 0% | 0.035 | $18,378,944 |

| MIN | Mineral Resources. | -10% | -19% | -27% | -22% | 56.23 | $11,623,351,787 |

| GW1 | Greenwing Resources | -10% | -10% | -53% | -64% | 0.13 | $20,910,178 |

| DYM | Dynamicmetalslimited | -11% | -21% | 0% | 0% | 0.165 | $5,950,000 |

| SYA | Sayona Mining Ltd | -11% | -22% | -57% | -63% | 0.082 | $854,343,569 |

| IMI | Infinitymining | -11% | -11% | -56% | -49% | 0.12 | $9,318,166 |

| THR | Thor Energy PLC | -11% | -47% | -60% | -72% | 0.024 | $4,408,413 |

| AKE | Allkem Limited | -11% | -15% | -8% | -30% | 10.375 | $6,827,951,409 |

| DLI | Delta Lithium | -11% | -23% | 32% | 16% | 0.625 | $352,284,651 |

| NKL | Nickelxltd | -11% | -14% | -33% | -66% | 0.054 | $4,742,019 |

| CXO | Core Lithium | -12% | -6% | -68% | -75% | 0.33 | $737,242,763 |

| STM | Sunstone Metals Ltd | -13% | -22% | -62% | -53% | 0.014 | $46,229,773 |

| LKE | Lake Resources | -13% | 3% | -79% | -84% | 0.17 | $248,927,824 |

| KOB | Kobaresourceslimited | -13% | -20% | -53% | -34% | 0.066 | $6,957,500 |

| PLS | Pilbara Min Ltd | -13% | -13% | -4% | -28% | 3.6 | $11,616,525,868 |

| A11 | Atlantic Lithium | -13% | -1% | -27% | -29% | 0.45 | $290,814,789 |

| RAS | Ragusa Minerals Ltd | -14% | -9% | -72% | -89% | 0.032 | $4,990,958 |

| OZM | Ozaurum Resources | -14% | -26% | 29% | 6% | 0.085 | $13,811,250 |

| PLL | Piedmont Lithium Inc | -14% | -29% | -26% | -48% | 0.475 | $193,340,513 |

| NMT | Neometals Ltd | -15% | -30% | -64% | -73% | 0.29 | $160,459,302 |

| OCN | Oceanalithiumlimited | -15% | -34% | -58% | -70% | 0.145 | $7,696,093 |

| QXR | Qx Resources Limited | -15% | -4% | -45% | -65% | 0.023 | $26,537,468 |

| REC | Rechargemetals | -15% | -39% | 4% | -26% | 0.14 | $16,702,796 |

| LRS | Latin Resources Ltd | -15% | -12% | 155% | 150% | 0.25 | $697,515,272 |

| EMC | Everest Metals Corp | -16% | -13% | 33% | 5% | 0.105 | $14,661,142 |

| LRV | Larvottoresources | -16% | -28% | -34% | -46% | 0.105 | $7,734,293 |

| NIS | Nickelsearch | -16% | -6% | -70% | -70% | 0.047 | $8,175,163 |

| PLN | Pioneer Lithium | -17% | 0% | 0% | 0% | 0.3 | $8,243,250 |

| RLC | Reedy Lagoon Corp. | -17% | -17% | -48% | -60% | 0.005 | $3,083,418 |

| TKL | Traka Resources | -17% | 0% | -38% | -17% | 0.005 | $4,376,646 |

| VSR | Voltaic Strategic | -17% | -38% | -15% | 5% | 0.02 | $9,662,078 |

| GT1 | Greentechnology | -17% | -19% | -52% | -51% | 0.4 | $88,385,672 |

| MM1 | Midasmineralsltd | -17% | -32% | -25% | -17% | 0.15 | $14,713,032 |

| VUL | Vulcan Energy | -17% | -25% | -64% | -63% | 2.29 | $402,321,369 |

| FRS | Forrestaniaresources | -17% | -36% | -79% | -82% | 0.029 | $3,580,556 |

| SUM | Summitminerals | -17% | -35% | -37% | -52% | 0.091 | $4,384,456 |

| FBM | Future Battery | -18% | -24% | 87% | 68% | 0.099 | $50,990,599 |

| SLM | Solismineralsltd | -18% | -32% | 200% | 231% | 0.225 | $18,262,838 |

| JRL | Jindalee Resources | -19% | -17% | -26% | -39% | 1.4 | $82,632,973 |

| WYX | Western Yilgarn NL | -19% | -35% | -40% | -35% | 0.078 | $4,469,175 |

| EG1 | Evergreenlithium | -19% | -21% | 0% | 0% | 0.21 | $12,651,750 |

| LLI | Loyal Lithium Ltd | -20% | -42% | 46% | -10% | 0.43 | $35,011,081 |

| IEC | Intra Energy Corp | -20% | -33% | -50% | -43% | 0.004 | $6,643,126 |

| INR | Ioneer Ltd | -21% | -33% | -59% | -71% | 0.155 | $348,319,343 |

| BMM | Balkanminingandmin | -21% | -41% | -59% | -47% | 0.135 | $10,665,112 |

| JBY | James Bay Minerals | -21% | -22% | 0% | 0% | 0.28 | $9,733,500 |

| EVR | Ev Resources Ltd | -21% | -21% | -21% | -54% | 0.011 | $10,392,578 |

| CY5 | Cygnus Metals Ltd | -22% | -32% | -67% | -73% | 0.125 | $39,155,756 |

| M2R | Miramar | -23% | -28% | -55% | -64% | 0.034 | $5,210,434 |

| DAL | Dalaroometalsltd | -23% | -17% | -60% | -70% | 0.04 | $3,040,000 |

| CRR | Critical Resources | -24% | -28% | -35% | -60% | 0.028 | $55,113,359 |

| LPM | Lithium Plus | -24% | -13% | -4% | -31% | 0.355 | $22,106,047 |

| ADV | Ardiden Ltd | -25% | -18% | -36% | -36% | 0.0045 | $10,753,341 |

| ENT | Enterprise Metals | -25% | -25% | -70% | -70% | 0.003 | $2,398,413 |

| LNR | Lanthanein Resources | -25% | -33% | -71% | -83% | 0.006 | $6,729,453 |

| ENT | Enterprise Metals | -25% | -25% | -70% | -70% | 0.003 | $2,398,413 |

| AML | Aeon Metals Ltd. | -27% | -31% | -59% | -58% | 0.011 | $13,156,807 |

| AL8 | Alderan Resource Ltd | -29% | -23% | 43% | 0% | 0.01 | $6,783,641 |

| EFE | Eastern Resources | -30% | -30% | -76% | -82% | 0.007 | $9,935,572 |

| RGL | Riversgold | -31% | -18% | -70% | -80% | 0.009 | $11,415,137 |

| LTR | Liontown Resources | -35% | -40% | 37% | -2% | 1.81 | $4,184,285,613 |

| MTM | MTM Critical Metals | -36% | -43% | -73% | -82% | 0.021 | $2,185,416 |

| AVW | Avira Resources Ltd | -50% | -33% | -67% | -71% | 0.001 | $2,133,790 |

| TOR | Torque Met | -56% | -57% | -17% | -19% | 0.15 | $19,300,001 |

The post How much is a buyer willing to pay for Azure, one of the hottest ASX lithium stocks of 2023? appeared first on Stockhead.