Uncategorized

Guy on Rocks: Now here’s a lithium developer worth accumulating

Gold (together with platinum and silver) prices could explode next year, setting new highs Cashed up Red Dirt Metals has … Read More

The post Guy on…

- Gold (together with platinum and silver) prices could explode next year, setting new highs

- Cashed up Red Dirt Metals has big plans for 2023 as it moves into lithium development at Mt Ida

- A DSO Lithium + Gold operation could be a low spend/high margin cash cow into 2024/2025

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Guns, money, revolution and gold

The big mover last week was Palladium which was off US$200/oz to US$1,642/oz (figure 1) after the US banned Pd imports from Nornickel (due to its Russian Oligarch connections) finishing with a massive buy-sell spread of US$150/oz.

Copper gave back last weeks gains to close at US$3.76/lb on fears of Chinese Corona virus lockdowns but remains in modest contango.

Uranium finished down slightly to US$47.88/lb with TerraPower, a company associated with Bill Gates, announcing there would be significant delays in the construction of modular reactors due to a shortage of enriched uranium which remains largely controlled by Russia.

Gold finished the week at US$1,797/ounce. Todd Horwitz from BubbaTrading.com believes that gold (together with Platinum and Silver) could explode next year and set new highs, as confidence in crypto currencies wane and punters become more concerned with Fiat currencies — ie those not backed by any hard commodities, such as gold.

Sentiment towards governments, according to Horwitz, seems to be on the decline with the COVID lockdowns crippling many small businesses over recent years, a move he believes could see a rise in the far right, particularly in the US.

Last week’s interest rate rise in the US came in at the expected 50 basis points and inflation came in at 7.1%; still high but below consensus estimates of 7.7%. In response, the US dollar index was down slightly to close at 104.76 and US 10-year treasuries finished at 3.48%, down 9 basis points for the week.

Just as I thought dementia Joe Biden had completely lost the plot running down the national oil reserve and buying heating oil, it appears the Honourable Jim Chalmers was doing the job of two people last week, namely Laurel and Hardy.

The Labor government’s move (likely to be implemented early 2023) to place a cap of A$12/GJ on gas sales for 12 months was likened to a “Soviet-style” gas policy that Santos Chief Executive Kevin Gallagher said will require the government to guarantee fiscal terms for new projects, such as Narrabri in NSW. Angela Macdonald Smith (AFR, 15 December 2022) points out that this is common practice in Nigeria! Now there is a model economy to follow.

I am not sure if the Stockhead faithful choked on your Christmas party lunch when you saw this little chestnut, but I almost burnt a hole in my Zegna suit at Cigar Social when I read this one.

Government policies are supposed to stimulate investment and market forces are supposed to find their natural balance on a level playing field.

As Dimitri Burshtein (The Australian, 15 December 2022) reminded us earlier in the week “the Australian energy market gives life to the American economist Milton Friedman’s words that if you put the US government in charge of the Sahara desert, in five years there’d be a shortage of sand”.

The energy policy is designed to:

“…protect Australian households, industry and manufacturers, save jobs, and ensure a stable and well-functioning wholesale gas market with adequate domestic supply at reasonable prices.”

Well, they are not looking to help out the gas sector by the look of it (ie: the geese that lay the golden eggs).

The government has also made the bold statement that this cap still allows “a reasonable return on capital, for gas sourced from currently operational fields.“ But this applies to new developments, not existing ones.

“Its such much easier under Albanese” was the response from the cigar social climate denial leadership group. How about bringing some clean coal back on line?

Fortunately for the gas explorers and developers out there, new sources of supply from undeveloped fields will be exempted from the cap and will instead be covered by the reasonable pricing provision.

The big news last week however was that the holy grail of green energy, Nuclear Fusion, took a step closer with scientists at the Livermore National Laboratory achieving a net 50% energy gain from the latest fusion experiment.

This is apparently the first time more energy has been produced than was put in using a system known as ‘inertial confinement’. This system uses lasers to heat up deuterium and tritium fuel units to extreme temperatures (3moC), causing it to implode and atomic fusion and energy release to occur.

Commercialisation of a nuclear fusion reactor could be a while away of course. In the interim, I have approached the lab and requested a 3moC laser to put up the rear end of the Australian labor party…

New ideas: Red Dirt Metals, lithium and gold developer

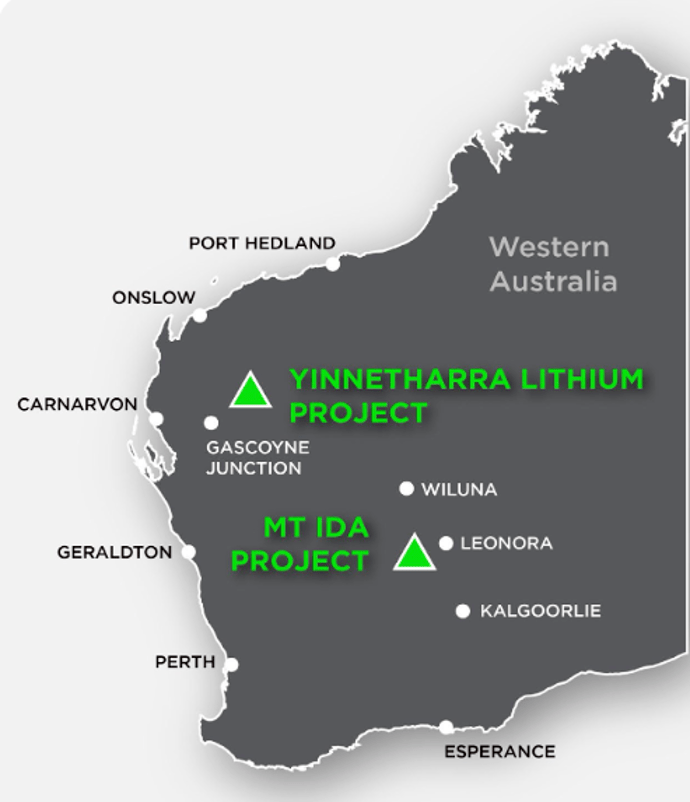

After topping up the coffers with $50 million at 50 cents a few weeks ago (supplemented by a $5m Share Purchase Plan), the cashed up Red Dirt Metals Ltd (ASX: RDT) has big plans for 2023 as it moves into the development phase at its Mt Ida Lithium project (figure 4).

The majority of the funds ($30.5m) are going to be applied to drilling at Mt Ida (A$18 million) with the balance to mining studies and related activities at its proposed spodumene DSO operation.

Just over $20 million is to be applied to RC and diamond drilling at the Yinnetharra lithium project northeast of Gascoyne Junction.

Mt IDA comprises a 12.7Mt Mineral Resource @ 1.20% Li2O and is situated on a granted Mining Lease with heritage and environmental surveys already complete.

The majority of the resource is made up of the Sister Sam Resource (5.7mt@ 1.3% LiO2) figure 5.

What also became apparent as I listened to managing director David Flanagan the other week, is that a large proportion of the gold resources (Inferred and Indicated Resources of 318,000 tonnes @ 13.8g/t gold) are likely to fall within the open pit.

So, depending on how you do your numbers, it looks like the gold could potentially pay for the mining costs or you could be producing spodumene with a significant gold credit.

Red Dirt recently signed a Non-binding four-year MoU that contemplates future negotiation of a binding offtake agreement for up to 45,000tpa of Spodumene concentrate with Vietnamese based VinES Energy Solutions that is subject to the future production capacity at Mt Ida and securing funding for development.

I think there is enough data out there to run at least some desk top numbers on this proposed DSO operation which I will continue on the back of a ciggie packet when I get down to Cigar Social later today.

Suffice to say, the DSO Lithium + Gold could be a serious low CAPEX, high operating margin cash cow moving into CY2024/2025, providing lithium and gold prices hold up of course.

At a pro-forma market capitalisation of around $200 million and an EV of just over $125 million, this is definitely one to accumulate under the recent 50 cent issue price for the Placement and Share Purchase Plan.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

The post Guy on Rocks: Now here’s a lithium developer worth accumulating appeared first on Stockhead.