Uncategorized

First mover: Leeuwin consolidates lithium-rich Cross Lake greenstone belt

Special Report: With over 70km strike of underexplored greenstone, Leeuwin Metals’ Cross Lake in Manitoba, Canada is now one of … Read More

The post…

- The Jenpeg project in Canada has been renamed ‘Cross Lake’ after the acquisition of additional tenure

- The Cross Lake lithium project now covers >2,000km2

- Acquisition confirms Leeuwin as a first mover across the Cross Lake Greenstone Belt

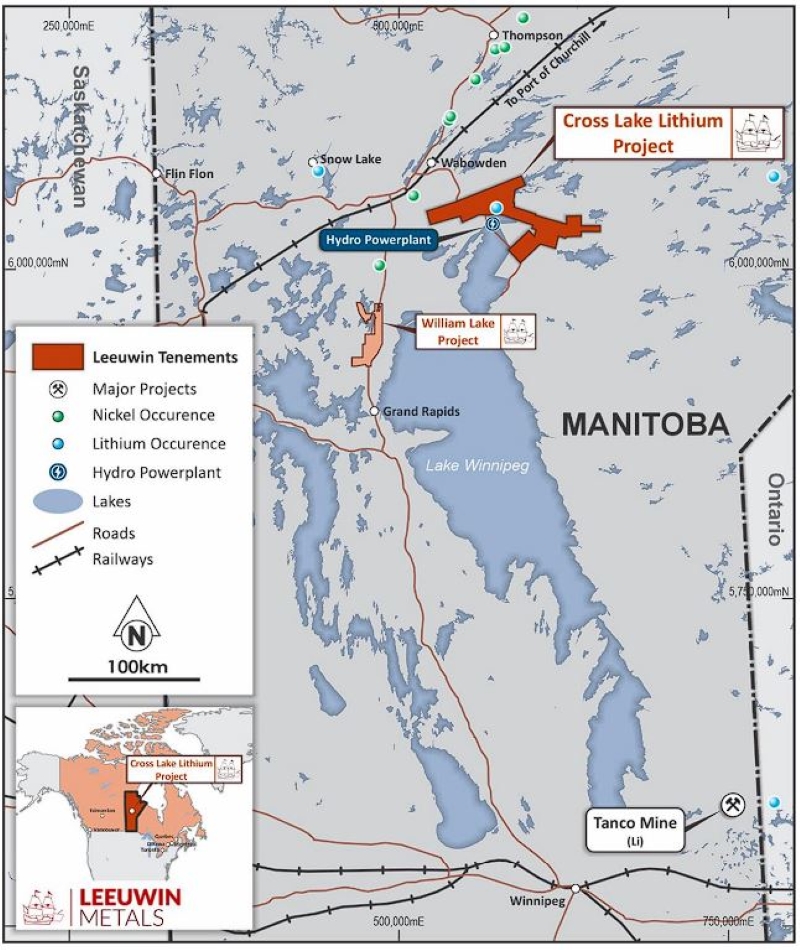

With over 70km strike of underexplored greenstone, Leeuwin Metals’ Cross Lake in Manitoba, Canada is now one of the region’s largest lithium exploration projects.

Famous investor Rick Rule firmly believes successful greenfields explorers often start with district scale land packages.

“The idea that an explorer could fit a 5Moz gold mining operation on a 70-hectare, postage stamp-sized project area is silly,” he says.

“Explorers need a district scale land package. And more often than not, you want it in mineralised terrain, but not a known camp.”

Size and prospectivity is what critical minerals explorer Leeuwin Metals (ASX:LM1) has at the underexplored Cross Lake. The company has now consolidated the belt via a binding agreement with Rocas Del Norte to acquire mineral exploration licence 1125A for C$50,000 in cash and shares.

“This cost-effective acquisition aligns with Leeuwin’s strategy as a first mover into the Cross Lake Greenstone Belt,” Leewuin MD Christopher Piggott says.

The Cross Lake project is ~120km south of the major regional mining centre of Thompson, with highway access and is well-serviced by hydroelectric power from the Cross Lake power station to the south.

Recent exploration at Cross Lake showed multiple shallow high-grade spodumene hits up to 1.75% Li2O from four holes, including:

- 5.14m @ 1.75% Li2O from 20.77m, and 14.18m @ 1.66% Li2O from 53m (XL-06)

- 6.62m @ 1.18% Li2O from 28.38m, 5.22m @ 1.24% Li2O from 39.78m and 9.65m @ 1.20% Li2O from 91.35m (XL-21)

- 13.87m @ 1.17% Li2O from 27.13m (XL-18); and

- 5m @ 1.18% Li2O from 17m, and 21.85m @ 0.81% Li2O from 26m (XL-05).

Leeuwin says the results indicate the mineralisation system remains open in all directions.

“This is a great result for the company, which has successfully secured 100% of the entire belt,” Piggott says.

“Additionally, this new tenure paves the way for further exploration success and regional growth, complementing the Cross Lake project area.

“This acquisition reinforces our commitment to strategic growth and ensures we maximise our ability to create shareholder value as we enter this exciting new phase of field exploration of our Cross Lake project.”

Assays are still pending for three drill holes and the company is expecting to start field work this quarter, with a focus on the >6km spodumene trend at the Spodumene Island prospect area.

Flagship nickel

Southwest of Leeuwin’s Cross Lake is its flagship William Lake nickel project, where drilling has returned assays that have “exceeded expectations”.

Recent drilling showed substantial intersections at drillhole WL23-367, including:

- 21.9m @ 1.02% Ni from 206.65m, including 7.35m @ 1.07% Ni from 206.65m,

- 12.15m @ 1.13% Ni from 216.4m, including 1.35m @ 5.02% Ni from 227.2m

- and 4.4m @ 1.55% Ni from 247.1m.

Its flagship William Lake project is in the world-class Thompson nickel belt, where several nickel mines are currently in operation, including Thompson, Sudbury and Norilsk which have grades of 1-2%, as well as Vale’s Voisey Bay which has reserves averaging 2.13%.

Elsewhere, it owns the Ignace lithium project in Ontario, and the Marble Bar lithium and Gascoyne REE-lithium projects in Western Australia.

This article was developed in collaboration with Leeuwin Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post First mover: Leeuwin consolidates lithium-rich Cross Lake greenstone belt appeared first on Stockhead.