Uncategorized

‘Entire walls of just spodumene’: Here’s why lithium explorers fought tooth and nail for ground in the Black Hills of South Dakota

Midwest Lithium has prime ground in the Black Hills mining region, one of the largest producing lithium districts in the … Read More

The post ‘Entire…

- The Black Hills of South Dakota is undergoing a lithium rush by explorers looking to feed US domestic demand

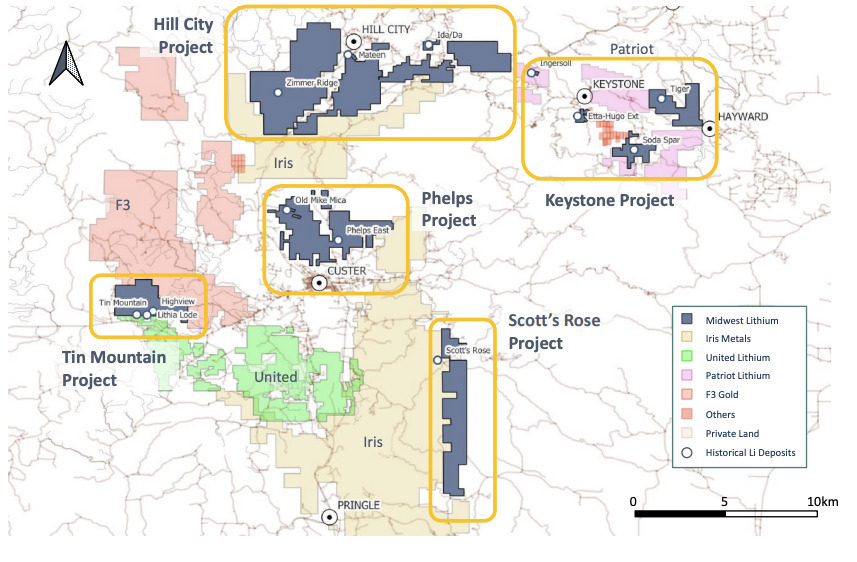

- Iris Metals, Midwest Lithium, United Lithium and Patriot Lithium are main landholders

- Midwest Lithium capital raise is now open for their planned ASX listing in October

Stockhead’s Jurisdiction Spotlight column delves into prospective lithium regions around the world, highlighting what makes the geology stand out and who’s exploring in the area.

The Black Hills mining region of South Dakota is perhaps best known for its rich gold deposits like Homestake, where 44Moz was mined over 100 years.

But, until recently, most people wouldn’t have been aware of its history as one of the largest producing lithium districts in the world from the late 1800s to the mid to late 1900s.

It is not one of those lithium districts previously mined for its tin or tantalum – this was a true lithium mining district. That means the geology and metallurgy is well understood.

It also boasts the largest spodumene crystals (~6% lithium) in the world.

How big? The Etta mine — at times the main source of spodumene in the world — yielded the largest (up to 15m long, weighing 90 tonnes) spodumene crystals ever mined.

All up, there are over 24,000 mapped pegmatites in the Black Hills.

Then there’s the infrastructure. 80% of all the power in South Dakota comes from renewable sources, making Black Hills lithium production some of the cleanest in the world with very low carbon intensity.

Aspiring producers can also just load a train at Rapid City 20 minutes away, transporting lithium rich spodumene concentrate to US based convertors for less than US$100/t.

Roads, clean power, an experienced workforce, and massive spodumene crystals – it’s all there.

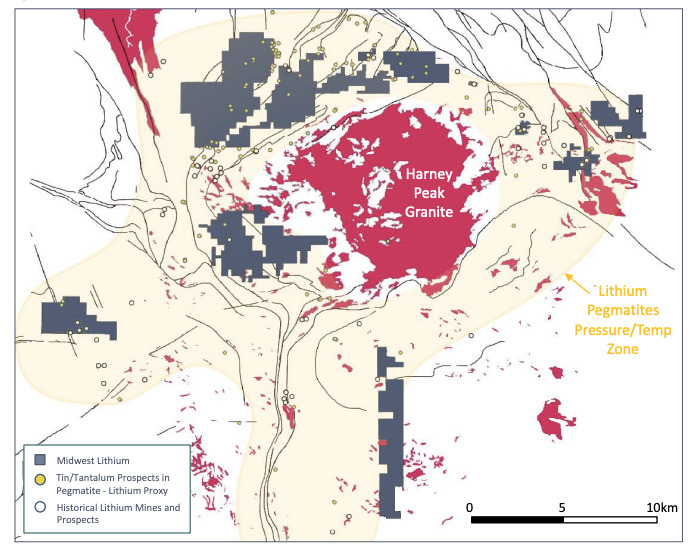

The lithium-caesium-tantalum (LCT) pegmatite occurrences in the Black Hills cluster around the Harney Peak Granite intrusion, forming a ‘halo’-like structure.

Projects between two to five kilometres from the border of Harney Peak hold prime position, being in the right temperature pressure zone for lithium bearing mineral crystallisation.

As interest in lithium runs red hot the Black Hills has once again found itself at the heart of another pegging rush.

Following a short flurry of activity, the best ground around the Harney Peak Granite is now tightly held by a handful of explorers: Iris Metals (ASX:IR1), soon-to-be-listed Midwest Lithium (ASX:MWL), Patriot Lithium (ASX:PAT), and TSXV-listed United Lithium.

The Black Hills pegging war

A March 2022 lithium ‘pegging war’ in the Black Hills resulted in three of seven companies battling for ground going home with nothing, according to Midwest Lithium executive chairman Rodrigo Pasqua.

In the US explorers can’t just request a tenement online. Instead, they must stake nine posts on the ground for each claim.

“We sent our crew out as the snow started to melt – by this time we knew Iris had already been staking claims for a few weeks,” Pasqua says.

“A lot of people were hammering posts. We have now 1,100 claims – Iris has more.

“It cost a lot of money, but we had to be quick — it was a good thing we had all the paperwork lined up, we got lucky.”

Midwest, Iris, Patriot and United scored ground. The rest went home with nothing.

Frontrunner Iris completed its strategic acquisition of White Rock LLC and its hard rock lithium projects in 2022 and has since uncovered multiple, wide, high-grade, and shallow lithium intersections at the Beecher project.

Beecher is located on the Beecher pegmatite trend, which was mined sporadically between the 1920s and 1950s for lithium, beryllium, tantalum, mica, and feldspar.

Lithium bearing ore from Beecher was treated at the Mateen plant, which now is part of Midwest’s portfolio.

Assays from the first six drill holes of a 38-hole reverse circulation program demonstrated the projects’ potential with highlight true width intersections of:

- 60m at 1.21% Li2O from 16m;

- 54m @ 1.30% Li₂O from 1m; and

- 40m @ 1.10% Li₂O from 48m.

Exceptional. The $250m capped stock is up over 800% since acquiring the ground in May last year.

Iris has since increased its landholding in the Black Hills area to 2,056 claims covering roughly 171sqkm. A diamond drill rig has been mobilised, ready to start testing the mineralised pegmatites at depth in late September.

Iris Metals share price today:

Patriot Lithium in the hood

Another company with boots on the ground is Patriot Lithium (ASX:PAT), owner of the Keystone (South Dakota) and Tinton West (South Dakota/Wyoming) hard rock lithium projects.

PAT’s projects – a short 3.5km away from the historic Etta mine – are the focus of a mapping and sampling program, currently underway over previously identified pegmatites.

The largest of these pegmatites can be traced at surface for over 200m along strike.

The explorer now plans to ramp up exploration efforts to identify new outcrops not evident in satellite imagery and generate drill targets.

“Given that many pegmatites are concealed beneath the forest canopy and/or covered by thick layers of lichens, traversing the area on foot is the only means of locating these hidden pegmatites,” the company says.

While there has been a spate of mining activity over a long time at Black Hills, PAT senior executive Phil Thick told Stockhead last year that work up to now has been fairly small scale, with no deeper exploration or drilling activity ever conducted.

“There is certainly enough evidence on the surface to suggest that there is a high prospect of success,” he said.

“There are a lot of spodumene crystals at surface right across this area that are … 1-2m, which is significant.

“If you have this evidence at the surface, there’s a high chance you are going to find something at depth as well.”

Patriot Lithium share price today:

Midwest IPO

But investors hungry for more Black Hills exposure should have October circled on their calendars as the to-be-listed Midwest Lithium is currently completing its IPO capital raise.

Backed by a team of accomplished veterans including former Evolution Mining (ASX:EVN) group head of Mining Rodrigo Pasqua and James Clark, former Benchmark Mineral Intelligence battery materials adviser to GM, Tesla, Ford, Rio Tinto and the US Department of State, Midwest Lithium is drumming up excitement as one of the biggest and best Black Hills tenement holders.

One of the only explorers in the area with private ground or patent claims, Midwest Lithium plans to use funds from its IPO proceeds to fast track an exploration campaign across various brownfield targets that could support the delivery of a definitive feasibility study by the end of 2025.

With a drill rig already being prepared to mobilise to site, the company, which will list under the code ‘MWL’, says it will focus on the historical Mateen and Ingersoll mines before moving to other areas such as Soda Spar and Scott’s Rose project, adjacent to Iris’s holdings.

Midwest initially plan to conduct low risk drilling to twin historical holes and underground mapping.

Mateen was one of the largest historical spodumene producers in the past, producing 34,000t at 1.2% lithium.

“You walk into the valley and then – the Mateen crystals aren’t massive, they are normal size but they cover the entire wall,” Pasqua says.

“The concentration, it’s something you don’t normally see. Entire walls of just spodumene.

“Other areas have some nice, 5-10m long crystals. I’m not very tall, but it’s still impressive to see crystals bigger than me.”

Iris and Midwest are the only ones with private ground, or patent claims.

“For federal ground it takes about 12 months to start drilling. In private land in South Dakota you can normally get a mining licence in months, and we are going to get drilling immediately after listing or even before,” Pasqua says.

“Black Hills are about to get very get busy from a lithium perspective.”

At Stockhead we tell it like it is. While Patriot Lithium and Midwest Lithium are Stockhead clients, they did not sponsor this article.

The post ‘Entire walls of just spodumene’: Here’s why lithium explorers fought tooth and nail for ground in the Black Hills of South Dakota appeared first on Stockhead.