Uncategorized

CLOSING BELL: Investors in pain as ASX falls 1.69% to 50-day low

The S&P ASX 200 has closed 1.69% lower setting a new 50-day low with Emerging Companies index also falling in … Read More

The post CLOSING BELL:…

- The S&P ASX 200 closes 1.69% lower setting new 50-day low, with Emerging Companies index also falling

- Golden Deeps uncovers in-demand germanium and gallium at Nosib vanadium-copper-lead-silver discovery

- AdAlta announces new data pointing to the potential efficacy of AD-214 in human patients with Idiopathic Pulmonary Fibrosis (IPF)

The ASX has had a shocker of an end to the first week of FY24, with July normally one of the strongest months of the year.

Yes we’ve all been left a little stumped, not dissimilar to the English cricket team at Lord’s.

Meanwhile, up the road at Wimbledon, British two-time champ Andy Murray is also feeling some pain.

After losing the first set to Stefanos Tsitsipas he was back to lead 6-7 (3/7), 7-6 (7/2), 6-4 when play was halted just before the All England Club curfew of 11pm.

The suspension came as 36-year-old Murray hurt his left groin, leaving him screaming out in pain.

But Murray battled on and managed to serve out the set and is scheduled to finish the contest with Tsitsipas when play resumes on Friday.

To Markets…

The S&P ASX 200 closed down 1.69% to 7042.30 points, setting a new 50-day low.

The S&P ASX Emerging Companies index (XEC) – a benchmark for Australia’s micro-cap companies – finished down 1.38%.

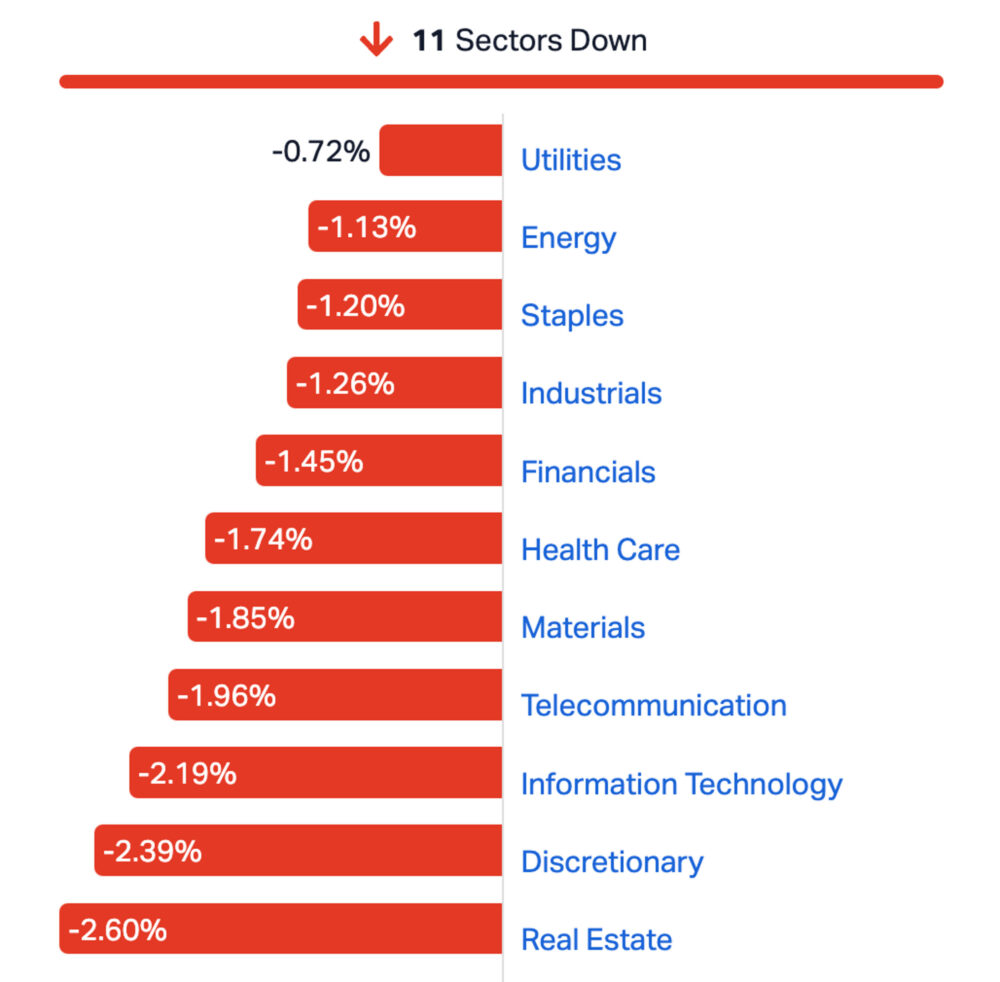

Every sector was in the red today with Real Estate the biggest loser with Goodman Group (ASX:GMG) falling 3.85% and REA Group (ASX:REA) down 2.97%.

As the saying goes when the US sneezes, Australian catches a cold. Aussie shares tracked US stocks sharply lower with overnight on Wall Street sinking as jobs data stoked more rate hike fears. The S&P 500 index closed -0.79% lower and the NASDAQ fell -0.82%.

The US ADP labour report showed that the private sector added 497,000 jobs in June, far exceeding economists’ estimates for 228,000 jobs.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| GED | Golden Deeps | 0.011 | 57% | 123,607,782 | $8,086,587 |

| TMB | Tambourah Metals | 0.225 | 55% | 4,731,977 | $5,972,927 |

| GMN | Gold Mountain Ltd | 0.013 | 44% | 49,060,975 | $17,729,394 |

| ARV | Artemis Resources | 0.02 | 43% | 21,827,668 | $21,978,857 |

| SIT | Site Group Int Ltd | 0.004 | 33% | 250,000 | $7,807,471 |

| WYX | Western Yilgarn NL | 0.16 | 33% | 421,346 | $5,958,900 |

| AYT | Austin Metals Ltd | 0.009 | 29% | 1,392,218 | $7,111,123 |

| NET | Netlinkz Limited | 0.01 | 25% | 2,348,623 | $28,244,227 |

| XTC | Xantippe Res Ltd | 0.0025 | 25% | 3,488,425 | $22,960,199 |

| PET | Phoslock Env Tec Ltd | 0.021 | 24% | 3,332,313 | $10,614,639 |

| 1AD | Adalta Limited | 0.037 | 23% | 5,401,117 | $11,000,386 |

| SNG | Siren Gold | 0.1 | 22% | 146,358 | $11,113,089 |

| VMC | Venus Metals Cor Ltd | 0.145 | 22% | 665,938 | $22,535,721 |

| CAV | Carnavale Resources | 0.006 | 20% | 21,579,987 | $13,667,759 |

| NSX | NSX Limited | 0.049 | 20% | 589,892 | $16,441,682 |

| TOY | Toys R Us | 0.013 | 18% | 4,105,157 | $9,493,953 |

| ICL | Iceni Gold | 0.11 | 17% | 625,061 | $19,605,714 |

| AHN | Athena Resources | 0.007 | 17% | 3,275,233 | $6,422,805 |

| AOA | Ausmon Resorces | 0.0035 | 17% | 1,000,000 | $2,907,868 |

| AVM | Advance Metals Ltd | 0.007 | 17% | 410,499 | $3,531,352 |

| CBY | Canterbury Resources | 0.028 | 17% | 209,999 | $3,468,565 |

| M4M | Macro Metals Limited | 0.0035 | 17% | 147,511 | $5,961,233 |

| OAR | OAR Resources Ltd | 0.0035 | 17% | 462,000 | $7,713,114 |

| RIM | Rimfire Pacific | 0.007 | 17% | 1,721,946 | $12,031,468 |

Golden Deeps (ASX:GED) is up 57% after uncovering germanium and gallium at the Nosib vanadium-copper-lead-silver discovery in Namibia, days after major producer China imposed export restrictions on the critical metals used in computer chips and semi-conductors.

GED said examination of one drillhole returned hits like 8.70m @ 128g/t Ga, 11.3g/t Ge (1.84% Cu, 1.88% V2O5, 10.2% Pb, 3.6g/t Ag) from surface.

The company said the market price of germanium is currently ~US$2,450/kg and gallium is ~US$230/kg, compared to vanadium (V2O5) at US$16.60/kg, copper at US$8.25/kg and zinc at US$2.41/kg.

Also on the winners list today is clinical stage drug maker AdAlta Limited (ASX:1AD) after announcing new data supports the potential efficacy of its AD-214 treatment in humans with Idiopathic Pulmonary Fibrosis (IPF) and other fibrotic diseases.

The new data links CXCR4 receptor occupancy with CXCR4 inhibition to provide direct evidence – suggesting that administration of AD-214 every two weeks could be clinically feasible.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CLE | Cyclone Metals | 0.001 | -50% | 3,546,725 | $20,529,010 |

| MRD | Mount Ridley Mines | 0.002 | -33% | 218,400 | $23,354,649 |

| MRQ | Mrg Metals Limited | 0.002 | -33% | 500,032 | $5,957,756 |

| TIG | Tigers Realm Coal | 0.005 | -29% | 304,643 | $91,466,917 |

| FGL | Frugl Group Limited | 0.008 | -27% | 283,557 | $10,516,682 |

| YPB | YPB Group Ltd | 0.003 | -25% | 22,719 | $2,973,846 |

| RGS | Regeneus Ltd | 0.013 | -24% | 6,283,192 | $5,209,428 |

| BDM | Burgundy D Mines Ltd | 0.23 | -23% | 14,450,289 | $424,811,966 |

| AD1 | AD1 Holdings Limited | 0.004 | -20% | 100,029 | $4,112,845 |

| BKG | Booktopia Group | 0.1325 | -20% | 667,037 | $22,664,284 |

| CUS | Copper Search | 0.225 | -20% | 171,216 | $14,782,571 |

| R8R | Regener8 Resources NL | 0.175 | -17% | 24,152 | $5,387,813 |

| CCO | The Calmer Co Int | 0.0025 | -17% | 162,263 | $1,692,233 |

| CPT | Cipherpoint Limited | 0.005 | -17% | 714 | $6,955,450 |

| OAU | Ora Gold Limited | 0.005 | -17% | 46,713,005 | $23,621,551 |

| TAR | Taruga Minerals | 0.011 | -15% | 2,512,323 | $9,178,348 |

| AIS | Aeris Resources Ltd | 0.415 | -15% | 14,599,079 | $338,563,342 |

| AVC | Auctus Invest Grp | 0.755 | -15% | 20,000 | $66,922,265 |

| BUR | Burley Minerals | 0.175 | -15% | 77,557 | $15,297,060 |

| ADS | Adslot Ltd | 0.003 | -14% | 65,351 | $11,433,159 |

| EDE | Eden Inv Ltd | 0.003 | -14% | 1,161,950 | $10,489,305 |

| BFC | Beston Global Ltd | 0.0095 | -14% | 3,791,908 | $21,967,516 |

| MKR | Manuka Resources | 0.057 | -14% | 578,870 | $35,697,424 |

| EMP | Emperor Energy Ltd | 0.013 | -13% | 249,340 | $4,032,937 |

| ARL | Ardea Resources Ltd | 0.62 | -13% | 1,118,507 | $122,904,762 |

Ora Gold (ASX:OAU) is on the loser list today after announcing it was raising $3 million at 4 cents/share, a 33% discount the last traded price.

The explorer said there was strong demand for the placement “following recent exceptional exploration results from the Crown Prince Prospect at the Garden Gully Gold Project”.

LAST ORDERS

Investment manager firm Challenger (ASX:CGF) has completed the sale of its Australian real estate business (CRE) to Elanor Investors Group (ASX:ENN) for $38 million, which has been received in new securities issued by ENN.

CGF said the revised total consideration for CRE reflects the termination of one third-party institutional mandate. ENN has secured the transfer of a third-party institutional mandate with a subsidiary of Abu Dhabi Investment Council (ADIC) as part of its acquisition of CRE.

ENN has issued 24.8 million new securities as consideration for the Transaction, representing ~17% of its securities on issue.

As part of the transfer of the ADIC mandate, CGF will transfer 4.5 million of the 24.8 million new securities in ENN to ADIC resulting in CGF’s and ADIC’s holding in ENN representing ~14% and 3% of total ENN securities on issue respectively.

Encounter Resources (ASX:ENR) has been successful in its application for the Federal Government’s Junior Mineral Exploration Incentive (JMEI) Scheme with up to $1.25 million of 2023/24 company tax losses that may be distributed to eligible incoming shareholders in respect of new shares issued before June 30, 2024.

The JMEI scheme encourages investment in exploration companies that carry out greenfields mineral exploration in Australia, by allowing these companies to give up a portion of their tax loses for potential distribution to eligible investors.

The scheme entitles Aussie resident investors in new shares issued by eligible minerals exploration companies to either a refundable tax offset or where the investor is a corporate tax entity, other than a life insurance company franking credits.

Canadian securities exchange listed Infinity Stone Ventures has become available to trade under the ticker code GEMS on Upstream, a trading app for digital securities and NFTs powered by Horizon Fintex and MERJ Exchange Limited (MERJ).

Infinity Stone said its free digital collectible NFT commemorating the dual listing are now available for all Upstream participants to claim with the claim code GEMS.

TRADING HALTS

Element 25 (ASX:E25) – Capital raise

Top Shelf International Holdings (ASX:TSI) – Capital raise

Sprintex (ASX:SIX) – Capital raise

Astral Resources (ASX:AAR) – Pending a court application in relation to its “inadvertent failure” to lodge a cleansing notice relating to its issue of shares on May 9, 2023

Harvest Technology Group (ASX:HTG) – Capital raise

Titanium Sands (ASX:TSL) – Capital raise

The post CLOSING BELL: Investors in pain as ASX falls 1.69% to 50-day low appeared first on Stockhead.

canadian securities exchange

nasdaq

asx

ax

gold

silver

vanadium

copper

zinc

titanium

germanium

gallium