Uncategorized

Closing Bell: ASX ends flat, but it’s not a good flat. More an Oxford Dictionary ‘to lack vigour; dull and lifeless’ flat

The benchmark ASX index closed short by -0.04% as Materials tried but couldn’t offset all else. Small caps, at least, were … Read More

The post Closing…

- Benchmark ASX index closes short by -0.04%

- Materials sector tries but cannot offset everyone else

- Small caps led by HAL, DTC

The ASX200 Index has closed slightly lower after jumping early (+0.3%) out the gates on Wednesday morning.

The benchmark S&P/ASX 200 (XJO) Index climbed about 12 points after the close to end 2.5 points or (-0.04%) lower at 6,854.

A fair judge might call that flat, but after the loopy business of Wednesday the 25th October, I’m calling it another loss.

The fact is, local markets never recovered after this:

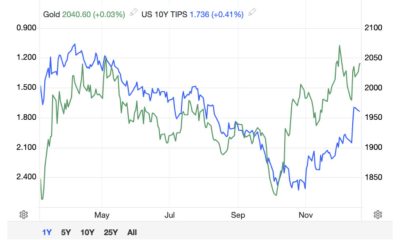

Mining stocks led the early advance on firmer commodity prices, while the benchmark looked set to track overnight wins on Wall Street as strong corporate earnings softened the blowback of Treasury yields.

Yess, the benchmark 10-year US yield has hit a 1-week low of 4.8%. And there was much celebrating, until…

Q3 inflation came in at 5.4%, lower than the 6% of the second quarter, sure, but also higher than the 5.3% expected by analysts.

It’s inflation and it’s not slowing is the basic message, and if you don’t believe me ask Reserve Bank of Australia Governor Michele Bullock who also said this week the central bank would not hesitate to raise its 4.1% cash rate if there were a “material” upward revision to the inflation outlook.

Or perhaps check in with the same analysts, as our colleagues at The Oz have:

The New Governor M Bullock, in the latest RBA minutes flagged inflation to remain well above the 2% target and was expected to do so for some time.

This morning, pre-11.30am, markets waged a mere 1/3 chance that the RBA will hike rates in November on Melbourne Cup Day. Markets have priced in a 2/3 bet on a hike.

But looking at the above news-flow, I’d say the big Cup Day money’s going to be closer to a 9/10 spread.

On the local index Materials did recover some form, but my word, Real Estate stocks got smashed.

ASX SECTORS ON WEDNESDAY

US FUTURES AT 1300 IN NEW YORK

RIPPED FROM THE HEADLINES

Someone has to win and it may as well be the roundly insignificant Australian dollar.

The rarely appreciated AUD appreciated very well circa 11.30am up toward $0.64, easily flexing its best since September, on the back of the too-late-I-warned-you-about-higher-than-expected inflation data.

Nevertheless, Top Money Man, Treasurer Jim Chalmers says the federal government is not considering a temporary cut to the fuel excise, despite inflation data showing fuel prices saw their highest quarterly rise since March 2022.

The federal government charges 49 cents a litre on petrol purchased at the bowser, as part of a fuel excise.

The previous Coalition government temporarily halved the tax in March last year for six months, after Russia’s invasion of Ukraine caused a massive global spike in oil prices.

The current government opted not to extend the excise cut when it expired last September, with government estimates suggesting the temporary cut resulted in about $5.6 billion of lost tax revenue during those six months.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| HAL | Halo Technologies | 0.23 | 219% | 460,418 | $9,323,655 |

| DTC | Damstra Holdings | 0.225 | 125% | 9,640,780 | $25,788,209 |

| HCT | Holista CollTech Ltd | 0.013 | 44% | 212,107 | $2,509,201 |

| SBR | Sabre Resources | 0.047 | 42% | 12,610,729 | $9,619,044 |

| IEC | Intra Energy Corp | 0.004 | 33% | 630,000 | $4,982,345 |

| SIH | Sihayo Gold Limited | 0.002 | 33% | 265,024 | $18,306,384 |

| RRR | Revolverresources | 0.125 | 32% | 251,296 | $23,239,305 |

| NIM | Nimyresourceslimited | 0.235 | 31% | 1,433,464 | $13,944,178 |

| BEZ | Besragoldinc | 0.13 | 30% | 4,650,740 | $41,810,091 |

| CY5 | Cygnus Metals Ltd | 0.155 | 29% | 1,212,138 | $34,805,117 |

| IVZ | Invictus Energy Ltd | 0.195 | 26% | 28,068,024 | $192,225,860 |

| 1ST | 1St Group Ltd | 0.01 | 25% | 2,500,000 | $11,335,930 |

| CNJ | Conico Ltd | 0.005 | 25% | 37,506 | $6,280,380 |

| HOR | Horseshoe Metals Ltd | 0.011 | 22% | 773,798 | $5,791,308 |

| MEL | Metgasco Ltd | 0.012 | 20% | 219,256 | $10,638,867 |

| SKN | Skin Elements Ltd | 0.006 | 20% | 366,250 | $2,847,430 |

| TKM | Trek Metals Ltd | 0.055 | 20% | 1,904,780 | $22,891,444 |

| SRJ | SRJ Technologies | 0.093 | 19% | 491,313 | $11,792,173 |

| TRIDB | Trivarx Ltd | 0.026 | 18% | 1,412,487 | $7,385,816 |

| AI1 | Adisyn Ltd | 0.02 | 18% | 205,263 | $2,222,174 |

| HYT | Hyterra Ltd | 0.02 | 18% | 126,315 | $8,187,178 |

| AOA | Ausmon Resorces | 0.0035 | 17% | 166,666 | $2,935,948 |

| CCZ | Castillo Copper Ltd | 0.007 | 17% | 50,015 | $7,797,032 |

| EXT | Excite Technology | 0.007 | 17% | 1,094,314 | $7,255,450 |

| PKO | Peako Limited | 0.007 | 17% | 37,907,980 | $3,162,508 |

Smashing it on lite volumes is still HALO Technologies (ASX:HAL). The stock was up over 200% when the sleepy ASX speeding cops finally pulled HAL over, kicking in a tail light as they did.

But there’s an explanation and the best part is it’s brief:

Halo is a Sydney-based provider and developer of FinTech products. It’s a fintech. So. Who really knows what those guys do or why they go up and down.

Damstra Holdings (ASX:DTC) has remained a strong buy, after revealing ‘conditional, non-binding, indicative proposals from multiple parties to acquire 100% of Damstra’s shares by way of a scheme of arrangement.’

Somebody wants the workplace management solutions provider big time.

DTC told shareholders:

“After assessing the proposals, the Board of Damstra has agreed to grant one of the interested parties the opportunity to conduct due diligence for four weeks on an exclusive basis (including an initial two week period during which the exclusivity provisions are not subject to a fiduciary carve out).

“Exclusivity has been granted on the basis of an indicative offer price of 30 cents per Damstra share.”

A few riders…

- There is no certainty that any binding transaction will proceed or eventuate.

- No action is required by shareholders at this time.

- Damstra will continue to keep the market informed in accordance with its continuous disclosure obligations.

- The company has appointed Jefferies Australia as financial adviser and Gilbert + Tobin as legal adviser.

Up 160%.

Sabre Resources (ASX:SBR) stock is still up around 40% after revealing it’s just added two ‘highly prospective tenement applications to its ground holding in the northwest Pilbara region of WA, along strike.’

And yes: ‘Only 5km to the northeast of the Andover lithium discovery of Azure Minerals (ASX:AZS)‘.

These new tenements take SBR’s tenement holding to >235sqkm in what is emerging as a world-class lithium region. The Andover discovery has produced drilling intersections which include up to 209.4m @ 1.42% Li2O

The two new Sabre Tenements lie only 5km along strike to the northeast of Andover and cover a target zone ‘where there is a bend in the structural corridor associated with a magnetic intrusion – a similar setting to the Andover lithium discovery.’

Sabre Resources CEO Jon Dugdale says the geology of the new tenements ‘appears similar to Andover – the only difference being the extent of cover over our target areas.’

“Following grant of the new tenement applications, the next steps will include detailed geophysical programs including gravity measurements to locate buried pegmatites which will then be tested with bedrock aircore drilling.

“The drilling will test for buried lithium bearing pegmatites within this highly prospective tenement package within what is now recognised as a world class lithium pegmatite region.”

Revolver Resources (ASX:RRR) has finished an additional $3mn in new equity funding, the stock is up and away, although the volume is not 4 to the floor.

Revolver has received funds from three existing shareholders for a share placement to each of A$1 million at an issue price of A$0.20 per share. The subscribers will also each receive 1-for-5 attaching options with a A$0.20 exercise price and 3-year expiry, plus a 2.5% free-carried interest in a Mining JV to be established solely over the existing MRE at Revolver’s Dianne Copper Project in north Queensland.

Revolver’s MV Pat Williams, said the new equity funding package was a strong endorsement of RRR’s strategic direction, and RRR was now focused on the near-term development of the Dianne deposit being facilitated by direct funding at the JV level.

To that end, he says discussions are advancing with several parties. He continues, in the Royal We:

“We are very pleased about the advancement of our underlying targeting work and drilling activities at both Dianne and Osprey.

“We also believe firmly in the potential for a super low-capital cost heap leach, SX-EW development of the remaining copper deposit from historical mining in the eastern part of Dianne.”

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| NWF | Newfield Resources | 0.1 | -33% | 74,802 | $132,307,086 |

| MTH | Mithril Resources | 0.001 | -33% | 26,315 | $5,053,207 |

| CHM | Chimeric Therapeutic | 0.029 | -29% | 4,312,095 | $21,902,321 |

| AUH | Austchina Holdings | 0.003 | -25% | 700,000 | $8,311,535 |

| CCE | Carnegie Cln Energy | 0.0015 | -25% | 207,226 | $31,285,147 |

| HLX | Helix Resources | 0.003 | -25% | 49,961,190 | $9,292,583 |

| VAL | Valor Resources Ltd | 0.003 | -25% | 356,000 | $15,493,339 |

| M2R | Miramar | 0.026 | -24% | 69,203 | $5,061,564 |

| PAM | Pan Asia Metals | 0.155 | -23% | 444,172 | $31,764,287 |

| DES | Desoto Resources | 0.11 | -21% | 273,277 | $8,389,710 |

| ICN | Icon Energy Limited | 0.008 | -20% | 1,552 | $7,680,137 |

| LBT | LBT Innovations | 0.004 | -20% | 2,673,181 | $1,779,502 |

| NC6 | Nanollose Limited | 0.033 | -18% | 20,500 | $5,955,455 |

| ADY | Admiralty Resources. | 0.005 | -17% | 895,400 | $7,821,475 |

| KPO | Kalina Power Limited | 0.005 | -17% | 741,155 | $9,091,175 |

| MTL | Mantle Minerals Ltd | 0.0025 | -17% | 1,202,081 | $18,442,338 |

| ROG | Red Sky Energy. | 0.005 | -17% | 2,716,666 | $31,813,363 |

| BTN | Butn Limited | 0.096 | -17% | 205,547 | $21,047,139 |

| EPX | Ept Global Limited | 0.021 | -16% | 229,500 | $11,147,843 |

| SPX | Spenda Limited | 0.011 | -15% | 3,460,285 | $47,804,024 |

| PFE | Panteraminerals | 0.057 | -15% | 129,782 | $6,567,761 |

| PRS | Prospech Limited | 0.018 | -14% | 1,559,409 | $4,614,959 |

| AJQ | Armour Energy Ltd | 0.12 | -14% | 3,685 | $14,436,816 |

| AYT | Austin Metals Ltd | 0.006 | -14% | 787,050 | $7,111,123 |

| BEX | Bikeexchange Ltd | 0.006 | -14% | 3,710 | $10,028,408 |

TRADING HALTS

Opthea (ASX:OPT) – In order for Opthea to finalise and make an announcement in relation to changes in the senior management structure of the company

Resources and Energy Group (ASX:REZ) – Pending an announcement by REZ to the market in connection with a capital raising

Kiland (ASX:KIL) – Pending an announcement by Kiland in relation to an application to be removed from the official list of ASX.

The post Closing Bell: ASX ends flat, but it’s not a good flat. More an Oxford Dictionary ‘to lack vigour; dull and lifeless’ flat appeared first on Stockhead.