Uncategorized

Black Cat is on the prowl for gold as resource drilling ramps up

Special Report: Black Cat’s built up its Kal East gold project, now a couple of ‘side hustles’ are starting to … Read More

The post Black Cat is…

Black Cat’s built up its Kal East gold project, now a couple of ‘side hustles’ are starting to take centre stage as it stalks its target of becoming a multi-operation gold miner.

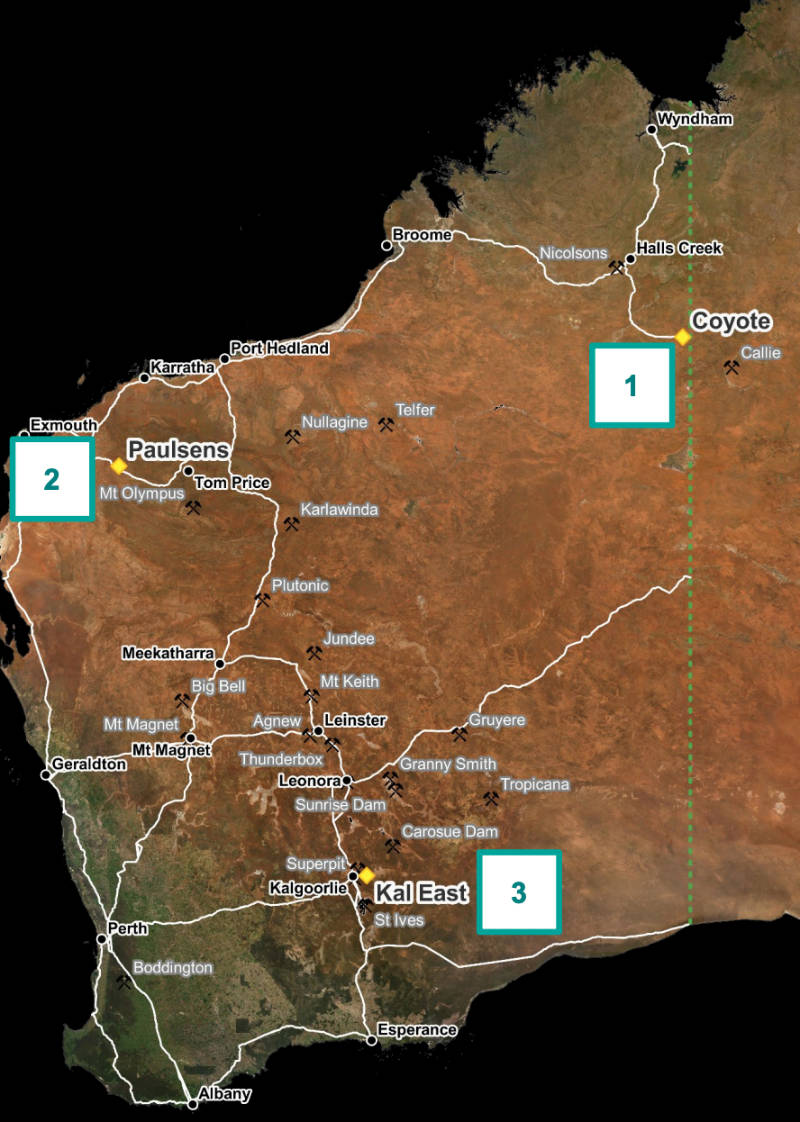

Since listing back in January 2018 under the leadership of Silver Lake Resources Ltd alumni such as managing director Gareth Solly, chairman Paul Chapman and non-executive director Les Davis, Black Cat Syndicate (ASX:BC8) has been steadily progressing its 800km2 Kal East gold project near Kalgoorlie.

This work has steadily built up the project from its early days as just the Bulong goldfield to its current status as a near development-ready project with 1.3Moz of gold resources and an attractive pre-feasibility study highlighting robust economics.

However, a single project – even one as attractive as Kal East – was not sufficient to fulfill Black Cat’s ambitions of becoming the next multi-operation gold miner like Silver Lake.

So in mid-2022 the company agreed to acquire the Coyote and Paulsens gold operations from Northern Star Resources (ASX:NST), lifting its total resources to 2 million ounces.

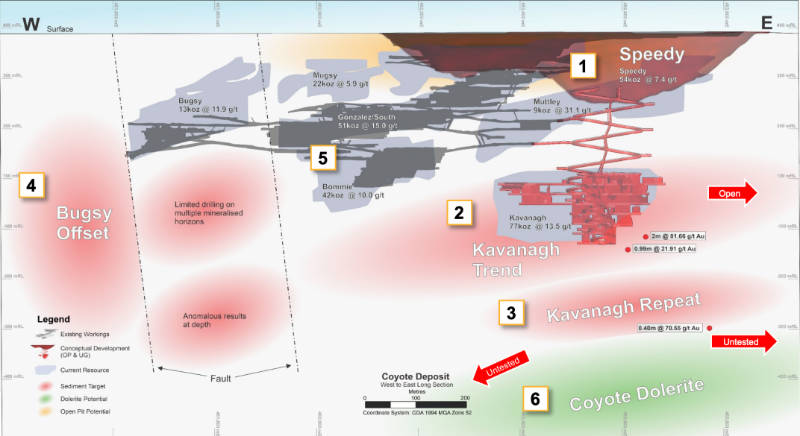

Coyote covers about 440km2 in the Tanami region of north-eastern WA. It has a resource of about 488,000oz at a high average grade of 5.1 grams per tonne (g/t) gold and historical production of 211,000oz at 4.9g/t from multiple small open pits and an underground mine.

It has an existing 300,000 tonne per annum (tpa) processing facility with supporting infrastructure which requires some refurbishment.

Paulsens – which was the first operation owned by Northern Star – has a landholding of about 530km2, historical production of 907,000oz at 7.3g/t gold, and existing resources of 217,000oz averaging 2.5g/t.

It is also home to a larger 450,000tpa processing facility which is currently on care and maintenance, with all supporting infrastructure for a quick restart in place.

Coyote, Paulsens providing options

Speaking to Stockhead, Solly said that while the previously producing projects haven’t had much attention paid to them for many years now, which was one of the points of interest for the company, they have significant gold resources and existing processing mills.

“These projects have got really strong growth prospects and we like the fact that they haven’t been drilled for a while as there are already targets both around the historical mines as well as the surrounding region,” he noted.

“Coyote and Paulsens have installed mills already. They’re well established and don’t have a lot of capital requirements to get them back into production.

“It’s a much easier and less risky venture for junior to restart those operations. We are still working on the specific cost, but it’ll be a lot less than building a new mine from scratch.”

Solly noted that while Paulsens was a great starter project for Northern Star, it simply became too small to fit into the portfolio of a company which is now Australia’s second largest gold miner, a theme which also holds true for Coyote.

“But for a junior, they’re great assets with great potential for near-term production.”

Room to grow

The company’s focus at this stage is aimed at building the resource base and testing potentially transformational targets at the two formerly Northern Star projects.

Black Cat currently has two rigs drilling at Coyote – the first drilling for a decade – focusing on near-mine and infill targets with a first resource update expected in the current quarter.

Drilling has already delivered high grade assays of up to 9m at 19.22g/t gold from a down-hole depth of 172m and 3m at 29.43g/t gold from 82m at the Speedy deposit.

“The whole system is open and we’re going to continue to grow it,” Solly said.

“Regionally, there are targets that haven’t been tested or have minimal testing but could be potential repeats so we’ll be drilling those areas in time.”

Over at Paulsens, work is underway to find a repeat of the main Paulsens orebody. Black Cat noted in July that previous drilling had returned high-grade, near-mine intersections outside the resource which highlight strong potential to extend the high-grade 89,000oz estimate.

Likewise, infill drilling had returned thick, high-grade results such as 5.72m at 35.32g/t gold that emphasises the robust nature of the existing resource.

What really interests Black Cat though is the potential for a big-ticket discovery.

“There’s repeat potential for Paulsens, the extension of Paulsens at depths and then there’s a whole load of high-grade mineralisation in the gabbros that Northern Star and the previous miners never really touched,” he added.

“We will be looking into whether we can turn those into mines as well. There’s a lot of potential and they may even eclipse Kal East.

“We have planned a little bit of drilling and exploration to go and make some more discoveries in the area.”

Underground drilling at Paulsens is expected to start later this month with preparation works already underway.

Solly said there is significant potential to grow the scale of resources at both projects.

“The exact production profile will change so we want to give it some time, put the drill rigs to work and grow the resources before we commit to operations,” he explained.

The Kal East surprise

For all the focus on building up resources at Coyote and Paulsens prior to making any decision on restarting their processing facilities, Black Cat has not forgotten Kal East.

Final grade control drilling at the Myhree open pit has returned high-grade gold hits which reinforce confidence in the open pit Ore Reserve of 0.6Mt at 2.4g/t gold for 46,000oz of contained gold.

With the open pit being fully approved, Solly flagged the potential for the company to toll treat ore mined from Myhree in the very near-term to produce cash flow.

“There’s potentially some capacity in mills around Kalgoorlie and we’re looking at options to go and start at the first approved mine,” he noted.

“Once we have concluded that, that could take off pretty quickly and we could be mining at Kal East early next year.”

While Black Cat’s focus is on gold, there’s also activity happening in base metals with the recent start of drilling at the Balagundi copper-zinc-lead-gold project – an overlooked gold and base metals field close to Kalgoorlie and the Myhree Mining Centre.

Corporate strength

Behind these projects is a strong board which consists primarily of former Silver Lake executives with Chapman and Davis both being founding directors of the gold producer.

“These guys are miners who have successfully built companies and they see the same opportunities when they started Black Cat,” Solly noted.

Other members include ZipCo founder Philip Crutchfield who he describes as “quite a well-versed businessman” and Tony Polglase who took Avanco Resources up from exploration through to production and its eventual takeover by Oz Minerals, giving the company mining, finance and legal experience.

“We are big believes in what we are doing and they some serious skin in the game,” he added.

“We’ve also got Northern Star and Silver Lake as major shareholders, which is a clear sign of confidence, and we have some big gold funds in there with big chucks of stock, so very well supported.”

This is backed by a strong cash base of about $20m post acquisition which Solly says will be used in the ground to grow resources.

This article was developed in collaboration with Black Cat Syndicate, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Black Cat is on the prowl for gold as resource drilling ramps up appeared first on Stockhead.