Uncategorized

ASX Small Caps Lunch Wrap: Who held the World’s Most Horizontal Morning Tea this week?

Wall Street Fear has kneecapped local markets again, but a dash of acquisition magic has helped some Small Caps to … Read More

The post ASX Small Caps…

Local markets have fallen again this morning, dropping 1.5% pretty much the moment the bell rang to start the day, before clawing back 0.5% to be at -1.0% at lunchtime.

It is, once again, Wall Street’s fault. The quiet panic among US investors is starting to get louder, as a confluence of surging bond yields, a dithering US Fed and a solid dose of good ol’ FUD pushed everything the wrong direction.

I’ll get to that in a minute, I promise – but first, we’re all off on a trip to South Africa, to learn a brief lesson about how no good deed ever goes unpunished.

Pretty much everyone’s a fan of a decent morning tea from time to time – whether it’s a charity thing or a more traditional “I would like cake for breakfast today, but I’ll push the time back a bit so I don’t look like a total maniac” kinda deal.

Kids, in particular, are fond of any chance to cram moist baked goods into their mouths at a moment’s notice – as my own children have repeatedly shown me, the most dangerous place in the world to stand is in between a pack of kids and a table laden with junk food.

So when students from Pulamadibogo Primary School, north-west of Pretoria in South Africa, spotted a couple of street vendors selling muffins by the side of the road, they spent up big and hauled quite a number of them away as a treat for their mates.

Because buying food from a couple of shady randos is always a great idea.

Anyway, it turns out that “space cakes” are pretty popular in South Africa, partly because when they’re made well, they can be light, fluffy and moist – just like grandma used to make from a packet in the 1970s.

They’re far more popular because they’re packed with cannabis – something 90 poor little tykes found out when they had their yummy morning tea, the walls started breathing and everyone developed a desperate urge to listen to King Gizzard And The Lizard Wizard’s Crumbling Castle on repeat.

The end result was 87 kids in hospital, and a couple of no good street punks banged up for supplying dope to the littlies, which is fair enough.

Space Muffins are preposterously dangerous, as I learned quite some time ago. A flatmate made a bunch of them, so I had a couple and it all spiralled badly out of control.

I ate the muffins, felt strangely hungry, found some muffins in the kitchen, ate some muffins and before too long those ‘irresistible’ muffins had turned me into an ‘immovable object’.

That said, I reckon we could all do with a bit of “morning tea” today, because the news from the markets here and in the US isn’t great – and I suspect quite a number of people are probably pining for the comfort of some magic muffins, a dark room and a beanbag today.

TO MARKETS

The benchmark started the day on a hiding to nothing, thanks to growing rumblings of foul discontent in the wake of the Fed’s decision to do nothing with interest rates.

Within minutes of the start of trading, the benchmark sank 1.5% – something which, in my admittedly limited market experience, isn’t a good sign.

But local investors appear to have dug deep into the collective ANZAC spirit, and the slow climb out of the early morning pit looks to be working.

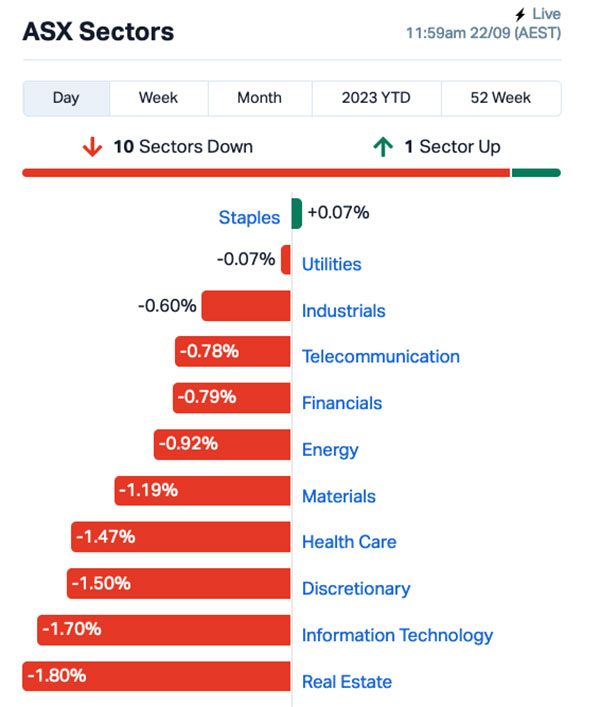

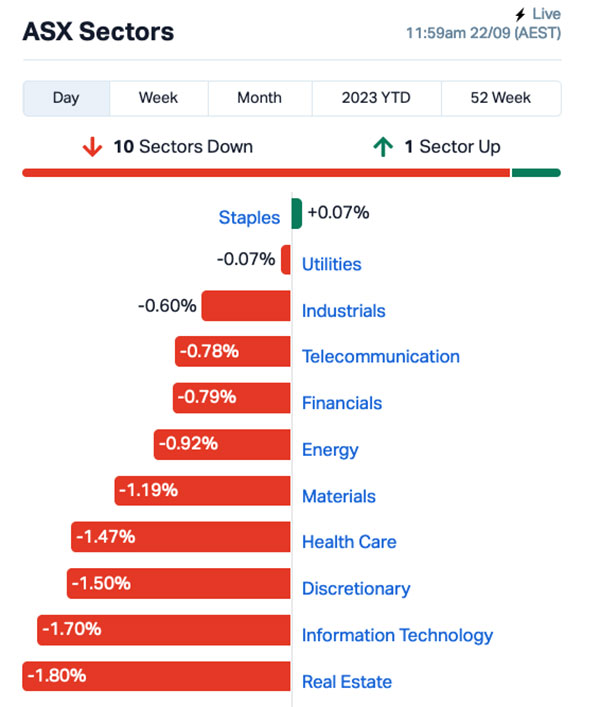

It might be Band-Aids on an axe wound, but the sector chart from lunch time actually looks a lot better than the one from earlier in the day.

Consumer Staples is the only sector with a nostril above water-level at lunchtime, helped along by a +6.5% jump from Costa Group (ASX:CGC) on news that Costa – major supplier of the avocados that (allegedly) crashed the Australian housing market, and mushrooms that (definitely) don’t kill people you invite round for lunch – is being bought by a consortium led by Paine Schwartz Partners.

Health Care and InfoTech are the worst performers today, making it the worst possible time to get a virus on your laptop.

In Large Caps news, Pilbara (ASX:PLS) is killing it this morning, up 5.0% to $4.18 a pop because “lithium”, and to a lesser extent “tantalum”.

And Liberty Financial (ASX:LFG) has added 5.8% after recently announcing it’s paying a divvy of $0.23767285 per share, thanks to all the money it saved by not paying off the ransomware hackers that made off with my personal info in March.

How excellent is that?

NOT THE ASX

On-the-spot disaster reporter Earlybird Eddy Sunarto was up really early this morning, to bring us news that Wall Street has really let the whole team down overnight.

The S&P 500 fell by -1.64%, the blue chips Dow Jones index was down by -1.08%, and the tech-heavy Nasdaq slipped by -1.82%, because traders are selling stocks on expectations that US rates will stay higher for longer after they combed through the Fed’s forecast.

The most alarming stat, though, is this one: The VIX, also called The Fear Index, spiked 16% to 17.5, its highest level since mid-August.

Eddy also reports that Big Tech stocks took the brunt of the selloff, with Alphabet tumbling by -2.5%, Amazon by -4.5%, and Nvidia by almost -3%.

Arm Holdings fell -1.4% and touched below its IPO price of US$51 before bouncing back to US$52.16. The ARM stock is now down for the fourth session in a row.

AI stock Splunk surged 20% after the company agreed to a US$28 billion takeover by Cisco.

To data, US new jobless claims came in at 201,000, dropping by 20,000 from the previous week – another sign of a resilient labour market.

In Japan, the Nikkei is down 0.57% this morning as the Japanese economy ground to a standstill following a nationwide plea from the government for citizens to provide “2, or possibly 3 old telephone books” for an “urgent, secret project”.

Turns out the phone books are to be used on the driver’s seat of Yuki Tsunoda’s Scuderia AlphaTauri F1 car at Suzuka this coming weekend, after a panel of experts discovered that the tiny Japanese driver’s on-track performance would be “vastly improved” once he’s able to see over the steering wheel.

In China, Shanghai markets have dropped 0.5% on alarming news that the national economy is in worse shape than previously thought.

According to China’s Endangered Species Fund, the local government-run Dongshan Park Zoo in Liaoning province is in dire financials straits, and has issued an appeal for citizens to send food for the animals, post-haste.

“There are still bear cubs in the park that need to be fed, the [horse] mare is about to give birth … and the zoo’s staff have not been paid for six months,” the fund said.

I see an easy fix, though: Feed the baby horse to the bears, charge people $20 to watch. Problem solved.

In Hong Kong, the Hang Seng is up 0.66%, although getting local investors there to tell me what’s happening was difficult, because apparently I’m an “a monster, devoid of empathy for all living things”.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 22 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MTH | Mithril Resources | 0.002 | 100% | 36,395,166 | $3,368,804 |

| INP | Incentiapay Ltd | 0.009 | 50% | 44,000 | $7,590,382 |

| GTG | Genetic Technologies | 0.0025 | 25% | 661,684 | $23,083,316 |

| KNO | Knosys Limited | 0.04 | 25% | 50,614 | $6,916,438 |

| RML | Resolution Minerals | 0.006 | 20% | 2,290,724 | $6,286,459 |

| WCN | White Cliff Min Ltd | 0.012 | 20% | 11,911,300 | $12,570,186 |

| SYM | Symbio Holdings Ltd | 2.69 | 20% | 488,694 | $193,522,883 |

| MEL | Metgasco Ltd | 0.013 | 18% | 50,000 | $11,702,754 |

| BTN | Butn Limited | 0.135 | 17% | 26,028 | $21,047,139 |

| AOA | Ausmon Resorces | 0.0035 | 17% | 275,000 | $2,907,868 |

| CHK | Cohiba Min Ltd | 0.0035 | 17% | 7,152 | $6,639,733 |

| EXL | Elixinol Wellness | 0.007 | 17% | 1,696,933 | $3,758,896 |

| NET | Netlinkz Limited | 0.007 | 17% | 3,338,295 | $21,183,170 |

| TIG | Tigers Realm Coal | 0.007 | 17% | 60,000 | $78,400,214 |

| DVR | Diverger Limited | 1.04 | 16% | 155,832 | $33,718,322 |

| CBL | Control Bionics | 0.075 | 15% | 20,689 | $6,656,580 |

| DTC | Damstra Holdings | 0.115 | 15% | 59,456 | $25,788,209 |

| SEG | Sports Ent Grp Ltd | 0.23 | 15% | 46,522 | $52,222,406 |

| ERG | Eneco Refresh Ltd | 0.016 | 14% | 2,250 | $3,813,017 |

| ETR | Entyr Limited | 0.008 | 14% | 1,200,614 | $13,837,977 |

| MHC | Manhattan Corp Ltd | 0.008 | 14% | 137,500 | $20,558,858 |

| 1TT | Thrive Tribe Tech | 0.024 | 14% | 301,731 | $6,229,052 |

| 5EA | 5E Advanced | 0.375 | 14% | 1,166,726 | $100,318,937 |

| STG | Straker Limited | 0.53 | 13% | 13,442 | $31,884,471 |

| ALV | Alvomin | 0.18 | 13% | 125,941 | $12,239,379 |

The Small Caps market is being a little weird this morning, with low-volume no-news price lurching all over the place.

Example: White Cliff Minerals (ASX:WCN) is up 20% on reasonable volume, despite no market-moving news for more than a week.

Symbio Holdings (ASX:SYM) is moving as well, up 19.6% because of an Improved, Best and Final buyout offer from Superloop (ASX:SLC) today. It’s complicated, so settle in.

On 01 August, Superloop offered a fairly basic offer on the table – $1.425 in cash and 2.14

Superloop shares for each Symbio share (50:50 cash and scrip consideration) valuing Symbio at $2.85 a pop.

Today, the offer’s been upped to this:

- $1.425 in cash and 2.14 Superloop shares for each Symbio share.

- Symbio shareholders would have the ability to receive a greater portion of the consideration in scrip or shares by way of a mix and match facility, subject to scale back to achieve an overall consideration mix of up to 60% cash or up to 60% scrip, depending on the elections made by shareholders.

- “Contemplation” of a fully franked dividend to Symbio shareholders prior to scheme implementation of up to A$0.35 per ordinary share, implying a release of franking credits of up to A$0.15 per share.

That all adds up to an offer valuing Symbio at $2.91 per share, based on Superloop’s closing price of $0.695 per share on 21 September 2023.

Diverger (ASX:DVR) rounds out the Top 3 this morning, up 16.2% on news that it has entered into a entered into a binding Scheme Implementation Agreement that would see Count (ASX:CUP) buy DVR holus-bolus.

The proposed deal would see Diverger shareholders bag $1.141 per share, comprising $0.367 per share in cash and 1.38 Count shares per Diverger share held, with flexibility in the plan for DVR holders to take the whole lot in cash if they want to.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 15 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CHR | Charger Metals | 0.14 | -26% | 2,183,226 | $11,801,730 |

| ADS | Adslot Ltd | 0.003 | -25% | 4,155 | $12,897,982 |

| TNY | Tinybeans Group Ltd | 0.12 | -17% | 825 | $12,156,596 |

| SRZ | Stellar Resources | 0.011 | -15% | 583,912 | $13,077,535 |

| MKG | Mako Gold | 0.017 | -15% | 1,851,151 | $11,520,164 |

| BBX | BBX Minerals Ltd | 0.029 | -15% | 383,435 | $17,602,976 |

| CAV | Carnavale Resources | 0.006 | -14% | 17,930,600 | $23,964,862 |

| PNN | Power Minerals Ltd | 0.24 | -14% | 288,999 | $22,320,530 |

| NGS | NGS Ltd | 0.013 | -13% | 2,749,556 | $3,768,411 |

| KTA | Krakatoa Resources | 0.02 | -13% | 1,078,625 | $9,806,661 |

| SI6 | SI6 Metals Limited | 0.007 | -13% | 178,819 | $15,950,875 |

| OLY | Olympio Metals Ltd | 0.175 | -13% | 4,651 | $10,231,011 |

| SSH | Ssh Group | 0.14 | -13% | 4,000 | $10,543,976 |

| PHO | Phosco Ltd | 0.049 | -13% | 174,957 | $15,367,148 |

| PLG | Pearl Gull Iron | 0.029 | -12% | 2,321,599 | $5,161,736 |

| AKM | Aspire Mining Ltd | 0.079 | -11% | 278,532 | $45,179,692 |

| AN1 | Anagenics Limited | 0.016 | -11% | 683,880 | $6,581,159 |

| GTI | Gratifii | 0.008 | -11% | 76,270 | $11,913,815 |

| SP8 | Streamplay Studio | 0.008 | -11% | 1,349,916 | $10,243,114 |

| IMA | Image Resources NL | 0.075 | -11% | 1,001,934 | $90,999,558 |

| EME | Energy Metals Ltd | 0.17 | -11% | 8,977 | $39,839,829 |

| VN8 | Vonex Limited | 0.017 | -11% | 28,000 | $6,874,744 |

| KCC | Kincora Copper | 0.035 | -10% | 145,913 | $6,254,783 |

| OJC | The Original Juice | 0.09 | -10% | 34,690 | $24,459,079 |

| LVT | Livetiles Limited | 0.009 | -10% | 50,097 | $11,771,106 |

The post ASX Small Caps Lunch Wrap: Who held the World’s Most Horizontal Morning Tea this week? appeared first on Stockhead.