Uncategorized

Arrow Minerals shows Simandou iron ore strategy as instos back placement to fund exploration

Special Report: The junior iron ore explorer in the box seat to leverage the development of the giant Simandou mine … Read More

The post Arrow Minerals…

The junior iron ore explorer in the box seat to leverage the development of the giant Simandou mine in West Africa has received the support of institutions for its strategy, raising almost $2.7 million in a well supported placement.

Arrow Minerals (ASX:AMD) says it has received firm commitments to raise $2.695m via the issuing of 490,000,002 shares to sophisticated and institutional investors at 5.5c a share along with a 1-for-2 unlisted option, which can be exercised at a 50% premium to the issue price.

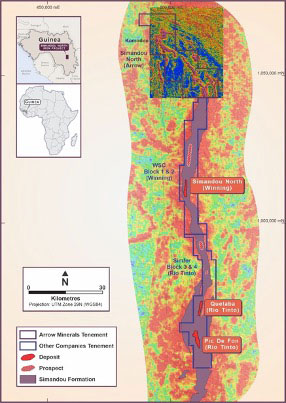

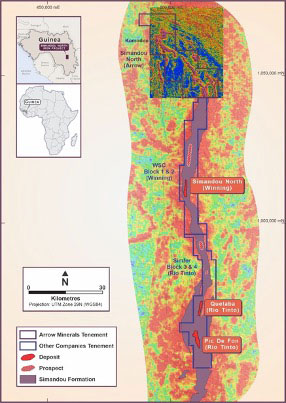

Priced at an 8.3% discount to Arrow’s last traded price of 6c, it will help progress the Simandou North project directly adjacent to the Winning Consortium’s Block 1 and 2 at the multi-billion tonne Simandou development in Guinea.

The Winning Consortium, Chinese steel giant Baowu, the world’s top iron ore exporter Rio Tinto and the Guinean Government are working together to construct the US$15 billion mine, port and rail project, which will include the construction of a 670km railway across Guinea and new deep water port at Morebaya.

The mine is slated, according to official estimates, to be in operation by 2025, which could open up significant infrastructure options for adjoining iron ore players like Arrow.

Arrow will use the funds to fulfil the $2.5 million expenditure commitment by way of an unsecured, interest-free shareholder loan to Amalgamates Minerals to fund exploration at Simandou North.

“We are very pleased with the strong support from new and existing shareholders for the capital raising,” AMD managing director Hugh Bresser said.

“This funding enables Arrow to accelerate our exploration activities at the Simandou North Iron Project over the coming months to identify areas of high-grade iron within the project area, which is proximal to planned major regional infrastructural upgrades, including rail and port.

“We look forward to keeping shareholders up to date with our progress during this exciting time.”

Skin in the game

Directors of Arrow have reinforced their strong conviction in the Simandou North project, subscribing for $95,000 in shares subject to shareholder approval.

The added skin in the game comes off the back of early exploration success at Simandou North.

Last month the company said its initial geological mapping had identified iron bearing formations spatially related to aeromagnetic geophysical survey highs, with hematite mapped in outcrop by field geologists.

The adjoining Simandou development is a high-grade 65% plus hematite deposit across four blocks, containing around 3.8Bt of ore, the only deposit so far identified of that scale and grade outside Brazil.

Contractor Mira Geoscience will complete Stage 1 geophysical remodelling work, combining mapping and geophysical results to provide a comprehensive understanding of the Simandou North Iron Project and will allow the Company to target large high grade iron zones for initial drill testing early this year.

Five high priority areas have already been identified, each between 5-7km in strike length, with mapping, surface geochemistry, ground geophysical surveys and drilling to come and field work anticipated to recommence in the coming weeks.

Proceeds of the placement will also be used to cover costs of the placement and general working capital, as well as maintaining Arrow’s interests in its gold assets in Burkina Faso.

Arrow holds beneficial rights to 33.3% in the Simandou North iron project in Guinea, with a “clear road map” to extend the rights to 60.5% over the next 24 months.

This article was developed in collaboration with Arrow Minerals (ASX:AMD), a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Arrow Minerals shows Simandou iron ore strategy as instos back placement to fund exploration appeared first on Stockhead.