Uncategorized

Anax on the final stretch to complete Whim Creek DFS

Special Report: Anax Metal’s ambition of becoming Australia’s next base metals has crossed a major milestone with the finalisation of … Read More

The…

Anax Metal’s ambition of becoming Australia’s next base metals has crossed a major milestone with the finalisation of mining and metallurgy studies for its Evelyn massive sulphide deposit.

Notably, the flotation test work returned excellent recoveries of up to 90% copper and 86% zinc.

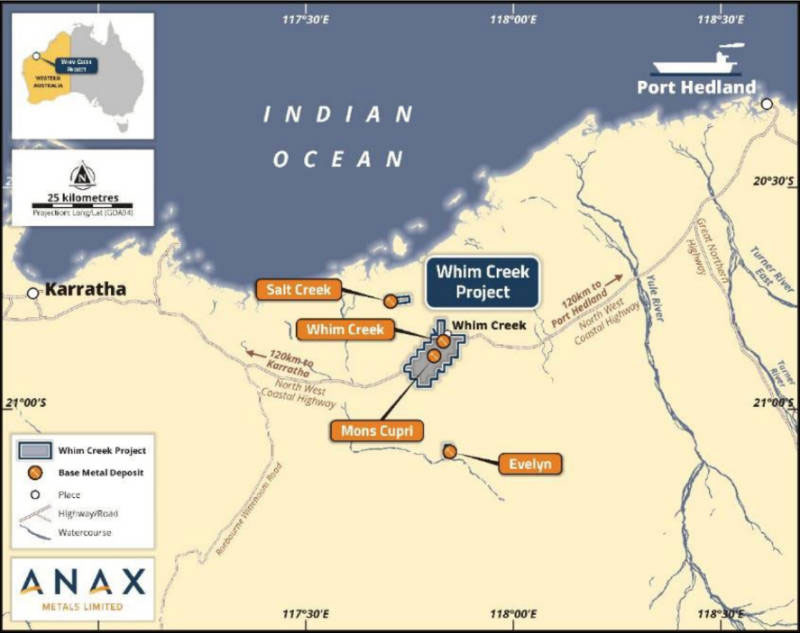

With other studies – including the underground mining study for Salt Creek – also nearing completion, Anax Metals (ASX:ANX) remains on track to deliver the Definitive Feasibility Study for its Whim Creek project in Western Australia’s Pilbara region by the end of the current quarter.

That the company is close towards delivering the key study that will enable a final investment decision – expected in the third quarter of 2023 – for the restart of the Whim Creek mine after purchasing an 80% from DEVELOP (ASX:DVP) in 2020 speaks volumes about just how lucrative Anax believes the project will be.

A 2022 updated scoping study envisaged about 11,000t per annum copper production (Cueq) over an initial 5-7 years for free cash of $291m at a very palatable Capex of just $55m.

This could potentially be conservative given widespread expectations of a copper shortage due to the lack of meaningful new copper discoveries to replace existing operations and dwindling global supply.

“Both the planned Evelyn and Salt Creek satellite underground mines fit into the Whim Creek schedule very well and indications from mining studies are that they will make a significant contribution to the Whim Creek project,” managing director Geoff Laing said.

“The Whim Creek project is shaping up to be a strategically significant asset for the Pilbara base metal province, positioning the project as a centralised processing hub capable of treating oxides, transitional and primary sulphide ores and supported by accommodation at the Whim Creek Hotel.

“Anax continues to focus on technical innovation as we seek to establish a valuable asset base for shareholders and we are excited to be on the final straight for the delivery of the Whim Creek DFS.”

Satellite mining boost

While the Whim Creek and Mons Cupri deposits remain at the core of the company’s redevelopment of the project, its decision to include the Evelyn and Salt Creek satellite deposits in November 2022 could add significantly to project economics.

Evelyn is located 25km south of the proposed Whim Creek processing facility and boasts contained resources of 14,900t of copper, 22,800t of zinc, 18,500oz gold and 779,000oz silver.

The Scoping Study found that a production target of about 250,000t of high-grade copper-zinc-silver-gold ore could be mined and trucked to Whim Creek for processing – a finding that was repeated in open pit studies completed in August 2022.

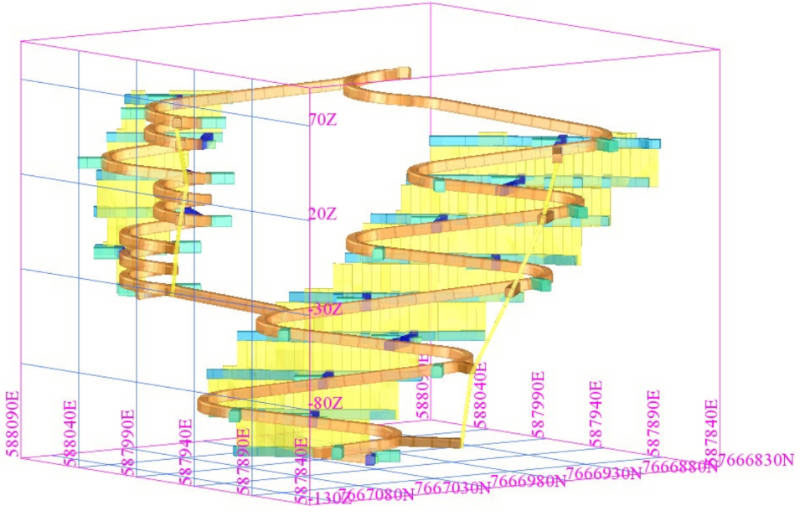

To top it off, Evelyn remains open at a depth of just 170m while another study has indicated that underground mining would provide a superior outcome to open pit mining due to its nature as a steeply dipping tabular orebody.

Anax is also progressing a Pre-Feasibility mining study for Salt Creek after a desktop assessment indicated that underground mining conditions might be more favourable than previously assumed.

The November 2022 desktop study assumed the modified Avoca underground mining method, with stopes to be backfilled using development waste (from Salt Creek), ore sorting rejects and/or heap leach material that will be transported to Salt Creek by backloading ore haulage trucks.

Salt Creek currently has a contained resource of 35,700t of copper and 95,000t of zinc.

Processing hub

While there’s little doubt that the two satellite deposits will add to the economics of Whim Creek, the work being completed on them has another potentially more lucrative objective.

The company believes the studies on the two deposits could potentially be used as a blueprint for unlocking value from similar small but high-grade stranded deposits of which there is no shortage of in the Pilbara.

While these deposits typically do not have the critical resource tonnages that would justify the capital costs for a standalone development, the company is developing Whim Creek as a processing hub capable of processing both sulphide ore through the concentrator and oxide/transitional ore through the heap leach facility.

Anax is already engaged in discussions with several mining companies that own small, high-grade resources in the district and is confident of reaching commercial agreements to unlock them to the benefit of all stakeholders.

This article was developed in collaboration with Anax Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post Anax on the final stretch to complete Whim Creek DFS appeared first on Stockhead.