Uncategorized

A clay rare earths project called ‘Colossus’ propels Viridis to massive gains in 2023

‘Colossus’ is already living up to its name, with explorer Viridis enjoying ASX-leading gains since announcing a deal to acquire … Read More

The…

- Viridis Mining and Minerals’ Colossus project stands out from other ionic adsorption clay-hosted projects thanks to its high grades

- Colossus next to Meteoric Resources’ 409Mt at 2,626ppm TREO Caldeira project

- Viridis and Meteoric are two of 2023’s best performing stocks, up 510% and 240% respectively

- Drilling at Colossus to continue to the end of next year with maiden resource estimate expected in 1Q 2024

Special Report: ‘Colossus’ is already living up to its name, with explorer Viridis enjoying ASX-leading gains since announcing a deal to acquire the ionic rare earths project in August this year.

Colossus sits within the Poços de Caldas complex – one of the largest intrusions in the world, within Brazil’s pro-mining state of Minas Gerais – and directly adjacent to Meteoric Resources’ (ASX:MEI) Caldeira project.

Caldeira is well known for hosting an existing resource of 409Mt grading 2,626 parts per million (ppm) total rare earth oxides (TREO) – the highest grade for any Ionic Adsorption Clay (IAC) project, with metallurgical testing continuing to show excellent leach extractions for valuable magnet REEs.

IAC projects are ostensibly easier to explore, mine and process, which offsets their low grades compared to their hard rock counterparts.

But the good ones are hard to find. VMM and MEI have now sewn up the available ground in the area prospective for IAC-hosted REE that isn’t held by the big players.

A $2.2m cap raise to fund the Colossus deal was cornerstoned by advanced IAC project developer Ionic Rare Earths Limited (ASX:IXR), which will provide the company additional expertise “to fast-track the Colossus project into development”.

Building the next high-grade IAC REE project

All this is good news for VMM, which acquired the Colossus project in mid-September after securing the thumbs up from its shareholders and immediately set about drilling.

Promising work had been done by the previous owners, including 34 shallow auger holes, drilled from surface to a depth of 3m each, that returned strong REE grades – up to 2,003ppm TREO within heavily leached layer.

Initial metallurgical work carried out by VMM also recovered significant amounts of valuable magnet REEs – used to fabricate permanent magnets found in electric vehicle magnets and wind turbines – through a single-step ammonium sulphate wash (pH4) at room temperature.

Average recoveries from surface samples within the leached layers were 46% for neodymium, 40% for praseodymium, 38% for dysprosium and 35% for terbium – confirming the ionic nature of the Colossus saprolite mineralisation with no sample preparation required.

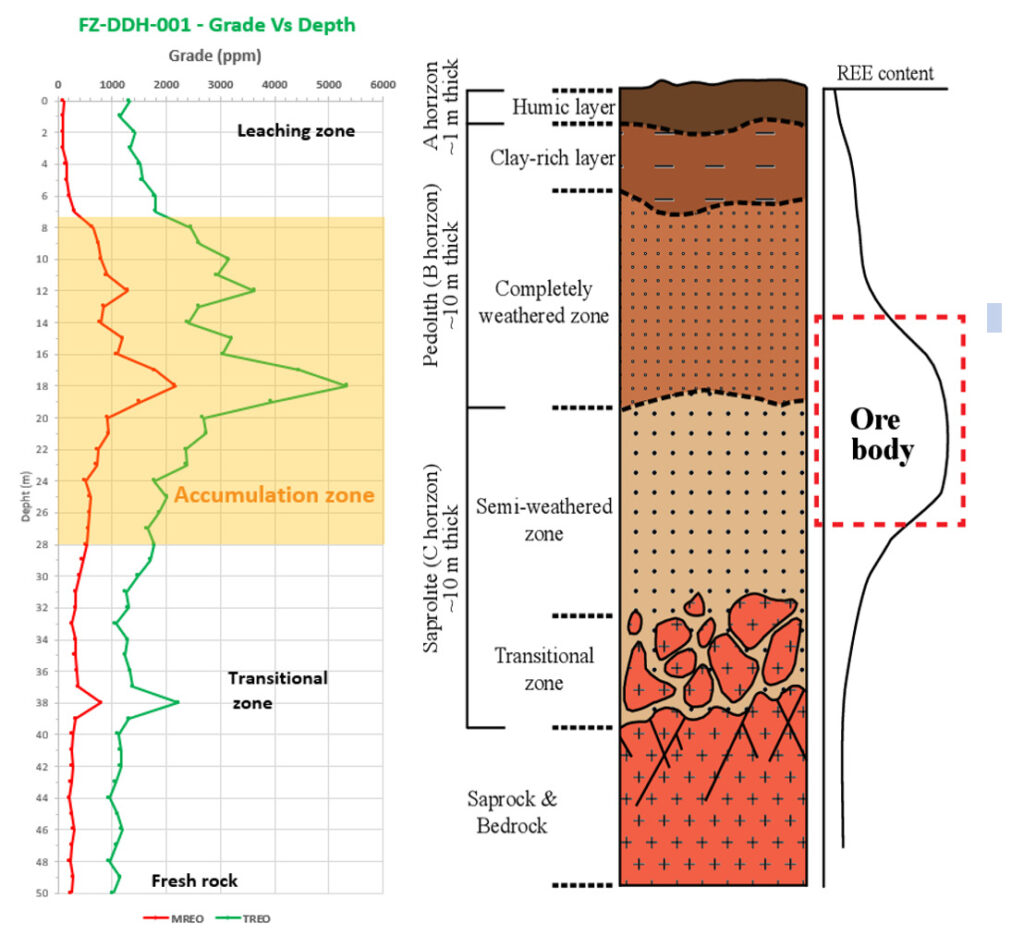

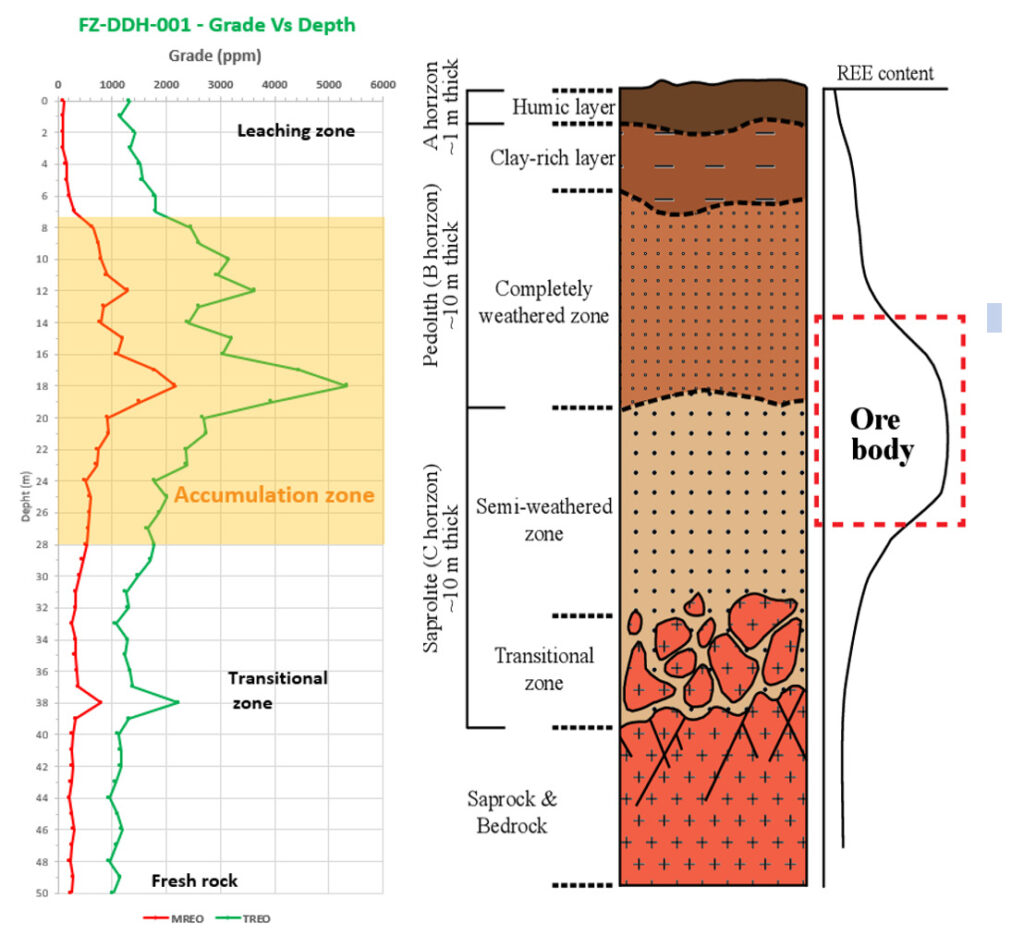

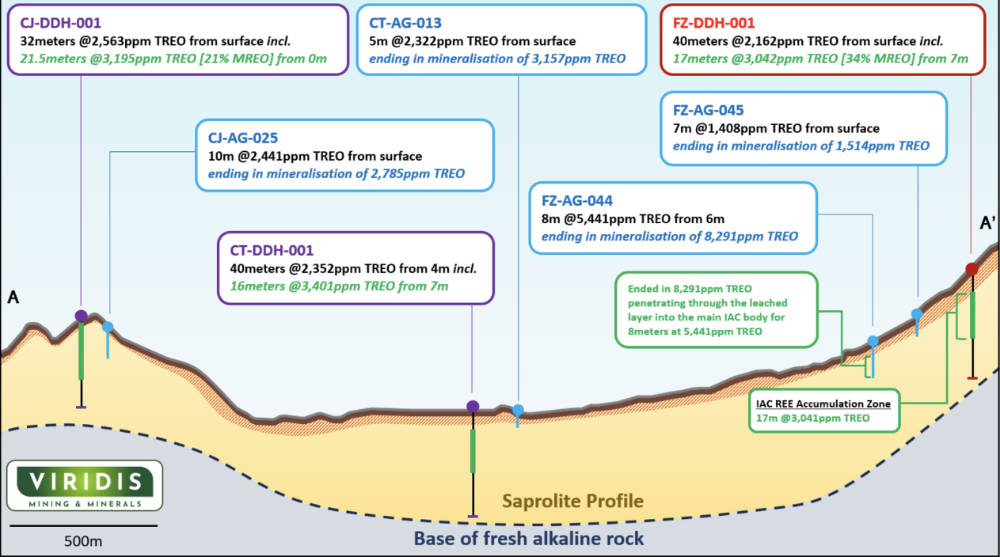

The first phase of drilling quickly returned assays topping up at 46m at 3,285ppm TREO from surface and revealed an IAC body ranging from 10-20m thick with a weighted average grade of 2,938ppm TREO at the Fazenda prospect.

An even more impressive 15-45m thick IAC body with a weighted average grade of 3,460ppm TREO was uncovered at the Cupim South prospect.

In November, the company engaged the Australian Nuclear Science and Technology Organisation (ANSTO) to conduct comprehensive metallurgical test work for ionic desorption leaching.

ANSTO will test optimised recoveries using the full spectrum of sample preparations before ionic desorption leaching across prospects.

It will also test composite samples within intermediate layers from drilling as it hosts the predominance of ionic mineralisation that is likely to deliver optimised recoveries.

More recently, assays from Phase 2 drilling returned more significant assays including a 21.5m at 3,195ppm TREO, confirming that widespread, high-grade IAC-hosted REE mineralisation is present at the Colossus project.

Homogenous mineralisation a major drawcard

The results that VMM has seen to date come as no surprise to executive chairman Agha Shahzad Pervez, who told Stockhead that the homogenous nature of the clay horizons in the region were a major drawcard for the company when it was actively shopping around for a company-making project.

The high grades present are also attractive with Agha Shahzad noting that the company was getting similar results to MEI.

“It is right next to Meteoric’s world-class ionic clay project, that’s why we see a lot of potential as the ground is homogenous, so we expect same grades and geology,” Agha Shahzad said.

“We have been there, we have seen the land, we have done our due diligence and picked up some surface samples as well, which was announced to the market.”

Management and the ionic connection

Viridis also benefits from an experienced leadership team with Agha Shahzad himself being an experienced corporate accountant and company secretary who is on the board of Pioneer Lithium (ASX:PLN) and fellow Brazilian REE play Equinox Resources (ASX:EQN).

Other directors include Faheem Ahmed, who has worked with big companies and has experience in management, analysis and risk modelling in the infrastructure, mining, health and transport sectors, and Christopher Gerteisen who has over 20 years of experience in geology and managing and advancing resource projects and is the chief executive officer of Nova Minerals (ASX:NVA).

The company’s final non-executive director is Tim Harrison, a very experienced metallurgist and executive with experience in resource companies who is currently the managing director of IXR.

Given IXR’s focus on developing its own IAC-hosted REE project, it unsurprising that Agha Shahzad attributes Harrison for providing a lot of help to the company.

This connection has proved invaluable for VMM’s acquisition of Colossus with IXR making a $600,000 investment as part of a $2.2m placement to fund exploration at the project.

IXR will also provide the company with additional expertise to fast-track Colossus into development.

The other significant members of its management are Dr Jose Marques Braga and Dr Klaus Petersen who are executive directors of its Brazilian mining team.

Dr Braga was the principal geologist for CBMM – the world’s largest niobium producer and the only REE producer in Brazil for 12 years and leads VMM’s exploration activities.

Dr Petersen has over 35 years of experience across iron ore, copper, gold, magnesium and rare earths and is the in-country manager.

Upcoming activity

VMM is currently executing the first two phases of exploration at Colossus which will now focus on a combination of RC and diamond drilling. In parallel, the company aims to complete optimised metallurgical studies with ANSTO over the following months.

The first two phases of drilling aims to achieve a JORC-compliant resource for the Colossus project which will rival that of Caldeira by the first half of next year.

However, this won’t slow down exploration efforts by Viridis.

“The plan is once we are finished with these phases of drilling, we will move right into resource expansion drilling, so we plan to report assays all the way to the end of next year”, Agha Shahzad said.

As Phase I & II exploration nears completion, Viridis also intends to commence work on its downstream strategy as part of the company’s vision to develop Colossus into the premier IAC project in South America.

Within five months of signing a binding agreement, Viridis has completed shareholder approvals, raised capital, secured drill permits and rigs, expanded its executive teams, completed preliminary metallurgical work, increased its landholdings and drilled over 200 holes with first two sets of assays announced. However, the company has no intentions of slowing down with its very active team looking to accomplish multiple game-changing milestones over the coming months.

This article was developed in collaboration with Viridis Mining and Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

The post A clay rare earths project called ‘Colossus’ propels Viridis to massive gains in 2023 appeared first on Stockhead.

asx

rare earths

ree

praseodymium

neodymium

terbium

dysprosium

rare earth oxides

iron

niobium