Precious Metals

What is the Velocity of Money

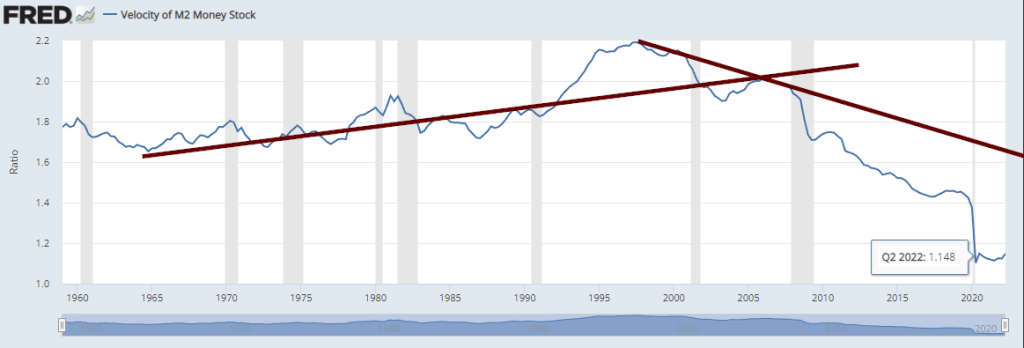

The above chart indicates that without constant money infusions, there is no long-term economy. A healthy economy has an upward-trending VM. The precipitous…

The above chart indicates that without constant money infusions, there is no long-term economy. A healthy economy has an upward-trending VM. The precipitous decline started after the Fed’s massive intervention in 2009. Since then, the trend has been negative; believe it or not, this is one of the best measures of real inflation (in a world that does not operate on “hard” money principles). A rising VM is usually associated with higher prices, but in this case, higher prices are generally warranted as a rising VM also indicates that the economy is improving.

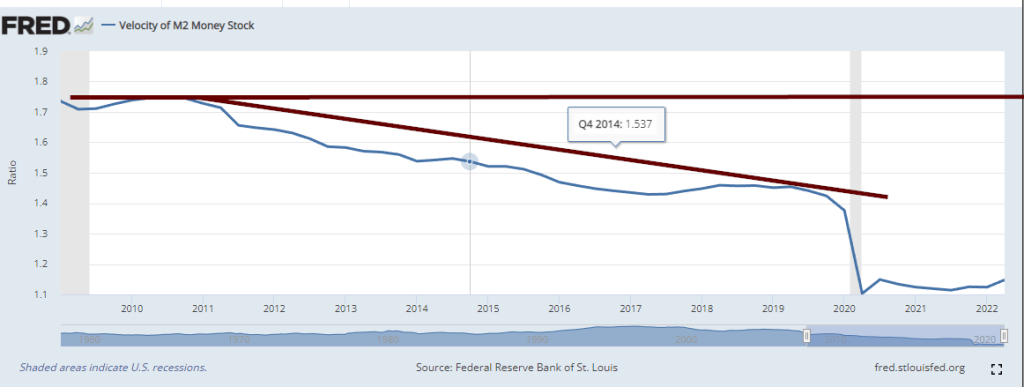

The velocity of Money from Feb 2009

If you look at the above chart, the economy has been sick since 2009, indicating that no matter what the Fed states, it will continue to juice the economy with money. They will intervene here and there to create the illusion that they are doing the right thing. One can also then argue that almost every inflationary move since 2009 has been artificially created, as there has been no uptick in the VM.

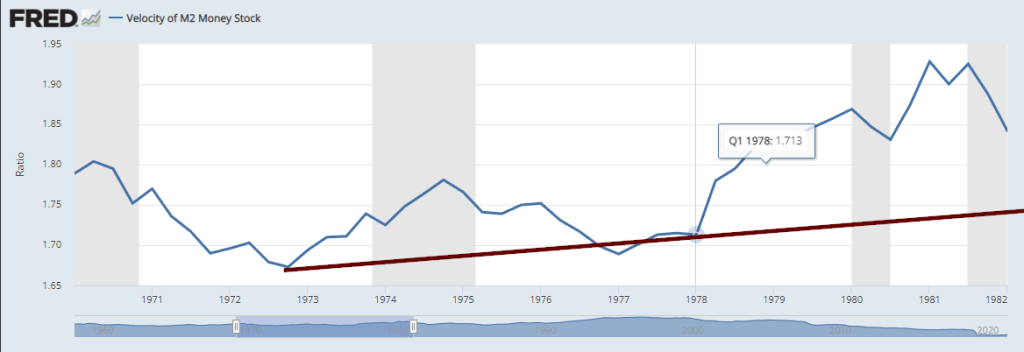

The velocity of Money 1970 to 1982

Now, look at the velocity of money during the inflationary period that started in the 70s and ended in the 80s. VM was rising. Yet since the advent of the internet (when it went mainstream roughly in the mid’ 90s), one could argue that inflation based on the VM formula has been declining. One could also say that all the inflationary events had a specific trigger behind them, for example, limiting the supply of critical goods, disrupting supply chains, and using psyops to create the illusion that you need to buy now or lose big tomorrow.

The Tulip mania occurred when hard money principles were quite strong. One could argue that if one knows how to use MP effectively, one could lay the groundwork to create inflationary forces in any market segment.

This is the danger of having large amounts of money; you can manipulate the trend by artificially using these massive amounts of money to create or destroy demand.

Other Articles of Interest

What is the Velocity of Money

Read More

Geopolitical news: The Energy Crises

Read More

The next Bull Market

Read More

Silver to Gold Ratio

Read More

Interesting Geopolitical Events

Read More

Market Rally: Will the Market Rally This Summer

Read More

The stock market is stuck in a trading zone

Read More

Stock Market Trading range: what’s next?

Read More

History of financial markets: The Masses are Doomed

Read More

Covid Resistance

Read More

Does Technical Analysis work?

Read More

Good Stocks: Value Stocks Usually Fall under this category

Read More

Negative Retained Earnings on the rise in the technology sector

Read More

Market Volatility: To Dance or Not to?

Read More

Fed Tapering: To Party or not to Party?

Read More

Market Sentiment: Is Turning too bullish

Read More

Federal Reserve bank of New York; What’s their Mission?

Read More

Reflation Rebuttal?

Read More

Margin Debt: Is it out of control?

Read More

Stock Market Cycles: When to buy & when to sit

Read More

Stock Market History and Market Crashes

Read More

The post What is the Velocity of Money appeared first on Tactical Investor.

gold

silver

inflation

markets

reserve

money supply

fed

inflationary

nasdaq

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…