Precious Metals

What does the Newmont takeover mean for the Aussie gold industry?

With the Newmont takeover of Australian gold miner Newcrest now given the green light by the board, Australia’s gold landscape …

Australian Minin…

With the Newmont takeover of Australian gold miner Newcrest now given the green light by the board, Australia’s gold landscape is set to change forever.

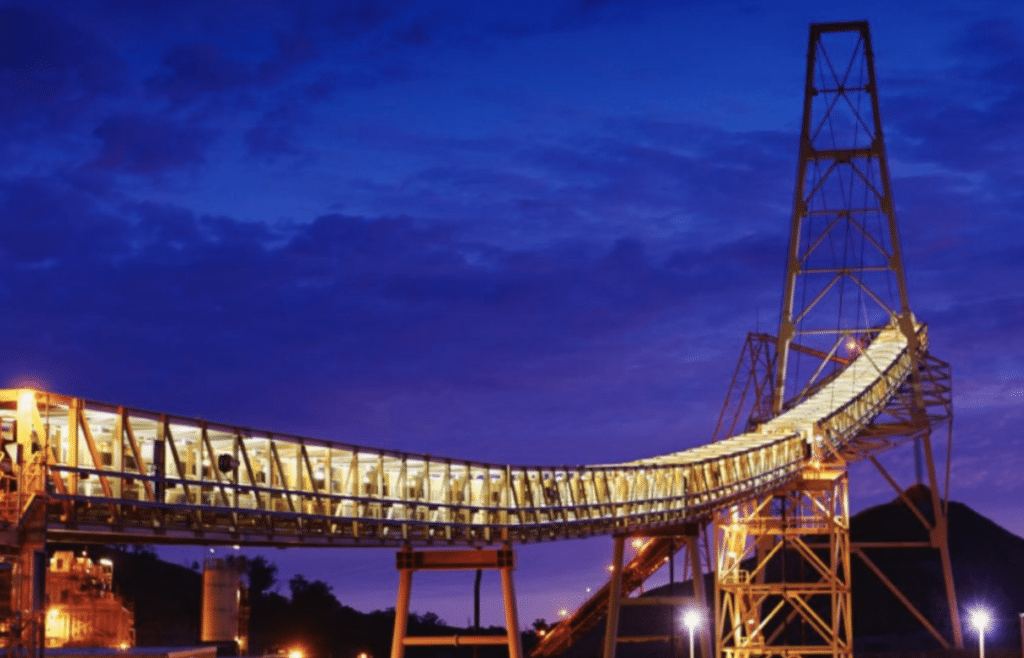

Newcrest has a strong portfolio of assets which the US gold giant is evidently keen to get its hands on, such as the Brucejack gold and silver mine in Canada, the Lihir gold mine in PNG, Cadia Hill in NSW, and the Telfer mine in WA – both among Australia’s largest gold mining operations.

Newmont already owns the Boddington mine in WA and the Tanami mine in the NT, so the takeover will put the company in control of four out of six of Australia’s largest gold mines.

But industry experts from the Australian Financial Review (AFR) are speculating that not all of Newcrest’s assets will make the cut, and will be divested before the dust settles.

Newmont chief executive officer Tom Palmer told AFR that he considers only two of Newcrest’s assets “tier one”, which are Cadia Hill and Lihir.

“Those assets are tier one, world-class by any measure. So, they are firmly in the portfolio,” he told AFR.

When the ink dries, this will give Newmont a portfolio of ten tier one assets.

Palmer also showed a keen interest in Newcrest’s Canadian assets, Brucejack and Red Chris, which are located nearby its own Saddle North project. Palmer called this combination of gold assets a “golden triangle”.

“I would call the golden triangle a tier one district,” he said.

That’s not to say that all everything else faces divestment, but it seems that Newmont will be considering its new assets very carefully.

“We are certainly looking for value over volume,” he said.

“So as we work our way through understanding the portfolio, we will be making judgements about what our go-forward portfolio is.”

If shareholders vote in favour of the Newmont takeover, foreign ownership of Australian gold assets will rise above the 50 per cent line, industry analysts from Surbiton Associates have revealed.

“In the early 2000s, the control of the Australian gold industry stood at 80 per cent,” Surbiton managing director Sandra Close said.

“It dropped to just under 30 per cent Australian control as overseas gold companies bought up Australian operations, and it was when the Aussie dollar was down around 50 (US) cents, so it was pretty cheap for them to buy the operations.

“Over time a lot of those operations were sold, so we’re currently looking at 60 per cent Australian control in the gold industry.

“But the recent announcement with Newmont and Newcrest, and we’ll be watching that closely, if that did go ahead it would mean Australian control would fall just below 50 per cent again.

“Whether we’d see yet another round of acquisitions as we did in the early 2000s is a pretty interesting question.”

The spot price of gold is currently trading at US$2015.60 per ounce.

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…