Precious Metals

Unmasking Stupidity: Rethinking the Student Debt Crisis

A problem clearly stated is a problem half-solved. Dorothea Brande Unravelling the Student Debt Crisis: Entitlement and Its Consequences Updated Aug 2023…

A problem clearly stated is a problem half-solved.

Dorothea Brande

Unravelling the Student Debt Crisis: Entitlement and Its Consequences

Updated Aug 2023

In the realm of higher education, a pressing concern emerges as certain college students forego the idea of labour in favour of attending elite institutions that demand substantial finances. An age-old question arises: What became of the time when one chose a college within financial means and contributed to its costs, either through personal efforts or cooperative familial support?

Central to this issue is the dynamic between parents and their offspring; parents often inadvertently endorse this imprudent aspiration. Today’s emerging generation harbours a conviction of entitlement to the utmost excellence without the requisite labour. Illustrating this conviction are college graduates who, despite being mired in debt, tenaciously cling to extravagant lifestyles—a poignant manifestation of this entitlement in practice. Instead of economizing their financial circumstances, they persistently accrue debt and subsequently bemoan their predicament as it unravels.

Reflecting on the era of the Baby Boomers and those who arrived in the United States decades prior, the ethos of strenuous labour defined the greatness of these generations. Hard work was paramount, without the luxury of handouts. In contrast, contemporary generations aspire to the finest opportunities without necessarily sharing the same commitment to the arduous effort.

Should no interventions address this predicament, the ensuing generations will persist in their pursuit of amplified privileges while expending diminished effort. Inevitably, the toll of these indulgences will be borne by others—higher taxes and increased financial burdens for diligent contributors to society, who will effectively subsidize those who opt for lesser contributions.

The Root Cause of the Student Debt Crisis: Lack of Financial Awareness

The current situation has deteriorated to the point where websites romanticize the notion of having a sugar daddy to finance one’s college education. Over 350,000 students are registered on these platforms, signifying a trend that is rapidly gaining traction. In most instances, these students opt for prestigious colleges rather than attending more affordable state or city institutions.

This phenomenon involves college students offering their companionship to sugar daddies to fund their education. Frequently, these students enroll in costly colleges and pursue degrees that lack practicality and fail to lead to lucrative employment opportunities. The question arises: what rationale lies in attending an expensive college to acquire a degree that won’t secure a well-paying job?

A considerable portion of these students might be enticed to continue with the newfound trade they embarked upon to cover their educational expenses. An alternative, simpler, and more effective approach would be to follow the straightforward strategy outlined below.

A Pragmatic Solution to the Student Debt Crisis

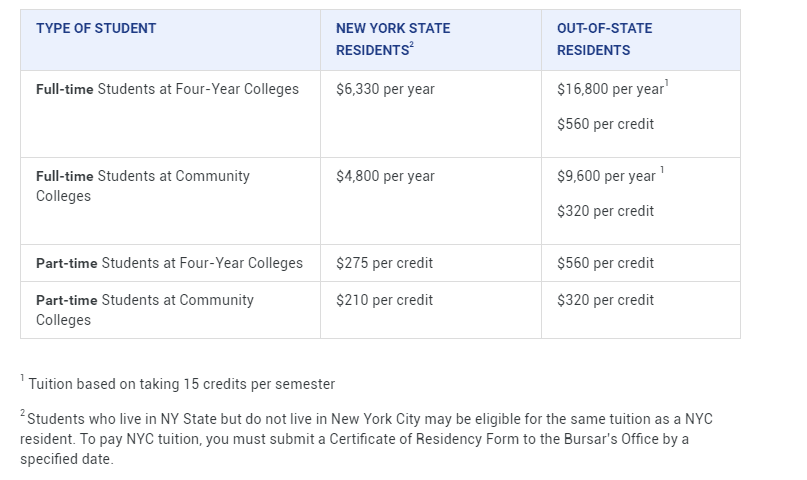

Cease offering these individuals gratuitous assistance and encourage them to earn their room and board. In simpler words, advocate for them to work and cover their university expenses. We conducted a straightforward calculation to illustrate how most individuals could afford their college education. To provide an example, New York residents could attend CUNY (City University of New York) for an annual cost of $6,330.

Source www2.cuny.edu/

Opting for SUNY (State University of New York) results in slightly higher fees, approximately $6,500 per year for state residents. Given their proximity to home, your children won’t need to incur exorbitant dormitory or apartment rental costs. With a part-time job, they should easily manage to cover these expenses, equating to around $550 monthly. This approach not only facilitates fee payment but also empowers them to earn their own spending money.

Encouraging Lazy Millennials to Embrace Responsibility

Initiating early responsibility in their lives will impart financial management skills and future planning instead of presuming that parents will cover all expenses. Furthermore, this could serve as an opportunity to encourage them to allocate a portion of their funds into market investments. As a parent, you could consider matching their contributions, akin to the incentives some companies provide for 401k plans. Repeatedly, the stock and real estate markets have shown their potential to create numerous millionaires.

Introducing work and planning at an early stage might foster a better comprehension of the concept of hard-earned money. The current generation remains unfamiliar with the genuine meaning of inflation; they equate it to price hikes, unaware that it signifies an upsurge in the money supply, with rising prices as a mere symptom. A fundamental grasp of this concept would illustrate why holding onto Gold or Silver becomes indispensable in an environment where the Federal Reserve is tirelessly expanding the money supply. Currently, this generation perceives Gold and Silver as archaic artifacts.

The Student Debt Crisis: Mismanagement and Entitlement

The student debt crisis is only a crisis because gullible parents support spoilt brats and allow them to believe they are the chosen ones when they are not. This debt problem, like most of America’s debt problems, comes down to mismanagement of finances. One should not live like a king on a soldier’s salary. When someone has to work for something, they appreciate and value it; when they are given handouts, they show no appreciation and demand twice as much. The student debt problem is due to plain stupidity and bad planning. The solution is simple, live within your means, work hard and spend less. Remember, the saying is highly applicable: “No good deed goes unpunished”.

Exploring Further Dimensions of the Student Debt Crisis

In the pursuit of advanced education, countless students find themselves entrapped in a tangle of debt, a predicament often stemming from lack of awareness and misguided decisions. The appeal of prestigious institutions and societal expectations to attend the most expensive colleges often obscure students’ understanding of the financial realities tied to their decisions. This problem is further compounded by a culture that encourages exceeding one’s financial means, setting off an escalating cycle of debt.

The heart of this dilemma does not rest solely with the students; their parents also play a role. There was a period when students chose colleges within their financial reach, frequently juggling part-time jobs to contribute towards tuition expenses. Nevertheless, this prudent approach has been overshadowed by a sense of entitlement, where the best education is demanded without a clear grasp of the financial consequences.

This mindset extends beyond education. Numerous college graduates, despite grappling with debt, resist altering their lifestyles. Instead of embracing an economic approach to managing finances, they indulge in extravagances, intensifying their debt burden. As financial pressures mount, they find themselves in a crisis that could have been averted with better financial understanding and planning.

Unravelling the Core Causes and Offering Remedies for the Crisis of Student Debt

The student debt crisis, frequently depicted as an insurmountable predicament, often emerges as an outcome of unwise financial choices. Nonetheless, altering the narrative remains feasible. Infusing financial literacy into high school curricula can equip students with the knowledge to make well-informed decisions regarding education and lifestyle preferences. Parents also guide their children towards comprehending the value of money and the repercussions of debt.

Furthermore, students should be motivated to explore affordable educational pathways like community colleges, online courses, or state universities. Scholarships, grants, and work-study programs can also contribute to alleviating the financial burden.

Conclusion

In the quest to unravel the intricate layers of the student debt crisis, valuable insights have risen to the surface. It’s unmistakable that this crisis is a convergence of factors far beyond financial struggles, encompassing misguided decisions, societal influences, and a dearth of comprehensive financial education.

Once a noble pursuit, higher education has been shadowed by the allure of prestigious institutions and the pressure to conform. This has propelled numerous students towards financially unsustainable choices, resulting in burdensome debt that can haunt them for years.

However, a glimmer of hope persists within this landscape. The student debt crisis can be tempered through proactive measures on both individual and societal levels. Integrating financial literacy into high school curricula can give young minds the tools to make astute decisions regarding education and finances. Parents, too, hold a pivotal role in steering their children towards a more profound understanding of money’s worth and the ramifications of debt.

Exploring alternative educational avenues, such as community colleges, online courses, and state universities, presents more economically viable choices. Scholarships, grants, and work-study initiatives provide avenues to ease financial burdens and foster prudent decision-making.

In essence, confronting the student debt crisis mandates a holistic shift in mindset. It beckons the young to embrace financial responsibility, make well-informed decisions about education and lifestyle, and resist instant gratification. It implores parents, educators, and society to place financial literacy at the forefront, guiding the upcoming generation towards a more sustainable future.

The student debt crisis transcends individual borders; it reflects a broader societal paradigm. By collectively reshaping our perspectives on education, finances, and personal accountability, we can carve a path towards a future where the weight of unnecessary debt is significantly lightened and enlightened choices define success.

Unmasking Entitlement: Decoding Unwise Choices Amid the Student Debt Crisis

Amidst these dynamics, a pivotal concern revolves around certain college students eschewing work and aspiring to prestigious institutions, often with parental endorsement. Remember the days when students chose affordable colleges and earnestly worked to shoulder expenses, aided by parents if necessary? The root lies in the mindset of both parents and students, with the former inadvertently fostering this unwise behaviour.

The contemporary generation seems to feel entitled to the best without matching effort. This mindset manifests when college graduates, drowning in debt, remain unwilling to relinquish lavish lifestyles—a poignant embodiment of entitlement in action. Rather than tightening their financial belts, they persist in accumulating debt, only to lament when their financial foundation crumbles. Exploring the Student Loan Crisis: Deconstructing Exaggerations and Unwise Choices

In conclusion, the student debt crisis transcends mere financial implications; it’s a societal conundrum necessitating a recalibration of perceptions and strategies for education and financial prudence. By nurturing financial literacy and championing cost-effective educational avenues, we can equip the next generations to sidestep the pitfalls of needless debt.

Anytime you think that the problem is out there, that thought in itself may be the problem. If it is out there, then you have no control, and you have to wait until it changes.

Anonymous

Originally published on August 4, 2016, this article has been periodically updated over the years, with the most recent update in August 2023.

Food For The Mind

AI-powered companies for 2023 & Beyond

Exploring AI Future Trends: What Lies Ahead

Unmasking Stupidity: Rethinking the Student Debt Crisis

Are Humans Naturally Violent? – Predisposed to Kill Each Other

Third Wave Feminism; Has It Ruined America?

Discover the Benefits of Fruits That Help Weight Loss

Succinic Acid: Powering Sugar Control, Energy, and Inflammation

Why Is Student Debt A Problem? Simple Fixes

The Rich Get Richer: Understanding Wealth Inequality

Permabear Doomster: All Bark With No Bite

Blue Gas: Hype or Reality for Sustainable Fuel?

Harmony Sex Doll: Your Personalized Companion At A Price

US dollar vs Japanese Yen: No Bottom In Sight For Yen

De-Stress Meaning: Discover the Art of Relaxation

Recession: Best Time to Invest in Real Estate

The post Unmasking Stupidity: Rethinking the Student Debt Crisis appeared first on Tactical Investor.

Canadian Silver Co. Will See Big Changes in 2024

Source: Michael Ballanger 12/22/2023

Michael Ballanger of GGM Advisory Inc. takes a look at the current state of the market and shares on stock…

EGR options out Urban Berry project in Quebec to Harvest Gold – Richard Mills

2023.12.23

EGR Exploration Ltd. (TSXV: EGR) has moved from owner to shareholder at its Urban Berry project in Quebec, this week announcing it is optioning…

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

Crypto, Crude, & Crap Stocks Rally As Yield Curve Steepens, Rate-Cut Hopes Soar

A weird week of macro data – strong jobless claims but…