Companies

Canadian Gold Co. Starts 10K Drill Program and Intercepts 104 G/T AU

Source: Streetwise Reports 08/02/2023

Recently, New Found Gold Corp. announced the start of Phase 2 of its 10,000-meter drill program, as well…

Source: Streetwise Reports 08/02/2023

Recently, New Found Gold Corp. announced the start of Phase 2 of its 10,000-meter drill program, as well as released intercepts from 14 diamond drill holes done in conjunction with a program that reentered and extended several drill holes targeting Keats Main Zone into the Keats Footwall domain.Read to see the results and what experts are saying about this gold company.

New Found Gold Corp. (NFG:TSX.V; NFGC:NYSE.American) reported today, August 2, the results from 14 diamond drill holes done in conjunction with a program that reentered and extended several drill holes targeting Keats Main Zone into the Keats Footwall domain.

In light of this, VP of Exploration Melissa Render said, “Today’s results provide us with an example of a discreet, yet very high-grade gold-bearing vein at a depth of roughly 300m, which will assist in training the seismic dataset to see if Paradox is recognized, how it interplays with the network of veins adjacent to the AFZ, and where other similar and undrilled structures may exist nearby for further testing.”

Highlights included:

- 104 grams per tonne gold (g/t Au) over 2.75 meters (m) in NFGC-21-393 EXT was intersected in the Keats FW Zone at a vertical depth of 300m. This domain of high-grade located immediately east of the AFZ is known as the “Paradox” vein.

- Other notable intervals from this vein include 119 g/t Au over 2.40m in NFGC-21-375 located 190m up-dip, 6.66 g/t Au over 5.90m in NFGC-21-342 located 220m up-dip, and 25m along strike to the northeast and 21.9 g/t Au over 2.50m in NFGC-20-73 located a further 25m to the northeast (Figure 2).

The Start of a 10,000-M Phase 2 Drill Program

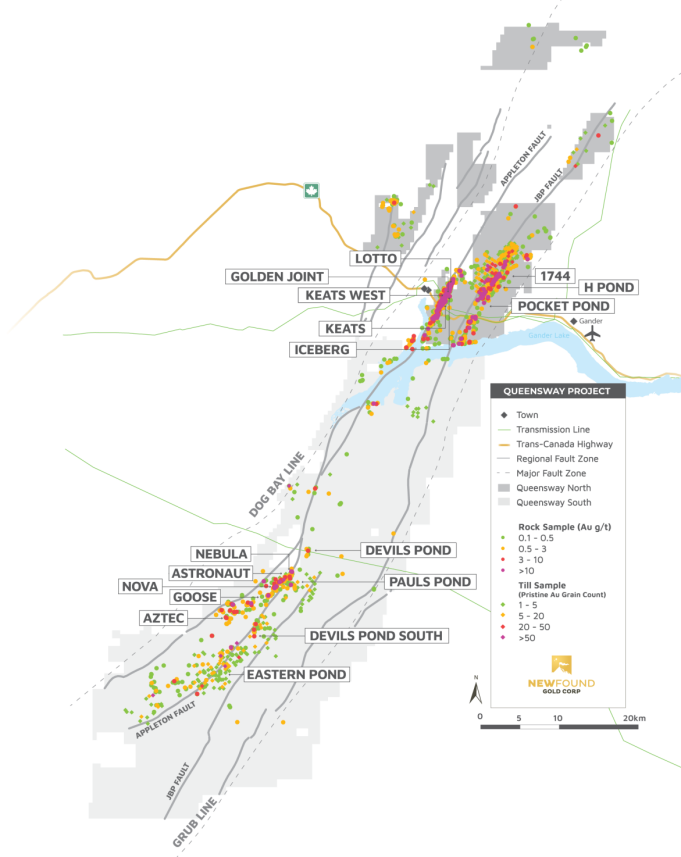

Recently New Found Gold also announced that it started Phase 2, a 10,000-meter drill program in one of its projects, the Queensway South (QWS), in the Canadian province of Newfoundland and Labrador.

The launch of the drilling program follows after the company saw significant gold mineralization in 27 out of 33 drilled holes during its inaugural 2022 drill program on May 25, as well as visible gold in 10 drill holes across four target areas.

The maiden drilling in May was done in tested early-stage exploration targets along an 18.5-kilometer stretch of the Appleton Fault Zone (AFZ), which is around 50km south of the Keats Zone.

“We’ve been itching to get the drill bit turning back at QWS, given the great success of our first program completed in the fall of 2022. From my experience with early-stage exploration projects, it is rare to have this kind of success on an initial pass, with 27 of 33 holes hitting significant gold mineralization,” Greg Matheson, COO of New Found, said.

Over the summer, New Found said the 10,000m drill program will further explore existing targets Pauls Pond and Devils Pond Trend, as well as pursue “several new high-priority drill targets.”

After 17 drilled holes, Pauls Pond was found to have a high concentration of gold anomalies and three new parallel structures Astronaut, Nova, and Nebula.

Barry Dawes of Martin Place Securities recently said that gold is expected to head up to challenge the US$2,000 level and beyond.

Astronaut and Nova contained visible gold in eight out of nine holes with a highlight interval at 19 grams per ton (g/t) gold over 3.15m.

They are located west of APZ and traced over 1,600m and 250m of strike length, respectively. Nebula, on the other hand, is situated east of APZ with an initial highlight result of 3.70 g/t gold over 4.30m.

On the Devils Pond Trend located on the east side of Appleton, the company discovered Devils Pond and Devils Pond South parallel structures found to have highly anomalous gold. Devils Pond has a highlight interval of 0.46g/t gold over 8m, while Devils Pond South has 1.01 g/t gold over 8.80m.

“In light of these QWS discoveries being made along trend of the AFZ, the same structure responsible for depositing high concentrations of gold 50km north at Keats and Iceberg, we are keen to see what our second pass of drilling will uncover. Applying knowledge gained from our strong understanding of the mineralization controls at QWN (Queensway North), we aim to rapidly assess these QWS targets with proven potential,” Matheson said.

New Found Gold has a total of 500,000-m drill campaign in the whole Queensway Project, with 180,000m drilling set for 2023. The whole property is divided by Gander Lake into Queensway North and Queensway South projects and sits on the Trans-Canada Highway, 15 kilometers west of Gander, Newfoundland island in the Canadian province of Newfoundland and Labrador.

The Catalyst: Seismic Survey in the North, Aggressive Exploration in the South

The company is currently completing its 3D seismic survey in Queensway North, which was launched in April and is expected to be completed this month. After its completed, New Found will test drill target areas from the seismic survey.

With investors looking to jump on the gold rush and searching for good gold stocks, Technical Analyst Clive Maund believes that New Found Gold has “BIG upside potential” and views it as “the best gold project in Canada.”

A first for a Canadian mineral exploration program, seismic survey help with maximum imaging of the structural framework adjacent to AFZ. This will ensure that drilling is more robust and targeted, thus saving on capital costs and increasing the likelihood of discovering new mineralizations.

For Queensway South, Phase 2, 10,000m drilling will be carried out over the summer. There is also an overall 2023 Program where the company will do aggressive exploration outside of the main AFZ, drill around 42,000m outside the northern AFZ strip, and generate and identify more target areas in the property.

Recon surface exploration activities will include soil sampling, mapping, prospecting, and trenching, which are expected to cost around $2.1 million.

Why Gold? Hot at US$2,000 Level

Gold has shown strength in the past few months, staying at the US$1,900 to US$2,000 per ounce level, as it has been recognized as one of the safe havens amid a weak dollar, which has been “extremely oversold.”

Paradigm Capital, in its July 20 research note, said New Found is a “Speculative Buy” due to the company’s too-good-to-be-true scenario of running into gold deposits even in their early stages.

Barry Dawes of Martin Place Securities recently said that gold is expected to head up to challenge the US$2,000 level and beyond.

“Given the seasonal influences, it could be expected that August might be relatively quiet until the end of the North Hemisphere summer, but the power of gold and its relative strength might push it much higher anyway. I keep expecting that US$100 intraday move, which I am sure is on its way to us,” he said.

Richard Mills of Ahead of the Herd said that gold and silver have entered the bull market, and the rallies have “only just begun.” The rallies are mostly attributed to the demand for gold being driven by central bank bullion purchases as a result of factors such as implied gold backing of the dollar.

“One analyst believes it’s only a matter of time before gold surpasses double digits on its way to $12,000-15,000 an ounce,” Mills said.

‘Best Gold Project in Canada’

With investors looking to jump on the gold rush and searching for good gold stocks, Technical Analyst Clive Maund believes that New Found Gold has “BIG upside potential” and views it as “the best gold project in Canada.”

He sees the stock as a “Strong Buy” for all timeframes, saying that “due to its compelling positive fundamentals, it is not considered to be unduly speculative,” even factoring in another funding exercise of the company.

“With regard to the risk of a funding slamming the price, it is worth bearing in mind that the company did a big funding for US$50 million late last year, so it seems unlikely that they have another one “up their sleeve” at this point, and if they did they would have to be stupid to pitch it much below the current share price, which would not be necessary,” Maund said.

“Even though the company has a substantial 188 million shares in issue fully diluted, if things come together for the company and for the sector as they look set to, the company’s shares could take off higher like this,” he added.

Don Maclean of Paradigm Capital, in a July 20 research note, said New Found is a “Speculative Buy” due to the company’s too-good-to-be-true scenario of running into gold deposits even in their early stages.

“World-class deposits are hard to spot in their early stages, but New Found appears to have one. NFG’s Queensway property near Gander, Newfoundland, has identified five high-grade zones so far among 15 high-priority targets since 2020 and has been rewarded with a large market cap, considering no resource estimate has been completed. Our analysis suggests the ounces found by NFG will be much higher than the average value (profit margin), underpinning the market cap. We see excellent exploration upside with a long-term 5 million oz potential,” Maclean said. [OWNERSHIP_CHART-9988]

“Overall, NFG remains a favorite explorer of ours. Yes, it has a large market cap, but it is unique and, as we show, has qualities that we believe warrant a premium. Most importantly, it is early in the story of this camp-sized land package. We remain confident that it has the potential to host 5M high-quality ounces in an ideal jurisdiction,” he added.

Ownership and Share Structure

According to Reuters, 5.25% of New Found’s shares are held by management and insiders. Founder, CEO, and Chairman Collin Kettell has 2.90%, with 5.16 million shares, and President Denis Laviolette has 1.22%, with 2.18 million.

39.97% is with strategic investors. Palisades Goldcorp Ltd. has 26.30%, with 46.77 million shares. Sprott Mining Inc. has 13.67%, with 24.30 million, and 2176423 Ontario Ltd. has 4.98%, with 8.86 million.

3.53% is with institutional investors. Van Eck Associates Corp. has 2.71%, with 4.81 million shares, and Integrated Advisors Network LLC has 0.38%, with 0.68 million.

The rest is in retail.

According to its website, New Found has a market capitalization of $1.069 billion, with 179 million basic shares outstanding and 12.5 million options. It has cash and marketable securities total of US$47 million.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Nika Catalado wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.

( Companies Mentioned: NFG:TSX.V; NFGC:NYSE.American,

)

tsx

aim

nyse

tsxv

gold

diamond

tsxv-nfg

new-found-gold-corp

new found gold corp

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…