Companies

Five Gold Funds to Buy for Protection from Crises

Five gold funds to buy for protection from crises offer investors refuge from financial and political storms near and far. The five gold funds to buy for…

Five gold funds to buy for protection from crises offer investors refuge from financial and political storms near and far.

The five gold funds to buy for protection from crises should serve as safe havens for investors specifically seeking a hedge against inflation. BofA Global Research proved to be correct when predicting several weeks ago that the price of gold would top $2,000 per ounce. On April 5, the price of gold futures reached $2,040.00, up 25.08% since slipping to $1,630.90 about six months ago on Nov. 3.

“Gold’s price moves based on several factors,” said Bob Carlson, a pension fund chairman who leads the Retirement Watch investment newsletter that offers several portfolios of recommended stocks and funds. “Many think of gold as an inflation hedge and, in general, it is. But gold also is sensitive to other factors. When interest rates rise, that often hurts gold’s price because it doesn’t pay income. Gold also is correlated with the amount of liquidity in the economy. When the Fed reduces liquidity as it did in 2022, that tends to put downward pressure on gold.”

Inflation Lifts Five Gold Funds to Buy for Protection from Crises

In addition, gold’s price tends to rise when inflation is climbing in the United States, Carlson said. The price of gold jumps when longer-term inflationary expectations increase in the United States.

Even though inflation rose through most of 2022 and was high throughout the year, expectations for inflation remained fairly low, Carlson said. Futures markets indicated that the majority of investors believed inflation’s rise was temporary. They expected inflation to decline quickly, and those expectations of low long-term inflation hurt gold in 2022, he added.

But since gold also is a “crisis hedge,” that perceived perception by investors recently has pushed up the precious metal’s price, Carlson said. The banking problems in the United States and elsewhere, the rising probability of a recession in 2023, the confrontations between the America and Russia, China and Iran, as well as other events, boosted uncertainty and the potential for one or more crises, he added.

Retirement Watch leader Bob Carlson meets with Paul Dykewicz.

Five Gold Funds to Buy for Protection from Crises Ascend

“Investors should have some exposure to gold in their portfolios unless they believe the potential for crises is low,” Carlson said. “Stocks of gold mining companies tend to move in the same direction as gold but are more volatile. The stocks will rise more than gold in bull markets and decline more than gold in bear markets.”

Gold mining company stocks essentially are leveraged plays on gold, Carlson counseled. The companies have substantial fixed costs but low variable costs. When the price of gold rises above a company’s cost of production, most of the price increase goes to the company’s bottom line.

But many mining companies now make their revenues less volatile by entering into contracts that sell a lot of their future production at fixed prices. They’ll profit less from gold price increases but be hurt less by price declines.

Also, shares of the mining companies might not move in lock step with gold. A company could have management or labor problems, carry too much debt, or have other characteristics that cause its price to decline when gold’s price is rising.

Five Gold Funds to Buy for Protection from Crises Offer Variety

There are ETFs that provide many different ways to invest in stocks of gold mining companies. For the adventurous, there are ETFs that aim to earn two to three times the change in indexes of the companies, on both the upside and downside, by using leverage. There also are funds that sell short the shares for those who are bearish on the sector.

Most investors should look at funds that either actively invest in gold miners or try to track an index of the miners. Almost all the ETFs invest in miners of other precious metals mining or some diversified miners in addition to pure gold mining companies.

The relative performance of the major ETFs varies over time. That’s why Carlson said he recommends that an investor interested in profiting from gold mining stocks buy a basket of the largest and oldest ETFs in the sector.

Carlson Chooses Four of the Five Gold Funds to Buy for Protection from Crises

Carlson recommended four such gold funds. The first is iShares MSCI Global Gold Miners (RING), an exchange-traded fund (ETF) that seeks to invest in companies that are mainly engaged in the business of gold mining.

RING maintains a sizable cost advantage over its competitors, according to Morningstar. The fund holds an array of gold mining stocks but the largest weighting by far is with Newmont Corporation (NYSE: NEM), consisting of 18% of the fund’s portfolio. Other top holdings and their respective percentage of the fund are Barrick Gold Corp. (NYSE: ABX), 15.05%; Agnico Eagle Mines Ltd. (NYSE: AEM), 11.79%; and Gold Fields Ltd. (NYSE: GFI), 5.42%.

The fund has jumped 5.21% in the past week, 19.29% in the last month, 8.80% in the prior three months and 18.54% so far this year. However, RING is down 14.92% in the past year, partly due to inflation not spiking until the latter part of 2022.

Chart courtesy of www.stockcharts.com

Five Gold Funds to Buy for Protection from Crises: Sprott Gold Miners

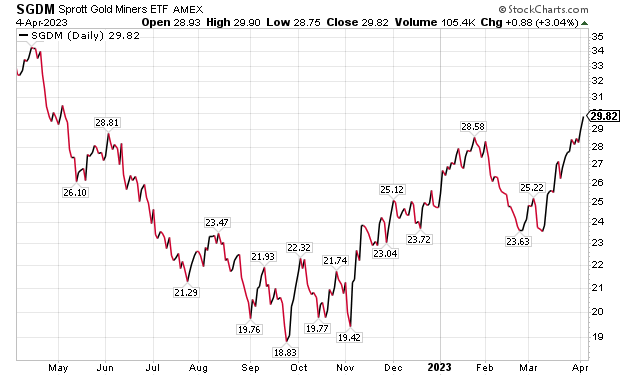

The second gold fund Carlson recommended is Sprott Gold Miners Exchange Traded Fund (NYSE Arca: SGDM). The ETF seeks investment results that correspond, before fees and expenses, to the performance of its underlying index, the Solactive Gold Miners Custom Factors Index. That index aims to track large-sized gold companies whose stocks are listed on Canadian and major U.S. exchanges.

The index uses a transparent, rules-based methodology that is designed to emphasize large gold companies with the highest revenue growth, free cash flow yield and the lowest long-term debt to equity. The Index is reconstituted quarterly to reflect the companies with the highest scores.

The top five holdings and their weightings in SGDM are: Barrick Gold, 11.71%; Agnico Eagle Mines Ltd., 10.32%; Franco-Nevada Corp. (NYSE: FNV), 10.29%; Newmont Corp., 9.26%; and Pan American Silver Corp. (NASDAQ: PAAS), 5.70%. The fund rose 4.89% in the last week, 18.24% in the past month, 11.69% in the prior three months, 20.44% so far this year but down 10.03% in the last year.

Chart courtesy of www.stockcharts.com

Five Gold Funds to Buy for Protection from Crises: GOAU

The third gold fund Carlson praised is US Global GO Gold and Precious Metal Miners (NYSE ARCA: GOAU). The fund provides investors access to companies engaged in the production of precious metals either through activities such as mining or production, or passive ownership of royalties or production streams.

GOAU’s top five holdings and their weightings consist of: Wheaton Precious Metals Corp. (NYSE: WPN), 10.25%; Royal Gold Inc. (NASDAQ RGLD), 9.56%; Franco-Nevada Corp., 9.47%; Anglo Gold Ashanti Ltd. (NYSE: AU), 4.78%; and DRDGold Ltd. (NYSE: DRD), 4.46%. The fund climbed 5.93% in the last week, 15.52% in the past month, 15.67% in the prior three months, 18.70% so far this year but dropped 13.04% in the 12 months.

Jim Woods, who leads the Bullseye Stock Trader advisory service, is well aware of Royal Gold and recently recommended the stock along with a related call option on March 30. The service, offering both recommendations of stocks and options, already has a 5%-plus gain in the stock.

Jim Woods heads Bullseye Stock Trader.

“Royal Gold manages precious metal royalties and streams, with a focus on gold,” Woods wrote to subscribers of his premium Bullseye Stock Trader service. “The company operates by purchasing a percentage of the metal produced from a mineral property for an initial payment, without assuming the responsibility for overseeing mining operations. Precious metal streams are purchase agreements with mine operators providing the right to purchase all or a portion of one or more metals produced from a mine in exchange for an upfront deposit payment.”

Generally, Royal Gold does not conduct any work on the properties in which it holds royalty and streaming assets, Woods continued. The company owns a portfolio of producing, development, evaluation and exploration royalties and streams, he added.

During the past three years, RGLD has posted an annual earnings per share (EPS) growth rate of 23%, a robust metric that put it in the top quartile of earnings growers. On the price front, the company’s six-month gain of 38% at the time of its recommendation in Bullseye Stock Trader had propelled it into the top 13% of all stocks in terms of relative price strength, Woods wrote.

Chart courtesy of www.stockcharts.com

Five Gold Funds to Buy for Protection from Crises: GDX

The fourth gold fund championed by Carlson is VanEck Gold Miners (NYSE ARCA: GDX). The ETF seeks to replicate, as closely as possible before fees and expenses, the price and yield performance of the NYSE Arca Gold Miners Index (GDMNTR). That index is intended to track the overall performance of companies involved in gold mining.

GDX is highly liquid and arguably is the popular investment product of its kind. The fund also retains a cost advantage compared to its competitors, according to Morningstar.

The top five holdings of GDX and their weightings encompass: Newmont Corp., 12.20%; Barrick Gold Corp., 10.01%; Franco-Nevada Corp., 8.62%; Agnico Eagle Mines, 7.40%; and Wheaton Precious Metals Corp., 6.63%. GDX gained 4.95% in the last week, 15.54% in the past month, 11.42% in the prior three months, 15.42% so far this year, but slid 14.79% in the 12 months.

Chart courtesy of www.stockcharts.com

Five Gold Funds to Buy for Protection from Crises: GDX

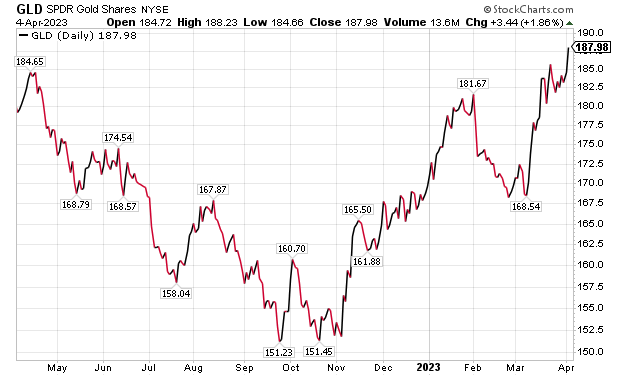

A fifth gold fund, SPDR Gold ETF (GLD), is recommended by Mark Skousen, PhD, in his Forecasts & Strategies investment newsletter. GLD is up 25.15% with his recommendation of SDR Gold ETF since it became a recommendation in Forecasts & Strategies.

“Gold is a long-term hedge against inflation and geo-political instability,” Skousen wrote to his subscribers in the April 2023 edition of his newsletter.

Mark Skousen heads Forecasts & Strategies.

GLD, listed on the New York Stock Exchange in November of 2004, has traded on NYSE Arca since December 13, 2007. SPDR Gold is the world’s largest physically backed gold exchange traded fund.

The fund’s sole assets are physical gold bullion and occasionally cash. Since it is not leveraged to the price of gold to the extent of miners, GLD’s gains in the past year were not as volatile as the exploration and production companies. GLG gained 1.42% in the last week, 6.99% in the past month, 7.88% in the prior three months, 8.78% so far this year and 2.81% in the 12 months.

Chart courtesy of www.stockcharts.com

Russia Threatens to Retaliate Against Finland for Joining NATO

Finland officially joined the North Atlantic Treaty Organization on Tuesday, March 4, more than doubling the alliance’s border with Russia. The move was spurred by Russia’s invasion of neighboring Ukraine and Finland’s desire for a stronger national defense.

Despite driving Finland’s leaders to NATO to deter Russian aggression, the administration of Vladimir Putin warned of “retaliatory measures” for the possibility additional NATO forces may be positioned near its border.

“Finland is stronger and safer within the alliance, and the alliance is stronger and safer with Finland as its ally,” said U.S. Secretary of State Antony Blinken.

Rather than want to create a direct conflict with Russia, Finland President Sauli Niinistö said the country’s desire is to promote stability in Europe. Finland, along with Sweden, sought expedited NATO membership just weeks after Russia’s invasion of Ukraine on Feb. 24, 2022. Sweden, in contrast, has been slowed in its progress to join NATO by objections from Turkey. Despite both Finland and Sweden having reputations and traditions as peaceful nations, Turkey claims both countries, but especially Sweden, are weak in responding to terrorist organizations. Turkey identified Kurdish groups among those that pose a security threat to its national interests.

In early March 2023, Sweden presented a draft law to its parliament intended to make supporting or participating in terrorist organizations illegal. Sweden’s leaders expressed hope it would reduce Turkey’s opposition to it joining NATO.

Ukraine President Volodymyr Zelenskyy congratulated Finland in a tweet for joining NATO, which he called the “only effective security guarantee in the region amid Russian aggression.”

CDC Shows the Number of People with Vaccinations Against New Bivalent Variant of COVID-19 Keep Rising

The U.S. Centers for Disease Control and Prevention (CDC) reported rising vaccination rates against COVID-19 and its bivalent variant. The CDC revealed that 269,955,210 people, or 81.3% of the U.S. population, have received at least one dose of a COVID-19 vaccine, as of March 29. Those who have completed the primary COVID-19 doses totaled 230,368,815 of the U.S. population, or 69.4%, according to the CDC. Also on March 29, the United States had given a bivalent COVID-19 booster to 51,580,927 people who are age 18 and up, equaling 20.0%. Vaccinations tend to help consumers feel comfortable to shop at stores, travel and spend money.

The five gold funds to buy present offer investment hedges against inflation and crises. Any of the the five gold funds to buy for protection against crises could prove to be profitable picks, regardless of Russia’s raging war against Ukraine, military risks in Asia and unexpected calamities.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. He is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for special pricing on multiple-book purchases.

The post Five Gold Funds to Buy for Protection from Crises appeared first on Stock Investor.

aim

nyse

new york stock exchange

nasdaq

gold

precious metals

tsx-ngt

newmont-corporation

newmont corporation

tsx-paas

pan-american-silver-corp

pan american silver corp

tsx-wpm

wheaton-precious-metals-corp

wheaton precious metals corp

Dolly Varden consolidates Big Bulk copper-gold porphyry by acquiring southern-portion claims – Richard Mills

2023.12.22

Dolly Varden Silver’s (TSXV:DV, OTCQX:DOLLF) stock price shot up 16 cents for a gain of 20% Thursday, after announcing a consolidation of…

GoldTalks: Going big on ASX-listed gold stocks

Aussie investors are spoiled for choice when it comes to listed goldies, says Kyle Rodda. Here are 3 blue chips … Read More

The post GoldTalks: Going…

Gold Digger: ‘Assured growth’ – central bank buying spree set to drive gold higher in 2024

Central banks will drive the price of gold higher in 2024, believe various analysts Spot gold prices seem stable to … Read More

The post Gold Digger:…